The right platform can make all the difference to investment success. Here, it’s Fidelity vs Vanguard, and they’re quite different – find out which one scores best in this review of both.

Fidelity and Vanguard. Two giants in the investing world. They’re known for their size, global presence, and excellent reputation for performance and service.

However, they have very different approaches to helping their customers achieve their financial goals.

You may already hold either Fidelity or Vanguard funds. It could be that you want to make your own investment decisions but are unsure of which platform to use – and Vanguard and Fidelity are on your radar.

I’ve composed this guide to help you make an informed choice. Read on to discover each platform’s unique tools and resources, product and asset ranges, costs, and pros and cons – because when you’re investing, knowledge isn’t only power, it’s profit.

TLDR: Which Is Best?

Both Fidelity and Vanguard are giants in the investment world, though they have different philosophies when it comes to helping you build your wealth.

Beginner investors may prefer the low entry threshold of Fidelity, together with its more personalised services.

Passive investors will resonate with Vanguard’s philosophy of keeping things simple, with its low-cost, passive funds ideal for long-term set-and-forget investment.

If your preference is to be more active in the markets, you are likely to prefer Fidelity’s broader investment asset options and analytical tools.

*Capital at risk

Who Are Fidelity & Vanguard?

Fidelity

Fidelity was founded in the United States when the world still watched television in black and white. It’s now a global investment house, helping people to save and invest for their future.

They offer a huge range of investment options, from mutual funds to pensions, stocks, bonds, and more. They boast more than 1.5 million customers in the UK alone.

*Capital at risk

Vanguard

Vanguard was founded in the mid-1970s, with an aim of keeping costs low and helping the ordinary person invest for the long term.

The ethos? Stick with your investments to ride out the ebbs and flows of the market instead of trying to outsmart it. Theirs is definitely a ‘set and forget’ modus operandi.

They’re not as big as Fidelity (with ‘only’ half a million UK-based customers), but are growing strongly.

*Capital at risk

Investment Wrappers: A side-By-Side Comparison

One of the key decisions you’ll need to make when you invest is how to invest as tax-efficiently as possible, and in a way that helps you meet your financial goals.

What we’re talking about here is investment products, also known as investment wrappers. Both Fidelity and Vanguard offer a General Investment Account (GIA), ISAs, Junior ISAs, and SIPPs.

A SIPP (Self-Invested Personal Pension) is designed to help you invest for your retirement. You’ll get tax relief on your contributions, and you can take 25% of your fund as a tax-free cash lump sum (usually from age 55, though this is rising to a minimum age of 57 from 2028).

Capital growth and income within the SIPP are free from tax, though any income you receive after you retire is tax liable.

An ISA (Individual Savings Account) is more flexible than a SIPP, allowing you to withdraw from it at any age. Your contributions into an ISA won’t benefit from tax relief; though, like a SIPP, capital gains and income within the ISA are free from tax.

Importantly, any withdrawals you make from an ISA are non-taxable, including any income. Junior ISAs are especially designed to help you invest for a child.

A GIA has no tax benefits, but also no restrictions on how much you can invest.

Investment Asset & Instrument Range

Once you have decided how you wish to invest, you’ll need to decide what assets to buy and hold in your investment wrapper. You might use more than one type of investment wrapper, depending upon your goals and personal circumstances.

You might think of Fidelity vs Vanguard like you would Netflix vs Disney.

Fidelity is the Netflix of the two. It offers a huge range of funds from multiple providers. You can also invest in shares, ETFs, and investment trusts.

In total, you have a choice of more than 6,000 investment instruments from around the world, allowing you to mix and match your investments to match your investment style and financial goals.

Vanguard is more like Disney – you can only invest in its funds. It’s a different approach to Fidelity. Vanguard likes to keep things simple, and to be fair, the choice includes some of the lowest-cost funds available today.

Research, Tools, & Features

Fidelity’s investment platform is a little like a Swiss Army knife – a whole toolbox in your pocket. It’s brimming with research tools, investment calculators, and educational resources, making it good for both beginners and experienced investors.

An example of this is Fidelity’s Navigator – a tool designed to help you select the best investments. You begin by choosing between income and growth, then continue by choosing how you would like your money managed.

A fund will be suggested, and you can access further information before deciding whether to place a buy order.

Vanguard also provides a range of educational contents and investment tools, but the emphasis is on straightforward, passive investment strategies. For example, its managed ISA service is designed to provide a hassle-free approach, with a range of managed funds to suit your risk appetite and time horizon.

If you find that a wider choice of investment assets makes things too complicated, Vanguard’s philosophy removes this complexity from the game. Its fund selection tool asks six questions to help it understand your risk appetite, and there’s a good pension calculator tool, too.

