ETF platforms can help you invest and trade in ETFs to create a thriving portfolio for your investment goals. Here, our expert Michael Barton shares with us the best ETF Platforms in the UK today.

If you want to take advantage of the many benefits of investing and trading in Exchange-Traded Funds (ETFs), you’ll need a robust and effective trading platform. But with so many to choose from, how do you know which is best for you?

Having helped in both the creation of the first ETFs for the European market and in the development and testing of trading platforms in various roles in the City, I’ve been exploring the current trading platform options for ETF investors in the UK.

In putting together this guide to the best ETF platforms in the UK, I’ve considered all the factors that matter, including fees, user experience, range of ETFs, and access to research and resources.

Grab yourself a cup of coffee, and read on to discover your ideal ETF platform.

TLDR: The Best ETF Platform For You

Don’t have time to read our full review?

Our verdict on the best platforms for ETF investing and trading for UK investors is as follows:

Best Overall For ETFs: eToro

Best For Lowest Fees: InvestEngine

*Your capital is at risk

Best ETF Platform Overview

Want a quick glance at what each platform offers and requires? This drop-down selection allows you a clear outline and comparison:

| Range of ETFs | Costs/Fees | Inactivity Fee | Investment Wrappers Offered | Minimum Investment |

| Over 300 | Commission-free stocks, withdrawal & inactivity fees apply | Yes, $10 (£7.70) per month after 12 months of inactivity | Stocks & Shares ISA via partnership with Moneyfarm | $10 (£7.70) |

*Your capital is at risk

| Range of ETFs | Costs/Fees | Inactivity Fee | Investment Wrappers Offered | Minimum Investment |

| 550+ | DIY: £0 Managed: 0.25%/year | No | Stocks & Shares ISA, SIPP | £100 |

*Capital at risk

| Range of ETFs | Costs/Fees | Inactivity Fee | Investment Wrappers Offered | Minimum Investment |

| Hundreds | Commission-free, FX fees apply for US stocks | No | Stocks & Shares ISA, SIPP | £2 |

| Range of ETFs | Costs/Fees | Inactivity Fee | Investment Wrappers Offered | Minimum Investment |

| Over 1,500 | £9.95 per trade, annual charge for funds 0.25% | No | Stocks & Shares ISA, SIPP, Lifetime ISA | £1 |

| Range of ETFs | Costs/Fees | Inactivity Fee | Investment Wrappers Offered | Minimum Investment |

| 1,000+ | £11.95 per trade, account fees may apply | No | Stocks & Shares ISA, SIPP, JISA, Lifetime ISA | £1 |

| Range of ETFs | Costs/Fees | Inactivity Fee | Investment Wrappers Offered | Minimum Investment |

| 13,000+ | Low trading fees, High interest on cash balances | No | ISA SIPP GIA | £0 |

| Range of ETFs | Costs/Fees | Inactivity Fee | Investment Wrappers Offered | Minimum Investment |

| 1,000+ | From £9.99 per month, includes free trades | No | Stocks & Shares ISA, SIPP, JISA | £25 monthly direct debit or £100 single payment |

| Range of ETFs | Costs/Fees | Inactivity Fee | Investment Wrappers Offered | Minimum Investment |

| 6,400+ | From 0.1% commission | No | Stocks & Shares ISA, SIPP | £500 |

| Range of ETFs | Costs/Fees | Inactivity Fee | Investment Wrappers Offered | Minimum Investment |

| Wide range | Commission-free, other fees may apply | No | Stocks & Shares ISA, SIPP | £1 |

eToro

Best for Beginners

Range of ETFs

Though eToro only supports 300 ETFs on its platform, these cover the major stock markets and industry sectors, meaning there is ample opportunity to build a good level of diversity into your investment portfolio.

Research & Resources

You cannot fault eToro for its educational and research material. From market insights to views or users, this feels like a community of information. Indeed, its focus on allowing investors to share tips and strategies, mistakes and successes is a great way to learn about investing.

If you’re a beginner, you’ll love the social trading aspect of eToro. This lets you copy and follow what other traders are doing – which could prove to be the guide you need as you become more experienced.

User Experience

The platform has been designed with the user in mind. It’s easy to navigate, and executing trades is simple.

It’s well-noted for its mobile app – a blend of sophistication and simplicity that is invaluable to both new and experienced investors.

Fees

You want commission-free trading? You’ve got it. That’s the good news.

What isn’t so good are the fees to withdraw and, if you don’t trade often enough, inactivity fees. However, these fees aren’t hidden in the small print, so you’ll go in fully informed from the start.

