Wallet Savvy founder Jason Mills takes a look at this app-based pension provider in our PensionBee review.

PensionBee is the pension service that aims to simplify a process that has, for too long, been overcomplicated. The very word ‘pension’ has been a word that is usually met with, at best, a shrug of the shoulders by most people, and this causes problems for us later in life.

It’s important that we start to take more of a control over our finances in order to plan for our future, and that is what services like PensionBee aim to do – to make our pensions more accessible and easier to understand.

A recent study showed that around 17% of people in the UK don’t have any pension at all, other than a state pension. This is alarming, and could put a huge strain on the economy for future generations. The best time to do something about your pension is now – no matter how old you are (assuming you are over the age of 18).

So in this article I am going to be taking a look at exactly how PensionBee can help you take more of a control over your financial future – I’ll look at the company, how the service works, the various pension options, who it might be suitable for, how safe your money will be and, ultimately, whether it is any good.

So let’s crack on with this PensionBee review.

TLDR: PensionBee Review

PensionBee is a wonderful service that simplifies everything to do with your pension. With one, straightforward fee you know exactly where you stand, and it is so easy to consolidate existing pensions into one place.

It’s the ideal service for anyone that feels a bit overwhelmed by pensions, or people that move jobs often. It is also great for people that are self-employed.

*Capital at risk

Who are PensionBee?

PensionBee was founded in 2014 by Romina Savora who wanted to do something that she thought would be pretty straightforward. She had left a job and wanted to move her workplace pension. What she discovered was that this process would be anything but straightforward.

She had to pay fees, fill out endless mind bending forms, get passed from department to department – all because she wanted to move her own money.

She joined forces with the co-founder of PensionBee, Jonathan Lister Parsons, and together they worked on simplifying this incredibly frustrating process. The result was a service built around their five values:

Love – every PensionBee customer is assigned a personal member of staff (a Beekeeper) to ensure their pension plan fits the customer’s retirement goals.

Honesty – not only do they make everything transparent for their customers, explaining their fees in detail, but they also campaign for more transparency for the entire industry with initiatives like the Pension Switch Guarantee.

Quality – they have partnered with some of the world’s largest money managers like Legal & General, HSBC and BlackRock.

Simplicity – they want to make sure you understand everything about your pension. They avoid jargon and over-complicated phrases to help you understand what is happening with your money.

Innovation – bringing the industry into the 21st century is a huge part of their motivation. The way we view our pensions is finally catching up with technological innovation, and PensionBee are at the forefront of that.

All of this seems to be working – they have amassed over 1 million customers since they started out, and the reviews are generally excellent. That’s not enough for me though, I needed to find out for myself, so join me as I take a deep dive into PensionBee.

*Capital at risk

How does PensionBee work?

One of the main selling points of PensionBee is about how simple it is to use. But it would be wrong to dismiss PensionBee as a basic product, because the true key to a successful product, no matter what industry it is in, is to be able to do quite complex things, but in a way that is easy for the customer to understand and use.

So let’s cover the simple aspect of it – in a nutshell PensionBee works like this:

You sign up with them via their website (you’ll need your National Insurance number) and from there you have the choice of starting up a brand new pension, or transferring a pension that already exists with another provider. From there, you’ll have a few different options of pension plans, all of which are explained in simple terms, and you are guided to pick your preferred choice.

That’s basically it – you’ll then be up and running, and your money will be safe in their hands. Of course, you’ll have the option of adding to it regularly – which is obviously recommended.

As with any pension, you need to be constantly topping it up in order to see the benefit when you retire. There are bonuses that you will receive at various stages, which we’ll cover as we look into these options in a bit more detail.

So there you have it – the whole process covered in two paragraphs – there is nothing too daunting there is there?

Let’s now take a look at the different choices you have when you set up a pension with PensionBee.

Transferring Existing Pensions to PensionBee

This is probably the most common reason that people sign up to PensionBee – to get all of their existing pensions into one place.

The reason people want to do this is mainly because it makes them much more manageable – you are much less likely to lose track of a pension if they are all grouped together. Plus, you might be paying fees to a number of different providers, so it makes much more sense to just pay one fee to one provider.

If you have moved jobs a few times, it’s likely that you will have a few different pensions – if your employer makes pension contributions on your behalf, they will have their own providers, so it’s like you have a few scattered about. All you will need to provide PensionBee with is the name of these various pensions and they will do all the leg work from there.

I have experienced trying to move pensions, and it is an arduous task. It can take weeks or even months to get it all sorted, so it is really great to be able to leave all of this to the experts. They will even give you updates on the PensionBee app to let you know how they are getting on.

It doesn’t matter how many different pensions you have, they don’t charge you to do this work for you – you’ll just pay the set fee for the pension.

