Two very popular investor platforms – but which can help you trade successfully? We pit IG vs Hargreaves Lansdown and identify their pros and cons and ultimately decide which is best based on your needs.

You’re looking for an investment platform that can help you achieve your financial goals, and you’ve been pointed in the direction of IG and Hargreaves Lansdown. Not surprising – they are two of the best-known and most popular investor platforms in the UK.

Which is the best for you?

In this article, I’ve dissected each for you. From types of investment account to costs of trading, user interface to educational resources, investment assets to managed portfolio options, all you need to know is here.

TLDR: Which Is Best For You?

Both IG and Hargreaves have unique strengths. Which is best for you depends upon several factors, including your investment goals, style, and preferences.

For long-term investors and retirement planning, as well as beginners who desire more education and support, Hargreaves Lansdown is a great choice.

*Capital at risk. 64% of retail CFD accounts lose money.

On the other hand, if you’re an active trader who prefers more speculative strategies, and you have decent investment experience, you might prefer the sophisticated trading and analytical tools and access to CFDs and spread betting that IG offers.

*Capital at risk. 71% of retail CFD accounts lose money.

Who Is Hargreaves Lansdown?

Hargreaves Lansdown started life in the spare bedroom of a Bristol home in the early 1980s. Today, it is one of the UK’s top 250 public listed companies. It boasts more than 1.7 million clients and around £120 billion in assets.

Its services are tailored to both beginners and seasoned investors, covering a range of financial services and types of investment accounts. On its platform you can access a plethora of investment education resources, as well as market analysis and investment advice.

In short, as a Hargreaves Lansdown client, you’ll benefit from a blend of tradition and innovation from a highly respected firm, and an extensive range of available investments.

*Capital at risk. 64% of retail CFD accounts lose money.

Who Is IG?

Founded in the mid-1970s, IG was the world’s first spread betting firm.

Headquartered in London, it has more than 300,000 clients around the world, with offices in around 20 countries. Its client base includes traders and investors.

A highly innovative broker, IG provides access to thousands of investment instruments, as well as CFD (contracts for differences) and spread betting.

Its state-of-the-art trading platform is intuitive and delivers a suite of features that are particularly appealing to more experienced traders and investors.

With a long history, extensive client base, and unique position as one of the world’s leading players in CFDs and spread betting, IG caters to a diverse range of investment styles.

*Capital at risk. 71% of retail CFD accounts lose money.

Comparison Of Investment Products

When you’re investing, it’s important to use the right type of investment product (aka as investment wrapper or investment account). Depending on your investment goals, you’ll need to choose the wrapper that offers you the best tax efficiency combined with the flexibility you need.

A Self-Invested Personal Pension (SIPP) provides you with control when you are investing for retirement, and you benefit from tax relief on your contributions as well as tax-free growth and income in your fund – though income that you take when you retire is liable to income tax.

An Individual Savings Account (ISA) offers tax-free growth and income within the ISA wrapper. Though you can only invest up to £20,000 into ISAs each tax year, you won’t pay tax on any profits or income you take from ISAs. Junior ISAs are aimed at helping you invest tax efficiently for your children’s future.

A General Investment Account (GIA) is the most flexible of investment accounts. It allows you to trade without investment limits, though there are no tax efficiencies to be gained when investing via a GIA.

Both IG and Hargreaves Lansdown offer GIAs, ISAs, and SIPPs. Hargreaves Lansdown also offers Junior ISAs and Junior SIPPs, which makes them more appealing if you wish to invest for your children’s financial future.

Another key differentiator is that IG offers CFD trading and spread betting. These are highly speculative financial instruments that let you bet on the direction of price movements of underlying assets.

You can make big profits when trading in CFDs or spread betting, but here’s the kicker: get it wrong by just a little bit and you could lose your shirt (and your house).

Investment Assets Choice

By investing through both IG and Hargreaves Lansdown you can trade in a diverse range of investment assets. However, the options available demonstrate that their target clients have distinct investor profiles.

Hargreaves Lansdown offers a comprehensive selection of global assets, including shares, ETFs, corporate and government bonds, and investment trusts. This range of investments lets you create your own diversified portfolio, across industries, geographies, and asset types to match your risk profile.

If you would prefer to let the professionals manage your investments, access to thousands of funds as well as HL Select Funds and their Wealth Shortlist provides a huge spectrum of opportunity.

