Anything that helps us budget effectively and routinely has to be a good thing – but with a number of budgeting apps out there and at varying costs, it’s hard to know which one to choose. Michael Barton takes Emma for a spin, in this Emma Budget App review.

I love digital banking. I’m also a passionate budgeter. You could say I’m a bit anal about managing my money. A challenge that most people have with budgeting is that it takes so much effort to track your spending. Which is why I’ve fallen in love with Emma.

There, I’ve said it out loud. Don’t tell my wife!

Let me tell you about Emma. She’s digital. She’s great at helping me manage my money. She keeps me in touch with my finances effortlessly. She’s worth every penny I spend on her. (There is also a free app, though I prefer the Pro version.)

Quick Verdict On Emma, The Budgeting App

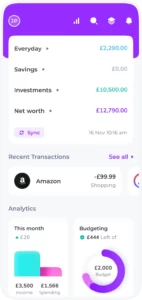

Emma is a powerful app if you want to control your finances and spending more effectively. It will help you identify where you are overspending, give you an overview of your total financial position, and save a heap of time on managing a budget manually.

My preference is Emma Pro at £9.99 per month. As well as saving loads of time on monthly money management, it also includes features that are important to me. However, for many people, Emma Free is likely to be sufficient for their needs.

What Is Emma?

Emma is an app that brings all your bank accounts into one place. That’s a godsend if, like me, you have several accounts including current accounts, savings accounts, credit cards, and an account that I reserve for spending abroad.

The free option will help you track your money, budget more effectively, and control your spending. Building on this, Emma subscriptions offer more features, including cashback deals, bill reminders, customisable spending categories, and more.

What Do You Get with The Emma Free Version?

Emma Free will be powerful enough for many people. It gives real-time information about your income and expenditure. It’s a user-friendly app which makes it easy to see what you need to know at a glance.

The tool uses previous spending and income information to generate a typical monthly budget. If you prefer, you can set your own budget, breaking up spending in up to 15 categories. Emma then notifies you if you are overspending or have money available toward the end of the month (or paycheque to paycheque period).

You can analyse your spending to see where your money is going. This includes by category and even by retailer.

Another useful feature is its subscription monitoring tool. This is great for identifying what subscriptions you have that you aren’t using. According to research published in 2022, we could save around £170 per year if we were to only cancel unused subscriptions. Emma will help you do this – as well as alert you when subscriptions are about to increase.

With paid-for bank accounts, higher interest rates, and overdraft fees, the cost of banking can be a drag on your finances. Guess what – Emma helps you keep on top of this, too. This will help you decide if you should transfer your overdraft elsewhere or even switch accounts to another bank to save money each month.

Bamboozled by all of this? Then access Emma Quests. These teach you how to get the best from your new digital friend in five sections:

- Getting started – setting budgets, using categories, managing subscriptions.

- Become a Ninja – revising budgets, uploading receipts, changing transaction dates, and splitting transactions.

- Master your accounts – checking your net worth, daily balances, bank fees, and more.

- Emma like a pro – rewards.

- Saving money – cashback offers and more.

All of this for free!

Emma Subscription Features

As with all financial apps, when you move from free to subscription versions you will have access to a growing range of features. You’ll be impressed with what you get.

Here’s a table outlining the features available at each subscription level:

Confused? Let’s take a closer look at some of the features that I believe are most useful.

On-Demand Syncs

In Emma Free, your bank accounts will be synced once per day. In all Emma subscriptions, you can sync on demand. In effect, you’ll have access to real-time account data in a single app.

You’ll also benefit from Turbo-updates, allowing you to automatically sync accounts up to four times each day.

Cashback

Earn money as you spend! Providing you use the retailer link via the Emma app, you’ll earn cashback when you spend through many retailers. Like other cashback offers, cashback through Emma will depend upon which products qualify for the reward. You can withdraw the cash from your Emma Wallet when you have accrued £5 or more.

The retailers that Emma has partnered with include:

- Boots

- Currys

- Dorothy Perkins

- Kwik Fit

- And many more

Rent Reporting

If you are a tenant, a good track record of paying rent can boost your credit score. The higher your credit score, the easier you will find it to obtain credit and a mortgage. Emma can report your rental payments to credit referencing agencies.

True Balance

What your bank balance says is rarely what you really have available. It’s dangerous to think you have a few quid remaining before payday, without remembering a subscription that’s due, for example. In your Emma Subscription app, you can choose to see your true balance – what you have available after those forgettable payments are accounted for.

Bill Reminders

One of my favourite features is bill reminders. Turn on the bill reminder feature and each Sunday you’ll get a reminder of all upcoming payments due during the following week. You’ll never miss a payment again.

