Unlock the benefits of the Tesco Clubcard: discounts, rewards, and how it can save you money. Is the Tesco Clubcard really worth it? We ring it all up right here.

The Tesco Clubcard is the supermarket’s equivalent of the old Green Shield Stamps. I used to sit and stick the stamps collected by my parents into special books when I was a kid. The idea was to promote customer loyalty by giving something back in return.

Times have moved on since those stamp-licking days. Now, supermarkets like Tesco offer loyalty cards. Shop with these, and all manner of discounts and other juicy rewards are available to you. But is having a Tesco Clubcard really worth it? That’s the key question we answer in this article.

Quick Verdict

The Tesco Clubcard scheme is a great way for you to save money. The points-to-vouchers exchange is roughly equivalent to 1% cashback, depending on your spending habits. There are ways to maximise this, too, and you’ll benefit from exclusive Clubcard prices on many items.

Clubcard Plus could give you even bigger savings, but you’ll need to calculate if the monthly premium makes sense for you.

You could boost the value of your Clubcard further by applying for a Tesco Bank Credit Card or Clubcard Plus Credit Card, and spending your points for double value with partner brands.

If you regularly shop at Tesco, I have only one question for you – why haven’t you got a Clubcard?

What Is Tesco Clubcard?

Tesco introduced the Clubcard scheme almost 30 years ago. Since then, and with advances in internet and smartphone technologies, Clubcard has evolved into a scheme that:

- Rewards you for spending at Tesco and associated stores

- Offers Clubcard customer discounts on a range of products

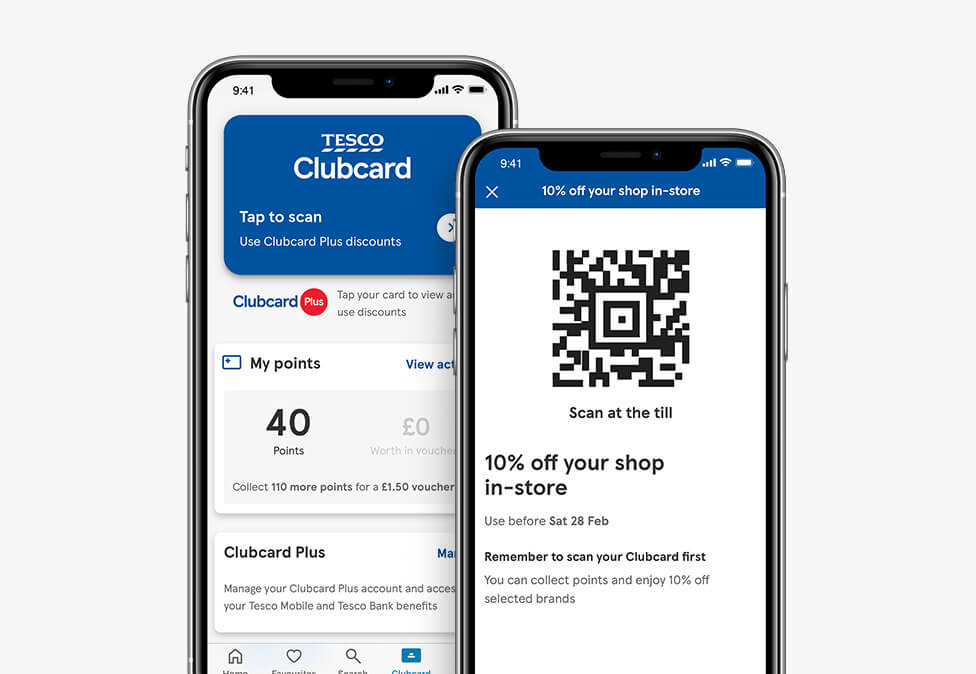

- Allows you to turn your Clubcard points into spending vouchers immediately on your mobile phone

You can use your Clubcard in-store or online, and with a growing number of Clubcard partners.

You’ll be joining around 17 million Clubcard holders in the UK who are already enjoying the benefits Tesco Clubcard has to offer.

With Clubcard, Points Certainly Make Prizes

When you spend and flash your Clubcard, you earn points. These points can then be exchanged for vouchers. How many points you’ll receive depends on how you spend. How much these vouchers are worth depends upon how you spend them.

Here are a few examples:

- For every £1 you spend on groceries, you’ll earn 1 point. Once you have accumulated 250 points, you’ll receive a voucher worth £2.50.

