Have you ever wondered if Revolut could change the way you manage your finances? Dive deep into its features, costs, and benefits in our Revolut review. From advantages for spending abroad to a detailed cost breakdown, get a comprehensive look at this trending banking app.

Wallet Savvy is a reader supported website. This means that some pages include links to products or services that we recommend and we may earn a commission when you make a purchase. You will never pay more by choosing to click through our links.

Post date

Post author name

Michael Barton

This article has been fact checked by a member of the Wallet Savvy editorial team and complies with our editorial standards.

Revolut is a banking app with a large and growing user number. Is it an app that you should be using? Does it offer value for money? What can it do for you and your finances?

In this article, we share our thoughts on Revolut as we walk you through its pros and cons, costs, and benefits. Don’t have time to read the full Revolut review… then see my quick verdict on the app and service below…

Quick Verdict: Revolut

Revolut will not replace your primary bank account yet, but it is a financial app that is worth considering. It offers a whole range of features and benefits that can help change how you think about your spending and save you money. With the ability to link your existing financial accounts, you’ll be able to monitor your current financial position more easily.

One of its greatest strengths is how you can use the Revolut card abroad – it’s cheap and offers a fantastic exchange rate when compared to most other travel cards – though you’ll want to keep a watchful eye on how much cash you withdraw.

With a ladder of plans available, it’s worth considering how you would use your Revolut account to ensure you get the best plan for you. While the highest plan on the ladder is £45 per month, the benefits it offers could be worth as much as £4,000 a year to you.

What is Revolut?

Revolut describes itself as ‘One app, all things money,’ offering easy money management to travel perks and investments.

Founded in 2015 by two friends (Nikolay Storonsky and Vlad Yatsenko) who had become disillusioned with the banking system, and how much financial companies were creaming off their customers, it offers a wide array of banking services, including:

- Currency exchange

- Debit and virtual cards

- Apple Pay

- Interest-bearing ‘vaults’

- Stock trading

- Crypto

- Commodities

- and more

Valued as high as around £27 billion, and with 28 million customers globally, it is much larger than rivals like Monzo and Starling. Though Revolut is registered as a bank in many parts of the world, in the UK it is best described as an electronic money institution – because it does not (yet) hold a UK banking license.

How Does Revolut Work?

At its most basic level, Revolut works like a pre-paid, contactless debit card (or, if you prefer, a virtual card on your mobile phone). You can buy products and services in stores and online using the card, and withdraw money from ATMs.

Like other similar financial apps, you can hold balances in sterling or foreign currency. If you hold your money in sterling when travelling abroad, the app automatically applies the exchange rate whenever you use the card. This makes it exceptionally easy to use while travelling.

You can set up a Revolut account within a couple of minutes. The system is paperless, and you manage your account through the Revolut app which is free to download.

At the more advanced level, Revolut gives you access to a range of features and financial options to help you manage your money more easily.

The app is easy to use with clear visuals. You can split payments (great for when you’re dining out with friends), receive money from friends and family effortlessly, and invest from just £1. Using Open Banking technology, you can see all your financial accounts in one place.

Revolut’s Key Features

Let’s get into the details of what services Revolut offers you.

Managing Your Finances

Some of Revolut’s best features are designed to help you manage your finances more efficiently and effectively:

All your accounts in one place

Having all your bank accounts visible in a single app is a time saver, and extremely convenient. You won’t need to switch between apps to view your balances before deciding which account to make a purchase from, and tracking your financial position becomes much easier.

See how you are spending

One of the secrets for managing your money better and building wealth is to understand how you are spending your money. When you know this, savvy budget planning becomes a breeze. Revolut provides a weekly breakdown of your spending, and you can set the categories to help you see what you are spending your money on.

Set your spending limits

Through the Revolut app, you can set spending limits to help you budget. Allocate your budget to specific spending categories (like shopping, entertainment, travel, etc.) and begin tracking what you’re spending. This makes it much easier to stay within your defined spending limits.

Revolut’s ‘Pockets’

One of the best ways to manage your money is to allocate it on the day you are paid. I remember my dad coming home with his pay packet at the end of the week, opening it and setting aside amounts in separate envelopes to cover the household bills (rent, the milkman, shopping, and so on). Revolut offers a similar system.

