Do you know where you stand with your pay? Is £30k a good salary in the UK, or are you getting left behind? Widen your view with all the info right here…

You’re in a job that pays a £30k salary, but you’re not sure if your boss is undervaluing you. For a start, you’ve heard that the average salary in the UK is now over £35k. On the other hand, £30k puts you way above minimum wage.

So, is £30k a good salary? Well, it depends. It could be exceptional. On the other hand, it might be time to ask your boss for a pay rise or look for a new job.

30-Second £30k Salary Summary

Are you wondering if £30k is a good salary in the UK? It’s a reasonable question to ask, especially as the average salary in the UK is over £35k.

But here’s the thing: it’s not just about what you earn, it’s about how you spend. Whether you are aiming for a pay rise or trying to make your net pay stretch further, the keys to living well are smart budgeting and savvy spending.

From cutting costs to boosting your savings, there are plenty of ways to make your money work harder for you. Get it right today, and your financial future could step up from looking good to being great.

How Much Is £30k After Tax?

Wherever you live in England, Wales, or Northern Ireland (Scotland has slightly different tax rules), £30k nets down to the same take-home pay after tax and national insurance.

Assuming you have the full personal tax allowance of £12,570, in the tax year 2024/5 you’ll have £3,486 income tax and £1,743 National Insurance deducted from your salary.

Here’s how that’s going to work out per year, month, week, and day:

| Gross Income | Taxable Income | Taxable Income | Income Tax | National Insurance | Take Home Pay |

| Yearly | £30,000.00 | £17,430.00 | £3,486.00 | £1,743.00 | £24,771.00 |

| Monthly | £2,500.00 | £1,452.50 | £290.50 | £145.25 | £2,064.25 |

| Weekly | £576.92 | £335.19 | £67.04 | £33.52 | £476.36 |

| Daily | £115.38 | £67.04 | £13.41 | £6.70 | £95.27 |

Can You Survive On £30k A Year?

Almost £500 in your pocket every week is not a meagre amount. It should certainly be enough to live on, though there are a few factors that affect your ability to lead a comfortable lifestyle on £30k – just as there are whatever your salary.

These include where you live, the type of property in which you live, how many people depend upon your salary, your monthly expenditure, and any debt you have.

Your biggest expense is likely to be keeping a roof over your head – your rent or mortgage. If you live in the northeast, where average rents are around £650 a month, you’ll be paying out much less than those living in London, where the average rent for a two-bedroom flat will set you back around £1,500 a month.

Given that you should budget for around 30% of your take-home wage on rent or mortgage, just on this metric alone £30k is a good salary in the northeast, but terrible in London!

You’ll need to consider other bills, too, such as council tax, utilities, food, transport, internet, your mobile phone, and insurances. All this adds up, which is why budget planning is critical to your financial health.

Factors That Affect Your Salary

When you’re trying to figure out if what you are earning is enough for the job you do, you might be tempted to first look at the average UK salary for that job. However, this simple approach doesn’t take into account the many factors that affect your earning potential, such as:

Location

Average salaries are lowest in the northeast, and highest in London. In fact, in London you should expect to earn an average gross of around £780 per week vs £576 per week in the northeast.

However, there are other factors that affect this, too.

Profession

The job you do is another huge factor in how much you earn. Wherever you live, the national minimum wage is the same. But if you’re an IT professional, you’ll earn more than an entry-level shop assistant.

Here’s a flavour of the range of average salaries by occupation in the UK:

| Profession | Average salary in the UK |

| Doctors | £74,800 |

| Solicitors | £57,200 |

| Sales | £54,080 |

| Lawyers | £53,746 |

| Software Developers | £50,440 |

| Nurses | £40,560 |

| Bricklayers and Masons | £27,040 |

| Waiting Staff | £17,680 |

Industry

The industry in which you work could also have a bearing on how much you are paid. Managers in retail stores tend to be paid less than managers in finance companies.

Seniority

Of course, whatever industry and company you work for, you should expect to be paid more the higher up the career ladder you climb.

Age & Experience

Things get a little more contentious when it comes to age and experience. There are two trains of thought here. The first is that those with more experience (usually also meaning older) should earn more – and this seems reasonable.

The second is that no matter your age and experience, if you’re doing the same job as the person next to you, then you should be paid the same salary – which also seems reasonable.

