Considering investing in a SIPP as part of your retirement planning? You need to look at AJ Bell vs Vanguard for SIPP Investors. Financial expert Michael Barton reviews them both to help you weigh up which is best for you.

If you’re in the process of long-term planning for your retirement, and you’ve exhausted your workplace pension allowance, following our tips for how to invest for the retirement you desire will have you considering how to invest in a SIPP. The easiest solution is to use an investment platform with a good SIPP product.

Two of the most popular are AJ Bell and Vanguard. In this article, I compare both under key factors that include cost, platform performance, and investment options.

Pour yourself a cup of your favourite brew, and settle in for a 10-minute read that will help you shape the retirement your desire and deserve – no matter how near or far that is.

Quick Verdict

Vanguard is a great choice if you want a SIPP but lack the confidence or experience to make your own investment decisions. You are, however, limited to investing in Vanguard’s own funds. Consequently, its costs are lower than other SIPP providers that offer a more extensive range of investment options. Overall, a very good ‘set-and-forget’ option for a SIPP.

*Capital at risk

On the other hand, AJ Bell’s award-winning SIPP is a better option if you are more experienced and relish having a variety of investment choices, including shares, bonds, ETFs, and a choice of more than 2,000 professionally-managed funds.

*Capital at risk

At-a-Glance Comparison

| AJ Bell | Vanguard | |

| Range Of Investments | Funds, ETFs, shares, bonds, and more | Only Vanguard funds |

| Minimum Investment | £25 p/m or £1,000 lump sum | £100 p/m or £500 lump sum |

| Done-For-You Investments | ✗ | ✓ |

| Set-Up Fee | £0 | £0 |

| Account Fee | Funds: 0.25% decreasing to 0% on funds > £500k Shares: 0.25% on value (max £10 p/m) | 0.15% capped at £375 p/y |

| Fund Management Charges | Typically 0.31% to 1% (According to individual funds held) | 0.06% – 10.78% (Average 0.20%) |

| SIPP Admin Charges | Within account charges | £0 |

| Exit Charges | £0 | £0 |

| Drawdown Set-Up Charge | £0 | £0 |

| Dealing Charges | Shares: £9.95 per deal (£4.95 for 10+ deals p/m) Funds: £1.50 per deal | £1.50 per deal |

The Vanguard SIPP

Vanguard has offered a SIPP product on its investment platform since 2020. You can use Vanguard’s own funds to create your own portfolio, or benefit from its ready-made LifeStrategy funds.

Minimum Investment

Known for its policy of keeping investor costs low, the minimum investment amount of £100 per month or a starting lump sum of £500 is surprisingly high. If you’re starting out on the road to investing toward your retirement, these minimums might prove a little restrictive.

Transferring In

You can transfer in from other pension schemes, and Vanguard will not charge you to do so.

What Can You Invest in?

Vanguard offers two options for investment into your SIPP:

1. Do It Yourself

Choose from a range of around 85 Vanguard funds. These will help you focus on the industries, sectors, and regions that are most interesting to you. They are diversified and actively managed, investing in shares and bonds.

Alternatively, you may decide to use Vanguard’s Target Retirement funds. The idea here is simple: you choose the fund that is ‘based’ closest to your retirement date, and the risk you are willing to take, and the fund balances investments to ‘mature with you’.

The fund managers do this by reducing risk in the fund as it moves closer to your retirement date (its base year).

2. Done for You

Based upon a simple questionnaire, Vanguard selects one of five portfolios for investment for you. The major criteria in this choice is your risk profile and anticipated retirement date/when you expect to start taking money from your plan.

This is a completely hands-off investment, though you should review regularly to ensure that it remains aligned to your evolving financial goals.

*Capital at risk

Costs

There is no fee to set up a SIPP with Vanguard.

Vanguard charges SIPP account holders an account fee of 0.15% based on the value of their funds. However, this is capped at £375 (if your fund is valued above £250,000, you won’t have a higher account fee to pay).

You’ll also be charged ongoing fund management charges each year. These range from 0.06% to 0.78%, though the average management fee is around 0.20%.

There are no additional SIPP admin fees.

Exit Charges

Some SIPP providers will charge if you wish to switch to a new provider. Vanguard neither charges for this nor does it levy a charge when you move the fund into drawdown.