You can set up ‘Pockets’, so that on payday your money is moved out of your account and into individual pockets. Your bills are paid from these. You’ll never miss a payment again, and you’ll always know how much you have available to spend, without overspending accidentally.

Payment reminders

Have you ever looked at your bank account balance and thought it’s a little light? I know I have, and it’s only when I investigate that I realise I’ve forgotten about a direct debit that has been paid. Infuriating. Which is why you’ll like Revolut’s upcoming payment reminders. You’ll never miss a payment again – and that’s great for your credit score.

Manage subscriptions

I recently had a situation in which I’d discovered I’d been paying two identical subscriptions for Amazon Prime each month! I had to phone Amazon’s helpline and get one cancelled. Fair play to them, the service I received was excellent – and I received a refund in full. But if I’d had that account linked to Revolut, they’d have notified me that I’d come to an end-of-trial period, urging me to cancel the unwanted subscription before being charged.

Saving and Investing

Once you are on top of your financial budget, you’ll want to put your money to better use. You’ll want to save more and invest more wisely. Revolut helps you with this, too:

Interest-paying accounts

Revolut allows you to set up savings ‘vaults’ (a little like its pockets, but for saving, not spending). These vaults are with third-party providers – you get paid interest and benefit from protection under the Financial Services Compensation Scheme (FSCS).

Roundups on spending

Now that we rarely use cash, you don’t get to put aside the loose change you accumulate in your pocket. Roundups are the digital equivalent. You can elect to have any spending rounded up to the nearest pound, with the difference being added to a savings vault. This can quickly add up to hundreds of pounds and you don’t even realise that you’re saving!

Invest commission free

To make your money work extra hard for you, you’ll need to consider investing. Revolut helps with this, too. It provides a route to invest in stocks, commodities, and even cryptocurrencies. Many of these will be commission free, though this depends upon certain limits and the type of Revolut account you hold.

Spending at home and abroad

Of course, the main purpose of a debit card is to use it to spend, but Revolut makes this a much more pleasurable experience by providing several features that make spending safer, easier, and less expensive, whether you are at home or abroad! These include:

Apple/Google Pay

Use your phone to spend with Apple Pay and Google Pay.

Virtual card

Since virtual cards were introduced, I have always balked at using them. Tapping my phone on a payment device just doesn’t seem right – or safe. But I’m coming round to the idea. Revolut’s virtual card allows you to pay online or instore and changes the card number each time. That’s a big plus in the fight against card fraud.

Split bills

When you’re out with friends or family, Revolut makes it easy to split the bill. You can edit individual amounts or split the bill evenly. As soon as the members in your group click accept, you receive the money into your account.

Rewards

With Revolut’s Rewards, you don’t need to hunt for bargains (though I think you always should). Shop with exclusive retailers and receive cashback and other rewards when you spend using your Revolut card.

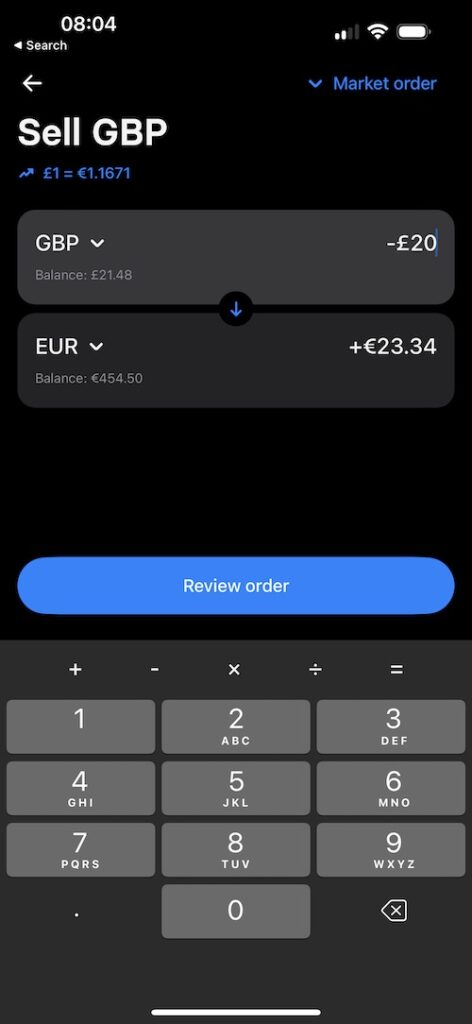

Fee-free spending abroad at great exchange rates

Doesn’t it annoy you when you spend money abroad and see the charges you’ve racked up on your credit/debit card? That’s before considering the cost of sub-par exchange rates.