User Experience & Customer Service

Investing is a little like a road trip. It’s not just about the destination, it’s about the journey to get there – and factors like the user interface, ease of use, mobile app availability, and customer service options can make all the difference.

Fidelity

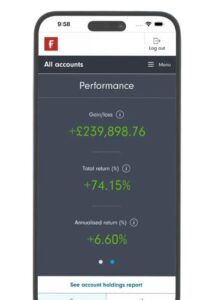

Fidelity’s platform is like driving a car with the latest technology on board. The user interface is highly intuitive – like having an onboard computer to guide you.

Whether you’re executing trades, exploring investment options, or checking on your portfolio’s performance, everything is at hand and easy to access.

Its mobile app is a powerful tool. Available for both iOS and Android, it will help you manage your investments on the go. It’s easy to use and functional, and information is presented clearly.

As a customer, you’ll also have access to a range of support options. These include online support, telephone assistance, and even the opportunity for face-to-face meetings at their Investor Centre in London.

On top of this, Fidelity also hosts regular webinars, which are great to learn more about investing and to ask questions in a live setting.

*Capital at risk

Vanguard

Vanguard’s website is functional and user-friendly, focusing on simplicity and ease of navigation. It’s much more no-frills than Fidelity’s platform, and aligned to its philosophy of keeping things straightforward.

Its customer service matches the robustness of its web offering – you have access to online and telephone-based assistance.

You won’t have the same level of face-to-face support and there are no webinars provided by Vanguard, but you do have access to a comprehensive suite of educational resources and FAQs on the website.

Something that has bugged Vanguard’s customers for a long time is its lack of a mobile app.

However, Vanguard has listened to these views and in February 2024 announced it is in the process of testing its UK Personal Investor Platform, with the aim of rolling it out later this year.

*Capital at risk

Fees & Charges

Fees and charges can be almost as damaging to your wealth as the taxman. Over time, they eat away at your returns. Although an annual management charge may seem small, it can make a big difference.

Thanks to compounding, even a 0.2% difference in fees will lead to a significant shortfall between two funds that both deliver, say, 5% per annum growth over 20 or 30 years.

Here’s how the fee and charges of both Fidelity and Vanguard compare:

Fidelity

Platform Fee

Fidelity charges a service fee that ranges from 0.35% on investments up to £250,000, reducing to 0.20% for investments between £250,000 and £1 million, with no charge on the portion of investments over £1 million.

The same fee is charged across your entire portfolio. The maximum fee that you will pay for a portfolio of more than £1 million is £2,000 a year.

Fund Fees

The cost varies depending on the specific funds you choose, and starts at 0.05%. Fidelity’s platform offers a wide range of funds, including some negotiated discounts on ongoing charges, potentially lowering your costs.

You may also have to pay a bid-offer spread, a performance fee, and a fund manager buy/sell charge.

Additional Charges

When you execute buy and sell orders, you’ll pay:

- £1.50 for deals as part of a regular savings or withdrawal plan, or for a reinvestment of income or a dividend.

- A simple charge of £7.50 for each deal placed online.

- £30 per trade placed over the phone.

*Capital at risk

Vanguard

Platform Fee

Vanguard’s platform fee stands at a straightforward 0.15% across all account sizes, capped at £375 annually. So, you’ll never pay more than £375 a year in platform fees.

Fund Fees

There’s no hassle here – Vanguard is known for its low-cost funds, and it claims an average ongoing costs of 0.20%.

Additional Charges

Vanguard does not charge for trading its funds. However, real-time trades with ETFs will be subject to a bid/offer spread.

*Capital at risk

Minimum Investment

Here is something else that differentiates Fidelity from Vanguard – how much you must invest.

With Fidelity, you can start investing with a lump sum of £1,000 or a monthly investment of £25.

Vanguard’s entry point is £500 as a lump sum or £100 monthly.

Are Fidelity & Vanguard Safe to Use?

Of course, whenever you invest your capital is at risk – markets can go down as well as up, right? But you don’t want to compound this risk with platform or regulatory risk.

Good news – both Fidelity and Vanguard protect your money and your personal data.

Both firms are regulated by the Financial Conduct Authority – the body that is responsible for maintaining the highest possible standard in the financial services industry. Being registered with the FCA means that Fidelity and Vanguard comply with strict standards set out for the protection of investors.

Both are also covered by the Financial Services Compensation Scheme (FSCS). This is a bit like having insurance for the funds you hold with them.

Up to £85,000 of your investments and cash held with either firm is protected against company failure or financial difficulties – though not against the ups and downs of the market.

On top of this, Fidelity and Vanguard apply security measures to help protect your accounts and personal information from being stolen or used maliciously. These measures include advanced encryption technologies to safeguard data transmission between investors and their platforms, and extra security measures when accessing and using your account (such as two-factor authentication).

