If you’ve not yet heard of Chase, it’s one of America’s big players in digital banking. And now, it’s available to us here in the UK. But what does it offer, and would you like to open a current account with them? We clarify everything you need to know in this Chase Current Account review…

Digital banks (also known as challenger banks) are all relatively new kids on the block. One of the newest is Chase. With its origins in the United States, could this be the banking solution for you? In this article, we dissect the Chase current account to help you answer this question and make the best choice of bank account.

Quick Verdict On Chase

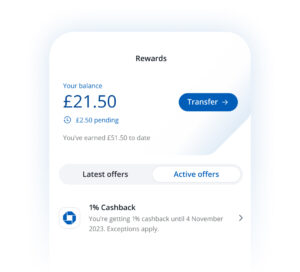

Chase UK is a digital challenger bank with a few features that set it apart from other similar banks. You’ll receive 1% cashback on eligible purchases for 12 months, and good interest rates on your current account, too. It’s easy to set up, and includes some useful budgeting features.

If you travel abroad, you’ll benefit from fee-free cash withdrawals and spending, as well as the 1% cashback. However, Chase UK doesn’t offer overdrafts, and you cannot deposit cash into the account.

Overall, a good option for many, though for most as a secondary account to a main bank account – the digital bank account you didn’t know you needed.

What Is Chase?

It may not be a household name in the UK, but Chase Bank is one of the largest banks in the United States. With more than 55 million customers in America, almost half of the country’s households have at least one Chase Bank account holder.

In the USA, Chase operates as a traditional bank, with more than 4,500 branches. It is also the nation’s largest digital bank. Combined, these numbers put Chase firmly in the top four banking groups in the USA.

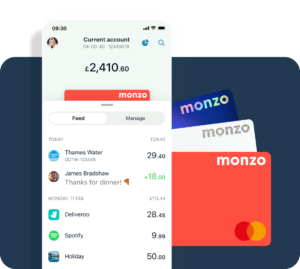

In September 2021, Chase launched its digital bank in the UK. To repeat its success over the pond, it has its work cut out. The UK is home to some amazing challenger banks, such as Monzo and Starling.

So you might expect Chase to offer some very competitive features. We look at these in more detail in this article, but to whet your appetite, here’s a little taster:

- Cashback on spending

- Free banking and up to 20 extra accounts free

- Spending insights to help you budget more effectively

- 24/7 customer service

- And more

While the bank has started its UK life at a measured pace, you can expect more to come in the future as it grows its customer base here.

How Does Chase Work?

If you prefer to bank in branch and in-person, then Chase isn’t for you. If you’re happy to bank online and through an app, then it could be. It’s easy to open an account, and you’ll receive a debit card through the post.

If you wish to use the Chase current account as your main bank account, Chase will take care of transferring all standing orders and direct debits from your existing current account automatically.

How to Open a Chase Current Account

Opening a Chase current account takes only a few minutes through the Chase app. You don’t have to switch from your existing current account at another bank.

You’ll need to be a UK resident and over 18, and you’ll need to download the Chase app to your mobile device, and have a UK mobile number. Before signing up, make sure you have a photo ID prepared. The most popular are a UK passport or UK driving licence.

As you work through the in-app application form, you’ll be asked to provide your:

- Full name

- Date of birth

- Your mobile number (you’ll be sent a verification code to enter into the app)

- Your email address

You’ll need to create a password, and enter your address details.

The app will ask you to take a photo of your ID with your phone, and send a selfie from the app to ensure that you are who you say you are.

Other questions you’ll need to answer include your employment status, source(s) of income, and tax status. After a couple more options (such as if you want emails about Chase products and services), you’ll be up and running with your Chase current account. Yes, it really is this simple!

Oh, when you receive your Chase debit card, you’ll notice it is a little different to most other bank cards: there won’t be any account numbers on it. These are in the app, but not printed on the Chase card. This is a security feature, as is the different number you’ll see registered when making online purchases.

Types of Chase Accounts

At the moment, there are only two types of account through Chase in the UK – a current account and a savings account, though you can only open a savings account via a current account.

