Wallet Savvy is a reader supported website. This means that some pages include links to products or services that we recommend and we may earn a commission when you make a purchase. You will never pay more by choosing to click through our links.

Your finances are out of shape. Savings are a struggle, and you don’t know how best to invest. It’s time you had some support, and there are some pretty savvy apps out there – one of them being Plum. Enter finance expert Michael Barton’s in-depth Plum app review.

Post date

Post author name

Michael Barton

This article has been fact checked by a member of the Wallet Savvy editorial team and complies with our editorial standards.

Are you one of the millions of people who have money to save when you get paid, but it’s all gone by the end of the month? How does that happen? More importantly, what can you do about it?

In this article, I review Plum – an adrenaline-fuelled savings and investment app that could eliminate the stress and effort needed to turn your saving goals into reality. I look at the good and bad, and take a snapshot against some alternatives to help you decide if Plum is for you.

Quick Verdict On Plum

If you find it hard to save, then Plum could be the ideal solution. It uses AI tech to figure out your spending habits and how much you can afford to save. It has some very cool rules you can set up to help you save, and automates the whole process seamlessly. You won’t even realise that some of your money is being saved… until you discover just how much you have accumulated!

When you’re ready to take the next step to grow your money by investing it, simply upgrade your account from the free Plum Basic. Great for those with beginner to intermediary money management skills.

*Capital at risk

What Is Plum?

Plum uses AI technology to analyse your spending and automatically save some of your money. It was founded in 2016 by two friends and entrepreneurs, Victor Trokoudes and Alex Michael. It now has around 1.5 million users who have more than £1.5 billion saved. Not bad for a financial infant!

The idea came from a challenge the two had going between them to see who could save the fastest and smartest. Alex wrote a program that calculated how much he could afford to save by first calculating how much he needed in his pocket to spend.

The thinking behind the program was simple. He would download all his transactions from his bank accounts. Every few days, the program would tell Alex how much he could safely put to one side without trashing his lifestyle. Alex transferred this into a savings account. After two months, Alex had saved almost £200 more than Victor. Plum had been conceived, if not yet born.

*Capital at risk

How Does Plum Work?

Plum connects to your bank accounts (all the major banks and more can be connected) and credit card accounts using Open Banking technology. The app then analyses your spending using artificial intelligence (AI). Here is where the magic happens.

Having analysed your spending, Plum figures out how much spare cash you have each week (your ‘fun money’). It automatically sweeps this into your Plum account. You can keep it here to earn interest, or choose to invest it in different ways (more about this later in this article). The app even suggests what type of investments might be best for you!

If you wish, you can also transfer money into your Plum account and use Round-ups when you spend to give your savings an extra boost.

Never heard of Round-ups? If you spend, say, £9.20, the app will round this spend to £10, with the 80p difference sent to your Plum account. It’s a no-fuss way to save a little extra without realising.

How Much Does Plum Cost?

There are four levels of Plum accounts, from the free Plum Basic account to the Plum Premium account, which costs £9.99 per month. With each paid plan (Plum Pro at £2.99/month; Plum Ultra at £4.99/ month; and the Plum Premium account at £9.99/month) you get your first 30 days free.

Features of the Plum Accounts

Plum Basic

For those new to saving and investing, Plum Basic is a great starting point. You’ll get:

- An Instant Access Saving Account.

- Unlimited free withdrawals.

- Round-ups to boost your savings.

- Pay Days – set aside an amount to save into your Plum account on the day you get paid (paying yourself first is a great savings strategy).

- One Interest Pocket – like the jar you save spare change into. Set up a Pocket, and earn interest on your savings.

Plum Pro

Moving up the scale to Plum Pro, you’ll get all the above with Basic, plus:

- 15 Interest Pockets on which you can assign savings goals

- Access to Investing, with access to 1,200 stocks and 12 funds with an annual management charge of 0.45% (plus charges levied by the funds in which you invest)

- Rainy Days – choose an amount to save each day it rains and let Plum transfer it automatically

- 52-Week Challenge – one of my favourite ways to save £1,378 in 12 months (fantastic for saving for Christmas)

- Cashback – shop at a Plum partner merchant using your Plum App and get up to 11% cashback every time you spend – even at Groupon (11%) where you already get great discounts!

Plum Ultra

With Plum Ultra, you get all the above, plus:

- Money Maximiser – transfers all your future spending allowances as calculated by Plum into an Interest Pocket except your current week’s spending allowance. Most of your money is earning interest.