Revolut is great for those travelling to foreign shores:

- Fee-free cash withdrawals (within certain limits) from ATMs

- No charges on spending up to £1,000 in a month

- You’ll benefit from the Interbank rate – that’s the rate that banks trade at between themselves

I’d go as far as saying that Revolut is probably the best solution for when you are abroad.

Stays

Another thing we like about Revolut is that they are continuously adding new products and services. It is an innovative company responding to customer needs, and always with a view to helping you manage and save money.

One of the services we like most is its Stays feature. Think booking.com on steroids!

Search holiday properties and hotels. Book and get up to 10% cashback! Get travel insurance and discounted airport lounge access if you are a premium or metal account holder (more about this later in this article).

Oh, and you can benefit from buy now pay later on your stays.

Experiences

Experiences are one of the best gifts you can give to others or to yourself. They create everlasting memories. I still remember my hot air balloon ride for my thirtieth birthday like it was yesterday – and it certainly wasn’t!

But why pay more than you need? Book one of more than 300,000 experiences through the Revolut app and receive up to 10% cashback (and no booking fees, either).

From managing your money, through saving and investing, to savvy spending, Revolut’s features can help you achieve your financial goals.

How Much Does Revolut Cost?

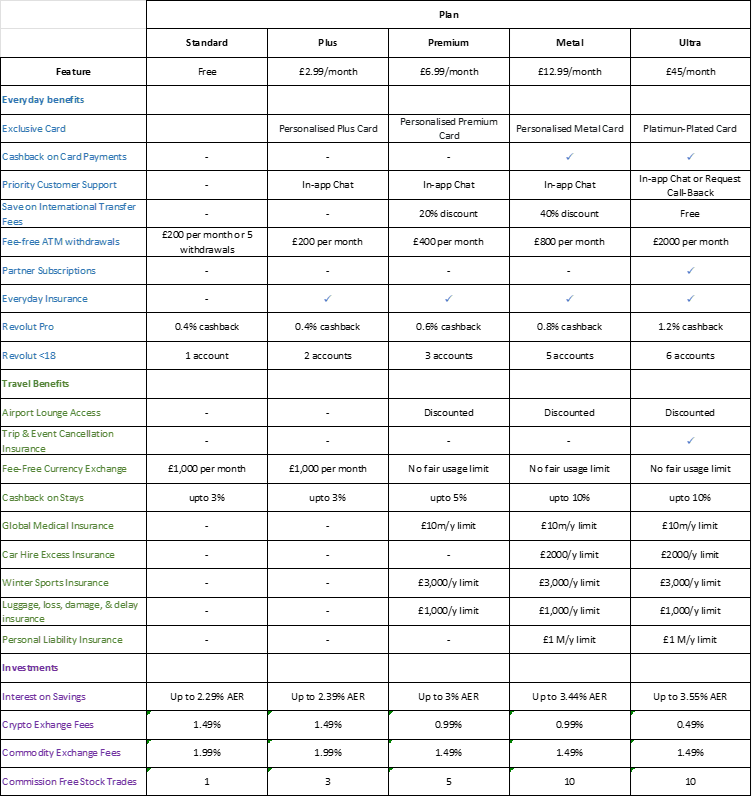

For all these features (and more), the question you now want answered is how much will it cost? The good news is that Revolut’s Standard account is free. However, the higher up Revolut’s account ladder you go, the more features (and higher-value features) you’ll have access to. Each rung up the account ladder will cost you a little more.

Standard Plan

Built-in budgeting, interest on your savings, cashback on Stays and Experiences, as well as saving money when abroad are all features available on the free Standard plan.

Plus Plan

A personalised Plus card, together with higher rates of interest on your savings, everyday insurance, and priority customer service are among the extra features when you upgrade to a Plus Plan for £2.99 per month.