Fidelity Vs Vanguard: Key Advantages & Disadvantages

Deciding between Fidelity and Vanguard as your investment platform may boil down to assessing the key pros and cons of each.

Understanding the strengths and weaknesses of each platform can help you match the platform with your investment goals and preferences.

Fidelity Pros & Cons

Pros

- Wide range of investment options, from mutual funds to stocks and ETFs which could help you take advantage of market movements and develop a portfolio that is diversified across geographies, asset classes, and economic/industry sectors.

- In-person services, which are great if you prefer face-to-face interaction. You’ll have the opportunity for personal consultations, as well as to participate in webinars. This could be the personal touch that helps you to make more tailored investment choices.

Cons

- Higher fees for some services. The level of personalised services comes at a price. When you compare Fidelity’s charges with Vanguard’s straightforward fee structure, Fidelity’s fees can be higher.

- Complexity for beginners. With such a wide array of options and services, if you’re new to investing you could find things a little overwhelming.

*Capital at risk

Vanguard Pros & Cons

Pros

- Low fees are the hallmark of Vanguard’s philosophy. Its fees are among the lowest in the financial markets, and are especially appealing to long-term investors.

- The focus on passive investing through its range of index funds and ETFs is ideal if you want to employ the kind of ‘set-and-forget’ strategy that has made investors like Warren Buffett very wealthy.

Cons

- Limited investment options. Unlike Fidelity, Vanguard offers a more limited selection of investment products, primarily focusing on its own range of funds. This might not suit you if you plan to use a more diverse or active investment approach.

- No in-person services are offered byVanguard. If you would benefit from face-to-face meetings or personal investment consultations, this lack of personal service would be a downside.

*Capital at risk

Tips For Choosing The Best Investment Platform For You

Choosing a suitable investment platform is a crucial decision in your investment journey. Here are seven tips to help you decide between Fidelity and Vanguard, and how to use your preferred platform effectively.

1. Define Your Investment Goals

Why are you investing? Is it a longer-term goal like retirement planning, or a medium-term objective like paying for your children’s education or saving for a home?

2. Consider Your Investment Style

Do you prefer to make your own investment decisions and take a hands-on approach, or would you prefer a more passive investment strategy?

Do you want more personalised advice, or are you happier to let your investment strategy be determined by an objectives and risk questionnaire?

3. Evaluate Fees & Charges

Understand the fee structure of each platform, and match these to your goals and investment style. Vanguard is known for its low fees, which can significantly impact your long-term returns.

On the other hand, the higher fees charged by Fidelity help to deliver more services and options.

4. Assess The Range Of Investment Options

If you value a broad selection of investment choices, including international markets, Fidelity might be more appealing.

If you prefer a straightforward, focused approach, Vanguard’s curated selection might be more to your liking.

5. Review Platform Tools & Resources

Both platforms offer educational resources and tools, but with a different focus. Fidelity offers a broader spectrum of analytical tools and educational content.

6. Start Small, Invest Regularly, & Diversify

When you have selected your preferred platform, start small, invest regularly, and look to diversify. This will allow you to become used to investing before committing larger sums, while simultaneously benefitting from pound/cost averaging (smoothing out market volatility).

Both Fidelity and Vanguard allow you to diversify your portfolio, albeit in different ways.

7. Review Your Portfolio Regularly

Life changes. So do financial markets. At least once a year, take stock of where you are at, and how the markets are moving.

This will help you to use the tools provided by Fidelity and Vanguard to rebalance your portfolio so that it remains aligned to your evolving financial goals.

The Verdict

While both Fidelity and Vanguard provide robust pathways to achieving your financial and investment goals, each has its unique features, advantages, and disadvantages.

The choice will come down to what you value most on your investment journey: the extensive choices and lower entry point of Fidelity, or the simplicity and slightly higher barrier to entry of Vanguard?

If you’re a newbie in the world of investing, Fidelity’s lower entry threshold of £25 will let you dip your toe in the water more cautiously. Together with user-friendly tools and diverse investment options, its broad range of educational resources make it an attractive proposition.

If your investment mindset is to ‘keep it simple’, then Vanguard could be the ideal choice. With a focus on low-cost, passive funds, it really is the epitome of hands-off investing.

For those who intend to trade more actively, making trade decisions based on research and market movements, Fidelity is more akin to your investment style with its comprehensive selection of assets and detailed analytical tools.

Whichever platform you decide on, you should always remember that markets can fall as well as rise. Your capital is at risk – which is why it’s crucial to diversify your investment and review your portfolio at regular intervals to ensure it is moving in the right direction.