- Plum Card – a Visa card that you load money onto, helping you control your spending. You won’t be charged to use your Plum card abroad.

Plum Premium

The top-tier Plum Premium delivers all the above plus:

- Repeat investments and access to more than 3,000 stocks and 21 funds, with an annual management charge of only 0.15%

*Capital at risk

Plum’s Primary Pocket

Your savings journey starts with Plum’s Primary Pocket, a feature of all Plum accounts. This is where Plum’s AI approach is first harnessed. It’s where Plum figures out an amount you won’t miss in your daily life. It’s great for saving toward a specific shorter-term goal or to build up an emergency cash fund, though it doesn’t pay interest unlike the Interest Pockets with each account.

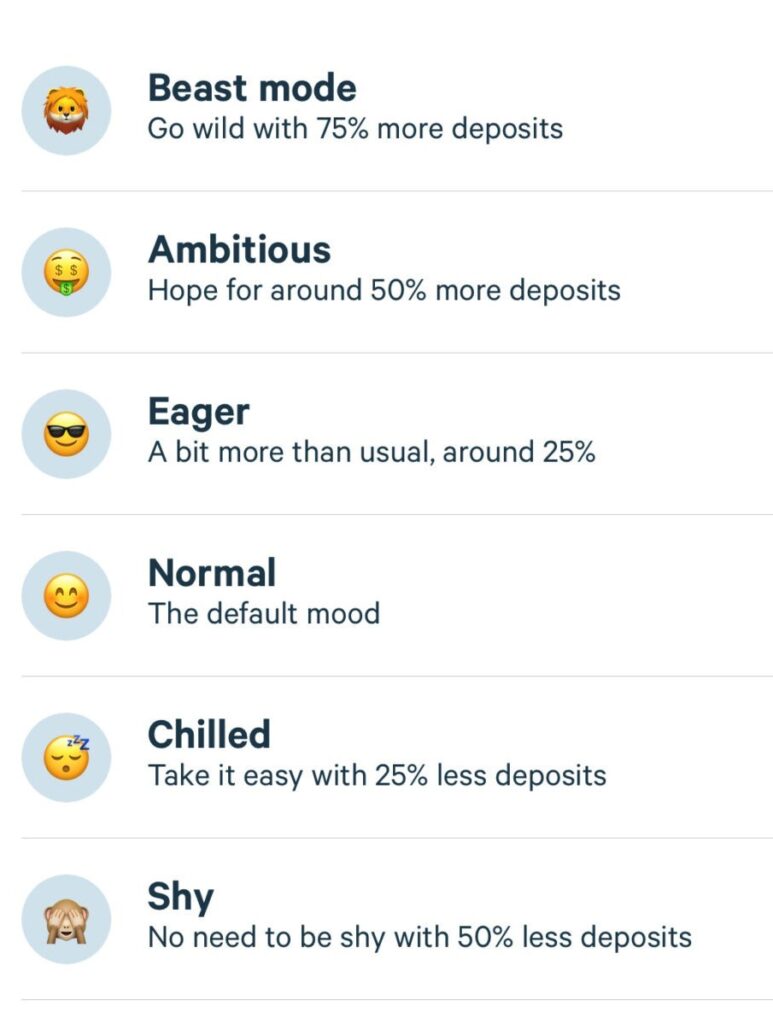

You can control how much it saves for you, too, by telling Plum your ‘mood’. Here’s how Plum describes the moods you can set:

Other Ways Plum Helps You Save

We’ve already mentioned a few of the automated saving strategies you can set up (like Round-ups, Rainy Days, and the 52-Week Challenge). There are other smart auto-save strategies that can make a real difference to your financial wellbeing, too. These include:

The Naughty Rule

What’s your guilty pleasure? Is it a creamy cappuccino, a dreamy doughnut, or a cracking curry? Maybe you can’t pass your favourite shoe shop without succumbing to the temptation to go in and try a few pairs, knowing you’ll walk back out with a shoe box under your arm. Mine is a well-known bookshop – I love browsing, and usually make at least one purchase.

The Naughty Rule was made for people like you and me!

Tell Plum who your Naughty Rule retailer is, and, whenever you shop there using your linked bank account or your Plum card, Plum will deposit an amount you have chosen into your Plum Primary Pocket.

Now you won’t feel quite so guilty about feeding your guilty pleasure – or you’ll be deterred from doing so.

Weekly Depositor

This is a great way to get into a regular saving habit. Decide how much you wish to save each week (from as little as £1) and Plum will move that amount each week into your Combo Depositor.