You won’t need to deposit a minimum amount each month into a current account, and there are no limits on how much you can deposit.

In your current account, you can set up direct debits and standing orders through the app, pay and receive money into your account, and transfer money to other UK bank accounts (with a daily limit of £25,000). Currently, the bank does not offer payments by CHAPS.

You can use the UK ATM network to withdraw cash, with a limit of £500 per day.

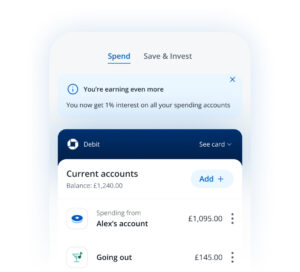

You also earn interest of 1% on your current account balance, which is paid monthly.

Chase Current Account Features

Now, let’s discuss the features of the Chase current account, because it is no ordinary current account. The 1% interest on your account balance is only the start of a few features that make Chase stand out from the average high street bank current account.

It’s Free

You won’t be charged to open an account, and there are no monthly account admin charges.

1% Cashback on All Eligible Spending for the First Year

This is one of the best cashback deals for UK current accounts. However, there is a long list of ineligible payments (which we will look at in a moment or two), and the deal is limited to a maximum of £15 per month.

Roundups and 5% Interest

You can elect to have your spending rounded up to the next pound, with the difference deposited into a roundup savings account. The interest rate in this savings account is an attractive 5% AER, with interest calculated daily and paid monthly.

If you’ve been following our blogs and reviews, you’ll know that we’re big fans of roundups as a way to save automatically and without noticing.

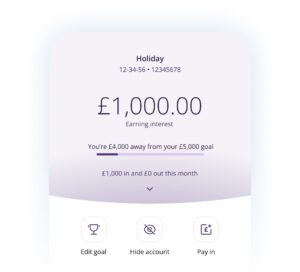

Open Up to 20 Extra Accounts for Free

Why do you need extra accounts? Well, it’s great for those who want to separate their spending. It’s like having ‘pots’ or ‘jars’ with other bank accounts.

As an example, I’ve got separate accounts for Christmas savings, car costs, shoes and clothes, and, of course, an instant access savings account for my emergency fund.

I also have other savings accounts for my grandchildren. Once a month, I deposit money into each of these accounts. This helps me to know exactly what I have available to spend each month, and protects my savings from myself!

Spending Insights

Another useful feature that allows you to see how you are spending and set limits in different categories.

Instant Account Notifications

You’ll receive instant notifications of transactions made on your account, which is a real help with tracking your spending and early detection of account fraud.

Payment Approval

Another feature that I like is its payment approval requirement. Some may find the need to approve a payment in the app before it goes through a bind, but it certainly makes you think twice about impulse buys and is another check on fraudulent use of your Chase bank account.

Easy Access Savings Account

You can open a linked easy access savings account (again with interest earned daily and paid monthly) with no minimum deposit amount. The rate of interest on this account is 4.10% AER.

Other useful features

Other useful features include:

- 24/7 customer service

- Disable, restrict, or block cash withdrawals, online spending, or specific transaction types (great to stop your temptations from ruining your finances)

- Immediate freeze/unfreeze of your debit card via the app if you think it may have been lost or stolen

More About the Chase Cashback Deal

The Chase cashback deal is attractive. 1% cashback on spending is certainly not to be sniffed at. However, it is only for the first year, with payment made after the debit card or online payment has been cleared. If you cancel purchases or receive refunds, the cashback amount will be adjusted.

