Stock trading apps can be hugely advantageous – but they all offer something different. Our finance expert Michael Barton outlines the best stock trading apps for beginners in the UK, and what you need from them to succeed.

The stock market is no longer a playground for the rich. You don’t need to pay high commissions and extortionate charges to invest through a stockbroker. You can do it all yourself, online, from anywhere.

However, when you’re starting out, finding the best stock trading app as a beginner can be challenging. What are the most important things to consider? How do you trade successfully to build long-term wealth?

In this article, we discuss the criteria to select the best stock trading app for beginners. We then compare the best apps, before discussing the basics in more detail.

Quick Verdict

We’ve put four stock trading apps under the spotlight. Each has its own merits. For ETFs, we recommend InvestEngine. For social trading on a highly advanced platform, eToro is hard to beat.

Whichever app is the right one for you, stick to a few basic investing/trading rules, use the right investment account/wrapper to hold your assets, and maximise your returns in a way that professional fund managers would find challenging – after all, no one knows your financial goals better than you.

InvestEngine – Best For ETFs:

eToro – Most highly advanced platform:

*Your capital is at risk

The Four Best Stock Trading Apps in the UK

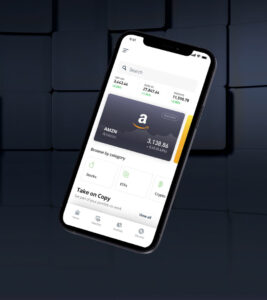

eToro

eToro claims to be home to the world’s largest social investing community, which can be great when you are starting out.

You’ll have plenty of trading and investment ideas to consider and hundreds of ongoing social conversations to take part in. You can even copy the most successful investors’ trades!

It also enables you to trade in a broad range of investment assets, including stocks, Exchange Traded funds (ETFs), Contracts for Differences (CFDs), currencies, and commodities.

There’s a demo account to help get you started before you commit your own money, and 24/7 support. You can trade fractional shares.

As for the costs – the account is free and there is zero commission to trade (though there are currency conversion fees to pay).

On the downside, eToro doesn’t provide ISA or SIPP wrappers.

*Your capital is at risk

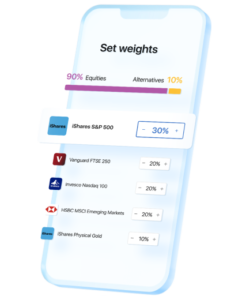

InvestEngine

I’m a huge fan of ETFs, and InvestEngine is an incredible app to trade them.

This app allows you to trade in hundreds of ETFs and create a DIY portfolio to suit your objectives and tolerance for risk. It’s free of charge, too (unless you decide to have InvestEngine manage your account, in which case you’ll be charged 0.25% of the value of your fund as an annual management fee).

It includes some very neat trading features. These include automated splitting of the money you invest into your weighted component ETFs.

You can also automate a regular monthly investment or reinvest your portfolio income to be invested according to your chosen portfolio weights.

Over time, you’ll need to rebalance your portfolio. InvestEngine makes this easy, too. A single click and it’s done for you. Trade in a general investment account or an ISA – but only in ETFs. InvestEngine also offers SIPPs and business accounts.

The app includes a useful Insights section, including trading tips and regular news. However, you cannot enter limit orders or stop loss orders, and it’s more for longer-term investment than short-term trading.

*70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

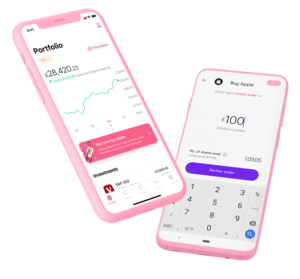

Trading 212

Trading 212 was one of the first apps to offer zero-commission trading. One of the things you’ll love as a beginner to stock trading is the wealth of video-based educational and tutorial material it provides.

There is also a demo trading account to help get you into the swing of things.

You can trade stocks, ETFs, and CFDs on an easy-to-use platform with 24/7 support. There is no account fee, though there are currency conversion charges of up to 0.15%.

You can trade in a general investment account or stocks and shares ISA – and fractional share trading is also allowed. It has a great charting facility to help you identify potential trades.

*Capital at risk.

Freetrade

Freetrade does what it says in its name – commission-free trading in UK and US stocks (though currency conversion fees do apply). You can trade in a general investment account, ISA, or SIPP.