Hargreaves Lansdown also offers advisory services, providing personalised investment recommendations to suit your financial goals and risk tolerance.

IG are more focused on providing market access to active traders or those with more speculative investment strategies.

Like Hargreaves Lansdown, IG offers a huge range of global shares and ETFs, as well as investment trusts. But they also offer investors the opportunity to trade in Forex and CFDs, and follow a spread betting strategy – both of which appeal to traders who wish to speculate on market price movements without owning the underlying assets.

Neither Hargreaves Lansdown nor IG offer direct investment into cryptocurrencies, though IG does offer crypto CFDs and spread betting.

Do IG & Hargreaves Lansdown Offer Managed Portfolios?

If you prefer a hands-off approach to investing, IG and Hargreaves Lansdown have you covered with their managed portfolio options. These are designed to cater for investors who might not have the time, expertise, or desire to manage their own investments.

IG offers its IG Smart Portfolios service – a suite of managed investment portfolios that have been created with BlackRock (the world’s largest investment manager). Each portfolio is composed of iShares ETFs and is aligned to a different risk profile, from conservative to aggressive growth.

They are actively managed by experts who balance the selection and allocation of ETFs to optimise performance according to market conditions.

Hargreaves Lansdown’s ‘Ready-Made Portfolios’ are designed to help you invest in a diversified way without needing to invest in individual assets.

Hargreaves Lansdown’s in-house team manages these portfolios, selecting the assets they buy, hold, and sell according to market conditions and investors’ varying risk profiles from cautious to adventurous.

Hargreaves Lansdown also offers a simplified managed portfolio service: Portfolio+. This is a collection of six ready-made investment portfolios designed to suit different investment strategies and goals.

Charges, Fees, & Other Costs

If you are investing, there are some charges you cannot escape, such as taxes or exchange trading fees. However, both IG and Hargreaves Lansdown are transparent with their fee structure and charges they levy – and both offer tiered charging structures, too.

IG Fees & Charges

Trading charges

IG has a tiered charging structure for trading in shares and ETFs, based on the number of trades you have executed in the previous month. The basic charge is £8 per trade for UK shares and £10 for US shares.

This reduces to £3 and £0 respectively if you have traded at least three times in the previous month.

Dealing In Funds

When you invest in IG’s smart portfolios, costs start from 0.5% of value but are capped at £250 per account type.

Custody Fees

You’ll pay £24 per quarter per account, waived if you make three or more trades in the quarter, or if the account holds more than £15,000 in a Smart Portfolio.

CFD & Spread Betting Costs

When you trade in share CFDs, you pay a commission as well as trade at the market spread.

In the UK, online trading commission is 0.1% with a minimum of £10. In the US, commission is 2 cents per share with a minimum of $15. Commission is higher if you trade over the phone.

When spread betting, you only pay the spread, though the spread depends on the underlying asset.

With both CFDs and spread betting, if you keep a position open overnight you will incur overnight funding charges. How much you’ll pay depends upon the underlying asset and the size of your open position.

Other Fees

Other fees charged by IG include foreign exchange fees of 0.5% and a same-day transfer fee of £15 on a transfer of less than £100. If you make a deposit via a credit card or PayPal, there is no charge applied.

*Capital at risk. 71% of retail CFD accounts lose money.

Hargreaves Lansdown Fees & Charges

Trading charges

Hargreaves Lansdown is by no means the cheapest broker in the market. It charges a flat fee for buying and selling shares and ETFs of £11.95 per trade.

If you are a frequent trader (10 to 19 trades per month), this is reduced to £8.95 per trade. Active traders (20 or more trades per month) see this trade fee reduce further to £5.95 per trade.

If you wish to trade by phone, you’ll be charged 1% of the value of a shares trade, with a minimum charge of £20 and maximum of £50.

Dealing In Funds

Hargreaves Lansdown does not charge for dealing in funds.

Custody / Management Fees

Custody / management fees are charged on a sliding scale, and are applied as follows for a GIA, ISA, or SIPP:

Funds:

- £0 to £250,000 – 0.45%

- £250 to £1 million – 0.25%

- £1 million to £2 million – 0.1$

- Over £1 million – No charge

Other investments (shares / investment trusts / ETFs / gilts and bonds):

- In a GIA – no annual charge

- In a Stocks and Shares ISA – 0.45%, capped at £45 per year

- In a SIPP – 0.45%, capped at £200 per year

Other Fees

Other fees charged by Hargreaves Lansdown include per trade foreign exchange fees of 1% on the first £5,000, scaling done to 0.25% on trades of more than £20,000.