If you deposit a minimum of £500 per month, the 1% cashback deal will remain in place after 12 months. However, as we mentioned earlier in this article, there are some types of payments on which you won’t receive cashback rewards. These include:

- Account and prepaid card funding

- Antique shops, including repairs and restoration

- Art dealers and galleries

- Bail payments

- Bank fees (such as financial consultations, loan fees, and product fees)

- Boat dealers

- Car and van dealers – purchasing or leasing new and used cars, repairs, and parts

- Cash withdrawals

- Cheques

- College and university fees

- Cryptocurrencies

- Debt repayments

- Deposits

- Gambling

- Government services not classified elsewhere

- Hospital fees

- Insurance premiums

- Intra-government purchases

- Investment into stocks, bonds, commodities, and mutual funds

- Money orders

- Money transfers

- Motor home, camper and trailer dealers

- Motorcycle shops and dealers

- Nursing and personal care facilities

- Pawnbrokers

- Precious metals

- Professional and financial services

- Real estate agent and management fees

- Savings bonds

- Stamp and coin stores

- Tax payments

- Timeshares

- Travellers cheques and foreign currency

The Benefits of Monthly Interest Payments

You’ll notice that all Chase interest payments are calculated daily and added monthly. This can really help to boost your savings. When you receive interest earlier, you immediately start earning interest on the interest. This will help your account balance to grow faster.

Also, having interest calculated each day means that you won’t get penalised as you would with an account that only calculates interest on a specific day of the month, which might be when your account balance is at its lowest.

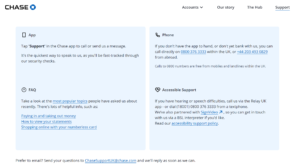

A Word About the 24/7 Support

Most of us need a little support now and again. It’s frustrating when you have a financial transaction you need to chase, or a query on your account, and you can’t get the help you require because you have the audacity to want support outside normal business hours. Chase removes this stress, with a system of 24/7 support.

There’s an in-app chat function which is usually pretty good, though you’ll need to work through the chatbot to get to a real person for assistance.

However, when you want to speak to a helpdesk employee, you can use a freephone number or dial from the app with a click of a button. Chase’s call centre is based in the UK, which I think is a big positive for UK customers.

Using Chase Abroad

You can take your Chase debit card abroad and rest assured you won’t pay extortionate fees to use it:

- You won’t be charged to withdraw cash from foreign ATMs (unless the local bank levies a fee)

- There are no charges on purchases made – though you should always remember to elect to pay in local currency

You’ll also benefit from the same 1% cashback deal as you do in the UK on purchases made.

(Another tip here: If you plan to make a high-value purchase while out of the country, you might do better to use a credit card to benefit from higher levels of consumer protection – called Section 75 protection.)

Is Chase Safe to Use?

Like most other challenger banks, Chase holds a UK banking licence and is regulated by the Financial Conduct Authority (FCA). Money you deposit with Chase is protected by the Financial Services Compensation Scheme (FSCS), which will compensate you on an amount up to £85,000 should Chase go bankrupt.

There is also a raft of other measures designed to protect your account from cybersecurity issues. These include 138-bit encryption to protect your personal data, numberless credit cards, and biometrics.

What Others Say About Chase

Chase has a 4.1/5-star rating on Trustpilot. 68% of the reviews left are posted at 5 stars, with customers commenting positively about the cashback deal and how the roundups make it easier to save money. There are also plenty of positive comments about the easy-to-use app and using the card abroad.

Of the negative reviews, it appears that some customers experience problems with Chase’s mobile payment process, though most of these reviews do seem to be answered quickly.

Tips to Get the Most Out of Your Chase Account

If you do open a Chase current account, how do you maximise the benefits to get the most out of it? Here are our top six tips:

1. Optimise Your Cashback Rewards

You won’t receive cashback on every purchase, so make sure you know which purchases you should make with your Chase account and if you can get better deals using other accounts or cashback services from other providers.

2. Use Spending Insights to Save Money

Take notice of the Spending Insights that you get from Chase. These will help you to understand how you are spending your money and identify areas in which you can reduce spending to save money.

3. Set Up Separate Accounts for Budgeting and Saving

If you, like many people, find it challenging to save money, you’ll benefit from using Chase’s free accounts as pots for your savings goals and to help you budget. Doing so will help you to stay disciplined and on course.

4. Activate Roundups!

Set your account to take advantage of Chase’s automatic roundups. You won’t notice the little extra taken from your current account each time you use your debit card. At the end of the year, how much you have accumulated in your roundup savings account (plus the interest, of course) is likely to be a very welcome surprise.