If you sign for a Freetrade Plus account, you’ll get priority customer service and receive interest on any cash held.

It’s a great app for beginners, but to access different account types and receive interest on your cash, you’ll need to upgrade from the basic account. This will cost up to £9.99 per month.

The educational material is not as well-rounded as other platforms, though it does boast more than 1 million users.

*Capital at risk.

What Is Stock Trading?

Financial gurus and financial advisors will often tell you that the secret to building long-term wealth is to ignore the ups and downs of financial markets and remain invested.

Those who trade stocks have a much shorter-term outlook. Even as short as a few minutes. The aim is to eliminate the downturns, or even profit from them.

Consider how, say, the 10-year history of the FTSE-100 Index looks (excluding dividends):

| Year | % Change | Accumulated % Change |

|---|---|---|

| 2013 | 14% | +14% |

| 2014 | -3% | +10.58% |

| 2015 | -5% | +5.05% |

| 2016 | 14% | +19.76% |

| 2017 | 8% | +29.34% |

| 2018 | -12% | +13.82% |

| 2019 | 12% | +27.48% |

| 2020 | -14% | +9.63% |

| 2021 | 14% | +24.98% |

| 2022 | 1% | +26.23% |

As you can see, the value of the FTSE 100 increased by 26.23% between 2013 and 2022. If you had invested £10,000 at the beginning of 2013, it would have grown to £12,623.

But in four of those 10 years the FTSE 100 fell. What if you could have avoided these falls, and only taken the gains?

Your gain then would be an incredible 81%! Your £10,000 investment would have grown to £18,100.

What about if you could have turned each loss year into a profit of the same amount? Now your gain would have been an astounding 149%. That original £10,000 investment would be worth £24,900.

That’s the power of stock trading. If you get it right, you could achieve your financial goals in a fraction of the time it might take otherwise. Selecting the right stock trading platform is critical to this.

Fundamental Analysis v Technical Analysis

Successful stock trading is never about luck. You need a system and a strategy.

Stock traders generally fall into two categories: day traders and swing traders. Both use mostly technical analysis (to decide when to buy and sell).

Day traders have the shortest timeframe for their trades. They may buy and sell within minutes. When day trading, you will usually close your positions by the end of the day, banking any profits and having no overnight risk. The margins are small, but occur more often.

Swing traders have a longer timeframe for their trades. As a swing trader, you’ll look to take advantage of the general ebb and flow of stock prices, holding a position for maybe a few days (sometimes even weeks) before closing and taking the profit.

As a swing trader, while technical analysis is most important to you, you’ll also take note of fundamental analysis.

If you’re investing with a longer timeframe, you’ll be mostly concerned with fundamental analysis.

What is technical analysis?

Technical analysis focuses on historic price patterns, seeking to identify trading opportunities using statistics like price changes and trading volumes on charts. It focuses on technical indicators (signals) like moving averages, momentum, and support and resistance levels.

What is fundamental analysis?

Fundamental analysis focuses on a company’s financials and underlying business. In this type of analysis, you try to identify if the company’s fair value is higher or lower than its current market price. If it’s higher the asset is a buy, and vice versa.

To make buy and sell determinations, you’ll use a range of financial ratios, like Price/Earnings and Dividend Yield.

The Connection Between Technical & Fundamental Analysis

Traders who follow technical or fundamental analysis are often contemptuous toward each other. Each believes they are right. However, the way that each describes price moves in terms of the other’s approach demonstrates the connection:

“A change in the fundamentals is merely the excuse for the price change that the chart predicted.”

Versus…

“The chart is following the fair value as now calculated by the fundamentals.”

*Your capital is at risk

Some Key Stock Trading Signals & Ratios

Technical Analysis

In technical analysis, there are many signals that you can use to decide whether to buy or sell. These include:

Crossing Moving Averages

The 50-day and 200-day moving averages are rolling averages that traders use to identify buying and selling momentum. Should the current market price cross above or below the moving average, it could be a buy or sell signal.

Volume Surges

Volume surges are viewed as a precursor to a market move.

Relative Strength Indicator (RSI)

Shows how the asset is trading and how other traders are acting. The higher the number, the more overbought the asset is and the closer to being a sell.