Hargreaves Lansdown does not charge for transfers in or out of your funds, nor does it charge for direct debits.

*Capital at risk. 64% of retail CFD accounts lose money.

Minimum Investment Amounts

Both IG and Hargreaves Lansdown have a low barrier to entry – you only need to deposit £1 to open an account with Hargreaves Lansdown, and there is no minimum deposit to open an account with IG.

You can set up a regular investment plan at Hargreaves Lansdown, though the minimum monthly investment is £25.

IG Website / Trading App

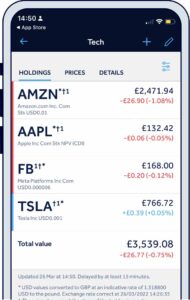

Geared toward more active traders, you’ll find IG’s mobile and desktop platforms offer a streamlined trading experience, backed up with sophisticated charting tools.

The mobile app delivers robust functionality, with live market data, real-time quotes, and interactive price charts. You can set price alerts, and analyse trends using a slew of technical indicators and drawing tools.

On both the mobile app and desktop version, you’ll have access to all the news and analysis you need to make informed trading decisions – and you can set up automated trading, too, as well as use the risk management tools to monitor your portfolio more effectively.

The interface has been designed with the trader in mind. It’s fast and intuitive, and you can customise its appearance to suit how you want to see all the data and market prices available to you.

Extensive yet easy-to-use research and trading tools, and access to the IG Academy to bolster your knowledge and skills through courses, webinars, and more – it’s a great trading tool whatever your level of investment experience.

*Capital at risk. 71% of retail CFD accounts lose money.

Hargreaves Website / Trading App

You can access the Hargreaves Lansdown platform on both desktop and as a trading app on your smartphone. The features available cater for all levels of investment experience.

You’ll find that the mobile app makes it easy to manage your investments on the go. You can trade directly from the app, view and manage your portfolio, and get real-time market data and analysis.

You can even set up watch lists and receive price alerts for the assets that interest you most. With an integrated news and research section, you’ll never be short of the information you need to make investment decisions.

As a desktop app, you’ll have even more tools and features available to you. This includes portfolio analysis tools and comprehensive educational resources that include articles, videos, and webinars.

Whether using the mobile app or desktop version, you can place a variety of order types, including at market, limit orders, and stop-loss orders.

Overall, the website and mobile trading app balances advanced research and analytics with easy-to-use trading tools. It’s a great platform for newbies and seasoned investors alike.

*Capital at risk. 64% of retail CFD accounts lose money.

Investor Education

I know I’ve mentioned investor education resources above, but I think it’s worth taking a closer look at what each firm offers. Neither lets you down.

IG’s investor education resources focus on providing those new to trading with the knowledge they need to start on the right foot, while also delivering to more experienced investors who want to refine their trading strategies.

The IG Academy is the standout feature. It offers free online courses covering a range of topics from fundamentals to advanced strategies and risk management.

You can progress at your own pace, benefiting from interactive investor education and quizzes to test your growing knowledge.

You’ll also have access to live webinars with themes such as market insights, trading strategies, and live Q&A sessions with experts. And, of course, there’s in-depth news and analysis available, including daily updates, expert commentary, and market analysis.

You don’t need to worry about any technical trading language going over your head, either – IG’s trading glossary is at hand to help you.

Like IG, Hargreaves Lansdown delivers a near-mountain of investor education. A library of guides and articles is at your fingertips, covering everything from the basics of investing to investment strategy, via a route that includes retirement planning and tax implications.

There are videos and webinars, including investment product guides and sessions that discuss financial planning and market movements.

You’ll benefit from its pension and ISA calculators, as well as investment planning tools. And if you want a deeper insight, take time to digest the detailed investment reports and analysis that are a hallmark of Hargreaves Lansdown’s approach to keeping its clients fully informed.

Are IG & Hargreaves Lansdown Safe To Use?

Something you must always check out before signing up to any trading platform, brokerage, or other financial service, is whether it is safe to use. While the value of your investments can fall as well as rise, you want to avoid putting your money into unsafe hands.