What’s the Combo Depositor? Instead of multiple transactions coming out of your bank account to satisfy your regular and rule deposits, Plum wraps all your deposits into one.

Use the Splitter!

Your savings deposits will get deposited into your Primary Pocket. Plum’s Splitter lets you automate what happens next.

All you need to do is configure what percentage of your combo deposit should go into which of your Interest Pockets or investment funds. This saves you time and effort, and makes sure that your money is working towards your financial goals. You can change, pause, or delete this when you need to.

*Capital at risk

How Much Interest Can Your Money Earn in Plum Pockets?

Your Primary Pocket at Plum is really no more than a holding account. A jar to keep your loose change before it mounts up and you decide what to do with it. The first port of call will be your Interest Pockets.

The Interest Pockets are Instant Access accounts, and they pay a variable rate of interest. At the time of writing this review, here’s what your money will earn in your Interest Pockets:

- Plum Basic: 2.99% AER

- Plum Pro: 3.20% AER

- Plum Ultra: 3.20% AER

- Plum Premium: 3.82% AER

Investing With Plum

While interest rates are on the march up right now, so, too, is inflation. The spending power of the pound in your pocket is falling faster than it has for decades. Even with the higher interest rates on savings accounts, your savings won’t keep pace with inflation.

This is why you must consider investing your money.

Never invested? Don’t know where to start?

Relax. Plum has you covered with three different investment wrappers (an investment wrapper is like a wrapper on a chocolate bar – it helps to protect what’s inside from outside influences, like tax):

Stocks & Shares ISA

A stocks and shares ISA allows you to invest in financial market assets without paying tax on the capital gain or income made on those assets. You are allowed to invest up to £20,000 each year in an ISA. If you keep your investments in an ISA and take income from it, that income is tax free – forever!

You’re only allowed one ISA per year, and can only invest in your own name.

General Investment Account

This is a standard investment account. Gains that you make – capital and income – aren’t tax free. However, you only incur a tax charge when you sell any of your investments. You can also offset any of your capital gains against your annual capital gains tax allowance of £6,000, though you must include all capital gains from any investments (except from your ISA).

Self-Invested Pension Plan (SIPP)

You can also save for your retirement in Plum’s SIPP account. This is a long-term investment, and you can’t withdraw any of your investment until you reach at least 55 years of age. Under current rules, you can then take a tax-free cash lump sum and income from your fund.

You’ll get a 25% tax credit on every penny you invest. Which means if you invest £80, then £100 will be invested in your SIPP (not often the government gives you money, is it?!). If you are a higher rate income taxpayer, you can claim some extra back on your self-assessment tax return.

Now all you need to do is decide what to invest in.

(Plum doesn’t provide investment advice, and all the usual risk warnings apply: the value of investments can go up as well as down, you may get back less than your original investment, and past performance is not a reliable indicator of future results.)

*Capital at risk

Investing in Shares

If you are a more experienced investor, you might want to select single companies to invest in. The potential gains are higher, though so, too, are the potential losses. You can invest in companies you believe in, and have your say by voting at AGMs (either in person or by post). Many companies also pay dividends, which you can either elect to receive in cash or reinvest in shares.

A challenge with investing in shares is meeting your financial goals while remaining within acceptable risk parameters. The smaller amount you invest, the more challenging this is. To help you achieve at least some diversification, Plum allows you to buy fractional shares – meaning you can invest as little as £1.

To invest in shares through Plum, follow this two-step process:

Step #1: Set your investment rules

Plum’s flexible investment rules allow you to design your investment plan to suit you. From the amount you invest to the rules you use for investments (like Round-ups), you can adapt how much money you invest.

Step #2: Choose which stocks you want to invest in

Depending on which Plum account you hold, you’ll have a list of available stocks for investment. You can trade these manually or set up automated trading to invest at regular intervals.

Buying and selling shares through Plum is commission free, too! However, you will be charged foreign exchange fees and regulatory charges if applicable, just as you would if dealing through a stockbroker.

*Capital at risk

Plum’s Investment Funds

Investing in the shares of single companies is not for those without knowledge or experience. It also requires a commitment of time. You’ll need to select which stocks to invest in after doing some research, including understanding financial statements.

If this all seems too much of a stretch for you, Plum also offers a range of funds for investment. These are professionally managed and will help you invest in a diversified portfolio aligned to your goals, values, and risk profile.