The lower the number, the more oversold it is and the nearer it is to being a buy.

Fundamental Analysis

Fundamental analysis ratios can indicate if an asset is overvalued or undervalued when compared to current market prices. They can also indicate the ability for a company to continue to operate or pay dividends. Common ratios include:

Earnings Per Share (EPS)

Shows a company’s net profit per share (net profit divided by shares outstanding), and indicates how much a company is making for each share in the market.

Price/Earning (PE)

Calculated by dividing the share price by the EPS. The number shows how many years it might take for an investment to be recuperated by the company’s profits (if profits did not change in the meantime).

In general, the higher the PE ratio, the more bullish investors are about the company’s future earnings potential.

Dividend Yield

The ratio between the dividend the company pays to its share price. It’s a terrific way of comparing the income of a stock to other similar stock and other assets.

Dividend Cover

The ratio of dividend paid to net profits. This gives an indication of how safe the dividend is.

For example, if the dividend cover is 2, then the dividend is covered twice by earnings. The lower the dividend cover, the more likely the dividend is to be reduced or not paid.

Different Types of Investment Account

It’s crucial to trade or invest in the most efficient way to meet your short-term and long-term financial goals. Different ‘wrappers’ offer different features:

General Investment Account (GIA)

There is no limit on what you can trade in a general investment account. You can trade in shares, funds, ETFs, CFDs, foreign currencies, and more in a general investment account.

You’re not restricted in how much money you can invest, and you can sell and withdraw your money at any time.

However, in this type of account all your investments will be subject to applicable taxes. This means you will be liable to income tax on dividend income, though there is currently an allowance of £1,000 of dividend income that is tax free.

The income tax you pay depends upon your personal income tax band:

- Basic rate – you’ll pay 8.75% on your taxable dividends

- Higher rate – you’ll pay 33.75% on your taxable dividends

- Additional rate – you’ll pay 39.35% on your taxable dividends

You should use a GIA after you have used your ISA allowance, because investing in an ISA wrapper is the most tax-efficient way to invest without locking your money up.

However, when you first start DIY stock trading, you might wish to invest through a GIA, because you can only have one stocks and shares ISA in any fiscal year. This will give you a chance to ensure that your stock trading strategy is profitable before committing to an ISA.

Stocks & Shares Individual Savings Account (ISA)

A Stocks and Shares ISA (also called an investment ISA) allows you to invest up to £20,000 in it each year. When you do so, you get a wedge of tax benefits:

- Income inside the ISA is not taxed

- Interest earned inside the ISA is not taxed

- Capital growth inside the ISA is not taxed

When you withdraw funds or take income from the ISA, there is no tax to pay.

Something to remember is that the investment amount of £20,000 in a year is measured by deposits/investments made into the ISA. You can’t withdraw and then top up to £20,000.

Self-Invested Personal Pension (SIPP)

A SIPP is a wrapper that helps you plan for retirement. It works like a personal pension, except it gives much more flexibility. In a SIPP you can invest in many assets, including:

- The shares of UK and overseas companies

- Collective investment schemes like mutual funds and open-ended investment schemes

- Investment trusts

- Commercial property

- ETFs

When you invest in a SIPP, you benefit from tax relief. In other words, your pension contributions are boosted by a payment by the government.

If you’re a basic rate taxpayer, this works out to be an extra 25% of your investment amount. If you are a higher rate taxpayer, you can claim extra tax relief through your self-assessment tax return.

Investments inside a SIPP also grow tax free – there’s no tax on capital gains or income.

Sounds too good to be true? That’s why how much you can invest in pensions is limited. You can invest up to 100% of your earnings, though if you invest more than the annual allowance (currently £60,000) you will be liable to pay tax. The annual allowance includes ALL your pension contributions.

Things to remember when investing in a SIPP is that it is a long-term investment. You won’t be able to withdraw any money before you reach age 55 (except in exceptional circumstances).

When you can start to withdraw funds, you can withdraw a tax-free lump sum of 25% of your fund. How you take income from the fund is very flexible. For example, you could:

- Buy an annuity (to provide a fixed income for life)

- Take a pension drawdown (a flexible income with your fund remaining invested)

You could also take your full pension fund, though only the first 25% will be tax free. Remember, too, that income from a SIPP is taxable.

