Want the reassurance that your retirement is set for success? Michael Barton outlines how to invest for the retirement you desire, with all your options and cautions to consider.

When you’re planning for your retirement, it’s crucial to make the best investment choices possible. Do this, and you’ll maximise all potential tax advantages, and benefit from growth and income that is aligned with your financial goals and risk profile.

In this article, we discuss two key questions:

- What choices do you have for investing toward your retirement?

- What choices do you have for your pension in retirement?

30-Second Summary

In this comprehensive guide, we cover key strategies and choices you’ll need to make for the best investment decisions for you, as you decide how to invest for your retirement.

You’ll gain an invaluable insight into the different investment wrappers available to you, as well as their limitations and unique benefits.

We also explore the investment assets that you can use to create your pension pot, and the critical nature of balancing risk and reward.

We don’t stop there, though. We also look at a few investment platform options, and your post-retirement choices for your pension pot.

At the end of this article, you should have a thorough understanding of the options available to you as you begin and progress through the evolving journey of investing for the retirement lifestyle you desire.

Investment Objectives Change Over Time

As you journey through life, your investment objectives are likely to evolve. You might get married, buy a home, have children, pay for school or university fees, and so on. While you’re doing all of this, you should also be investing for your long-term future: your retirement.

However, even when considering retirement planning, your investment persona is likely to evolve.

For example, the younger you are, the more risk you might be willing to accept. As you near retirement, you’re likely to want to reduce the risk to your pension pot – you won’t want a bad year on the stock market to cause a delay to your planned retirement date.

The shifting sands of your life and retirement plans is why it’s so important to conduct a regular financial review.

I recommend that you assess your household budget and finances, your financial goals and objectives, and how your existing savings and investments are performing at least once a year, preferably once every six months, or best of all, every quarter.

When it comes to investing to achieve your financial goals (including your retirement), you’ll need to decide on two key factors: how you invest, and what you invest in.

How You Invest – Investment Wrappers

Some financial advisors will talk to you about investment products, but I prefer to refer to these as wrappers – like wrappers on sweets.

Their job is to protect what’s inside. In the case of a sweet, a foil wrapper will offer the most protection. An unwrapped sweet is least protected – put that in your pocket and you’ll be chewing on dust and grit when you finally go to enjoy it.

What are your wrapper choices for investing?

General Investment Account (GIA)

Using a GIA, you can invest in any investment asset you wish (subject to the rules of the provider). There is no limit to how much you can invest, either.

However, any potential tax advantage that you might have within other funds does not apply:

- There is no tax relief on money invested in a GIA

- Funds held in a GIA don’t grow tax free

- Any income or capital gain you make on them is taxable (depending on your personal tax situation)

- Investments in a GIA are liable for inheritance tax

For these reasons, the rule-of-thumb advice is to only invest via a GIA when you have used up your ISA allowance.

Individual Savings Accounts (ISAs)

ISAs are very similar to GIAs, except that they protect your investments from the taxman. There is usually no charge for the ISA wrapper, either. Why should you invest via an ISA wrapper? Here’s a list of the benefits:

- No income tax or capital gains tax is payable on returns in an ISA

- You can take income from the fund without paying income tax

- You can withdraw funds from an ISA at any time

- A spouse can inherit the ISA, retaining all the tax benefits

On the other hand:

- You don’t get tax relief on contributions as you would in a Self-Invested Personal Pension

- You can only invest up to £20,000 into ISAs in any tax year

- You cannot withdraw funds and then reinvest into the ISA unless it is ‘flexible’

- You cannot carry forward ISA allowances – if you don’t use your allowance in a year, you lose it

- ISAs are liable to inheritance tax

- While the investment options are vast, there are some restrictions

There are also different types of ISA available. These include:

- Cash ISAs – often ideal for medium-term cash savings, though unlikely to produce inflation-beating returns.

- Innovative ISAs (or Innovative Finance ISAs – IFSAs) – allow you to invest in peer-to-peer lending opportunities.

