No matter your income – high or low – knowledge and strategies are key to the power of controlling your wealth. Here are some easy ways to make your money work harder for you.

Finding ways to make your money work harder for you doesn’t have to be like searching for the Holy Grail. Sure, it suits some so-called financial experts to make things sound as complex as possible, but the truth is that anyone can employ a few easy tactics to be smart with money instead of having to work harder for money.

You see, it’s not about how much you earn. It’s about how wisely you use your earnings. Every pound you cut from spending, and every penny you reduce from debt, can be funnelled into savings and investments that make your life easier today and fruitful in the future.

When you develop good financial habits, making your money work harder for you is no longer a challenge. It’s just something you do daily. It’s not hard to do – but you do have to be strategic.

Let’s get started, shall we, with 30 smart tactics to make your money work harder.

30-Second Summary

Do want to make your money work harder for you? Who doesn’t, right? It’s easier than you think.

Start with a shift of mindset. Then analyse your spending habits, and set a realistic budget to achieve your financial goals. If you have unnecessary debt, wave goodbye to it. Learn to spend wisely on the things that really matter to you. Save and maintain an emergency stash of cash that will reduce the financial stress in your life. From here, invest for life-transforming growth and income – and take advantage of every tax-efficient investment wrapper available to you.

Finally – and here’s the kicker – invest in yourself. Boost your skills, health, and network. Because making your money work harder for you isn’t just about the cash. It’s about creating an enjoyable life – a life that you love.

Boost Your Money Smarts

Being smart with your money is about getting it to do the hard lifting for you. We’re going to touch on a few key areas.

First, changing the way you think about money. Mindset is everything – it’s the foundation of finances that work for you, rather than for others.

Next, we’ll dive into a few tips around budgeting, before tackling debt – you don’t need the cost or stress of debt, do you?

We mustn’t forget about savvy spending – a game where you really can win big. I’m going to show you how. Of course, I’ll also discuss a few key tactics to use when saving and investing, because this is where your money really starts to grow.

Finally. I’ll examine something that so many forget about – investing in yourself. Why? Because you are your most important and valuable asset.

Refine Your Money Mindset

Shifting your money mindset is more than being positive about your finances. It’s about being smart with your money. Here are three crucial tactics:

1. Improve Your Financial Knowledge

In whatever you do, knowledge is power. If you know how to play the game, you’re more likely to be the winner.

By spending a little time each week seeking financial education through blogs, podcasts, and books, you’ll up your game quickly. You’ll learn the ropes of planning your finances, get access to better financial deals and products, and make better decisions about your money to help you achieve your financial goals faster.

2. Set Your Financial Goals

Speaking of goals, let’s talk about goal setting. Have you ever heard of SMART goals? Specific, Measurable, Attainable, Relevant, and Time-bound. It’s like saying, “I want to save £1,400 for Christmas, with a regular savings plan,” instead of, “I want to save some money.”

When you set SMART financial goals, they give you clear targets. You can split them into mini-milestones and actionable steps, and track your progress more easily.

3. Automate Your Finances

Things are so much easier when they are on autopilot, aren’t they? To save, set a standing order to move money into your savings account on the day after you get paid.

You’ll soon not notice the difference, and you won’t need to lift a finger. Put your regular bills on direct debit to avoid missing a payment and incurring late fees.

In fact, automating your finances is a terrific way to make budgeting easier.

Budgeting

We often think that budgeting is about restricting ourselves. In truth, it’s about understanding your money to make it work harder for you.

Now, I know that budgeting can be overwhelming, and you might even find it tedious, but there are some things you can do to make it a breeze.

4. Track Your Spending

Here’s the part that most of us find most challenging. Oh, we start off with the best intentions – we might even buy a new cashbook to keep a diligent record of our spending, or create a spreadsheet to make the job a little easier.

But tracking your spending often goes the way of New Year’s resolutions – starting with an enthusiastic bang and fizzling out with a whimper.

So, here’s your first SMART goal: write down every penny that you spend for two weeks. Whether it’s a morning coffee or your electricity bill, make a note of it and categorise it.

Sure, this is a chore – but it’s also eye-opening. You’ll start to notice patterns where you are leaking cash.