Different Investment Assets

There are many types of investment assets, and even cash is classed as an asset!

Most DIY investors and traders typically employ the following in their trading strategies:

Shares

Stocks and shares are small parts of a company.

Companies might want to become public companies to raise money by selling shares or to allow original investors or founders to sell some of their shares. They will hold an initial public offer, and the shares then become publicly listed and tradeable on a stock exchange (called the secondary market).

A stock exchange is either a physical or virtual place where shares are traded. Examples are the London Stock Exchange, The New York Stock Exchange, and Nasdaq (an American exchange focused on high-tech companies).

Now, shares can be highly priced (which doesn’t mean they are overvalued – price and value are two different things). This can make it difficult for the man in the street to invest in shares. This is where fractional shares come into play.

A fractional share is a small part of a single share in a company. Great if you want to buy shares in companies like Apple, in which a single share would cost around $197 (£158) at the time of writing this article.

When you buy fractional shares, you still get paid dividends declared, but they will be paid pro rata.

Exchange-Traded Funds (ETFs)

An ETF is like other funds. It is a type of collective investment, which means that it holds shares in many companies, or other assets depending on the ETF.

ETFs are commonly benchmarked on different underlying indices. For example, you can invest in a FTSE 100 ETF, which then replicates the movement of the FTSE 100.

It’s a much more efficient and cheaper way of holding a diverse portfolio. You don’t need to calculate the weightings of every share in the FTSE 100 and then allocate your investment accordingly.

ETFs are cheap to own and trade exactly like shares on a stock exchange.

There are thousands of ETFs available for investment. You can buy an ETF based on a stock index, a market sector, or even sub sectors (like the chip manufacturers of gold, or gold miners).

Contracts for Differences (CFDs)

Another way to trade is through CFDs. These are more complex, and riskier than ETFs of single shares.

You can trade in CFDS on most shares, and they allow you to leverage your investment. That’s a technical term for borrowing money to invest. You may also hear terms like trading on margin to describe leveraging.

The cool thing about CFDs is that they not only allow you to maximise potential profits, but they also allow you to go short of stock. This is selling shares you don’t own, if you think the price is going down; instead of buying low and selling high to make a profit, you sell high and buy low.

CFDs are a cross between shares and options. You make an agreement to trade the shares at a specific price at a specific time in the future. The buyer pays the seller the difference between the current market price and its value when the contract expires. However, in the meantime, you can buy and sell the CFD, just as you would an ordinary share.

CFD prices can move quickly. If you use leveraging, you can make profits much faster, too. For example, if you have £100 and use 5x leveraging, you will effectively invest £500. If the CFD goes up by 10%, you will make £50. That’s 50% profit on your £100!

While this may sound enticing, you should remember what would happen should the price fall by 10%. You lose 50% of your original £100.

My take? CFDs could be an added string to your bow, but only when you have cut your teeth on less complex investment assets.

Foreign Exchange

The biggest market in the world is the foreign exchange (Forex) market. It’s used by governments, companies, and individuals to change money from one currency to another.

The value of a currency – like the pound – is often associated with the economy of that currency’s country. When economic announcements are made, currency values can react violently.

Because it is such a large and sometimes volatile market, Forex trading has become popular with armchair traders. Some stock trading platforms (like eToro) allow you to trade Forex, and trade with set strategies or by following the crowd, too.

*Your capital is at risk

How to Compare Stock Trading Apps for Beginners

To choose the best stock trading app for you, it’s crucial to consider what features are most important to you.

In this review of the best stock trading apps for beginners in the UK, we’ve considered a range of questions that you should ask yourself.

Understanding what you want a trading app to do for you is the starting point to making the best choice, just like it is with anything you buy or use.

As you think about each question, you’ll need to consider which features are most important to you to ensure the app you choose is best for your needs.

Is the app user-friendly?

Here, we’re looking for ease of use. From opening an account to placing orders, from monitoring trades to withdrawing funds, the app should be simple to use, present information clearly, and include great customer support.

What Trading Features Does It Have (e.g. Limit Orders)?

Does the app include various order types, such as limit orders and contingent orders? I also want to see my portfolio balances easily.

Other features like community trading (seeing what others are doing) and access to trading signals, newsfeeds, and sort and filter options (helping to navigate through the stocks you wish to trade) are also important.

