Looking for a workable bookkeeping software that helps you with the painstaking task of keeping on top of your invoicing, payroll, expense tracking, and all that comes with running your own freelance or small business? Here we run a FreeAgent review to see if this could be the software for you.

Wallet Savvy is a reader supported website. This means that some pages include links to products or services that we recommend and we may earn a commission when you make a purchase. You will never pay more by choosing to click through our links.

Post date

Post author name

Michael Barton

This article has been fact checked by a member of the Wallet Savvy editorial team and complies with our editorial standards.

Are you a small or medium-sized business owner, or freelancer? Do you loathe keeping on top of your finances? All those hours it takes to record and collate money received and money spent, administer expenses, take care of tax, report payroll… the list goes on, doesn’t it?

Maybe it’s time to try FreeAgent. I did a few years ago, and was surprised by how easy it is to use. My accountant was surprised by how slick my accounts suddenly became. Could FreeAgent be the answer to your bookkeeping nightmares?

In this article, I explore the pros and cons of FreeAgent, look at its many features, and share my tips to get the most from this piece of software. I’ve rarely been more excited to write a review.

TLDR: FreeAgent Verdict

If you own and run a small business – or perhaps you’re a freelancer or landlord – FreeAgent is the software that makes bookkeeping a breeze. It’s easy to use, provides a real-time picture of your business finances, and is packed with intuitive features that help to remove any financial anxiety.

Its core features include invoicing, payroll, expense tracking, and full integration with your bank accounts (and accountant, if they support it). If you run into any issues, you’ll find them covered by a tonne of online articles and help resources.

In short, FreeAgent takes the angst out of accounting. It will save you time, effort, and money, and your accountant will love you for it.

What is FreeAgent?

FreeAgent is a one-stop solution to your bookkeeping woes. It’s a piece of cloud-based software that puts the power of financial control in your hands. You can access it via your computer or smartphone, as you can with many other accounting software solutions.

It offers all the features that a small/medium-sized business or freelancer might need – including invoicing, expenses, time tracking, bank-feed integration, VAT, payroll reporting, and more.

Features of FreeAgent

Though it’s a single piece of software, FreeAgent packs a powerful punch with an array of features that will help you with your business as well as bookkeeping. It’s intuitive, too, and all your paperwork generated on the system can include your company logo.

Here are a few of the features that I find most useful:

Customer Estimates

Easily compose estimates and send to customers, including all you’d need to provide an accurate estimate. A few clicks, and the estimate is emailed to the customer, with a record kept within your account.

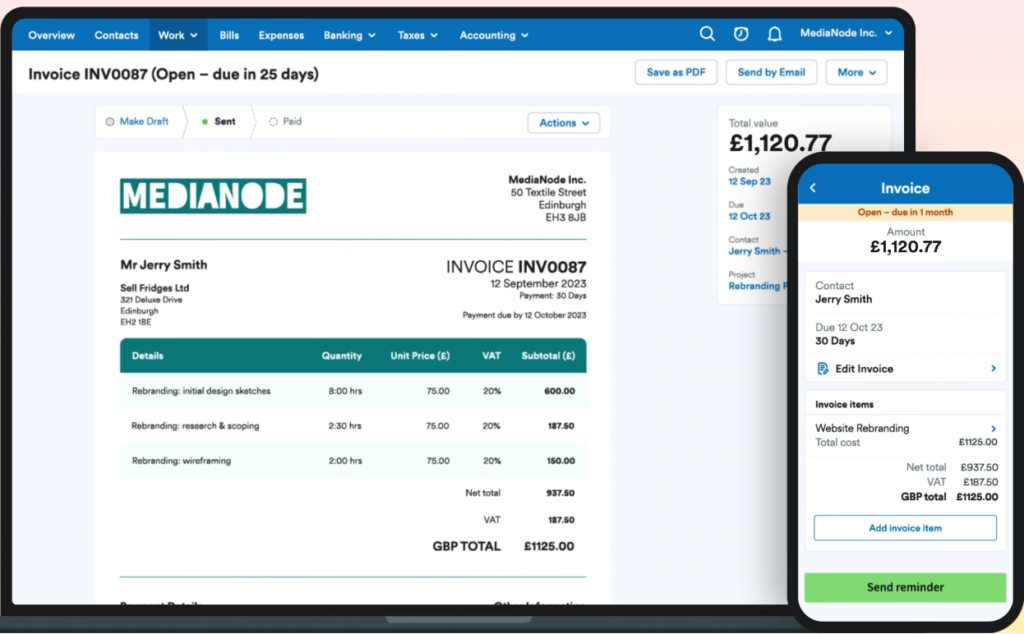

Invoicing

Set up an invoice template to use with your customers (you can also set individual templates). Then open the template, fill in the details, and click send.

