Starling is on a mission to ‘change the way we bank’. But will we like the new way? What does Starling offer its customers? From services to interest rates and features, and of course protection, this Starling Bank review covers everything.

It’s a multi-award-winning bank that is helping to redefine how we all ‘do banking’. But is Starling Bank all it is cracked up to be, or is it overhyped by great PR?

In this article, we dismantle Starling to examine all the pieces. Is it as easy to use? Are there any cogs that need oiling? How does it compare with other challenger banks, like Revolut and Monzo?

These questions, and more, must all be answered before you can make an informed decision about Starling being the best bank for you. Let’s get started, shall we?

Quick Verdict On Starling Bank

A superb alternative to traditional banks, offering a host of features to help you manage your money more effectively. Starling Bank puts you in control of your banking, with an exceptional app that delivers full power in your palm!

A multi-award-winning company, Starling is innovative and cost-effective. You can open a variety of bank account types through the app, set up direct debits and standing orders, arrange an overdraft, and automatically set money aside toward your savings goals.

Open a Starling Bank current account, and it could soon become your go-to everyday banking solution.

What Is Starling Bank?

Starling Bank is what is known as a challenger bank. It received a banking licence in 2016, and has been disrupting how banks do things ever since.

It was founded by Anne Boden MBE. She has worked for big names like Lloyds and Allied Irish Bank, and helped to develop the real-time payments system CHAPS in the UK. In a nutshell, Boden is well-versed about the UK banking environment.

What Starling offers is a new way of banking. No branches, but more control. An app to manage your finances, and 24/7 support for the odd occasion where you need a little help.

Starling Bank isn’t a high street bank. It’s a bank on your phone.

An Award-Winning Institution Already

If Starling were an English football team, it would be in a league of its own. It has won more than 60 awards in its short history. These include Britain’s Best Bank from 2018 to 2021, and Best Current Account between 2018 and 2022. In 2023, Starling has been named:

- Banking Brand of the Year

- Company of the Year

- Best Business Account Provider

- Best Foreign Currency Account

2022’s awards included:

- Best Current Account Provider

- Best Children’s Financial Provider

- Banking App of the Year

We think you’ll agree, it’s a sparkling chorus line of trophies. However, all the industry accolades in the world wouldn’t matter one iota if its financial products and services don’t live up to expectations. It set out to be ‘Banking. But Better.’ Have they achieved this aim?

Starling Bank Accounts

When it comes to bank accounts, Starling plays all over the pitch. You can open personal and joint accounts, or an account for your child (there are two – one for younger children, and one for the teens). Starling also provides business accounts, and special accounts for sole traders.

You can also hold foreign currency in your Starling accounts which is part of what makes the bank such a good account option for spending money abroad.

Here’s a brief summary of the different account options with Starling Bank:

Personal Account

App-based banking with a Mastercard debit card. You’ll get access to app features, earn around 0.05% on your cash balance, and have support when you need it.

How to open: It only takes a few minutes to apply for a personal account from a smartphone with internet access. You’ll need a valid photo ID (such as a driving licence or passport). Download the Starling Bank app, and follow the instructions to complete your application.

Joint Account

You can create a joint account within the app, proving both account holders already have Starling personal accounts. Control your money jointly, with access to the same app features as a personal account.

How to open: Both proposed joint account holders must have a Starling current account. Simply apply through the Starling Bank app.

Euro Account

Ideal for those who send, receive, or spend money in euros.

How to open: Providing you have a Starling current account, apply through the Starling Bank app.

Kite Account

Specifically for children aged 6 to 16, as a parent you can monitor and control your child’s account. A great introduction to banking, budgeting, and saving for youngsters.

How to open: This is a little different. You’ll need to set up a space within your personal account, and then follow the steps on the app. Once opened, you’ll receive the Kite card within days.

Teen Account

A halfway house account between the Kite and adult personal accounts, this young adult’s account for those aged 16 and 17 includes a Mastercard debit card, 24/7 customer support, and strict control on overspending.

How to open: Teenagers can apply for their own account at Starling, with a passport ID, from the app. You’ll also need to provide proof of address. Once opened, you’ll receive your Mastercard debit card through the post, and be able to control your finances through the app.

In the rest of this article, we’re going to focus on a review of Starling’s personal accounts.