What investment assets can I trade on the app?

Do you want to trade stocks, foreign exchange, CFDs or ETFs? You’ll want an app that provides access to all the markets you need, whether in the UK or abroad.

Does it charge commission when trading?

Costs are crucial. The higher the commissions, the harder it is to make a profit. Today, most apps offer commission-free trading, though there may be other charges to pay (such as regulatory fees and FX charges if dealing in foreign shares).

What are the minimum trade sizes?

You should only trade with money you can afford to lose. One question you’ll need to ask is how small you can trade, especially when starting out and getting used to the app and trading or testing out your stock trading strategy.

Can I invest in different investment wrappers, like ISAs?

How you invest includes the ‘wrapper’ in which you trade inside. A general investment account is how most people start. However, trading in a stocks and shares ISA offers tax advantages. If you are trying to maximise your retirement funds, a self-invested pension plan (SIPP) could be best.

Is my money protected under the Financial Services Compensation Scheme (FSCS)?

Don’t trade with an unregulated firm! Always make sure that the firm is authorised to provide the services it offers, and that your money is protected under the FSCS (which protects up to £85,000 of your money if the firm goes bankrupt, for example).

How do its customer reviews stack up?

Don’t only take our word for how good these stock trading apps are – do your research and learn what others think.

What educational resources does it include?

What is your existing trading and investing knowledge? How much help do you need to navigate the markets and trades profitably? Do you need an app that will allow you to practice trading before going live?

5 Tips to Start DIY Stock Trading

Before you rush into stock trading, I want to share five tips that will help you become successful.

Practice Trading

Always practice your trading before you place live orders. Decide on a trading/investing strategy and paper trade – either on a demo trading platform or on paper. This will get you used to how asset prices move and how to use the trading platform.

Start Small

When you do start to trade for real, start small. Only commit small amounts of cash. This will help you learn about the emotional side of trading or investing. Believe me, when you are trading with real money, it’s a different ball game to paper trading.

Build Up Slowly

Don’t seek to run before you can walk properly. Build up the size of your trades, and build up your knowledge gradually. Get involved with trading communities. And learn from the mistakes of others. If anyone tells you they have never lost money, ignore them – every investor and dealer will lose money sometimes.

You Never Go Bust Taking a Profit!

Don’t become so emotionally attached to a stock or trade that you miss the opportunity to take profits. A trading mentor once told me, “You never go bust taking a profit.” Wise words.

Here is another stock market saying for you: “The first cut is the cheapest.” If you have started losing money in a stock, consider selling and taking the loss, before the stock falls even further and you lose even more.

You can take the emotion out of trading by:

- Working out a price at which you would be happy to sell for a profit, and place a limit sell order at that price

- Knowing the maximum loss you can afford to suffer and setting a stop loss at that price

Money management in trading is every bit as important as your trading strategy!

Never Risk More Than You Can Afford to Lose

Finally, never risk any more than you can afford to lose. This amount will be a moving target, too (we’re back to money management in trading).

As your profits accumulate, you may wish to place bigger trades to make bigger potential profits. Manage your risk like a professional, and never overstep your limits.

The Bottom Line

If you are just starting out in stock trading, it’s crucial to be disciplined with your money, learn from others, and have a strategy. It’s also critical to use a great stock trading app – one that does all you need it to.

The good news is that there is a stock trading app for you. Whether you wish to trade shares, ETFs, Forex, or CFDs, the platforms we’ve discussed in this article have you covered. With low (or zero) cost trades, your money will work harder for you.

Especially when investing for the longer term, you’ll be able to maximise your gains by using tax-efficient wrappers like ISAs and SIPPs.

These stock trading apps are best for beginners in the UK:

- To invest in ETFs and benefit from their low costs and market replication qualities, InvestEngine would be my choice.

- To learn from the crowd and participate in social trading, then eToro is hard to beat.

- Trading 212 is a great all-rounder, with good tutorial material and a top demo trading facility.

- Of the four stock trading apps we’ve examined, Freetrade brings up the rear. It’s a good app, but we don’t like the subscription costs to access diverse types of trading accounts.

Whichever app you use, good luck in your trading and investment life, but be warned – it’s easy to catch the bug (and your pocket could profit from it)!

*Your capital is at risk