The founder of Wallet Savvy takes a look at two pre-paid cards for kids as he puts HyperJar Vs GoHenry – find out which is best for you and your family below…

HyperJar and GoHenry are two of the most popular prepaid children’s bank cards available in the UK, but which one should you go for?

In this article we are going to explore what each of them offers in order to help you find the right account for you and settle the HyperJar Vs GoHenry debate once and for all.

TLDR: HyperJar Vs GoHenry

While this will ultimately come down to personal preference, I found GoHenry to have such a wide range of features which meant that I could be a lot more hands on when it came to teaching my children about how to handle their money.

Of course, you have to pay for these features but in a straight head to head, out of these two, GoHenry wins for me.

HyperJar is a much more basic service, but it is free – so if you just want a cash card and nothing else, that could be the way to go.

At what age should I give my child a cash card?

Before we get into looking at HyperJar and GoHenry, I think it’s a good idea to address the question of how old a child should be when you first give them a cash card, because it’s a difficult question that parents struggle with.

Every child is different, of course, so there isn’t one answer that will apply to everyone. Both Go Henry and HyperJar are available to children from the age of six, and to be honest I don’t think that my children were really ready for the responsibility of a cash card at that age.

We had just started introducing them to cash, and getting their heads around the different coins and notes – it didn’t seem right to throw in cash cards on top of all that at such a young age.

Obviously, as a parent, you will have control over the money that goes into the account, and as both HyperJar and GoHenry are ‘pay as you go’ cards, you don’t need to worry about going into overdrafts or anything like that.

This limits the amount of risk, so it just really comes down to whether you think they will be able to understand the concept of the card and whether they are responsible enough to use it sensibly – or at least deal with the consequences if they have spent all of their money on sweets at the shop, so can’t afford the new computer game they really want.

I started my eldest on it at 9, and my youngest was a little younger as he’d seen his brother using it, so had more of an understanding.

There is very little risk in introducing it to them earlier, but I just wanted to make sure they fully understood it before we took the plunge.

You’ll know your children best, so as long as you have read up about the various options, you’ll make the best decision for your family. What is absolutely certain is that it is critical that we teach our children about personal finance as early as we can – I am a firm believer that it should be taught in school, but as parents we have a responsibility to make sure our children are fiscally responsible.

Now let’s take a look at HyperJar and GoHenry individually to help get an understanding of each.

What is HyperJar?

HyperJar are a tech and data company that specialise in personal finance. They have developed technology that helps people track and budget their spending using helpful visuals.

They’re a relatively young company, established in 2019, but they have over 500,000 customers spending over £100 million a year using their services, and they have excellent scores on review sites. This all points to a company that you can trust to do a good job.

What we’re really interested in here is the Kids Card. However, in order to use a Kids Card, you also have to have an adult account that can be linked to it. This is another prepaid card that enables you to budget, but the really good news here is that both the adult and the kids account are free to set up and use.

How does HyperJar work?

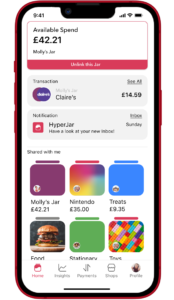

The idea here is that the prepaid card works in conjunction with the HyperJar app. Obviously, if you want the child to be in full control of this, they will need their own phone, but if they don’t, or you just want them to focus on getting used to the card, you can simply download the app onto your phone and you can control everything from there.

Either way, as the card has to be linked to an adult account, you will still have full control as a parent.

The whole premise of HyperJar, both the adult and child services, is that you split up your money into different ‘jars’ on the app. Each of these jars will represent something different that you’ll be spending your money on – so for the adult version you’ll have a jar each for food shopping, energy bills, phone bills, clothes shopping etc. On the child’s account it will be more like ‘toys’, ‘sweets’, ‘games’ etc.

And both versions will have ‘Savings’ jars!

So you assign money to each of these different jars, and from there that money can only be spent on that. So, for example, if you give your child money to get the bus, and put it into their ‘public transport’ jar, they won’t be able to spend that money on sweets – the transaction will be blocked.

You don’t have to use that feature – you can just give money to the central pot and they can either spend it directly from there on whatever they want, or assign the money themselves (that has to be the goal that you work towards – that they start to budget their money independently).

This has been a great feature for my kids – a great way to visually represent where their money goes every month.

At every stage, you can see what your child has been spending their money on, and even see the transactions that were blocked. There is even a detailed breakdown of when and where they spend their money, if you feel like you need these kinds of statistics (I haven’t really seen much need to be honest, but some people might find it interesting).

The card can’t be used to withdraw cash, but to be honest I don’t think that will be much of a problem as almost everywhere accepts card payments these days.

One feature we really like in our house is the messaging on the app – we can ask our kids to do various chores and offer them a financial reward for doing them. “Could you clean the car – Reward £5” for example.

Now, obviously we could just as easily ask them in person to do this, but to be honest they get a bit of a kick out of receiving these messages, and it seems to really motivate them to do what we ask them.

Having all of this on one app is more exciting, and when they reply to say that it is done, we can send them the money straight away.

