“Look after the pennies, and the pounds will look after themselves.”

A common saying, but what does it really mean?

I looked it up. What I discovered is that it means ‘if someone takes care not to waste small amounts of money, they will accumulate capital.’

But is it really possible to turn pennies into pounds?

The answer is yes! Putting your pennies in a jar is a great way to get into the savings habit. You can literally watch your pot of pennies grow. It’s a beautiful thing!

When you’ve been saving those coppers for a few weeks, the amount can soon start to build.

How do you start? How about giving the 1p challenge a go?

Let’s look at how you can get your penny wealth creator going, what will keep you on track, and the results you can expect. If you don’t think it’s for you, I’m also going to show you a few alternatives.

Are you ready to take your first step to becoming wealthy?

Why Does the 1p Challenge Work?

One of the many things I’ve learned during my career in finance is that wealth accumulators are habitual and disciplined. This isn’t something that comes naturally to most people. We need to work at it. Build a habit gradually. It takes discipline.

If you find saving a struggle – maybe you’ve never saved a penny in your life and now realise it’s kind of important to have savings for a rainy day – the 1p challenge could be the method that motivates your savings mojo.

The idea is simple:

- Start small

- Build up over time (you don’t feel an impact)

- Do it every day

By the end of the one-year challenge, you’ll be saving more than £25 a week.

What Is the 1p Challenge?

This well-known challenge is a savings strategy that lasts 365 days.

On day one, you save one penny. Each subsequent day, you increase how much you are saving by one penny. So, on day two you save 2p. On day three, this rises to 3p, and so on. On the last day of the challenge, you’ll put aside £3.65.

£3.65. That’s all. Around the price of a Costa coffee. It doesn’t seem a lot, does it? Yet starting your savings routine at just 1p per day and building gradually soon adds up.

How Much Can You Save Using the 1p Challenge?

Incredibly, by following this savings strategy you will have saved £667.95 after a year of saving. Follow through, and stay on track, and you’ll have achieved something even more rewarding.

You’ll have proved to yourself that you can be disciplined and save. You’ll have developed a good financial habit. You’ll be asking yourself, “How much could I save if…?”

The 1p Challenge Is Harder Than It Sounds

Before you rush to get started with your first penny in the jar, it’s only fair that I warn you about a few stumbling blocks you’ll encounter along the way.

- The first of these is negativity from friends or others. Comments like, “A penny? Is that all? Not worth doing.” Or “Why not just start by saving £25 per week?” Ignore all the naysayers! Keep your eyes on the prize.

- The second is the lack of pennies in your pocket. I mean, who uses cash nowadays? Even if you do, what are the chances of having, say, 27p in your pocket on day 27? Fortunately there are ways round this. I’ll discuss them a little later in this article.

- The third is temptation. You’re six months into the challenge, and you have saved more than £165. Couldn’t you just take a £40 or £50 for a night out with your friends? There are times when you’ll need to be strong and remain disciplined.

How Can You Save for the 1p Challenge?

Many people set this as a New Year’s resolution, starting on January 1st. It doesn’t have to start at the beginning of the year, though. You can begin any time you like. Perhaps today, after you’ve read this article.

There are three ways you can take on this challenge:

1. Put Your Pennies in a Piggy Bank or Jar

This is how the challenge first got started. Seeing that first penny be joined by other coins can be motivating.

The visual aspect can be enough to keep you going. Plus, if you do get to the point of pandering for a night out but you’re short of cash in the bank, are you really going to stuff £50 in loose change in your pocket?

2. Transfer the Cash Online

I love online banking. It makes financial management so much easier. Including transferring money into savings accounts. However, you’ll need to open a savings account (many digital banks allow you to have multiple ‘pots’ or ‘jars’ to help you segregate your savings) and make sure that your bank will let you transfer small amounts.

What you might find easier – especially if you are paid monthly – is to move the money into your digital savings account on the day you get paid. Set a reminder in your diary, log on, and transfer the money before you spend it elsewhere. If you save for the 1p challenge this way, you’ll be saving the following amounts:

| Month | Save | Accumulated | Month | Save | Accumulated |

| Month 1 (Jan) | £4.96 | £4.96 | Month 7 (July) | £61.07 | £225.78 |

| Month 2 (Feb) | £12.74 | £17.70 | Month 8 (Aug) | £70.68 | £296.46 |

| Month 3 (Mar) | £23.25 | £40.95 | Month 9 (Sep) | £77.55 | £374.01 |

| Month 4 (Apr) | £31.65 | £72.60 | Month 10 (Oct) | £89.59 | £463.60 |

| Month 5 (May) | £42.16 | £114.76 | Month 11 (Nov) | £95.85 | £559.45 |

| Month 6 (Jun) | £49.95 | £164.71 | Month 12 (Dec) | £108.50 | £667.95 |

3. Put Your 1p Challenge on Autopilot with Monzo

If you bank with Monzo, you’ll already know they have some very cool ways to save.