Premium Plan

Up to £400 of fee-free ATM withdrawals per month, higher savings rates and cashback, global medical insurance, discounted airport lounge access, and more are included on top of the features of a Plus plan when you pay £6.99 per month for the premium Plan.

Metal Plan

Unlimited fee-free spending abroad, £800 per month in fee-free ATM withdrawals, car hire excess insurance, and personal liability insurance are all included with the Metal Plan at £12.99 per month – oh, and cashback in Stays and Experiences rises to up to 10%.

Ultra Plan

For £45 per month, you’d expect a bag full of extra features. You won’t be disappointed. A nice-to-have is the platinum plated card. You’ll also be allowed to withdraw up to £2,000 per month from ATMs without fees, benefit from free airport transfers, unlimited airport lounge access, and trip and event cancellation insurance. Revolut says that the benefits on this card are worth around £4,000 per year.

Here’s a summary of costs and features at each account level:

Other Types of Revolut Accounts

As well as individual personal plans, Revolut also offers four other types of account.

Joint Account

You can share an account with a partner, family member, or friend. Each of you will have a Revolut card, and you can open a joint account with any of the Revolut plans.

To open a joint account, you’ll need to invite the other applicant from the Hub in the Revolut app. Both of you will need to be existing Revolut account holders, as well as 18 and resident in the same country.

A word of warning about joint accounts – whether with Revolut or another bank – is that this links you to the other account holder financially. Their liabilities may become yours, and you may be affected if they have a poor credit rating. Also, joint accounts don’t benefit from FSCS protection.

Business Account

Especially if you own a business that trades in foreign currencies, a Revolut business account could benefit you as it allows you to:

- Accept payment in multiple currencies (and contactless payments to your iPhone)

- Hold and exchange more than 25 currencies

- Use pre-paid business cards abroad, and set spending limits for individual employees

- Integrate your accounts into accounting software packages

- Automate cross-border transactions

Like personal plans, Revolut business accounts are offered across a range of plans: Free, Grow, Scale, and Enterprise. As you move up the scale of account, monthly fees increase, but so, too, do the features and benefits applicable.

Revolut Pro

The Pro account is particularly targeted to the self-employed and freelancers. If you make money through a side hustle, this could also be for you. Pro accounts offer:

- A free self-employed business account

- Multiple currency payments

- Tracking for invoices

- Fee-free spending abroad

- Up to 1.2% cashback on card spending

With a unique IBAN number, your personal and business finances will be kept separate – making accounting far simpler.

<18 Accounts

Designed specifically for children between 6 and 17 years of age, the <18 account helps you to educate your child around sound finances. It’s your child’s account (and they’ll have a debit card), but you also have access to it. You and your child will be able to track their spending, receive instant spending alerts, and apply custom card controls.

With a Plus, Premium, Metal, or Ultra plan, you’ll get more features to help your child build good financial habits, including creating financial tasks and goals.

Revolut Abroad

Revolut is one of the best options for spending money abroad, and it’s easy to understand why:

- You’ll benefit from using the Interbank rate. This will save you a small fortune when compared to the rates you might receive at a Bureau de Change, and better rates than from most other prepaid cards. (A bonus tip here: never exchange money at the airport, you’ll be ripped off something rotten.)

- You can withdraw up to £200 per month fee-free at an ATM, though you’ll need to pay a 2% charge after this (with a minimum of £1).

- You can spend up to £1,000 on your card without incurring fees. After this, a 1% fee is applied, which reduces to 0.5% if you have a Revolut Plus plan.

- If you hold a Premium or Metal plan, fee-free withdrawal and spending limits are higher. As an Ultra plan holder, you can withdraw up to £2,000 per month from an ATM without fees and benefit from unlimited fee-free card spending abroad.

Comparing Exchange Rates and Prepaid Travel Cards

How much can you save on exchange rates?

Here’s a comparison that we made on 3rd August 2023:

- Interbank rate: £1 = €1.1595, and £400 will buy you €463.80

- TravelEx rate: £1 = €1.1316, and £400 will buy you €452.64

- Post Office rate: £1.1186, and £400 will buy you £447.44

A TravelEX Money Card allows you to load it with up to 15 currencies, locking in exchange rates in advance. You can also easily switch between currencies, though you’ll pay through the nose to do so, with a minimum transaction fee of 5.75%! If you don’t use your card for 12 months, you’ll be charged a £2 per month inactivity fee.