5. Use A Budgeting App

I always found the most challenging aspect of tracking my spending was to remember to write everything down. Even when I collected receipts, they usually gathered dust on my desk before being thrown away after weeks.

This is why I love budgeting apps.

Not only do apps like Moneyhub let you connect all your cards and categorise spending on them, but they also give you a real-time review of your spending habits and financial position.

Other budgeting apps like Snoop help you to identify cheaper alternatives for household expenditure, while Plum is a great app to help you create and maintain a budget that targets saving and investment.

Of course, one of the best things about budgeting apps is they remove all the tedious work from budgeting – providing you always use connected cards when spending any money.

The result – you’ll be tracking your spending automatically, categorising it precisely, and receiving real-time insights into how you are spending.

6. Create A Detailed Budget

Once you have a better understanding of where your money is going, effective budget planning will put you in control of it. You’ll need to list your income and expenses, and prioritise your spending – and don’t forget to include occasional expenses like birthdays, Christmas, and holidays.

Now you can allocate your money to cover all your priorities and other spending. Banking apps like Monzo and Wise let you create jars to keep money separate.

I have jars to cover things like car insurance and servicing, Christmas saving, shoes and clothes, and holiday spending, as well as savings jars for other specific goals. They’re like accounts that are ringfenced from my everyday spending.

You can also use these mini accounts to put aside money for food shopping, travel expenses, entertainment, and more. Once you have spent the money in a jar, no more spending in that category until after your next pay day.

7. Review Your Income & Spending

You can’t manage what you don’t monitor. People get into money problems when they take their eye off the ball. Take a bad kick with your finances, and you’ll soon be scoring own-goals for fun – except it isn’t fun, is it?

Checking in on your finances monthly helps you keep a tab on your spending habits and stay on track to achieve your financial goals. It’s much easier to make small adjustments each month than to be forced to make a massive change every six months.

Budgeting isn’t about being rigid with your money. It’s about being aware of how you are spending, identifying how you can reduce expenditure, and being flexible to adjust along the way.

8. Negotiate Regular Bills

Are you overpaying on your regular bills? Here’s a challenge for you – pick up the phone and ask for a lower price. You’ll be surprised at how many providers will react positively – especially if you threaten to leave or switch to another provider.

Take Sky as an example. They often offer cut-price deals to new customers. That’s not fair, is it?

Call their customer retention team, and tell them you are considering leaving. You could save hundreds of pounds each year while remaining on the same package. (A family member did this last year, and saw his monthly subscription reduced by almost 50%, saving him almost £500 a year.)

Budgeting Overview

Stop thinking about budgeting as penny pinching! It’s about being in control, and making good financial decisions. By tracking your spending, using budgeting apps, creating a detailed budget plan, and reviewing regularly, you are set for success.

It may take a little effort at the start but, once it becomes habitual, you’ll see your finances start to move in the right direction. You’ll be less stressed, and have more financial freedom.

Paying Down Debt

Debt: a four-letter word with dictionary-sized consequences. Like an invited guest who turns up to your party, drinks all your alcohol, eats all your snacks, and then hangs around way too long.

Like a payday parasite, eating away at your earnings and leaving a wound that just won’t heal. If only you could show debt the door, your bank balance could be transformed overnight. Here’s how:

9. The Debt Avalanche Method

That pile of debt is like a mountain to climb, isn’t it? The debt avalanche method of debt reduction is like tackling the steepest slopes first. Get those out of the way, and the rest is like a hike in the park.

What are the steepest debts you have? Those with the highest interest rates – they never get smaller. This is where you want to throw as much money as possible, starting with the debt that has the highest interest rate (often a credit card).

Once you’ve secured the highest debt from avalanching, move onto the next.

10. The Debt Snowball Method

If you have small debts littering your accounts, these are the snowballs, and they can be easy to tackle, leaving you freer to clear those big avalanches.

The avalanche (higher-rate) debt is your priority. But if there’s a much smaller debt you can afford to clear too, it’ll make quite a difference to you mentally as well as financially.

11. The Debt Consolidation Method

Have you been shopping and tried to hold all you have bought in your arms? It’s easy to drop a few items, isn’t it? Having a few debts hanging around can be the same. Drop one, and the result could be devastating.

Debt consolidation is packing all those debts into a single basket – one loan with a lower rate of interest. Easier to manage, and less interest to pay.