You can also set up recurring invoicing, to easily accommodate clients with whom you work regularly and invoice equally each month. I do this for a couple of clients, setting them to draft and then confirming them on the invoice date.

Here’s something very neat, too: you can set the system to automatically send invoice reminders, at intervals to suit you (and by customer/client). This removes the pressure of manually tracking your invoices and composing reminder emails – a big weight off your mind.

Payment Monitoring

Expenses are easy to record and track – and you’ll never lose a receipt again (yep, a pain in the proverbial when that happens, isn’t it?). Capture a photo of the receipt in the FreeAgent app, and log it with your expense. Categorise the expense, and the system does the rest for you.

Time Tracking

I don’t use this feature myself, but others who do have said how good it is. It’s like a stopwatch, building an interactive timesheet to invoice clients.

Bank Feeds and Transaction Approval

This is one of my favourite features – the software integrates with your bank accounts. This allows it to pull in your balances and transactions at the beginning of each day. On your bank overview page, you’ll see items that need to be approved – then it’s a question of clicking on these, using a couple of dropdowns to categorise the transaction correctly, and it’s job done.

This is also intuitive, so if it’s a payment or payee that you’ve made before, the system prefills the details – and all you need do is click ‘Approve’. If the transaction is a credit linked to an invoice, once you have approved it, the system will send a ‘Thank you for payment’ email.

One thing to be wary of is that bank feeds time out after 90 days (this is to protect you, and in accordance with regulatory guidelines). This used to be a bit of a bind, but FreeAgent have now streamlined the process of reactivating bank feeds and, like so many of its features, a click or two and your feed is live again.

Payroll

Another of my favourite features. My accountant used to charge me £30 a month to report my payroll to HMRC. Now, it takes me two minutes each month to do using FreeAgent.

The system calculates how much tax and NI I must pay, and tells me how much to pay myself and my employees net of these costs. You can edit the gross pay amounts, and then access your gov.uk account to report your pay from the FreeAgent app/site.

Is producing pay slips a bore and a chore for you? Not with FreeAgent. You can automatically send your employees an email with a link to view and download their own payslips.

Mileage Tracking

Here’s another extremely useful feature – mileage tracking. All you need to do is add your journey as an expense, key in the number of miles, and let the system work its magic. As you pay the mileage to the employee, you get a running tally of what remains owing.

The only bug with this is that you cannot add an eligible passenger to the mileage to claim the extra 5p per mile. To get around this, it’s necessary to create a separate mileage expense.

Self-Assessment

FreeAgent is continually adding features and streamlining how you do things on the system. One of its more recent additions is enabling income tax self-assessment.

Back in the day, this used to take me what seemed like forever to complete. So, I handed the task to my accountant. I haven’t yet taken this back from them, but I’m considering doing so – the system holds all my payroll info, and all I will need to do is add any other income and allowances and click a button to complete my self-assessment tax return.

VAT Returns

The last thing you want is to get on the wrong side of the VAT man – an old boss of mine used to joke that they have more power than the police. Having gained more experience, and heard many horror stories, I don’t think I would argue with him.

With FreeAgent, you can wave goodbye to painstaking VAT calculations. Check the numbers, make alterations if needed, and file your VAT return. It really is as simple as that. What if you later find you’ve made a mistake? FreeAgent retains the existing VAT return and adds any corrections into your next return.

Other FreeAgent Features

I’ve covered the nuts and bolts of the software. Now let’s look at other features that will enhance financial control of your business.

Radar

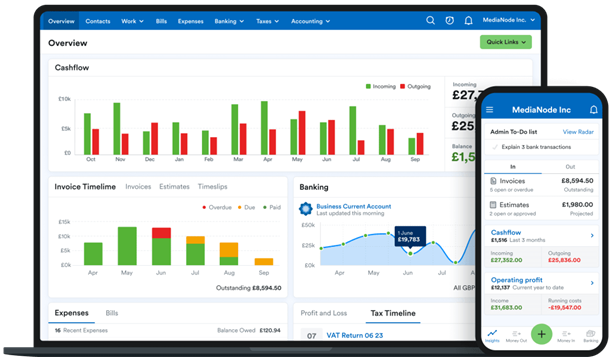

The FreeAgent Radar is a hub of information, where you’ll find business insights and key trends within your business.