There are a couple of types of pension that you can’t transfer to PensionBee –

A current workplace pension: If your employers are still paying into one of your pensions, it cannot be transferred over to your PensionBee portfolio – this is just so it stays available for your employer to keep paying to! You may be able to speak to your employer to see if they would be willing to pay into a PensionBee pension instead, but to be honest, this is quite a lot of hassle.

Large pensions: If you have over £30,000 in your pension you will be required to seek advice from a regulated financial advisor – this is a rule that has been introduced to ensure that people are fully aware of the benefits and costs of moving such a large amount of money. Once you have done this, you will be able to move it to PensionBee, if you still want to.

Public service pensions: If you have worked as a teacher, in the NHS, police, fire service, civil service etc, the government won’t allow you to move your pension. These often have additional benefits so make sense to leave them where they are anyway.

Setting up a new pension with PensionBee

If you don’t have any other private pensions to transfer over, you can set up a brand new one with PensionBee. All you have to do is sign up on the website and you can select your plan. You don’t need to start paying a fee until you have a pension to manage, so if you decide it is not for you after you have signed up, it won’t cost you a penny.

*Capital at risk

The Different Pension Plans With PensionBee

There are plenty of different options when it comes to what sort of pension you want to put your money into, but even though there is plenty of choice, it is still very simple to understand what each of them does and what you can expect. You also get the chance to change your plan whenever you like, so if you are not happy with how it is performing, you can switch it around.

The main choice is what sort of risk you would like – low, medium or high risk.

Pensions are investments, ultimately, and so there is always an element of risk – the money that you put into your pension could go up or down. Low risk pensions are less likely to go down, but probably won’t increase massively, whereas high risk pensions are more likely to go down, but have the potential to go up much higher. Pretty self explanatory.

Generally, the level of risk that you are willing to undertake is dictated by your age. If you are younger, you are more likely to accept a higher level of risk in the hope of bigger increases, but as you approach retirement range, you will want to protect your pension with a lower risk option.

Let’s take a look at the different options:

Lower-Risk Pensions on PensionBee

Preserve

This pension plan will make short-term investments into companies that are deemed as creditworthy. The returns on this will be modest, but these types of companies are less likely to experience sharp drops in value, and the fact that the investments are short-term means that your money can be moved around frequently to minimise risk.

Medium-Risk Pensions on PensionBee

Tracker

The Tracker plan will be dictated by financial markets all around the world. This is a good option for people that want to set up their pension and not worry about it again – the return will be dictated by the global economy.

Tailored

If the idea of keeping track of this as you get older seems a bit too much for you, then PensionBee have you sorted there with the Tailored plan. Rather than tracking the global economy, this will track your life – you’ll start off investing in riskier options, but as you get older, the risk will reduce.

This is a great option for people that want to take a little bit more risk, but don’t want the responsibility of managing their pension throughout their working life.

4Plus

The goal of the 4Plus pension plan is to achieve long-term growth of 4% a year above the cash rate. This requires a hands on approach from PensionBee, but nothing else from you. It’s a good option for people that will want to access their pension in the medium-term.

Higher-Risk Pensions on PensionBee

Fossil Fuel Free

If you are passionate about where your money goes, you can opt for the Fossil Fuel Free pension plan, which will avoid investing in companies in the fossil fuel or tobacco sectors. This is the socially responsible option, but does come with a slightly larger risk as you are excluding some of the most profitable companies in the world – an unfortunate fact of life.

Shariah Plan

On a similar note, if you would prefer to invest in companies that are Shariah-compliant, this is the plan for you. Again, as you are limiting the companies that you can invest in, there is a slightly elevated risk, but for many people it will be important to have their money invested in companies according to their faith.

Impact

A step further than the Fossil Fuel Free plan is the Impact Plan. This is where your money will exclusively be invested in companies that are addressing the social and environmental needs of the world.

Pre-Annuity Plan

This plan attempts to recreate the impact of purchasing an annuity (an investment that you might consider with your pension pot when you retire). This plan relies on the stock market, which will give you the possibility of increasing in value, but there is also the chance that it could decrease.

There is something for everyone here, including those that just want to set up a pension and forget it. So have a look through the options and see which one takes your fancy – and remember that you can change your plan at any time.

How much does PensionBee cost?

One of the things that often puts people off even thinking about pensions is that it can be really difficult to work out exactly how much you will be paying people to look after your money. There can be so many different fees involved that it becomes a struggle to work out whether it’s worth it.

That’s not the case with PensionBee – there is no fee for setting up a new pension, or transferring an existing one across. There are no sign up fees, or anything like that. All you have to pay is one annual fee.