- You can also exchange points for vouchers as soon as you reach 150 points – you can do this online or on your Tesco Clubcard app.

- When you buy your petrol or diesel at a Tesco petrol station, you receive 1 point for every 2 litres you buy.

- You can also earn points when you use a Tesco mobile – at the rate of 1 point for every £1 spent.

- Take a 15-minute Tesco survey, and earn 25 points.

Other ways you can earn points include:

- At Tesco Pharmacy

- Having your car washed at Waves Hand Car Wash

- By recycling your printer ink

Tesco often run special points promotions, too. For example, as I’m writing this, you could receive 500 points for signing up with Halfords Motoring Club Premium.

Maximising Your Tesco Clubcard Points

By now, you’ll get the picture. On your grocery shopping, those points are equivalent to 1% cashback. That’s not a bad return, though there are ways to get even more…

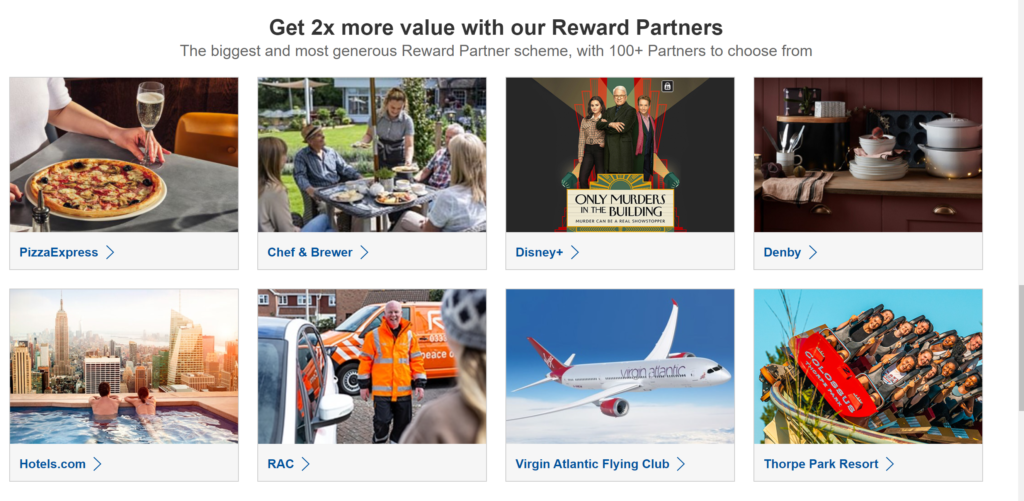

Double Your Clubcard Voucher Value at Tesco Reward Partners

Tesco has teamed up with over 100 other retailers and organisations that will accept Clubcard vouchers in lieu of payment (or part payment). Here’s a flavour of the partners who will give you £1 of value against every 50p of Clubcard vouchers:

Home and Essentials

- New Skills Academy (£1 for every 50p of vouchers)

- RAC Breakdown

Eating Out

- Hungry Horse

- Chef & Brewer

- Prezzo

Travel, Hotels, and Holidays

- Best Western

- Royal Caribbean

- Hoseasons

- Butlin’s (minimum £5 of vouchers)

- Hotels.com (minimum £5 of vouchers)

Lifestyle

- Fitbit

- SpaSeekers

- English Heritage

Days Out and Entertainment

- Alton Towers Resort

- Blackpool Pleasure Beach

- Cineworld

- Pleasurewood Hills

- West Midland Safari Park

- Spinnaker Tower

- The Beatles Story Exhibition

- Edinburgh Dungeon

Tesco Clubcard Prices

Here’s one of the best benefits of being a Clubcard holder: Clubcard Prices.

If you shop at Tesco, you’ll notice a lot of items have yellow price tags. These are discounted prices for Clubcard customers. The discounts can be as much as 50%!

I recently did a little shopping at Tesco, and took a great deal of interest in these discounts. They can be by way of a straight drop in price, or on volume deals (2-for-1 or 3-for-2 as examples).

Clubcard Points on Tesco Bank Credit Cards

Another way to squeeze the maximum from your Clubcard is to spend using a Tesco Bank Credit Card. When you buy your groceries at Tesco and do this, you’ll receive 5 points for every £4 you spend instead of 4.

You’ll also receive a point for every £4 you spend on Tesco fuel, plus 1 point for every litre you buy (compared to a point for every 2 litres otherwise).