On the Notifications page, you’ll find an ‘Admin To-Do’ list, such as business account transactions to explain. You’ll also find the Radar, with key information such as:

- Business health stats (like who your biggest customers are)

- Reminders of the end of your accounting period

- Identification of slowest-paying customers

- Quarterly performance

- Your top spending/expense categories

- Product upgrade notifications

- And more

These insights will help you to control your business – and your clients – more effectively, without the need for hours of digging through paperwork and notetaking.

Pensions Auto Enrolment

If your company is of a size that means it must offer a workplace pension, you’ll be pleased with this feature. You can automatically enrol your employees into the pension scheme, and the FreeAgent will calculate the contributions to make. It also integrates with pension providers, allowing you to easily process opt-outs and refunds, as well as generate all necessary reports.

Accounting Reports

My accountant will tell you that I am notorious for being late when sending him all the information he needs to process my accounts and file to HMRC and Companies House. It’s one of those jobs that I put off as long as possible, even though I know I shouldn’t.

He’ll also tell you that my accounts are so clean that it only takes him a couple of hours or so to work through them and agree them. This is all thanks to FreeAgent. Compiling my accounts for the year is easy, thanks to all the reports available on FreeAgent, including:

- Profit and Loss

- Balance Sheet

- Transactions

- Trail Balance

- Bank Reconciliation

- Audit Trail

Then I download all my bank statements, package it all in a zipped file, and email to my accountant. All done in an hour or two, depending on any mistakes I’ve made through the year.

Smart Capture

This is a neat feature for speeding up processing of expenses. Photo your receipt or upload a file, and it will be automatically linked to a ‘Money out’ transaction on your bank account. If there isn’t a matching transaction, the system will search for one every day for seven days. 10 of these are included free, or for £5 per month you can have unlimited Smart Capture.

Amazon Integration

If you sell online through Amazon, this feature will import Amazon data like it does bank data, making it easy to process sales and credits.

The FreeAgent Navigation Bar

The FreeAgent navigation bar includes the following tabs:

Overview – Your Dashboard

This is your ‘at-a-glance’ overview of your business finances. It’s where you can immediately see your 12-month cashflow, overall bank balance, invoice and tax timelines, and state of expenses and bills.

It’s as near real-time as makes no difference. It’s an immediate and overarching view of your business that helps you keep on top of all the crucial financial elements.

Contacts

Click on this tab and you can view, add, delete, and edit all your contacts (clients and suppliers). You can click through to individual contacts, and add invoices, projects, estimates, and more. You can see how much individual clients owe you, too.

Work

This tab has five sub-tabs:

- Estimates

- Projects

- Time-Tracking

- Invoicing

- Recurring Invoices

Click through on each of these, and you can use each feature, adding, editing, deleting, and so on.

Bills

This is where you add and track new bills.

My Money

On the My Money tab, you can navigate further to use the following features: Expenses, Dividends, Salary, and Payroll. Whatever you wish to do under each of these categories, you’ll find it’s a simple, step-by-step process.

Banking

Control your bank feeds and view your cash flow in detail via this tab.

Taxes

Here’s where you access the system to complete those wonderful HMRC-related tasks like self-assessment, corporation tax, PAYE and National Insurance. At least FreeAgent takes all the heavy lifting out of these delights!

Accounting

Access your reports, journal entries, and end-of-year accounts. Now here’s something that you might also really like – you can use FreeAgent to file these reports with HMRC and Companies House, if you wish.

FreeAgent Support

There are three ways to access support should you need it.

Your first port of call is likely to be FreeAgent’s online resources and articles (Knowledge Base). I’ve found almost all I need to know in times of need in these, and this is certainly the fastest way to find the information you need to solve any issues you may have.

Next, there is its online Chatbot (Ruby the Robot) accessed through the Help button at the bottom of the screen. This will attempt to answer questions and direct you to appropriate Knowledge Base articles.

Finally, there’s the ‘Get in Touch’ facility at the bottom of Ruby’s messaging window. You can either ‘Live chat’ with a support team member or leave a message to email the support team. This facility is only available between 9am and 5pm Monday to Thursday, and 9am and 4pm on Friday.