Starling’s Personal Current Account in More Detail

As a current account holder with Starling, you’ll be able to do much of what you can with a traditional bank account, without needing to travel to the nearest branch, queue for what seems like hours, and have the bank teller close their desk just as it’s your turn.

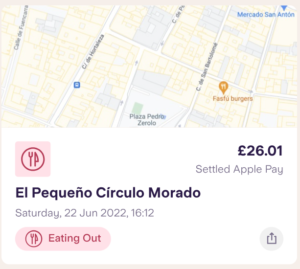

You’ll be able to set up direct debits and standing orders, and make payments from the app. You’ll also be able to use Apple Pay instead of your Mastercard if you wish.

You can withdraw up to £300 per day without charge. If you have cash to deposit, you can deposit this at any one of 11,500 Post Offices around the UK. Be aware though, that if you deposit more than £1,000 in cash in any 12-month period, you will incur a charge of 0.7% of the amount over £1,000.

The app will become your financial hub! You’ll see every in and out on your account within seconds, providing a real-time balance on screen. But it does much more than this.

Your app provides spending insights that will help you understand your financial habits more acutely. This will give you the information you need to budget more effectively and make better financial decisions. It’s just a shame that (as yet) Starling doesn’t let you set budget limits on specific spending (Monzo is a winner with this).

The Round Ups feature is a good way to boost your savings, and you can elect to boost these Round Ups by up to 10x to accelerate your savings.

Talking about saving money, Starling current account holders can earn high interest rates on 1-year fixed rate savings accounts, though you’ll give up access to your cash until maturity.

If you need an overdraft, you can arrange this through your app, too. However, a word of warning – though you will only incur interest charges on the amount of your overdraft, at between 15% and 35% depending on your credit score, a Starling Bank overdraft is not cheap. I would suggest you avoid going overdrawn.

The Starling Bank Current Account’s Key Features

Starling offers a comprehensive range of banking, including some you’d be hard pressed to find at a high street bank. These include:

- No monthly fees, making for a highly cost-effective bank account.

- Interest payments on your money, which may be a token on your current account, but really add up in your savings spaces.

- Real-time banking notifications, helping you to keep on top of your transactions the moment they happen.

- Completely digital banking, allowing you to manage your money wherever you are from an app on your mobile phone.

- A suite of money management tools, designed to help you budget more effectively and spend more wisely. You can view spending by category, letting you see at a glance where you could be saving.

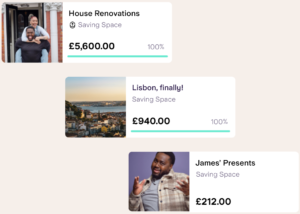

- Saving spaces, virtual ‘jars’ to put money aside automatically. Decide on your savings goals, and have your savings jars fill up each pay day.

- Round Ups, to help you save without realising it. Set your account up to round all your card payments to the next pound, with the difference deposited in a separate savings space – the equivalent to emptying your pockets of all that loose change each day.

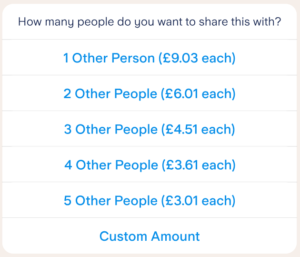

- Bill Splitting, a great feature for all those who want to split a bill after an evening out or a meal with friends. Select who owes you money, and watch as their part of the payment hits your account.

- Low-fee international transfers, made via SWIFT, almost immediately, in all major currencies (and more) to more than 35 countries.

- Withdraw fee-free at ATMs abroad, and you can make fee-free payments in most foreign establishments, too, helping to keep the cost of travel lower.

- Overdrafts available, but no personal loans as yet.

- Deposit cheques digitally, by scanning the cheque in your app using your phone’s camera. Not all digital banks offer this as a service.

- Integrated marketplace, linking you to other financial institutions to access a range of financial products not yet available directly through Starling (like mortgages, loans, pensions, and insurances).

- 24/7 support, for those, like me, who do their banking on the fly. No more waiting around until the next business day ─ get your query solved at any time.

The Connected Card

As a personal account holder, you have access to an innovative feature called the Connected Card. This is a debit card linked to your account. The idea is that you can allow a person to make purchases on the Connected Card, without the need to share bank details, give out cash, or (which you shouldn’t do anyway) share your own bank card.