Plum’s funds cover a range of industries, sectors, and geographies. You can invest in what matters most to you:

| Natural Resources | Invest in equities with a focus on oil, gas, exploration, diversified mining, gold, and precious metals. |

| Global Gold | Invest in gold and gold mining companies from across the world. Actively managed fund. |

| Biotech & Genomics | Invest in equities with a focus on biotechnology, genomic and medical research. |

| Real Estate | Invest in real estate companies across the US, Japan, and Hong Kong. |

| Inflation Protected | Invest in UK corporate bonds and cash. Actively managed fund. |

| UK Dividends | Invest in UK equities from different industries with a focus on dividend growth. |

| Global Dividends | Invest in equities from across the world and different industries with a focus on dividend growth. |

| Japan Prime | Invest in equities with a focus on the Japanese market. |

| Chinese Supreme | Invest in equities with a focus on the Chinese market. |

| Tech Giants | Invest in Technology Shares (like Facebook and Apple). |

| The Medic | Shares of Healthcare, Pharmaceuticals and Biotechnology companies. |

| Rising Stars | Invest in the growth of new giants in Asia and Africa. |

| Balanced ESG | A diverse mix of assets selected based on Environmental, Social and Governance criteria. |

| Socially Conscious | Invest in companies selected for their Social Responsibility. |

| Growth ESG | Shares of global companies selected for their Environmental, Social and Governance track record. |

| American Dream | A very wide range of US company shares that tracks the performance of the S&P Total Market Index. |

| Best of British | A wide range of UK company shares that tracks the performance of the FTSE All-Share Index. |

| European Essentials | Shares of large and mid-size companies, in developed European markets. |

| Slow & Steady | With 20% shares 80% bonds, you can expect moderate returns, but are better protected from losses. |

| Balanced Bundle | With 60% shares 40% bonds, this fund offers a balanced combination of shares and bonds. |

| Growth Stack | With 80% shares 20% bonds, this fund leaves you most exposed to growth or losses in the market. |

*Capital at risk

The fund investment process

As with investing in single stocks, you first set your investment rules, then choose your funds. (My tip here is to select several. By doing this you will increase your diversification and reduce risk by being too narrowly exposed.) Plum will automatically split the cash you are investing to invest in your fund selection.

Is Plum Safe?

Plum is authorised and regulated by the Financial Conduct Authority (FCA), just like the most respected UK financial institutions. The money and investments that you hold with Plum are also protected by the Financial Services Compensation Scheme (FSCS).

This means that if Plum should go bankrupt or, for example, be adversely affected by a cyberattack, you will be compensated up to £85,000. Of course, the FSCS does not cover losses that might be incurred because of a fall in the value of your investments.

What Does Its Customers Say About Plum?

Plum has a high rating from its account holders. It commands a Trustpilot score of 4.3 stars out of 5 from more than 4,600 reviews. Almost four in five reviews are 5-star, with people most pleased with its simplicity and how it helps them to save money so easily.

Plum’s Customer Support

Customer support is provided in three ways:

- The FAQ pages, which contain a lot of useful information

- A live chat facility within the app

- Email support

Overall, these three support routes provide an efficient service, though you won’t have a voice at the end of a phone.

*Capital at risk

How to Get Started with Plum

It’s easy to get started with Plum:

- Download the app

- Enter your email address and confirm your details

- Enter a few pieces of personal information

- Link your bank account and credit cards

- Create a PIN to secure your account

Alternatives to Plum

There are other saving and investment apps that you might also like to consider. These alternatives to Plum include:

Chip

This works like Plum. You can set savings goals and track your progress. Like Plum, Chip is FCA regulated, and you’ll benefit from DSCS protection, too.

Moneybox

Moneybox offers a wider choice of investment wrapper, including Lifetime ISAs (great if you’re saving toward buying your first home) and Junior ISAs. It, too, is regulated by the FCA and benefits from the FSCS. If you can afford to lock your money away, Moneybox also offers a range of notice accounts with higher interest rates.

You might also consider Revolut or Monzo for your savings.

The Bottom Line

Plum gets a big tick from us.

It’s a great app to get you started with developing good saving habits and introducing you to investing. It takes all the legwork out of doing both. Set, forget, and review every few months. You’ll be surprised how fast your savings accumulate by using a few simple rules to automate deposits.

The free Plum Basic account is a great place to start, test out how it all works, and get used to creating rules and automating savings. When you are ready to start investing, the Plum Pro account is what you’ll need.

Overall, Plum is easy to set up, very user friendly, and takes the strain out of saving and investing. Ideal for beginner to intermediary money management skills.

*Capital at risk