As far as online and phone support goes, FreeAgent’s is among the best there is and has won awards for its service levels.

Who Will benefit from a FreeAgent Subscription?

Could you benefit from a FreeAgent subscription? If you are a limited company (like mine), a partnership, sole trader, or landlord, the answer is yes. Here’s a breakdown of the features included for each category of user:

| Feature | Limited Company | Partnership / LLC | Sole Trader | Landlord |

| Dashboard | ✓ | ✓ | ✓ | ✓ |

| Radar / Business Insights | ✓ | ✓ | ✓ | ✓ |

| Estimates | ✓ | ✓ | ✓ | ✓ |

| Invoicing | ✓ | ✓ | ✓ | ✓ |

| Expenses | ✓ | ✓ | ✓ | ✓ |

| Projects | ✓ | ✓ | ✓ | ✓ |

| Time Tracking | ✓ | ✓ | ✓ | ✓ |

| Payroll | ✓ | ✓ | ✓ | ✗ |

| Banking | ✓ | ✓ | ✓ | ✓ |

| UK-Based Support | ✓ | ✓ | ✓ | ✓ |

| End-Of-Year Filing | ✓ | ✗ | ✗ | ✗ |

| VAT Filing | ✓ | ✓ | ✓ | ✓ |

| Self Assessment | ✓ | ✗ | ✓ | ✓ |

| Property Finances | ✗ | ✗ | ✗ | – |

| Mobile App | ✓ | ✓ | ✓ | ✓ |

| Smart Capture | ✓ | ✓ | ✓ | ✓ |

| Amazon Integration | ✓ | ✓ | ✓ | ✓ |

How Much Does FreeAgent Cost?

When you sign up for FreeAgent, you receive a free trial period of 30 days. After this, the costs depend upon your business model:

| Business Type | Monthly Fee | Paid Annually |

| Limited Company | £29 | £290 |

| Partnership | £24 | £120 |

| Sole Trader | £19 | £95 |

| Landlord | £10 | £50 |

New users receive a 50% discount for six months if paying monthly, and 50% discount for the first year if paying annually.

Here’s a little bonus for you – if you have a business bank account with any of the following banks, you get access to FreeAgent for no cost:

- NatWest

- Royal Bank of Scotland

- Ulster Bank

- Mettle Bank

What if you decide to cancel your FreeAgent subscription? There’s no cost, and no extended notice period necessary.

Tips to Maximise the Benefits of Using FreeAgent

Like any system or piece of software, the benefit you get from FreeAgent depends on how you use it. Here are my tips to help you reap the biggest rewards from this business software:

1. Login Daily

Make it a part of your morning or evening routine to log in and view your dashboard and Radar.

2. Update Your Data

Keep your business data updated regularly. Approve transactions as they appear, and add expenses, invoices, and receipts promptly – all good practices to maintain business health.

3. Automate Your Bank Feeds

This saves a huge amount of time and effort, and ensures your reconciliation and balances are always updated.

4. Use the Invoicing & Time Tracking Features

Seriously good feature to help you keep on top of the most important part of any business – receiving payment for services provided or goods sold.

5. Customise for Your Business

Customise all you can to suit your business needs, such as payment terms, invoice templates, and categories for expenses and income.

6. Integrate with Other Business Tools

Streamline as much of your business as possible using FreeAgent’s integrations with payments services, eCommerce applications, calendars, CRM tools, HMRC, and more.

FreeAgent – The Bottom Line

You don’t need to struggle with business finances and bookkeeping. FreeAgent is incredibly user-friendly, and its stack of features such as invoicing, payroll, expense tracking, and bank integration will simplify your business finances and processes.

One of the standout aspects is its intuitive nature, which allows easy management of banking transactions and expenses. Its bank feeds and transaction approval process are particularly effective, providing a real-time overview of finances. The payroll feature, like all its other features, will save you time and effort – and money, too, if your accountant charges you to submit your payroll.

The dashboard provides a comprehensive overview of the financial state of your business, and the Radar delivers valuable business insight.

FreeAgent isn’t the cheapest bookkeeping software available, though not the most expensive, either. Personally, I’ve found the time and frustration it saves to be more than worth the cost. Of course, if you hold a business bank account at NatWest, Royal Bank of Scotland, Ulster Bank, or Mettle Bank, this could be a free addition to your suite of business tools.