5. Know the Chase App

The app is easy to use and navigate, but you’ll get the most out of it if you familiarise yourself with it. Take time to explore its features and learn how to do the day-to-day tasks, like pay a bill through the app.

6. Be Safety Conscious

Chase’s app has a lot of safety features, but at the end of the day your safety is your responsibility. Ensure that you:

- Keep your app updated

- Use private Wi-Fi, not public Wi-Fi, when using the app

- Keep your contact information updated and secure

- Use a strong password, and never share it

- Always exit the app when you aren’t using it

It’s also worth checking through your transactions regularly to ensure there are no unauthorised payments on your account.

Pros and Cons of Chase

It’s time to summarise the pros and cons of Chase UK. This list will help you to decide if it is the account for you:

The Pros

- It’s free to open

- You receive 1% interest on your current account balance

- You receive 1% cashback on eligible purchases

- You won’t pay fees to withdraw cash or spend on your card abroad

- You’ll receive a good rate of interest on your savings accounts

- Roundups are deposited in a roundup savings account, and earn 5% interest

- You can open multiple accounts to help you achieve budgeting and savings goals

- Spending Insights is a useful tool in your budgeting armoury

- The app is easy to use

- Chase UK is fully FCA authorised and FSCS protected

The Cons

- The cashback deal is limited to only 12 months, and the list of exemptions on your spending is extensive

- The interest you can earn on your savings is good, but you may be able to find better interest rates by searching for the best regular savings accounts

- There are no overdraft or loan facilities (yet)

- Chase UK is a purely digital bank – a negative if you prefer branches and face-to-face banking

- You cannot deposit cash or cheques into a Chase UK account

Chase UK Alternatives

Of course, Chase UK isn’t the only digital bank account that you could choose as your banking solution. We’ve compared Chase UK to Starling, Monzo and Revolut. Here’s a summary of this comparison.

All four of these challenger banks offer free personal accounts, though only Starling, Monzo, and Revolut offer business accounts. In terms of regulatory credentials, Revolut does not have a UK banking licence, while the other three do.

You’ll find that features such as direct debits, standing orders, and budgeting aids are universally available across these banks, though there are some distinctions worth noting in other areas:

- Chase and Starling stand out for providing interest on current accounts, a feature missing in Monzo and Revolut.

- When it comes to cash handling and credit services, Starling and Monzo accept cash deposits and offer overdrafts, while Chase and Revolut don’t offer these services.

- Of the four banks, only Monzo provides credit facilities.

If you travel abroad, all four banks support fee-free cash withdrawals and spending abroad.

In short, each bank has its strengths and limitations:

- Starling and Monzo are the most feature-rich, offering both personal and business accounts along with overdraft and cash deposit services.

- Chase offers interest on current accounts, but lacks business accounts and overdrafts.

- Revolut is unique in not having a UK banking license, but offers most of the other features.

The Bottom Line

How does Chase UK measure up as a banking solution for you?

A big player in the United States, it has come across the pond and is dipping its toes in UK water. As a digital bank, it offers some attractive features.

With strong security features including numberless debit cards, and 24/7 support, Chase UK could be the digital current account for you, especially if you enjoy travelling (enjoy your time with 1% cashback and no fees). However, there are some features lacking – such as overdrafts and no ability to deposit cash.

It’s easy to open an account, and the Chase banking app is easy to navigate and use, too. You’ll love the hassle-free account switching service, if this is what you plan to do.

Chase’s current account isn’t just any regular account. The 1% cashback on eligible spending for the first year is a real bonus. You can create up to 20 extra accounts for free, making it easy to have separate accounts to suit your budget and savings goals – no more spending your holiday fund, or underfunding your shoe addiction!

If you find saving money a challenge, you’ll also love the roundup feature where your spending gets rounded up to the next pound, and the difference goes straight into a savings account. The 5% interest you’ll earn is very attractive, too.

In a nutshell, Chase could be a game changer for you – the digital bank account you didn’t know you needed.