It works by connecting to a specific ‘space’ in your personal bank account setup, rather than to your personal account itself. There’s a spending limit of £200, too. These are useful features that help protect you from overspending (whether accidental or intentional).

A Connected Card can only be used in-person – not online. It also cannot be used to withdraw cash from an ATM, or to access your banking app. All in all, a good range of safety features.

Fees and Charges

That’s a pretty impressive list of products and services. They must come at a cost, right? You’ll be surprised when you compare the following list to most other bank accounts:

| Product / Service | Fees / Charges / Interest |

| Account Fees | No fee |

| Additional GBP Personal / Joint Current Account | No fee |

| Connected Card | £2 per month |

| Kite Account | £2 per month |

| ATM cash withdrawals in the UK | Free |

| Debit card payment in UK | Free |

| Depositing cash via Post Office | Free up to £1,000 per year, 0.7% fee for deposits above £1,000 |

| Sending money in the UK | Free |

| CHAPS payments in the UK | £20 |

| Overdraft | Free to set up, but incurs 15% to 35% on overdrawn amount |

| Refusing a payment due to lack of funds | No fee |

| Allowing a payment despite lack of funds | No fee, though refer to overdraft fees |

| Cash withdrawal in foreign currency outside the UK | No fee (Mastercard exchange rates apply) |

| Debit card payment in a foreign currency | No fee (Mastercard exchange rates or merchant rates/fees apply) |

| Sending money outside the UK | Fees and exchange rates apply (shown on International Payments page in the app) |

| Receiving money from the UK/outside the UK | Free |

| Replacement debit cards (UK) | £5 |

| Replacement debit cards (overseas) | £10 |

| Certifying documents | £20 |

Using Your Starling Card Abroad

Starling is among our top picks for the best ways to spend money abroad, and a serious rival to more widely-known travel credit cards. It’s not hard to see why.

First, you’ll benefit from competitive exchange rates on cash withdrawals and card transactions. Starling doesn’t take a penny out of the Mastercard exchange rate, unlike many other banks. There are also no fees to transact in a foreign currency when you’re abroad. These savings versus traditional bank accounts can save you enough for a family lunch or night out on the town while you’re away!

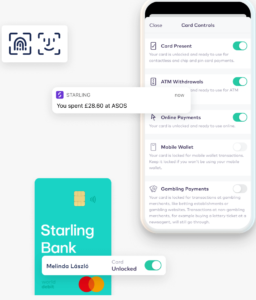

A thought that always fills me with dread is losing my card (or having my pocket picked). Starling’s card controls remove this fear. If your card is lost or stolen, simply block it on the app and order a new one – or flip to paying with Apple Pay. (The 24/7 support is comforting while abroad, too.)

Finally, use Starling’s currency calculator to convert those pesky foreign prices into sterling to know how much you are spending.

Is Starling Safe to Use?

A concern that you might have with digital banks is their safety. You don’t need to be anxious about this with a Starling account. From opening an account to using the app, and safety of your money held in your Starling account setup, there is nothing to fear apart from yourself!

For a start, you’ll need to verify your identity when you go through the application process. You’ll need to provide a scan/jpeg of your passport of UK driving licence, and then verify who you are by recording a short video of yourself.

You’ll also need to set up a PIN code for each device you use to access your account. As if this isn’t enough, if your phone or other device allows biometric or facial recognition, you’ll be able to set this up, too.

Should you wish to set up payees or make payments through the app, you’ll also need to provide a personal password. The same goes if you wish to edit or update your personal information.

The real-time notifications of actions on your account are another cool safety feature. The sooner you know about a potentially fraudulent transaction, the faster and more successfully you can deal with it.

You can also disable contactless and chip and PIN payments from your card on the app, as well as control ATM withdrawals, online payments, and your mobile wallet. Plus, if you believe your card has been stolen, or that you have lost it, you can block or cancel it immediately using the app.

There are 3D secure payment security features, confirmation of payee requirements, and you can use a virtual card to protect your debit card further while shopping.

Starling has also invested heavily in protecting its hardware and software across its entire network. It has put a raft of cybersecurity measures in place to protect your personal data and comply with GDPR rules and regulations.

On top of all this, you are protected by the Financial Services Compensation Scheme (FSCS). This means that, for example, should Starling go bust, up to £85,000 of your eligible deposits are fully protected against loss.