The key to real success with this method is to continue paying the same amount if you can, to chip away at the debt faster.

12. Overpay Your Mortgage

Now, a mortgage is usually the last debt you should seek to repay as quickly as possible. It’s what I call good debt – it puts a roof over your head and, hopefully, the value of your home will increase over time.

However, if it’s the only debt you have, you might consider making extra payments to pay off your mortgage faster (providing the T&Cs of your mortgage allow you to without penalties).

What difference could regular overpayments make?

On a £200,000 repayment mortgage with 20 years remaining and an interest rate of 5%, were you to overpay by £100 per month, you would pay off your mortgage two years and three months early.

That extra £100 a month will save you almost £15,000 in interest. Oh, and you’d have an extra £1,419.91 in your pocket every month once your mortgage is repaid.

Debt Overview

Paying down debt frees up money to work harder for you. You’ll have more money to save and invest, or to enjoy your life more.

Your finances shouldn’t be a source of stress. When you start to see your debts disappear, you’ll be ready to tackle your financial goals with extra gusto.

Savvy Spending

Savvy spending isn’t about pulling your purse strings so tight that it strangles the joy in your life. It’s about making smart spending choices to help you toward your financial goals without decimating your lifestyle.

13. Focus On Wants Vs Needs

Step one is to distinguish between wants and needs. We’re back to mindset in a way – having the mental discipline to pause before spending and ask yourself, ‘Is this something I really need?‘

One simple question that could prevent you unnecessarily spending your money.

14. Wait Before You Impulse Buy

Do you suffer from impulse buys – you see something and just have to purchase it? Forget impulse buys, they are more like regret buys.

Whether it’s a Mars Bar or a pair of shoes, do yourself a favour and wait at least 24 hours before you splash your cash on impulse. It’s a fantastic tactic to save you from buyer’s remorse and maintain a healthy budget.

15. Use Cashback & Rewards Cards

Turn your everyday purchase into rewards or cash. Opt for cards that offer the best points in your main spending categories and help build rewards toward things you like to do, like travel and overnight hotel stays.

Don’t forget, though, that if you don’t pay off your balance in full each month, you’ll rack up interest faster than value.

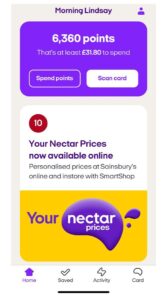

16. Sign Up For Loyalty Cards

Store loyalty cards are easy wins. They are usually free to join, and will unlock exclusive prices, rewards, and other benefits at your favourite shops. Regularly review point balances and redeem them for discounts, products, or services.

17. Shop In Bulk

Especially for non-perishable items (like toiletries and cleaning supplies) and long-dated items (like tinned goods and dry goods), you can save significant amounts when you buy in bulk.

Not only will you save money, but you could also reduce the number of shopping trips you need to make, saving time as well as money.

Here’s an example:

A popular supermarket recently had Heinz tomato soup on its shelves at the following prices:

- A single can for £1.40

- Five cans for £5.00

- A Pack of six cans for £5.00

- Two packs of six cans for £8.00

That’s a price range of £1.40 to £0.67 per can, proving that when you buy in bulk, every little extra helps.

18. Warehouse Club Membership

Join a Warehouse Club like Costco, and you could save on bulk purchases as well as earn cashback on eligible shopping.

19. Shop Around For Insurances

Don’t settle for the renewal quote from your existing insurer. Whether it’s for your car, your home, or other insurance needs, shop around. Make sure that you aren’t paying for cover that you don’t need either. You can save hundreds of pounds each year.

(Tip: Check what insurance cover you have through your credit cards before you buy another policy – often, insurance like travel insurance is included.)

Savvy Spending Overview

When you become a savvy spender, you become much more money savvy. Find that balance between needs and wants, and don’t let money slip through your fingers, and you’ll be well on your way to making your money work harder. Because you’ll have more in your bank account to pump into saving and spending.

Saving & Investment

Here’s where making your money work harder for you gets really juicy! You could say that everything so far has led to this. It’s not simply about squirrelling your money away, it’s about savvy saving and smart investing.

20. Set Up An Emergency Fund

If you don’t have an emergency fund already, this should be your savings priority. An emergency fund is the buffer you need to help you hurdle life’s little nasty surprises effortlessly.