What you may not know is Monzo can do all the work for you and transfer your daily 1p saving challenge amount into a separate savings pot. To do this, it uses a web service called IFTTT (IF This Then That). All you need to do is set it up through your Monzo account and let your 1p challenge run in the background.

Here’s how easy it is to do:

- Open the 1p Saving Challenge on IFTTT

- Log into your Monzo account and review and agree with the T&Cs

- Select a pot for your 1p savings challenge amounts to be credited to

- Click ‘save’

That’s it! Within a minute, your penny challenge pot is up and running.

Variations on the Penny Challenge

The 1p challenge isn’t everyone’s cup of tea. This doesn’t matter, because there are many ways to mix it up and make it your own. Here are a few ideas of how you might adapt the 1p Challenge to suit you.

The Reverse 1p Challenge

If you think you’ll find it easier to save now than at the end of 12 months, turn the penny challenge upside down. Start by saving £3.65 on day one and then deduct a penny a day: £3.64 on day two, £3.63 on day three, and so on. If you’re saving monthly rather than daily, here’s what you need to save each month:

| Month | Save | Accumulated | Month | Save | Accumulated |

| Month 1 | £108.50 | £108.50 | Month 7 | £49.95 | £553.19 |

| Month 2 | £95.85 | £204.35 | Month 8 | £42.16 | £595.35 |

| Month 3 | £89.59 | £293.94 | Month 9 | £31.65 | £627.00 |

| Month 4 | £77.55 | £371.49 | Month 10 | £23.25 | £650.25 |

| Month 5 | £70.68 | £442.17 | Month 11 | £12.74 | £662.99 |

| Month 6 | £61.07 | £503.24 | Month 12 | £4.96 | £667.95 |

This could be ideal if you have children, and start in January. By months 8 and 9, as the expense of sending the kids back to school kicks in, you are saving less and so the responsibility of saving isn’t so great. Come Christmas, you’ll have extra money in your pocket and a packed savings pot to take the strain.

Evening It Out

Does the prospect of saving £108.50 in a single month feel too challenging for you? At the same time, popping £4.96 seem too easy?

Then find a middle ground. Even out your payments over the year and still reach your target of £667.95 by saving £55.67 each month. You could set up a regular direct payment from your current account into your savings challenge account. Set this for the day you get paid, and you’ll be less likely to miss the money.

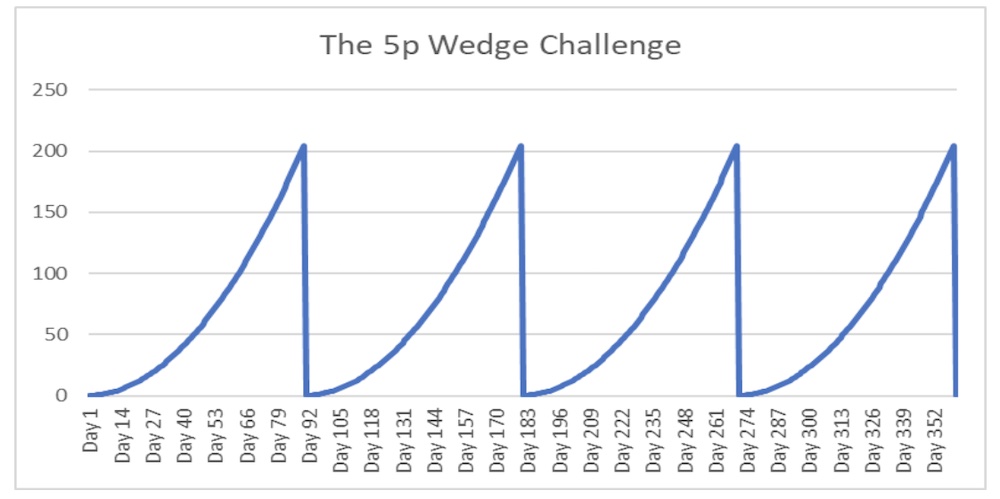

The 5p ‘Wedge’ Challenge

This is a great way to save for a treat every three months. It works like the 1p Challenge, except you start with 5p and increase the amount you save by 5p each day for three months. For ease of calculation, let’s say that each month is 30 days:

- At the end of month one, you will save £1.50 on day 30 and have accumulated £23.25 in your savings pot.

- At the end of month two, your day 60 saving will be £3.00, and your total savings will be £91.50.

- On day 90 at the end of month three, you’ll set aside £4.50 and have a total of £204.75.

Then, you start the cycle again.

Every three months, that’s around £205 to do with as you wish. Easter eggs and a family lunch paid for. A start-of-summer barbecue at the end of June without worrying about the cost. A couple of days out with the kids during October half-term sorted. And the money to enjoy a belter of a New Year Party.

Here’s what your savings look like using this method:

Saving Without Thinking

Does the 1p Challenge seem like too much hard work?

If you want to save money without thinking about doing so, then roundups could be the way to go. Most banks now offer a roundup facility, and there are apps available that also allow you to do the same (but at a cost).