Finally, and I appreciate that you are here for personal finance advice, and this does not fall under that banner, but the card itself glows in the dark. I’m not too proud to say that even I was quite impressed by that, and my kids loved it.

I should point out here that if they lose their card, there is a fee of £5 to get a replacement. You can get them cancelled immediately, and block any transactions through the app as soon as you know that it is missing, so you don’t need to worry about the security there.

What is GoHenry?

GoHenry was founded in 2012 by a group of parents who, at the time, were having to use their own credit cards to fund their children’s online gaming accounts. It was a clunky way to do things, and posed a lot more risk to them, so they wanted to come up with another idea.

So the entire company is aimed at families with the aim of teaching children about personal finance – a goal that I am sure you can get on board with if you’re reading this article.

Over 2 million people use the card and app, with over 92% saying that they would recommend their services. This is a positive start.

The entire service is of interest for the purposes of this article – while you will need an adult account to link to the child’s account, you’ll get the benefit of all of their features. There is a cost for this one though, of £2.99 a month per account – so you will have to be sure that you will get your money’s worth out of the features before you sign up. (You are offered a one-month free trial before you start paying).

How does GoHenry work?

GoHenry is more in depth than HyperJar, which you would expect considering there is a monthly fee. It’s important to note though, that having more features doesn’t necessarily mean more complicated to use – one of the great selling points of GoHenry is just how simple it is.

It is probably aimed at children a little bit older than HyperJar is aimed at – there is just a bit more sophistication about it. I guess it’s just a bit more like a ‘proper’ bank account.

There are plenty of similarities between the two – like with HyperJar, as a parent you will ‘load’ up your child’s account with money. This is really quick and simple to do on the app. You can set up regular payments if you plan to give your child regular pocket money, but another great feature is the ‘tasks and chores’ section.

I mentioned when discussing HyperJar how much we enjoyed the messaging service on the app to assign them tasks in return for money, but GoHenry has gone a step further here. You can set up as many tasks as you want for your children, with a reward for each one.

This is great because all of those little jobs that need to be done every week (put the washing away, sort out the recycling etc) can be added for small fees. It’s a great way to teach them about the importance of work and money, while at the same time helping to keep the house in order!

That’s just the start of the features – you can set them up with savings goals as well, to encourage them to put money away to one side. You can set up interest rates for when they achieve these goals, to keep them motivated. (You’ll be paying the interest rates, of course, but it’s a great way to introduce them to the concept).

There are Money Missions on the app, which are videos and quizzes for the children to do to earn points and badges. To be honest, we didn’t find this feature that useful without offering some kind of cash reward on top!

One thing that we did like, though, was the split the bill feature – this meant that when they went out together (or with friends that also had the same app), they could all chip in rather than making a load of different payments – this felt like a very grown up thing to do.

Finally, the last thing that I really liked is that other people can top up your child’s account. This was great for us, because relatives are always giving money for birthdays and Christmas, and they either give cash, which we then have to find time to take to the bank, or they transfer the money to us and we have to remember to forward it on and not spend it ourselves! This just cuts out the middleman.

The features here are great, and coupled with the ease of use, it makes GoHenry a really attractive product for anyone wanting to teach their kids a bit more about personal finance, with many practical benefits.

There are loads of different designs for the cards, but you have to pay £4.99 if you venture away from the standard design, and any replacement card will also cost £4.99 – standard or not.

Which is better: HyperJar Vs GoHenry

Well, I’ll start this section off by disappointing you – the purpose of this article was not to give you a definitive answer to the question: “Which is better: HyperJar Vs GoHenry?” What I wanted to do here, is to give you the information you need to decide which one would be better for you and your children, which is a question that only you can answer.

The good news here is that both of these products are excellent, depending on what you want to use them for. They are highly recommended by millions of users, and my family had positive experiences with both of them. In truth, you can’t really go wrong – but it’s likely that one of them will be more suited to your family than the other.

From my experience, I would say that HyperJar is more suitable for younger children – it’s a great ‘my first debit card’ kind of product. The visuals of the jars will certainly help young children, and it is very simple to use.

Crucially, it is also free. Young children aren’t going to be using their cards all that often, so you have to ask yourself, “do I want to be paying £2.99 a month for a few trips to the local shop to buy some sweets?” I would argue that the answer to that question is likely to be no. You just won’t get good value for money for younger children.

However, GoHenry is definitely the more complete product. The features are a lot better – they give you more flexibility, more control and they offer a much better opportunity for kids to learn about their money – but only if they are old enough to understand it.

There is no point telling a six-year-old that if they save another £13 this month, they could be looking at an extra 2.5% interest on their savings. They just won’t be ready to understand that, and in general it might just be too overwhelming for them – stick with pictures of jars with numbers on them that you get on HyperJar – it’s more appropriate for how they learn at that age.

Then, as they get older, you can look at the more in depth features that come with GoHenry. You can give them a huge list of chores to work through, they can split bills with their mates and they can watch videos to develop their understanding. And yes, they can start to learn about interest rates too, the lucky devils!

So there you go – I found that HyperJar worked best for younger kids, and GoHenry was much better value as they get older, but you will know by now which is best for your family – happy shopping!