Interest on Savings

You can create different savings pots in Emma – perfect for saving toward your financial goals. Label the pots for each goal, like the 1p Challenge or saving for Christmas, and see your money grow with interest of up to 3.20% at the time of writing.

Other Features Across All Emma Subscriptions

Whether you subscribe to Plus, Pro, or Ultimate, you’ll also get access to the following features:

- Priority support, meaning any issues will be dealt with faster

- Fraud detection, letting you compare your personal details against known data breaches

- Merchant budgets, allowing you to set limits for your spending with any one merchant/retailer

- Bank transfers, enabling you to transfer balances between bank accounts in Emma

The Advantage of Going Emma Pro

In addition to the features you’ll access on Emma Free plus the features described above that are available on all Emma subscriptions, paying £9.99 per month (or £83.99 per year) will get you Emma Pro. This gives you access to even more features. I think the following are most useful:

Net Wealth Tracking

Add all your accounts to Emma, and you’ll be updated on your net wealth across them all as each individual balance changes. This will help you decide if you need to transfer money between accounts, and helps to keep a tab on your progress toward your financial goals.

Create Offline Accounts

One of my personal bugbears with so many online budgeting tools is that many only include the numbers from online accounts, and accounts they may have access to.

In Emma, the offline account feature allows you to create accounts that aren’t supported by Emma (you’ll be pleased to hear that most UK accounts are). For all accounts like this, I simply manually update once a week in Emma (or if I make a major purchase using an offline account).

Rolling Budgets

The budgeting facility in Emma works from paycheque to paycheque (or monthly, if you wish). In the Free and Plus apps, as soon as the month is done, your budget balance starts again. This could be an advantage to you – any balance remaining at the end of the month is a ‘surprise’ in your bank account.

For me, though, the rolling budget facility works well. Whatever is left over from my budget v actual spending is rolled over at month end. I still try to keep within my budget – that’s what it is for, after all – but it’s nice to know I have a cushion.

Smart Rules

Smart Rules are one way that Emma helps to reduce the workload on managing offline accounts. All you need to do is link payments made to the offline account to update the balance of the offline account. For example, I transfer money from my current account to an offline savings account for my grandchildren (well, one day they may need to take care of me!). By linking that payment to the offline account, my offline account balance is automatically updated.

Transaction Splitting

Here’s a useful tool to help control your budget: transaction splitting. This allows you to split a transaction between different budget categories. A supermarket bill divided between weekly food shopping, and Christmas items (we shop throughout the year to save toward Christmas period partying). Spending on clothes divided between shoes and shirts.

Transaction splitting gives a more accurate appraisal of how you are spending your money and in what specific areas you could reduce spending and save money.

Savings Goals

Saving money is always much easier when you are saving toward specific goals. In Emma, you can create those goals, give each a value, and set a finish date for each. Know you can figure out how much you need to save each day/week/month to reach your goals, and track your progress toward them.

Data Exporting

Remember I said that I’m a bit anal about budgeting? I’m also a spreadsheet freak. Which is why I adore the data export function on the Pro version of Emma. I can export all transactions and balances held by Emma for a date range, and play with the numbers to my heart’s content. Then I can print out and keep the data I need in paper format, too.

Invest Through Emma, Too

If your finances are a little more advanced, Emma also enables you to invest. Link your existing, eligible investment accounts to Emma, and direct your investments through the app.

You can also invest in thousands of global stocks commission free (though you’ll have a foreign exchange fee to pay if buying or selling foreign stocks). You can also deal in fractional shares, investing as little as £1.

Features of the investment piece of the app include tracking watchlists and viewing under a range of different categories.

In your investment account you will see three balances:

- Withdrawable cash that you can transfer to your current account immediately.

- Unsettled cash, which is proceeds from sales before they have settled to be transferred to your withdrawable cash balance,

- Reserved cash, which is cash queued to settle any purchases you have requested before they have been executed.

Your total balance is a sum of all three of the above balances plus any investments held.

How to Get Started with Emma

Getting started with Emma is easy, though you will need to provide some personal details, including your mobile phone number. Once the app is downloaded to your phone (you can do this through the Apple App Store or Google Play Store), create your login details.

Now you can begin to your financial accounts. Search through the app, find your bank/financial account provider, and click on the link. Follow the instruction, and the job’s done.

Is Emma Safe to Use?

Digital banking has made life easier. It’s also given crooks another way to get at your money. Which is why you should always ask about the security of any online financial apps before downloading and creating an account. Here’s how Emma shapes up:

Safeguarding Your Personal Details

Emma uses bank-grade encryption to safeguard your data from abuse or being stolen. If you’re happy to access your Barclays, Lloyds, HSBC, or other financial accounts online, then rest assured that the safety protocols used by Emma are very much the same.