Customer Service

Hard to fault. Its support team is very accessible, and you’ll find them very helpful. This is comforting if you’re just starting out, and adds to the platform’s reliability.

Summary

This isn’t only an investment platform – it’s a community in which interaction, education, and sharing of trading ideas and strategies is part of the experience.

With a good range of ETFs, rich investor resources, and commission-free trading, eToro is a really good platform for advanced traders, and a great one for beginners – and for that reason, we crown it our best ETF platform overall.

*Your capital is at risk

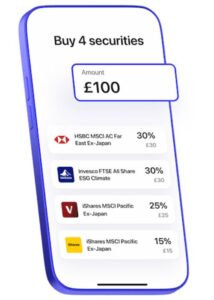

InvestEngine

Best For Lowest Fees

Range of ETFs

InvestEngine offers a curated list of more than 500 ETFs – not a supermarket, but a boutique of carefully selected investment options covering market indices, specific sectors, and sustainable investment themes.

Research & Resources

InvestEngine doesn’t skimp on knowledge sharing. You’ll find plenty of educational material that will help to demystify ETF investing.

There are also market insights to get your teeth into, which act as a great guide when making investment decisions. I like the way that it presents information, too – clear and concise, without trying to bamboozle.

User Experience

If you want a no-hassle, easy path to choosing ETFs to add to your investment portfolio, this could be the platform for you. It’s easy to browse, explore, select, and invest.

It’s not as sophisticated as other platforms, but it is easy to use – like having a toolkit with everything within easy reach.

Fees

I love InvestEngine’s approach to fees. There’s no commission on DIY investments, and low fees for its managed portfolios.

It’s a refreshing and open approach to fees that means you keep more of your returns in your pocket.

Customer Service

InvestEngine may be a streamlined platform with a low fee structure, but this doesn’t mean you won’t receive robust customer service. Most queries are dealt with promptly, providing peace of mind that’s invaluable whether you’re making your first investment or adjusting a well-established portfolio.

Summary

With a straightforward approach to ETF investing, this is a great platform if you want simplicity, clarity, and efficiency.

It’s easy to select the right ETF for your investment from its select range of ETFs, and its commission-free trading and low fee structure are ideal whatever your investment profile.

*Capital at risk

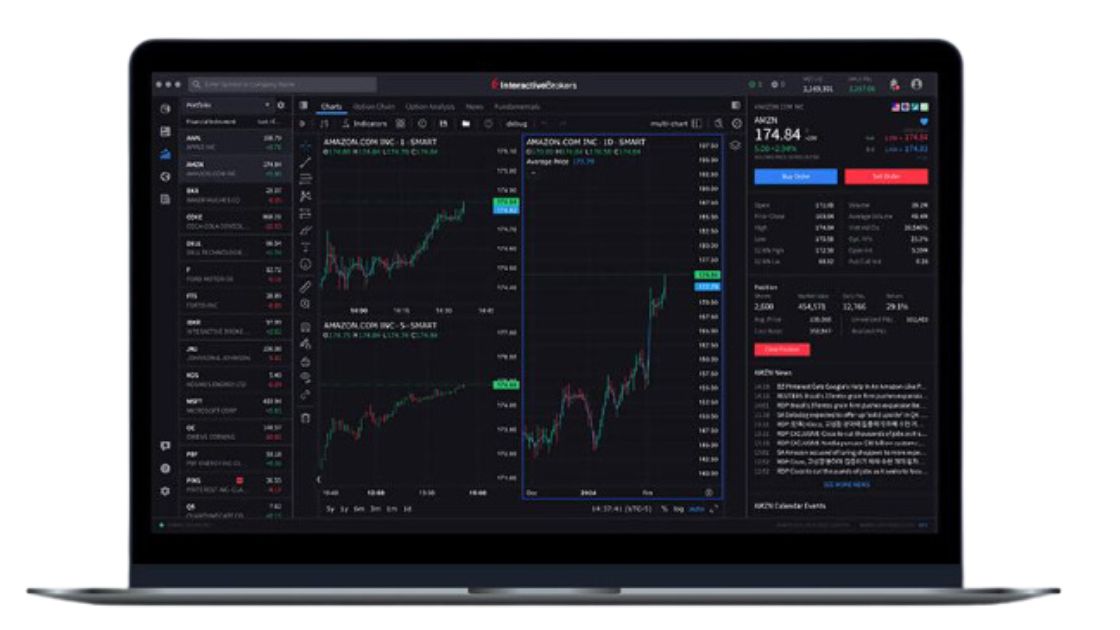

Interactive Brokers

Best ETF Range

Range of ETFs

I have to congratulate Interactive Brokers for the sheer range of ETFs on its platform. You’ll have access to more than 13,000, giving you exposure to 90 of the world’s stock markets. It’s the smorgasbord of ETF investment opportunities!