If your goal is to invest toward your retirement (or your first home purchase), then a Lifetime ISA (LISA) might be on your list:

- You can deposit up to £4,000 in any tax year into a LISA

- The government will pay you a 25% bonus on your deposits each year (up to a bonus of £1,000 per year)

- The bonus does not count toward your ISA allowance

- You can pay into a LISA between the ages of 18 and 50 (though you must be under 40 to open one)

- You can withdraw funds from your LISA tax free after the age of 60 (or earlier if using it to buy your first home)

Personal Pensions

A personal pension plan allows you to invest with some incredible tax benefits.

There are currently two types of personal pension plans: A Stakeholder Pension, and a Self-Invested Personal Pension (SIPP). Both are defined contribution plans – how much you get out of them depends upon how much you have paid in and how well your investments perform.

You can usually withdraw money from a personal pension from the age of 55, though this is set to increase to age 57 in 2028. A Stakeholder Pension works in a similar way to a workplace pension.

A SIPP is more flexible, with the key features being:

- Tax relief on contributions up to the annual allowance

- You can usually carry forward three years of annual allowance

- You can take up to 25% of your pension fund as a tax-free lump sum after you have reached the age of 55

- Growth within the pension is free of income tax and capital gains tax

- You won’t usually be liable for inheritance tax on the SIPP, and the fund can be inherited by your heirs

Unlike ISAs, any income you take from a SIPP will be liable to income tax.

Workplace Pensions

Most employers must provide a workplace pension, and you will be enrolled into it automatically (unless you stipulate otherwise) providing you:

- Are aged 22+

- Have not yet reached state pension age

- Are earning more than £10,000 per year

- Are not already in a qualifying pension scheme

- Are employed in the UK

Your contributions must total at least 8% of your salary, and this is calculated by adding up the following:

- Your contribution

- Tax relief on your contribution

- Your employer’s contribution (which must be at least 3%)

Let’s say that your salary is £25,000, and that you contribute 3% and your employer contributes 6% of your full salary.

This will cost you £50 per month in your take home pay, but with the government paying £12.50 in tax relief and your employer contributing £125, your pension contribution will be £187.50 per month.

(A note here: under automatic schemes, your contributions are based on earnings between £6,240 and £50,270 per year.)

If your workplace pension scheme is a defined contribution scheme, what you will get when you retire depends on how much has been contributed to the scheme and how well the investments have performed.

You will also usually benefit from the Pension Protection Fund (PPF), which ensures that if your employer goes bust you will get:

- 100% compensation if you’ve reached the scheme’s pension age

- 90% compensation if you’re below the scheme’s pension age

So, How Should You Invest to Plan for Retirement?

There is no hard and fast rule on how to invest for retirement. The wrappers you use will depend upon your individual circumstances, financial goals, and objectives.

However, for most people, this will be your order of investment priority for retirement planning:

- Workplace Pension – to benefit from tax relief and the ‘free’ money your employer contributes, as well as tax fee growth and income within the fund.

- Lifetime ISA – to benefit from government bonuses and tax-free income from the fund in retirement.

- Personal Pension – to benefit from tax relief on contributions as well as tax fee growth and income within the fund.

- ISAs – to benefit from tax fee growth and income within the fund, and tax-free income in retirement.

There are some ways you might consider investing that we’re not going to discuss in this article – for example, Venture Capital Trusts (VCTs) and Enterprise Investment Schemes (EISs). These are both geared toward higher earners.

What You Invest In – Investment Assets

When you invest, you’ll need to consider your risk profile, financial goals, and timeline for your investment.

When considering your risk profile, you’ll need to think about:

- Aversion to risk – if you’d be mortified to see the value of your investments fall (even if only for a short time), then you’ll be better investing in lower-risk assets.

- Ability to take risk – this is a measurement of if a market shock and fall in asset values would harm you, perhaps damaging your ability to maintain your existing lifestyle. The lower your ability to withstand asset value declines, the lower the risk you should take.