What Others Say About Starling

Taking a look at Trustpilot, we see that around 37,000 customers have given their opinions about Starling. 76% of these have given the bank a 5/5-star rating. Customers particularly like the budgeting features, the ease and cost-effectiveness of using the card abroad, and access to help when it is needed. They also comment on the quality of the app, the tech, and general banking features.

On the flipside, 11% rate it as only 1-star, often citing poor service levels, and payments made without permission being given.

How to get the Most from Your Starling Personal Current Account

If you’ve never used digital banking before, Starling can be a little bemusing. Just how do you use it to its full effect to help make your financial life easier?

If you are using or planning to use Starling Bank, here are some tips for getting the most out of it:

- Make sure you choose the correct account for your needs.

- Set up those notifications. This will help you keep track of what’s moving in and out of your account in real time.

- Use the Financial Goals function to help you decide how much money you should be setting aside for specific savings targets. Do you want to save for Christmas, a new car, or build up an emergency fund so that life’s little emergencies don’t become financial catastrophes?

- Monitor your spending with in-app analytics to better understand your spending habits and identify how you could save money.

- Set up Round Ups. You’ll never look back, and you won’t even realise you are saving.

- Avoid using the overdraft if you can. It’s great as an emergency, but the interest is a killer.

- Use your Starling account and card wisely overseas, to benefit from fee-free transactions, and a great exchange rate that could put a few extra pounds (or euros/dollars, etc.) in your pocket while abroad.

- Set up all the extra security features for added peace of mind – biometrics, facial recognition, etc.

- Finally, use Starling’s Integration and Marketplace tools as part of your research for financial products such as mortgages and insurances.

Alternatives to Starling Bank

When looking at potential alternatives to Starling Bank, we’ve come up with the following four possibles:

- Monzo

- Revolut

- Monese

- Cashplus

All offer free standard accounts, as well as personal current accounts, business accounts, and, like Starling, you can set up direct debits and standing orders. All five have money management features to help you budget more effectively.

However, there are some key differences:

- Revolut and Monese do not have UK banking licences, so you won’t benefit from protection under FSCS.

- While Starling Bank, Monzo, Revolut, and Monese offer fee-free spending abroad, Cashplus does not. It’s the same with fee-free cash withdrawals abroad, all except Cashplus offer this feature, though there are limits on the amount you can withdraw fee-free.

- Only Starling Bank offers interest on the money you hold in your current account.

- Starling Bank, Monzo, Monese, and Cashplus allow for cash deposits. Revolut does not offer this feature.

Overall, Starling Bank offers the most comprehensive list of features, including being a UK registered bank, offering overdrafts, and paying interest on current accounts.

Monzo comes close, but lacks the interest feature. Revolut and Monese offer fewer features of traditional banking, which includes no overdrafts or loans. Cashplus, although a registered UK bank with overdraft and loan facilities, does not offer fee-free transactions abroad.

The Bottom Line

As an alternative to a traditional bank account, Starling provides full functionality. You’ll have a debit card, with a UK bank account number and sort code. You can make withdrawals at ATMs, deposit cash and cheques, and set up standing orders and direct debits. You can also receive your salary into a Starling current account.

However, Starling goes much further than this. You get to control your banking from the palm of your hand. You’ll gain insights about your spending habits that could help you turn your finances around, and be able to set saving goals and set money aside toward them automatically.

With a range of account options, a host of features you’d be hard pressed to find with a high street bank account, and a support infrastructure that quite frankly puts others to shame, it’s not surprising that Starling stands out from the crowd with its multitude of banking awards.

However, you don’t need to take my word for it. A very good friend of mine, Michael Dollimore, has had a Starling Bank account for several years. Being a recently retired VP of Professional Services at a Global Payments Company, he knows a thing or two about banking. Here’s what he has to say about Starling:

“It’s a really good bank, and the app is superb. It’s far better than many others from traditional banks.

“I use Starling for my everyday contactless spending as if it were cash. I can instantly top up my account from my main banking app. If someone needs to pay me, I can send a payment request without fuss. The link they receive lets them pay quickly and easily.

“When I’m abroad, I can withdraw from a cash machine without fees, and I don’t pay commission on foreign exchange.

“I can also categorise my transactions easily and get reports accordingly. It’s my go-to everyday card.

“Oh, and did I mention their online support? That’s superb, too.”