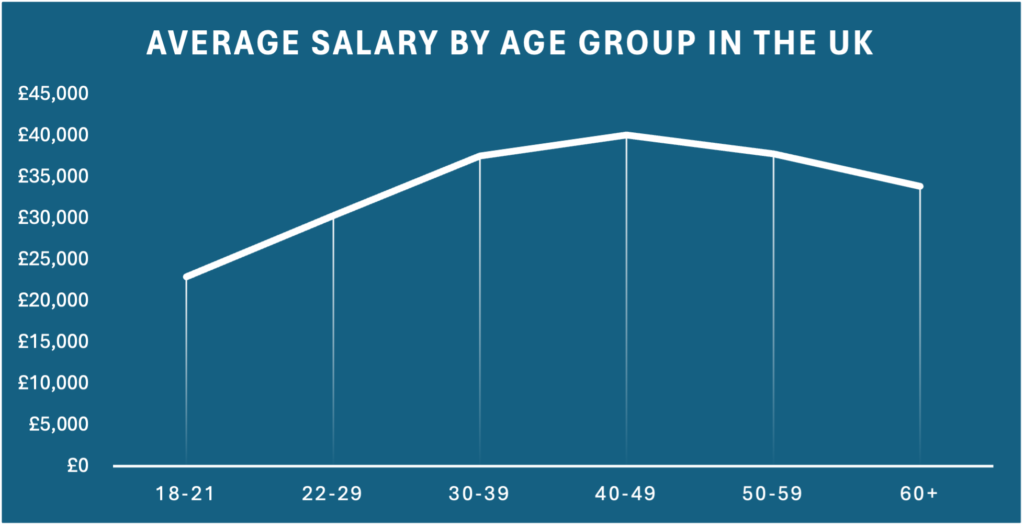

Whichever your point of view, the graph of average salaries by age group might surprise you:

Whatever the reasons for this (and there are many, such as people who have paid off their mortgages can take jobs with less responsibility, which generally come with a lower salary), your peak earning period is likely to be in your forties.

Public Sector vs Private Sector

Here’s something that may surprise you – according to average weekly earnings statistics from the Office for National Statistics (ONS), if you work in the public sector, you are likely to earn more than if you work in the private sector.

In April 2023, full-time employees in the public sector earned an average of 8% more than their peers in the private sector, though this gap has been narrowing since the pandemic.

It’s Not What You Earn, It’s How You Spend That Makes The Big Difference

Being financially comfortable isn’t only about how much you earn. It’s how you manage your money that really counts. Effective budget planning and sensible spending habits can make your money stretch much further.

Paying off debt, choosing more affordable accommodation, and reducing unnecessary impulse buys can make a huge difference to your finances – hundreds of pounds a month. That’s like giving yourself a pay rise of several thousand a year.

Can You Afford to Buy a House on a £30k Salary?

For all the noise about how expensive and unaffordable homes are today (and I’m not going to dispute that UK property is expensive), it is possible to buy a home with a salary of £30k.

With a 10% deposit, you could afford a mortgage of around £120k (four times your salary), and more if you partner with someone else to purchase a house. It may not be enough to buy a property in London, but in the regions there is still good value to be found.

As for that deposit – as we’ve just seen, a sensible budget and good spending habits could save thousands a year. Why not redirect these savings into a Lifetime ISA (LISA), and benefit from a government bonus of up to £1,000 each year on those savings?

Should You Ask for a Pay Rise?

Whether you should ask for a pay rise is a challenging question to answer. If you’ve done your homework, discovered that others in the same profession and same role as you in your area are earning more than you, then it may be something to consider.

If you do decide to ask for a salary increase, here are my tips to improve your chances of success:

- Ask your boss for a meeting to discuss your salary.

- Go prepared with industry data.

- Prepare your case with data and evidence about your performance (the value you bring to the table).

- Be ready to negotiate – sometimes your boss may be able to give extra benefits (such as more holiday or flexible working hours) rather than extra money.

- Talk about the future and how you can achieve the salary you desire (for example, by taking on extra responsibility) and set a timetable for review of performance.

If your boss rejects your request and shows no willing to budge or look toward the future, it may be time to start looking for a new job.

Tips to Make a £30k Salary Go Further

Making a £30k salary stretch further is very possible if you act with a bit of financial savvy. Here are my top tips to live more comfortable on a £30k salary:

1. Budget Wisely

Track your income and expenditure using a budget tool like Emma to learn how you are spending your money. Use this information to plan to manage your money better.

2. Reduce Housing Costs

Housing is typically the largest monthly expense. Could you move to a more affordable area, or to a smaller property to reduce this cost? If you own your home, could you refinance to reduce your mortgage payments?

3. Cut Unnecessary Expenses

How are those monthly subscriptions and memberships working for you? Are there any that you could cancel, switch, or renegotiate?

When you are out and about, before you purchase anything, ask yourself if you really need it. If you do, could you wait to make that purchase when a sale is on?

4. Save on Groceries

Another major expense is the weekly food bill. I cut my food shopping bill drastically when I started planning my meals, making shopping lists (and sticking to them), and bulk cooking.

You should also use vouchers, shop for discounted goods, and shop at the cheapest supermarkets. You really can save hundreds of pounds each year.

5. Pay Off Debt & Build An Emergency Fund

Get rid of that expensive debt! Credit card balances especially can eat into your take-home pay.

Prioritise repaying bad debt, and when you have done this start saving as hard as you can to build up an emergency savings pot of three times your monthly net salary.

The Bottom Line

Wrapping up, living well on a £30k salary can be challenging in some parts of the UK, but it doesn’t need to be. What you earn is just one piece of your personal financial puzzle.

Equally important is how you manage your money. The key is to take a sensible approach to budgeting and spending, and to understand your value in the jobs market.

With the right mindset and strategies, not only can you live well today, but you can look forward to a financially stable and fulfilling future too.