When reviewing your retirement plans, you should also review your current risk profile. I like to think about:

1. My existing financial situation

My income, expenses, assets, liabilities, and debt. With a clear picture of this, I can make a better calculation of how much I can invest (and the risk I can afford to take).

2. My investment goals

Here, I consider why I am investing, my expected return, and my investment timeline. I also need to make sure that my investment goals are realistic.

3. My current personality

Would a temporary fall in the value of my investments cause me stress? I want to sleep well at night, and not worry about my future. So, I measure my confidence – the more optimistic I am, the more risk I am willing to take.

What Is the Right Asset Mix for You?

The financial goals that you set yourself will also help to determine what assets you should invest in, as will the timeline for your investment – the longer the term of investment, the longer you have to make up any fall in valuation as the markets ebb and flow.

Here’s a rundown of the major assets, and how they work within an investment portfolio (such as a pension pot):

Cash

You might think of cash as being the notes and coins in your pocket, but when you invest in cash in the markets, it’s something a little different. Examples of cash investments include:

- Money market funds – which may be invested in government bonds, bank debt, or corporate bonds

- Short-term government bonds – like the U.S government’s T-bills

- High-rate or fixed-rate cash deposits in fixed-term accounts

Cash is the least risky of all assets, though you are unlikely to beat inflation over the longer term.

Bonds

These are securities that are issued by companies (corporate bonds) or governments (such as Gilts and Treasuries). Effectively, you become a lender, and the issuer (the company or government) pays you interest. Usually, this interest is at a fixed rate and for a fixed term.

Bonds are riskier than cash, but less risky than stocks. When the bond reaches maturity, your capital will be returned to you.

The returns you make are likely to be better than cash, but lower than stocks over the longer term. If interest rates rise, the price of bonds is likely to fall, as new bonds issued will offer higher interest rates.

Stocks

Stocks (also known as shares or equities) are shares in companies. As a shareholder, you participate in the growth of a company as well as benefiting from income paid to shareholders (by way of dividends).

Generally speaking, you might invest in:

- Growth stocks – often smaller companies forecast to grow strongly, typically paying no dividends. You’ll be reliant on capital growth delivered by a rising share price.

- Value stocks – the shares of companies that are trading being their perceived value, making them attractive for long-term investors.

- Blue chips – these are the shares of big, established companies (like those in the FTSE 100) with track records of steady performance and dividend payments.

- Dividend stocks – shares of companies that have a track record of paying steady and increasing dividends.

Exchange-Traded Funds (ETFs)

ETFs are designed to track specific market indices. The biggest ETFs include those based upon the FTSE 100 and America’s S&P 500 Index. However, there are hundreds of ETFs available that track various assets around the globe.

You can buy and sell ETFs on a stock exchange, just like you would trade shares. They have lower management fees than mutual funds, and you can build a highly diversified portfolio using ETFs (that are themselves highly diversified) – tracking different assets, different geographies, and different industries.

If you want an easy-to-manage investment, tracking the stock market, with low management fees, an ETF could be a good choice.

Mutual Funds

Mutual funds are actively managed funds that may invest in stocks, bonds, cash, and other assets. A mutual fund might be targeted at a single asset class, multiple asset classes, different industries, geographies, and more.

The objective is to beat their benchmark (which may, as an example, be the FTSE 100 Index).

These are lower risk than investing in single stocks, and you benefit from professional investment management. However, you’ll pay higher management fees than you do when owning ETFs.

There are thousands of funds to choose from, but a word of warning – in many studies, it has been found that around 80% of managed funds underperform the benchmark they are tracking.

High-Risk Securities

At the highest end of the risk scale are other securities, like derivatives (options, futures, and swaps) and cryptocurrencies (like Bitcoin, Ethereum, and thousands of others).

You’ve really got to know what you’re doing here. Sure, you can make many, many times your investment, but you can also lose it all. Prices are volatile, markets can be restricted, and a profit can turn into a damaging loss in minutes (or even moments).