Plus, use your Tesco Bank Credit Card for other shopping, and you’ll get a Clubcard point for every £8 you spend.

How does this stack up in Clubcard points?

You’ll find a handy calculator on the Tesco website.

Here’s a calculation I did based on the following monthly expenditure:

- Spending at Tesco (online and instore) = £400

- Spending on Tesco fuel = £100

- Spending outside Tesco = £300

Over a year, this spending pattern will give you 7,595. This is 2,195 more points than you would receive using only your Clubcard. That’s worth £75 in Clubcard vouchers to spend in Tesco – or £150 with Tesco partners. This isn’t accounting for the discounted Clubcard prices you’ll benefit from. Not bad for doing no more than you usually do.

(Tip: Always pay off any credit card balance when it is due to avoid interest charges.)

Clubcard Coupons

Just when you thought you’d exhausted the ways that Clubcard rewards you, up pops another!

As a Clubcard holder, Tesco will send you Clubcard coupons every now and then. You’ll only receive these if you opt for Tesco Marketing (they’ll collect your data and use it to send advertising to you). If you’re happy with this, sit back and wait for your coupons by post or into your Tesco Clubcard app.

You can use these coupons to reduce the cost of items you buy regularly or ones that Tesco wants to persuade you to buy, depending on the coupon you receive. You can spend them instore or online.

Clubcard Plus

Depending on your spending habits, you might opt for Clubcard Plus. This is a premium Clubcard account, which costs £7.99 per month. Why would you want to do this? Here are the benefits you’ll gain as a Clubcard Plus customer:

- 10% off your Tesco shopping each month. You’ll be restricted to two shops per month with a maximum discount value of £40. Make the most of this by shopping every other week, or doing a big monthly shop.

- Get 10% off F&F and selected Tesco brands always.

- Receive double the data on a Tesco Mobile contract.

- Apply for a Clubcard Plus Credit Card and get up to 24 months interest-free credit from account opening, pay no fees on foreign exchange, and benefit from earning Tesco Clubcard points almost anywhere you spend money when you use your Clubcard Plus Credit Card.

While these benefits sound terrific, before you rush to apply for a Tesco Clubcard Plus card, you’ll need to figure out if this is worth it. To be honest, if you only do small shops at Tesco, the answer is probably no.

If you tend to spend more on each shopping trip to Tesco, then once you hit £80 shopping in two trips or less, your monthly premium is paid for – and anything in excess of this will save you money. (Remember that two-trip and/or £40 discount limit.)

Signing Up for a Tesco Clubcard Is Easy

It couldn’t be easier to get a Tesco Clubcard. Go to the Tesco website, create a Tesco account, and sign up for a Clubcard at the same time. You can also do this from the Tesco app. It takes seconds to apply, and you can start accumulating Clubcard points immediately.

It’s free to join unless you decide to sign up for the Tesco Clubcard Plus.

You can share your Tesco Clubcard, too. Which means that anyone you know can use your Clubcard to get discounted Clubcard prices and add to your points balance at the same time!

Using Your Clubcard Vouchers

Once you have received your Clubcard vouchers, it’s best to use them quickly, though they won’t expire for two years.

If you sign up for Clubcard Plus, you’ll receive vouchers equivalent to your total discount. These will either be in your Tesco app or can be applied in store or online.

Whether you have the free Clubcard or Clubcard Plus, don’t forget to use your vouchers – once expired, they are gone forever.

The Bottom Line

The Tesco Clubcard scheme is a great way for you to save money. It works a little like a cashback scheme, but with vouchers for you to spend. These equate to 1% off your shopping, but you can squeeze extra value from them by using them at Tesco partner brands.

You’ll also benefit from discounts specifically for Clubcard holders, and receive coupons now and again that could save you even more money.

If you are a big shopper at Tesco, you might opt for the premium Clubcard Plus. However, you’ll need to calculate if this is worth the monthly cost.

Finally, you could boost the value of your Clubcard further by applying for a Tesco Bank Credit Card or Clubcard Plus Credit Card.

If you do this, remember to pay off your balance in full before you start getting charged interest.

Having said all this, Tesco is not the cheapest supermarket in the UK – although its Aldi Price Match promotion is helping it to regain its price competitiveness. Thus, it might not be worth switching your regular supermarket to Tesco just to benefit from becoming a Clubcard member.

But if you are a Tesco shopper, or use the store now and again, then I’ve only got one question for you – why haven’t you got a Clubcard?