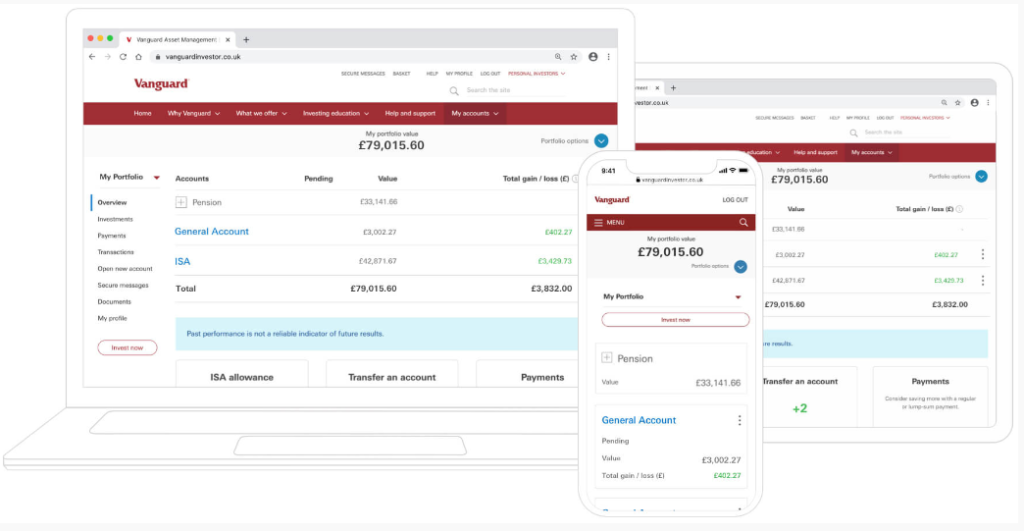

Investment Platform

You can access Vanguard’s investor platform on its website or on your smartphone. While its dashboard gives you the information you need to monitor your funds in an easy-to-view format, it does not provide the advanced analytical and educational tools that other trading platforms offer.

Financial Advice

Vanguard launched an advice service to support its retirement services in 2021, but has since closed this due to a lack of demand.

Customer Support

Vanguard’s customer support receives high praise on reviews published on Trustpilot, where it has received an overall rating of 4/5 stars across 2,600 reviews, with more than 75% posting a 4 or 5-star review.

Should You Use Vanguard for Your SIPP?

Though Vanguard’s pension product is called a SIPP, I’d argue that it is not exactly this because it only allows you to invest in Vanguards’ own funds.

If you want to invest in shares or other provider’s funds, you’ll need to look elsewhere. Also, if you require financial advice as part of your financial planning strategy, Vanguard is not for you.

This said, if you are looking for a low-cost option for your retirement planning, then Vanguard could be a good option. There are no fees to set up, its management fees are also lower than most funds, and its account fees are capped.

The Vanguard platform may be on the basic side, but if you are not an active investor – not investing in individual shares and bonds regularly, for example – do you need more?

Its done-for-you service is simple and slick, which makes it a good choice for you if you are a less-experienced investor. However, its £100 per month minimum investment may prove a stretch if you are at step one of your retirement planning journey.

If you do open a SIPP account with Vanguard and then decide to switch to another provider, you won’t need to pay a penny to do so.

*Capital at risk

The AJ Bell SIPP

AJ Bell has been rated as the best SIPP provider in a number of industry awards. Its SIPP was the first to be offered online. You can invest in a large range of investment instruments, as well as AJ Bell’s passively-managed funds.

Minimum Investment

Though the minimum lump sum you can invest in the AJ Bell SIPP is £1,000 (including tax relief), if you wish to make regular monthly contributions you need only commit to investing £25 per month. If you are transferring in from another pension scheme, you do not need to make any contributions.

Transferring In

Though you are able to transfer existing pensions into an AJ Bell SIPP, you will be charged an administration fee of £60 per transfer.

What Can You Invest in?

Here is a key differential between Vanguard and AJ Bell.

You can invest in a wide range of investment instruments in your AJ Bell SIPP. This includes shares and a wide range of funds from multiple providers.

You can also invest in bonds and gilts, and ETFs within your SIPP, among other investments. In total, you’ll have access to more than 2,000 investment funds, as well as other investment options.

AJ Bell doesn’t support lifestyle-type funds, believing that ‘lifestyle funds are from a bygone era’. Instead, they cater to investors who are more experienced in making their own investment choices, or those who already benefit from financial advice.

*Capital at risk

Costs

AJ Bell does not charge to set up a SIPP.

Its account/platform/custody fees start at 0.25%, and then reduce to 0% for fund valuations over £500,000.

If you buy and sell shares in your SIPP, you will pay dealing charges of £9.95 per trade. Fund purchases and sales cost £1.50.

You’ll also need to pay the fund charges levied on individual funds. For AJ Bell funds, there is a charge on top of the platform charge as follows:

- 0.31% on its growth funds

- 0.65% on its income funds

- 0.45% on its Responsible Growth fund

Other annual fund management fees will be charged as per the schedule of annual management charges applicable to the fund(s) you buy and hold in your SIPP.