You’ll find an ETF for you no matter what your investing direction, with specific ETFs covering tech, emerging markets, healthcare, commodities, market indices… the list is almost endless.

Research & Resources

Interactive Brokers also arms you with the tools to make informed decisions.

I particularly like its analysis tools, market data, and news stream. You get expert insights and detailed reports that will help you make savvy investment decisions.

User Experience

This is a well-designed platform that is a good option for beginners while packing a punch for more experienced investors. It has an intuitive interface which makes finding the best ETF for your investment goals a breeze.

Fees

What can I say? A cost structure that is competitive and won’t eat into your investment returns. If you’re an active trader, you won’t need to worry about high trading fees unbalancing your trading strategy.

Another thing I like is that Interactive Brokers pay interest on cash balances you hold with them – a nice little bonus when you have money parked to invest.

Customer Service

There’s a tonne of helpful resources online – including articles and FAQs – to cover most of your questions and queries. If this isn’t enough, you can take a more direct approach and contact their support team, who you’ll find are knowledgeable and responsive.

Summary

You’ll find that the Interactive Brokers platform is an empowering investment tool. It’s got a vast range of ETFs, great research, a competitive fee structure, and offers a user-friendly experience. Whether you are new to ETF investing or an experienced trader, this is a terrific choice.

Trading 212

Best For User Experience

Range of ETFs

Trading 212 delivers an impressive range of ETFs, allowing you to invest in a wide array of sectors, themes, and global markets.

Research & Resources

Trading 212 provides a valuable resource hub and educational material, such as real-time data and trend reports. This will help you to decode the market and make more informed decisions, while continually learning.

User Experience

From the moment you open your account, you’ll understand why I’ve named this platform as providing the best user experience. It’s clear, intuitive, easy to navigate, and won’t overwhelm you with information.

The investment process is seamless – overall, an easy-to-use, efficient platform that is a joy, not a trial, for all investors.

Fees

Another thing you’ll like about Trading 212 is its commission – free trading, though it does charge for making deposits into your account (0.7% after you have deposited a cumulative £2,000). Which, for me, negates the zero-commissions.

Customer Service

Help is never more than a few clicks away, with several channels available to access support when you need it.

Summary

With a broad range of ETFs, good research tools, and commission-free trading, there’s a lot to like about Trading 212. The best, though, is the ease of use for investors of all levels.

It’s a hassle-free, intuitive front-end that makes ETF investing easy.

Hargreaves Lansdown

Best For Research

Range Of ETFs

With more than 1,000 ETFs to choose from on its platform, Hargreaves Lansdown caters to a wide spectrum of investment strategies and preferences. Whether you wish to focus on niche sectors, champion sustainable investments, or concentrate on blue chips, its list of ETFs offers breadth and depth.

Research & Resources

This is where Hargreaves Lansdown stands out most. It really is the gold standard for investor education and insight.

From detailed analytics to investment ideas, market commentary and educational materials, it’s almost like having an analyst sitting on your shoulder. Ideas and complex elements are shared with clarity and precision.

Exceptional for all investors, especially if you are more experienced.

User Experience

Unsurprisingly, the user experience is crafted for investors who wish to make research-based decisions. However, it has been designed in such a way that this enhances useability.

Research tools integrate seamlessly with the trading tool, making it an easy-to-use app for all investors.

Fees

For the power behind its front-end, there is an inevitable cost. Trading fees are on the high side for smaller portfolios, but the unparalleled research facilities make this a valuable choice for many.

Customer Service

With Hargreaves Lansdown, the support offered is more akin to that offered by a discretionary broking service. Whether you need help with the trading platform or guidance on your investments, help is available from a highly experienced and responsive team.

Summary

If you want to take a research-based approach to investing in ETFs, you won’t find a more comprehensive trading platform. With an extensive range of ETFs and an intuitive trading interface, as well as options for more personalised guidance, Hargreaves Lansdown could be your ideal ETF investment partner.

*Capital at risk

AJ Bell

Best For Customer Service

Range Of ETFs

With more than 1,500 ETFs on its platform, AJ Bell covers all the sectors and geographies you might want to add to your investment portfolio. From tried and trusted industries to new-age technologies, from the most developed stock markets to emerging markets, you’ll never run short of investment choice.