Platforms for Investing for Your Retirement

When I first started trading in stocks and shares, there was no real option for private investors – the person in the street – to invest for their financial future other than to use the services of an often expensive financial advisor.

Investing rules and regulations have been relaxed significantly over the years, especially in the pension sphere. Today, there are a multitude of investment platforms you can use to access ISAs, SIPPs, and GIAs.

For those investing toward their retirement, there are platforms that allow you to self-manage your investment funds as well as benefit from managed funds for your financial planning.

Here are a few of my favourites:

AJ Bell

- Wrappers available include ISAs and the AJ Bell Platinum SIPP

- Invest in assets including stocks, investment trusts (mutual funds), and ETFs

- Take advantage of six growth portfolios, catering for the gamut of risk profiles

- Low management fees of 0.25% maximum

- Dealing charges of £1.50 per deal for funds

- Share deals cost up to £9.95 per deal

Interactive Investor

- Wrappers include ISAs, SIPPs, and GIA

- Invest in a range of assets, including stocks, funds, and bonds

- £3.99 per deal for shares (£9.99 for international shares)

- SIPP fees range from £5.99 per month to £12.99 per month

- Five model portfolios, catering for a range of investment styles, plus three Vanguard Lifestyle Strategy funds

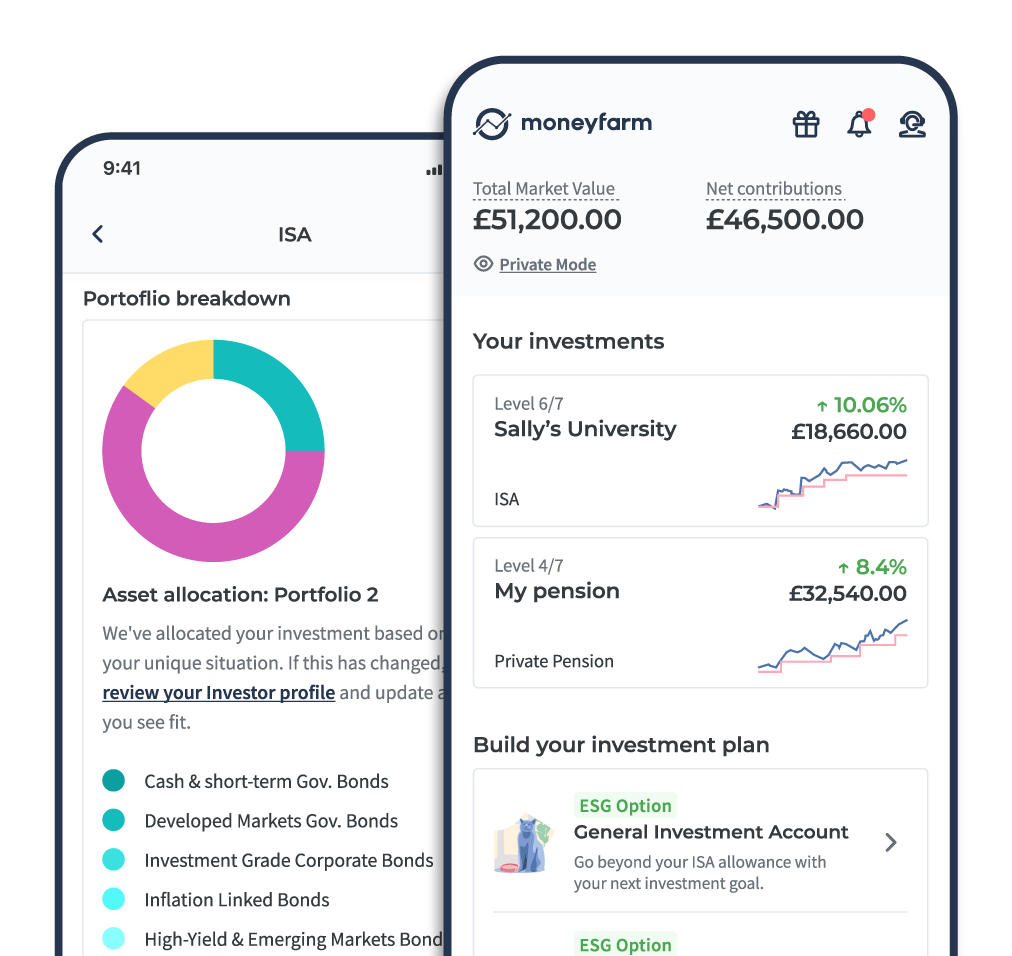

Moneyfarm

- Access investments via ISAs, a GIA, or a SIPP

- Benefit from robo-advice

- Seven actively-managed portfolios, investing in handpicked ETFs

- No platform fees

- Portfolio management fees range from 0.35% to 0.75%

Nutmeg

- Access wrappers that include ISAs and pension

- Select from fully managed funds, as well as other assets

- A choice of diversified investment portfolios available

- Management fees typically fall between 0.25% and 0.75%

- Minimum investment of £500

Penfold

- Only offer pensions

- Consolidate existing pensions easily

- Offer a range of pension plans, from the Standard Lifetime Plan to the Sustainable Lifetime Plan – investing in companies with high Environmental, Social, and Governance (ESG) ratings

- Annual fees range from 0.4% to 0.75%

PensionBee

- Pension investing only

- Easy to consolidate your existing pensions into a single provider

- Access to a range of managed funds catering for all risk profiles

- Fees range from 0.5% to 0.75%, and are halved on funds over £100,000

In Retirement – Your Options for Income

It used to be that you had to convert your pension fund (after you have taken the tax-free lump sum of up to 25% if you so wish) into an annuity when you wanted to start to take the benefits from it.