It doesn’t store any banking details, either. This means that even if Emma suffers a cyberattack, your banking details cannot be compromised.

As a company, Emma Technologies Ltd. is an appointed representative of RiskSave Technologies Ltd., which is authorised and regulated by the Financial Conduct Authority (FCA). Emma is also independently registered with the FCA under the Payment Services Regulations 2017 for the provision of payment services.

Safeguarding Your Money

Money that you hold in Emma’s easy access accounts is protected under the Financial Services Compensation Scheme, which protects up to £85,000 on deposit or invested in any single financial entity.

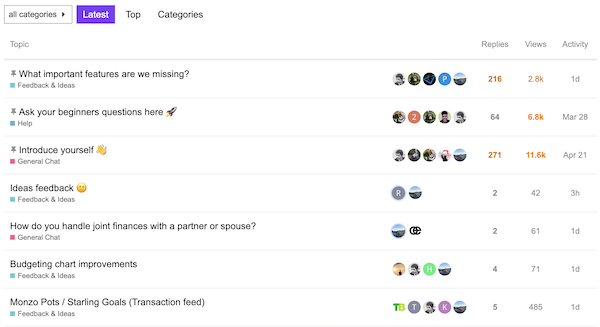

A Community of Users

Another piece of the Emma puzzle that I like is its blog section. This is packed with useful information, from news about Emma to tips on how to recue spending and increase saving, plus articles on mortgages, pensions, and debt.

It also has a community page that allows its more than 1.5 million users to contribute to conversations ranging from new feature suggestions to frequently asked questions.

How Much Does Emma Cost?

Emma has four levels:

- Emma Free – no cost for a hatful of features that would suit many people’s budgeting needs

- Emma Plus – building on the Free features for a monthly cost of £4.99 or £41.99 per year

- Emma Pro – my personal choice at £9.99 per month or a single annual payment of £83.88

- Emma Ultimate – top of the range at £14.99 per month or £124.99 per year

A Word About Emma Ultimate

While I’ve focused this review on the features and benefits of Emma Pro, it wouldn’t be complete without mentioning Emma Ultimate – designed with entrepreneurs in mind.

Ultimate allows you to assign ‘spaces’, separating your personal and business accounts. You can then give access to who needs access. If you have more than one business, or multiple business accounts, you can link them all to Emma to see a seamlessly updated overview – that would be useful for many businesspeople I know.

Alternatives to Emma

Some consider Emma to be a little on the expensive side. There are alternatives that you might wish to test drive:

Money Dashboard

Money Dashboard has many of the same features as Emma. It’s quick and easy to set up, and free features include custom categories and split transactions. While it boasts an uncomplicated design, there is a lack of guidance in the app.

Moneyhub

Security is on a par with Emma. Emma is more user friendly, though overall Moneyhub is easy to navigate. There’s no free option, but the first six months are free. It doesn’t include as comprehensive a list of providers as Emma, so you may not get the financial picture you really need.

Snoop

Snoop is free, but will it give you all you need to manage your money effectively?

This is the beginner’s budgeting tool. However, it lacks some of the tools you’ll find on Emma, Money Dashboard, or Moneyhub. While it’s free, it does sell customer data – so you may find you start receiving unwanted sales calls.

How Does Emma Make Money?

This is a question that you should always ask. Some budget planning tools like Snoop will sell your customer details to marketing companies. Not Emma. It makes money from two sources:

- The subscriptions it charges

- Linking to external sites and receiving a referral fee

Personally, I have no problem with a company earning revenue in either of these ways. If I choose to pay a subscription, I consider that I am getting value for money. The company will only receive a referral fee if I then buy a product or service I have been referred to – in which case I also consider my purchase to represent value for money.

Emma – The Bottom Line

Emma is a great budgeting app. Its extremely friendly user interface is easy to use and understand. I like how its graphs and charts are presented. I also like how you can categorise spending and customise categorisations, as well as transaction splitting to get a more accurate picture of exactly where (and on what) you’re spending money.

Being able to get a real-time view of your full financial position will help you to manage your money more effectively. It has easy-to-understand financial management analysis tools, too.

If you are just starting out with budgeting, the Emma Free will give you a good handle on just how effective using an app like this can be. It’s going to save you time and make you much more aware of the financial choices you are making.

As your budgeting becomes more sophisticated, you’ll want more advanced features – which is why my favourite Emma app is the Pro Subscription. It will save you hours on budgeting and you’ll be fully financially aware in real time.