Both IG and Hargreaves Lansdown are authorised and regulated by the Financial Conduct Authority (FCA) in the UK, meaning they must adhere to strict financial and ethical standards.

On top of this, they are both covered by the Financial Services Compensation Scheme (FSCS) – a safety net that insures up to £85,000 of any money you hold with either firm should they go bankrupt.

You’ll also want to know if they do all they can to protect your personal data and accounts from malicious activity. Again, there’s nothing to find fault with.

From two-factor authentication (2FA) for account access, encryption technology to secure data transmissions, and continuous monitoring for potential threats, the security measures employed meet banking security standards.

IG Pros & Cons

IG’s strengths lie in the broad market access it provides, together with advanced trading tools, great educational resources, and CFD and spread betting opportunities.

On the downside, its charging structure could be seen as complex (with potentially costly fees for certain services), and being more targeted to active traders means it’s less tuned into beginner investors.

| Pros | Cons |

| Wide range of markets | Complex pricing structure |

| Advanced trading platforms | High fees for certain services |

| Comprehensive educational resources | Limited direct access to cryptocurrencies |

| Strong regulatory framework | Platform complexity for beginners |

| In-depth research and analysis tools | |

| Good customer service | |

| Demo account available |

*Capital at risk. 71% of retail CFD accounts lose money.

Hargreaves Lansdown Pros & Cons

Offering a wide range of investment options, user-friendly tools, and extensive research and analysis, as well as excellent educational resources, Hargreaves Lansdown will appeal to all investors, whether you’re a beginner or have years in the game.

However, high fees compared to some competitors will be a consideration if you are cost conscious, and the trading tools may not be advanced enough for more active traders.

| Pros | Cons |

| Wide range of investment choices | Higher fees compared to some competitors |

| User-friendly website and mobile app | Limited advanced trading tools |

| Extensive research and analysis | |

| No charge for fund trades | |

| Excellent customer service | |

| Comprehensive educational resources | |

| Strong regulatory compliance |

*Capital at risk. 64% of retail CFD accounts lose money.

Get The Most from IG Or Hargreaves Lansdown

Whichever is your choice of investment platform, how you use it will be a big factor in your success. Here are five tips to maximise the features and benefits of both IG and Hargreaves Lansdown:

1. Leverage Educational Resources

Investment markets don’t stand still, and neither should you. There is always something to learn.

Get stuck into the educational materials available to you. Take part in webinars. Read articles. Take courses. Knowledge is power and profit.

2. Utilise The Demo Account (IG) Or Low Minimums (Hargreaves Lansdown)

Whether you’re new to trading or an experienced investor, make use of IG’s demo account and the low minimums available with Hargreaves Lansdown to test strategies and get used to the platform.

Investing successfully is a marathon, not a sprint, and a slow start should pay handsome dividends.

3. Engage With Market Analysis & Research

Take advantage of the comprehensive market analysis and research offered on both platforms. It will help you identify potential investment opportunities as well as reduce risks.

4. Take Advantage Of Tools & Apps For Portfolio Management

With so many features available on both platforms, it would be a crime to ignore them! Wherever you are, providing you have internet access you can monitor your portfolio’s performance, set alerts for price movements, and execute trades – investment control is at your fingertips.

5. Consider Managed Portfolio Services For A Hands-Off Approach

If you don’t fancy managing your investments yourself, then hand the reins over to IG or Hargreaves Lansdown by investing in their managed portfolios. They are excellent options for hassle-free investment.

The Final Analysis

If you’re focused on long-term investing, Hargreaves Lansdown is the best platform because of its comprehensive range of investment options, extensive research and analysis, user-friendly interface, and excellent customer service.

Whether you’re a novice or seasoned investor, it’s a great choice for developing and managing a diversified portfolio.

On the other hand, if your focus is on frequent trading and more speculative instruments like CFDs and spread betting, you’ll benefit most from IG’s advanced trading tools, in-depth market analysis, and educational resources geared toward trading strategies.

Which is best for you depends on your investment style, asset preferences, and investment goals.

Whatever your choice, always be mindful that asset prices and values of investments can fall as well as rise – and use the strengths of your chosen investment platform to help you fulfil your financial objectives at a level of risk with which you are comfortable.