Each plan has a different fee, but the range is from 0.5% to 0.95%. The current national average is over 1%, so you can see that PensionBee are one of the cheaper pension providers around. And, if you are lucky enough to have a pension of over £100,000, they will even halve your fee for you.

As an added bonus, if you ever aren’t fully satisfied with PensionBee, or if you think you can get a better service elsewhere, then you can leave any time you want without any cancellation fee.

*Capital at risk

Do you still get the Government bonus when you have a pension with PensionBee?

If you weren’t already aware, the government has a policy which is designed to encourage people to save money for their pension. Basically this means that they will give you a 25% bonus for everything you contribute to your pension.

This is huge, as I’m sure you are aware. The reason they do this, though, is because you have already paid tax on your earnings, and a pension is supposed to be a tax-free payment. So the 25% is basically them repaying the tax that you have already paid on that money. Still, 25% is not to be sniffed at.

So to answer the question – yes, you will still get this handsome bonus when you have a pension with PensionBee, and they will sort out everything for you – as soon as you have set up your pension, you won’t need to worry about the government top ups.

Quick note – if you pay the highest bands of tax at 40% or 45%, you can claim this amount back too, but you will have to do it via a Self Assessment Tax Return.

Is PensionBee good for people Who are self-employed?

As a self-employed worker myself, I know how easy it is to forget about pensions. When you first start out by yourself, a pension is the last thing on your mind – you are just trying to earn enough money to survive, and when you have done that, you need to work out how to grow your business. So, inevitably, a pension keeps getting pushed down your list of priorities.

That’s why a service like PensionBee is so important – it takes away all the hassle from pensions, and makes things as simple as possible.

You can bring together any pensions from any previous jobs you have had, and you can make contributions whenever you want. I know as well as anyone that your income can fluctuate drastically when you are self-employed, and you may not be able to commit to paying a certain amount every month. With PensionBee, you can top up your pension whenever you want – with the 25% bonus on top.

My advice – if you are self-employed and have not yet set up a pension, do it today. Sign up to PensionBee now and get the ball rolling. Just having the app on your phone will remind you to top it up, which you can do quickly and easily whenever you need to. Stop putting it off. (Like I did for far too long!)

How do I get my money when I retire?

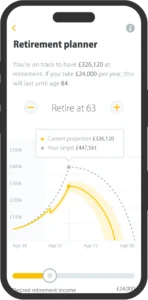

Let’s fast-forward to when you retire – how do you get your money? Well, you can start withdrawing your money from PensionBee when you turn 55 – although this is moving up to 57 from 2028.

I would guess, though, that it is highly unlikely that you will be fortunate enough to retire at that age, so it is probably best if you leave it in there, hopefully growing bigger and bigger, until you retire and really need it. When this happens, you have the choice between two options:

Drawdown – this means that you will withdraw money from your pension pot whenever you need it – sort of like a regular bank account. You can withdraw up to 25% of the total completely tax free at any time. This way, you can leave most of the money in the plan, steadily earning a little bit more as you go.

Annuity – the other option is to take an annuity, which will guarantee you a set income for the rest of your life. This will be a fixed rate offered to you, and it will normally last until you die, no matter how far away that is. PensionBee use Legal & General to provide annuities, and they can sort this all out for you if you choose to go down this road.

PensionBee User Experience

I have to say that as a customer of PensionBee, I don’t have many negative things to say about my experience at all.

The setup was more straightforward than I imagined it could be (the hardest part was locating my National Insurance number!), and whenever I have needed to find something out or ask a question, I have found the (human!) customer service to be friendly and very helpful. Although, I haven’t needed them very often at all, because everything has been so straightforward!

I have also found the dashboard to be really easy to follow and understand. Everything is laid out clearly, so I can see exactly what is happening to my money, and just the fact that I have an app at all is a constant reminder that I should be topping up my pension whenever I can – this little nudge is exactly what I need, as a pension is easy to forget about in your day to day life.

Reassuringly, I also know that my money is protected by the Financial Services Compensation Scheme (FSCS). This means that if something awful happened to PensionBee I could claim all of my pension back. Obviously the value of my pension can go up and down, but that is the case with any pension provider.

One thing I have noticed is that you can’t get any direct financial advice from them, like you might be able to with some other providers. But that isn’t a huge problem as there are plenty of financial advisors out there if you need extra help.

PensionBee Verdict

As you have probably already gathered – I am a huge fan of PensionBee.

They take something that can seem intimidatingly complicated, and they simplify it for you. Anything that makes pension planning more accessible is great in my view, but this also happens to be one the cheapest services around, which when coupled with the great customer service and the range of choice you get, I’m not sure this can be beaten by anything else in the industry.

If you don’t have a private pension, sign up for PensionBee today and get started. Your future self will be grateful that you did.

*Capital at risk