Another card that you might consider when travelling is Caxton FX Currency Mastercard. There are no monthly ATM limits or fees for overseas purchases or ATM withdrawals (though you might be charged by the STM provider).

However, if you haven’t loaded the correct currency on your card, you’ll be charged 2.49% on top of the currency exchange rate. Like TravelEx, if you don’t use the card for 12 months, you’ll pay £2 per month inactivity fees.

Revolut – Not a UK Bank, but What Does This Mean for You?

Though it holds banking licenses across many of the countries in which it operates, Revolut is not licensed as a bank in the UK. It has applied for a UK banking license, but its application has hit a roadblock with the Bank of England. What this means for you as a Revolut customer is that:

- Money held within Revolut accounts is not protected by the FSCS

- Revolut cannot extend its product range to include typical banking products like mortgages and loans in the UK

However, all of this does not mean that your money is not protected. Instead of being protected through the FSCS, it is protected through what is known as ‘safeguarding’. These are laws that dictate how your money is kept for you.

Your money is either lodged with third-party providers who are subject to FSCS protection, or deposited in a dedicated safeguarding account. It might also be protected by specific insurance policies, though this is more unusual.

The real difference between FSCS protection and safeguarding is that it is the financial institution that protects your money, not a statutory body.

Further, these rules only apply to the money you hold in your Revolut account – your ‘e-Money’. Your savings are deposited with third-party providers, all of whom are FSCS protected. However, it is worth noting that investments into stocks, commodities, and cryptocurrencies are not covered by safeguarding rules (investments can go down as well as up).

Revolut is Free – or Is It?

The Revolut app is free to download, and there is no monthly fee on its Standard account. But it is a business and levies charges to cover expenses and make a profit. What are the ‘hidden costs’ you’ll need to consider?

Your Revolut card may be free, but you’ll need to pay delivery charges. These are detailed in the Revolut App. If you want additional Revolut cards, you’ll be charged £5 plus delivery per card.

As a Standard Plan holder, you’ll have up to 5 free ATM withdrawals per month with a total of up to £200. If you break these limits, there is a 2% charge with a minimum of £1 on further withdrawals.

What Customers Think About Revolut

It’s always worth reading what other customers think of a product or service before taking the plunge yourself. Revolut’s score of 4.3/5 stars on Trustpilot is an indication of how well it serves its customers. 75% of the 137,000+ reviews are 5-star, with only one-in-ten giving only 1-star (and these are often for issues with cashback, or technical problems such as logging in and uploading documents).

The Bottom Line

Let’s address the elephant in the room first – that Revolut doesn’t have a UK banking license, with no FSCS protection for your money.

OK, the first question to ask is this: do you plan to park a considerable sum of money in your Revolut account?

The best way to reduce your risk is to limit your exposure, only keeping the balance that you need. All you need to do is top up your balance when you must, which is an easy and instantaneous process via the app.

On the plus side, it’s an easy-to-use app, with lots of notable features that will help you manage your money more effectively. We like its system of pockets to segregate spending and vaults to separate savings.

While the monthly spending limits might be a little irksome, they do make you think more about what you are spending, as do the spending categories you can set up. Having said this, stick below £1,000 monthly card spending and you won’t pay a penny in charges for your spending.

We also like its innovation, always seeking to provide new products and features that could prove advantageous to you. It’s quick and easy to open an account, and can help you to save without knowing when you use the Roundup feature.

If you travel abroad, you’ll benefit by using your Revolut card for general spending with a great exchange rate and no fees – though there are limits applied to this according to the plan you have signed up to. You could easily benefit by 2% or 3% – and this could pay for a lunch or more while on your holiday.

If you are a regular traveller, the extra travel benefits and features that the ladder of plans provide could more than pay for the cost of the higher-level plans.

Overall, Revolut is a fantastic financial app, and especially so for those who prefer to use a prepaid card when at home or abroad. As a tool in your financial armoury, it could help you to think differently about your money while helping you to save money on your spending.

Revolut may not replace your primary bank account yet, but if it does receive a UK banking license in the future, it may even be worth considering switching.