Research & Resources

Knowledge is power, and the AJ Bell platform delivers power to you through extensive research tools and educational resources – including market analyses, investment insights, and user-friendly guides.

It nearly took the spot for best research from Hargreaves Lansdown.

User Experience

A simple design that offers depth and breadth of research – this is what you get with AJ Bell. It’s welcoming to beginners, and has enough meat on the bone to satisfy the experienced investor.

Whether you are researching ETFs, trading, or reviewing your portfolio, the process is easy to follow.

Fees

Not the cheapest on the market, but neither are they the most expensive. AJ Bell is reasonably competitive, and transparent in its pricing for ETF investors. No hidden surprises.

Customer Service

AJ Bell excels in its customer service, and has won awards for this. If you need your hand to be held or an arm around your shoulder, AJ Bell’s team is there for you.

If you have suffered from poor customer service before, AJ Bell will restore your faith. Excellent is the word that sums up their approach and execution in this area.

Summary

The AJ Bell platform is one designed for all ETF investors, with the tools and resources you need to invest successfully. With second-to-none customer support, an array of ETF options, and incomparable customer service, this is a great platform whatever your ETF investment strategy.

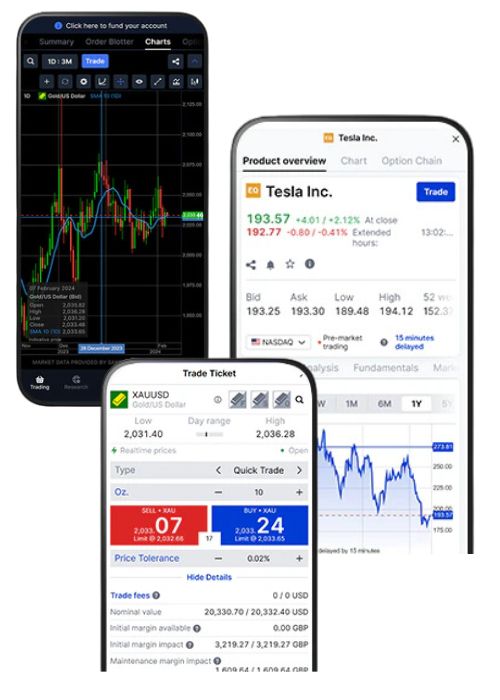

Saxo Markets

Best For Experienced Investors

Range Of ETFs

On the Saxo platform, you have access to around 6,400 ETFs from more than 30 global exchanges, covering every sector, investment theme, and geography you need to build a highly diversified ETF portfolio.

Research & Resources

The research and learning resources delivered by Saxo Markets are very close to the level of resources offered by Hargreaves Lansdown.

There are courses and information covering a multitude of investor needs, including market analysis, investment trends, and expert commentary: your own personal, on-demand investor academy!

User Experience

I’d call this platform sophisticated yet functional. Advanced tools and in-depth data integrate wonderfully well with a clean, crisp trading interface.

You’ll find navigating between research and trade entry to be streamlined, helping to make this an empowering investment tool.

Fees

Saxo Markets is priced competitively, though the pricing does reflect that this is a premium product aimed predominantly at experienced investors and traders.

Think of it like travelling in business class not economy, but with transparent pricing that lies somewhere between the two.

Customer Service

Whether you are posting orders in a complex investment strategy, require technical assistance, or need clarity on research, Saxo’s customer service team are helpful and possess the experience and expertise to help.

Summary

With resources and tools that are a step up from many trading platforms, combined with superior research and a transparent fee structure, Saxo Markets is a good solution for experienced investors who want to benefit from a premium service in ETF markets.

In short, it’s a platform designed to help you craft a sophisticated investment portfolio comprising ETFs.

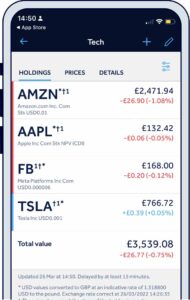

Interactive Investor

Best For ISAs

Range Of ETFs

Whether you wish to trade market-leading ETFs or focus on emerging trends, you’ll find an ETF to suit your needs among the more than 1,000 available on the Interactive Investor platform – perfect to mix and match to create your own portfolio to align with your investor profile.

Research & Resources

A great range of resources, including research, market data, and commentary of investment and market trends. Whether it’s detailed ETF analysis you want or investment ideas, you’ll find no end of resources to help you online at Interactive Investor.

User Experience

New to ISAs? Experienced in ETF investment? Your experience in the markets and with ISAs and ETFs does not matter. This platform is a breeze to use.