Exit Charges

AJ Bell scrapped its exit fees in 2021, as it did with its pension drawdown fees.

Investment Platform

AJ Bell’s investor platform is easy to use and has a professional feel about it. Your portfolio value is shown clearly, and there are some trading tools to help you select which investments to make to suit your financial goals and investment profile. It can be accessed on your computer or as a mobile app on your smartphone.

When buying and selling investments, you’ll have the choice to either deal at market price or place a limit. Overall, functional if not sophisticated.

Financial Advice

AJ Bell does not offer financial advice directly.

Customer Support

AJ Bell has also received a lot of praise for its customer service and the level of support it provides. It has a 4.8/5-star overall rating on Trustpilot, with 89% of customers giving it 4 or 5 stars.

*Capital at risk

Should You Use AJ Bell for Your SIPP?

AJ Bell’s SIPP gives you access to a wide range of assets, and doesn’t restrict you to only its own funds.

If you plan to invest in shares, there won’t be annual management charges, though holding funds will incur annual management charges. Dealing in shares or funds also attracts a per-deal charge – though these are reduced if you trade 10 or more times per month.

There are no fees to exit or put your SIPP into drawdown, though transferring in will attract a fee of £60 per provider/transfer.

Its investor platform isn’t designed for day-traders, but for longer-term investors it does all that you need it to do. Its platform/custodial fees may be higher than Vanguard’s, but if you have a larger portfolio, these fees graduate lower.

If you are comfortable with investing, AJ Bell is certainly one of the better low-cost platforms for a SIPP.

Why It Makes Sense to Use a Low-Cost SIPP Platform

When it comes to investing, costs really matter. They eat into the performance of your investments, reduce returns, and can slash your final fund value. Paying higher costs for the same performance could seriously damage your financial health – and the longer you pay higher costs, the worse it will be.

Here’s a simple example (not allowing for inflation) of how costs can impact your investment:

| Value Of Fund At Set-Up, With No Further Contributions | Gross Average Annual Return | Annual Costs | Value After 10 Years | Value After 25 Years |

|---|---|---|---|---|

| £100,000 | 5% | 0.25% | £159,052 | £319,042 |

| £100,000 | 5% | 1% | £148.024 | £266,583 |

| £100,000 | 7% | 0.25% | £192,167 | £511,912 |

| £100,000 | 7% | 1% | £179,085 | £429,188 |

The difference between costs of 0.25% and 1% might not sound like a big number, but as you can see, it has a huge impact on net returns.

5 Tips to Help You Choose the Best SIPP for Your Retirement Planning

Choosing a SIPP provider can be a little like navigating a minefield. It’s crucial to get right – your future life depends upon it. Here are my tips to help you make the best decision:

- Consider your investment experience and style – do you prefer a hands-off approach, or do you wish to be more involved in investment decisions?

- Ensure minimum investment is sustainable – ask yourself if the minimum investment required is within your budget.

- Understand how costs affect your retirement plans – always consider how fees will affect your investment over time.

- Evaluate the investment options – are they broad enough to suit your investment style and align with your financial goals?

- Review transfer policies and additional charges – if you’re considering transferring from another pension scheme, always consider the costs of doing so in relation to all of the above.

Vanguard vs AJ Bell – Which is Best for Your SIPP?

Now’s for that burning question you’re probably asking yourself: which of AJ Bell and Vanguard is best for your SIPP choice? Summing up:

Vanguard’s SIPP is known for its low costs, but requires a minimum investment of £100 monthly or a £500 lump sum. You can transfer other pensions into the SIPP without a fee, investment options are limited to around 85 Vanguard funds, or you could opt for its Target Retirement funds.

Annual management fees are low in comparison with average AMCs in the market, and there are no set-up or exit fees. The investor platform is basic, but good for investors wanting a more hands-off approach.

AJ Bell’s SIPP, awarded as a top provider, only requires monthly contributions of £25, though if you wish to invest a lump sum, you’ll need to invest £1,000. Transferring in costs £60 per scheme.

Its range of investment options is far broader, and includes shares, bonds, and over 2,000 funds. AJ Bell charges 0.25% platform fees (reducing for larger funds) plus trading charges. It’s ideal for more experienced investors who prefer a wider choice and don’t mind slightly higher costs.

Remember that selecting the best SIPP for you depends on several factors, including your investment style and experience:

- If you’re starting out or prefer a simple, low-cost option, Vanguard’s straightforward approach could be your match.

- However, if you’re a more seasoned investor and/or desire a broader range of investment options, AJ Bell’s flexibility and extensive investment range might be more appealing.

The final thing to remember? When investing, lower costs can significantly boost your returns over time.

*Capital at risk