A car repair, medical emergency, urgent home maintenance, or loss of your job all take their toll on your finances. If you are prepared for them, you can take all of these in your stride. An emergency fund of between three and six months of living expenses will give you peace of mind and financial stability.

You’ll need instant access to your emergency fund, but this doesn’t have to mean poor interest rates on your savings. For example, the Chip Instant Access Account currently pays 4.84% AER.

21. Pay Into A High-Interest Savings Account

The problem with cash savings is that they rarely beat inflation, so over the long term they won’t help you build wealth or sustainable income. Make sure your savings are earning the highest rate of interest possible.

This doesn’t have to be hard work – you could opt for the Active Savings Account at Hargreaves Lansdown and get great rates with no hassle.

22. Start Investing Early

The earlier you start investing, the more you’ll benefit from compounding – a phenomenon that Albert Einstein called the eighth wonder of the world. Over time, you’ll earn interest on your interest, or dividends on the shares bought with previous and ongoing dividends payments.

Compounding is a key to exponential growth in the value of your investments.

For example, if you start investing at 30 and save £100 per month until you are 60 in an investment that earns an average of 5% per year, you will have invested a total of £36,000 and have a fund with a value of £79,726 when you reach 60.

If you had started investing at age 20, you would have saved a total of £48,000 and have a fund of £144,959 at age 60. (Remember, this is an illustration only.)

23. Maximise Tax-Efficient Investments

Tax is a killer, especially when it comes to investments. Which is why you need to use tax-efficient investment wrappers to their max. Individual Savings Accounts (ISAs), workplace pensions, and Self-Invested Personal Pensions (SIPPs) offer tax benefits that can seriously pump up your wealth.

Take that £100 per month investment growing at 5% per year. In a workplace pension in which your contributions are matched, you’ll benefit from an employer contribution as well as tax relief. Your £100 contribution will attract tax relief that adds £25, and then a matched contribution of £125 from your employer – a total of £250 per month.

Over the course of 30 years (again, growing at 5%), your £100 will grow to approximately £199,316. If investing over 40 years, you’ll end with a pension pot of around £362,399 – more than three times the average pension pot in the UK.

(Again, remember that this example is an illustration only – you should always seek personal advice.)

24. Automate Your Investments

Just as you can automate contributions into investment accounts, you can also let technology do much of the work for you. Using a robo advisor like Wealthify or Moneyfarm, you simply enter details about your tolerance and attitude to risk and your financial goals (often by a simple questionnaire), and your investments are worked out for you, using algorithmic trading.

The platform manages your investment portfolio, choosing investments to suit your investor profile and making small adjustments over time to keep your portfolio on track. The result is a hands-off investment approach that is disciplined and prevents emotional decision-making.

25. Peer-To-Peer Lending

Never heard of peer-to-peer lending? It’s like you becoming the bank. Through platforms like Kuflink, Loanpad, and CapitalStackers, you lend money to individuals and small businesses. You earn interest on these loans, often higher than you would in, say, a savings account.

Your primary risk is borrower default, though this risk is reduced by diversifying the loans you make (which is usually done by the platform).

Saving & Investment Overview

Whether it’s the lower stress you feel when you maintain an adequate emergency fund, the exhilaration of seeing your investments rise in value, or the satisfaction of passive income in retirement, saving and investing is the key strategy to make your money work harder for you.

By taking the conscious decision to save and invest, and taking advantage of tax-efficient investment wrappers, you’re setting yourself up for a more fruitful and meaningful life. Each pound you invest is a stepping-stone toward your financial freedom.

But remember, this is a marathon, not a sprint. It requires patience and consistency – if you’re advised to invest in a get-rich scheme that sounds too good to be true, at best it usually is, and at worst it’s a scam.

Build Financial Freedom From Solid Foundations

Making your money work hard for you is within your grasp. By refining your money mindset and budgeting wisely, you lay the foundations to build toward financial freedom. From this base, everything you do can help you build life-changing wealth.

Every penny of debt you repay quickly gives more financial wiggle room. Being savvy about your spending leaves more money in your wallet. Money with which you can then build and maintain a financial safety net, before saving and investing toward life-transformative goals.