All the tools you need are fully integrated, allowing you to focus on optimising your ISA to align with your investment goals using the power of ETFs.

Fees

Interactive Investor’s fee structure is transparent. For most investors, the worry of accumulating costs is eliminated with a fixed monthly fee and one free trade each month.

You’ll find this massively simplifies budgeting for investment into your ISA.

Customer Service

As an ISA investor, you may have specific questions around tax, ISA rules, contributions limits, and more, as well as queries about investing in ETFs and technical hitches to overcome.

Use its Help Centre first, and if this doesn’t answer your queries, then either send a message or contact customer support by phone.

Summary

A great platform if you want to maximise your ISA’s potential by investing in ETFs. You’ll have access to a rich vein of ETF options, trade easily on a solid platform, and be able to take advantage of some stellar research and resources to help you build a high-performing ISA.

Freetrade

Best For Frequent Traders

Range Of ETFs

Freetrade offers a good selection of ETFs, across several markets and sectors.

Research & Resources

As a frequent trader, you want fast access to research, data, and up-to-the-minute financial news. This is essential when you’re day trading.

I like how you can access this easily on the Freetrade platform, and that you can tailor to your needs. For me, this is crucial to capitalise on potential market moves.

User Experience

I want to be able to trade in and out of ETFs quickly. So the system has to be simple and efficient. Freetrade hits the mark – it’s sleek, intuitive, and integrates seamlessly with its research and news tools.

It’s the closest to frictionless trading that I’ve found – like being in a cockpit with every piece of information in plain view.

Fees

Commission-free trades for frequent ETF traders are a must, and Freetrade provides this. You won’t have to worry about trading fees mounting up so rapidly that they destroy your profits.

It also means that you can pursue a highly active trading strategy if you wish, without the ticket price hampering you.

Customer Service

Even with the sleekest of trading platforms, problems do occur – and when you’re trading rather than investing, the cost of an unresolved issue can climb quicker than an Apollo rocket.

Which is why the responsive nature of Freetrade’s Customer Service Team is a godsend: they really work hard to resolve any problems quickly.

Summary

Freetrade is a platform built for trading. It may not be the most sophisticated, but it will help you achieve your goals when trading in ETFs, or if you simply want to actively manage an ETF portfolio.

If you’ve traded in ETFs before, you know that the ride can be exhilarating – Freetrade can help that ride be profitable, too.

How Do You Choose the Best ETF Platform?

We’re all different, with unique investment goals and personal circumstances. Before you step into investing in ETFs, you’ll need to make certain that the platform you select is the best for you.

To do this, you’ll need to consider the factors we’ve looked at for each platform, and how it will impact you:

The Range of ETFs offered

Does the platform offer a wide enough range of ETFs to satisfy your investment goals and needs for diversification across industrial sectors, geographies, and asset types?

Costs & Fees

Are the costs of trading suited to your trading/investment style? Think about every cost possible, including commissions, fees, annual charges, and any inactivity fees.

Investment Wrappers

What investment wrappers will you use for your investments?

User Experience

You’ll need to consider your experience, and ask what type of platform would best suit you?

Tip: if a platform offers a demo, use it to assess the platform.

Research & Resources

Do you need access to research and other trading/education resources, and does the platform provide what you need?

Customer Service

Is the customer service reliable, and is support offered in the way that best suits you?

Platform Reputation & Security

Have you checked customer reviews? Is the platform regulated by the FCA? Is it safe to use?

Why Invest in ETFs?

I’m a big fan of ETFs, and here are a few reasons why:

- They are cost-effective – generally lower expense ratios compared to funds.

- They provide instant diversification – you can hold a basket of stocks or assets in a single trade.

- Liquidity – they are traded on a stock exchange just like shares.

- Flexibility – with such a wide choice of ETFs, you can gain instant exposure to different markets, sectors, geographies, and assets to tailor or even pivot your portfolio easily.

- Tax efficiency – they can be held in tax-efficient investment wrappers, like ISAs or SIPPs.

In a nutshell, ETFs are a simple and effective way to create the perfect portfolio for your investment goals.

Which Is the Best ETF Platform for You?

Choosing the right ETF platform is crucial. Unfortunately, there is no one-size-fits-all solution. You may even need to use more than one (for example, to invest in an ISA and to execute a day trading or swing trading strategy).

The important thing is to make certain that the platform you select meets your needs as closely as possible. Whether you’re a beginner, experienced investor, or someone in between, my list of the best ETF platforms in the UK is your gateway to making an informed decision.