Again, and thankfully, you now have a choice of options. This isn’t to say that you should rule out buying an annuity: the choice depends upon your personal circumstances and needs when you retire.

Here’s what you need to know:

Annuities

When you buy an annuity, your pension pot is converted to a fund that pays a guaranteed income for life, however long you live.

On the plus side of the equation:

- Annuities provide reliable income

- You can customise an annuity to fit your needs (e.g. to provide an income for your spouse should you die)

- You’ll never run out of funds in retirement

On the negative side, you’ll need to be mindful that:

- There are often high fees associated with an annuity

- On a joint life annuity, your spouse will usually only receive half the monthly annuity payment after your death

- There is no flexibility to withdraw more or less than the amount set when you buy the annuity

- If you don’t have a joint annuity, when you die your annuity dies with you – the fund cannot be inherited

Remain Invested

Instead of buying an annuity, you can elect to remain invested in your pension funds. You can usually withdraw up to 25% as a tax-free cash lump sum from the age of 55 as well as access your pension funds to create an income. You can:

- Take a regular income if you wish

- Withdraw lump sums when you need to

- Leave it invested to grow

Unlike annuities, you won’t have a guaranteed income for life. How much is available depends upon the value of your fund and how much you decide to withdraw – you’ll need to allow for living longer than you expect!

This said, your fund does not die with you. It will be there for your spouse or other heirs to benefit from.

As you near retirement, it is advisable to seek advice on your income options – the decisions you make could set your financial course for the remainder of your life, as well as have repercussions for those you leave behind.

Investing for Retirement – The Bottom Line

Drawing to a close, investing for retirement is a process that evolves as your life evolves. You’ve got many options available to you. These include workplace pensions, personal pensions, ISAs, and GIAs.

As you make your investment choices, you should:

- Consider the limitations and benefits of each investment wrapper

- Balance risk and reward in the selection of assets for investment

- Review your circumstances and investment performance regularly, and adjust accordingly

- Utilise the investment platform that is best for your unique profile

As you near retirement, seek advice on the options available to you – including tax-free cash withdrawals and income-generating products in retirement.

Finally, to build the finances you need to live the lifestyle you desire in retirement, ensure that you make informed choices and retain adaptability in your retirement planning strategy.