What Are Roundups?

Pre-Covid, I did most of my spending in cash. At the beginning of each week, I’d withdraw my ‘spending money’ from my bank’s ATM and pop it in my wallet. Whatever I bought, I would use the notes in my wallet to pay. Whatever coins I got back in my change, I’d put in my pocket. Notes would go into my wallet.

At the end of each day, I’d empty my pocket into a jar at home. I wouldn’t even think about it. That jar was a godsend! If any financial emergency cropped up, I’d usually have the money available in my ‘pennies jar’.

Roundups are the digital equivalent to the pennies jar.

With a roundup facility, whenever you spend on your debit card the bill is rounded up to the nearest pound. The amount of the roundup is swept into a savings account. Bought a coffee for £2.30? 70p is added to your savings account and £3.00 deducted from our current account.

You don’t even realise it’s happening. It’s passive saving at its most potent! The savings add up quickly, too. For an even more aggressive roundup, some banks (NatWest springs immediately to mind) allow you to double up every roundup. Instead of saving 70p when you buy that coffee, you’ll save £1.40.

According to Moneybox – one of the apps that offer roundup facilities – its users make an average of 30 transactions per week with an average roundup of 28p. This equates to £8.40 automatically transferred to the savings pot each week. £436.80 per year of seamless savings.

My Top Tips to Beat the 1p Challenge

It may sound easy, but a spoonful of discipline is certainly needed to beat the 1p Challenge. That, and using the tools at your disposal. You may face temptation or apathy on the way, which can be devastating to achieving your saving goal. Here are my tips to help keep you on track:

1. Set a savings reminder

Our lives are full of to-do lists, alarms that wake us up in the morning, timers to tell us to check on the pizza in the oven, watches that tell us to take a walk… You get the picture. We need reminding to do things.

Why should savings be any different?

Whether you are saving daily, weekly, or on the day you get paid from work, set a reminder that you must attend to your savings. Missing a savings transfer is bad news for your wealth.

2. Make saving part of your daily routine

I have my daily routines. After following them for a while, they become habitual.

My morning routine includes checking my emails, adapting the goals and schedule for my day if needed, checking my blood pressure, and completing a quick cryptic crossword online. Oh, and transferring my daily savings. If I haven’t done all these things, I can’t start my day right.

Make saving a part of your daily routine, whether it’s in the morning, at lunch, or in the evening.

3. Get competitive with a friend

Use the power of the collective and compete with a friend to keep you focused on your goal. It’s the psychology that makes slimming clubs and fitness classes so popular.

The support and encouragement you receive could be the motivating factor that helps you maintain your momentum. Plus, you want to beat your friend to the prize, don’t you?

4. Always ask for change

If you are pursuing the challenge with cash savings, make sure to always ask for change when you pay with cash. If you usually make purchases using your debit card, use cash to pay now and again – and get the change! You can put this toward your daily savings.

5. Don’t touch your savings!

Whether you are saving in cash or direct into a savings account, don’t be tempted to touch your growing stash. Raiding your pot for a night out, however well deserved, will leave you with a hangover in the morning, and a sense of failure.

6. Forgive yourself if a raid on savings is unavoidable

There may be times when you need to dig into your 1p Challenge pot. It’s something that is likely to devastate you. You’d saved all that money, and now it’s gone. But, hey, if you need your central heating repaired before your kids freeze, then I suggest you forgive yourself.

In fact, in such circumstances, shouldn’t you give yourself a pat on the back? I mean, you stuck it out so long without cracking that you saved the money to save your family. You didn’t need to go and beg, steal, or borrow the money. In my book, that’s heroic.

You can always reboot your savings.

7. Don’t rely on the 1p Challenge alone

My last word of advice today is never to rely on the 1p Challenge as your sole means of saving. There are many other savings tactics you can combine with this one, and diversifying how you save will help you save more successfully.

Throw that loose change in a pot at the end of each day. Set up a roundup account at your bank. Commit to a week or month not spending on anything unnecessary. There are hundreds of ways to save. The secret is to find those that work best for you, and make them habitual.

Get Started with the 1p Challenge Today

Being financially secure and achieving your financial goals starts with the first penny you save.

You might be tempted to delay starting the 1p Challenge. After all, it’s only a penny today, isn’t it? Even if you left it a month, you’d only need to put away less than a fiver to have caught up.

Sorry to tell you this, but catching and keeping the savings bug just doesn’t happen like this. Making a start and putting that first penny in the pot is crucial. You will never reach your destination unless you take that first step of the journey.

If you delay saving, you’ll miss out on valuable time that will help your savings pot grow. Not only this, but having a pot of cash readily available – no matter how small the pot – could be the protective cushion you need in an emergency.

Should an emergency occur and you need a few quid in a hurry, it’s extremely liberating to know you won’t have to rely on the goodwill of others or borrowing money at extortionate interest rates.

So, start saving today, because if you look after the pennies, the pounds really do look after themselves.