Looking for an easier solution to managing your investment options for your retirement planning? In this Nutmeg review, our finance expert Michael Barton explains exactly how a robo-advisor could be the solution you need, and whether Nutmeg is a good one.

Would you like to take more control over your investments, but you don’t consider you have the experience to make informed investment choices? It sounds like you need a robo-advisor.

“A robo-what?” you say?

Let’s bust a myth. A robo-advisor isn’t some computer or machine making investment decisions. It’s an automated financial advisor that cuts out an often-expensive middleman when making investment decisions. The assets you invest in are still managed by humans.

One of the UK’s biggest and most popular robo-advisors is Nutmeg. In this Nutmeg review, I examine how Nutmeg works, what it costs, the investment options it offers, and if it’s good for retirement planning.

Quick Verdict

If you are new to investing, or a seasoned investor seeking a hands-off approach, then Nutmeg could be the online solution for you – a user-friendly platform, offering a range of investment options for a range of investment styles.

Backed by security of FSCS protection and the expertise of J.P. Morgan, Nutmeg ensures a safe, efficient investing experience. Focusing on ETFs, whatever your risk profile and financial goal, Nutmeg has a portfolio to suit you – and you can even benefit from more personalised options, too.

Combining convenience, expert management, and robust performance, Nutmeg is an ideal choice if you are seeking a hassle-free path to growing your wealth.

*Capital at risk

What is Nutmeg?

In a nutshell, Nutmeg is a digital investment platform through which you can build up your wealth through investment in a range of funds.

Nutmeg is regulated by the Financial Conduct Authority (FCA). This means the money you hold in your Nutmeg account is safe under the Financial Services Compensation Scheme (FSCS), which protects up to £85,000 held in a single financial company from fraud or the company going into bankruptcy.

Nutmeg was founded in 2012, and now has over 150,000 with more than £4.5 billion invested. It’s owned by J.P.Morgan Chase.

How Does Nutmeg Work?

When you sign up for a Nutmeg account, you’ll give the platform a few personal details. Nothing too in-depth, but it does need to learn a little about you.

You select the type of account you want, choose your investment style, fund your investment, and select an investment style. Then you’re away! Your money is managed by professionals. They choose the assets to hold within the funds aimed at meeting your investment goals, while remaining aligned to your risk profile.

Is Nutmeg Good for Beginner Investors?

Yes! It’s easy to use, and with its choice of investment funds to suit different risk profiles and objectives, you should have access to investments that are ideally suited to you. It takes the strain out of investing, making it a good choice if you’re a beginner, or also if you are savvier but without the time to focus on selecting your own investments.

*Capital at risk

Nutmeg’s Investment Accounts

Nutmeg offers a range of investment accounts:

General Investment Account (GIA)

You can hold a range of investments in a GIA, though you won’t have the tax advantages of an ISA or pension.

Individual Savings Account

Nutmeg offers three different ISAs:

- Stocks and Shares ISA – you can buy a range of investments, and benefit from growth and income free of tax.

- Lifetime ISA (LISA) – like an ‘ordinary’ ISA, but designed for those saving for their first home or for retirement (you cannot open a LISA over the age of 40). It benefits from a 25% bonus from the government to a maximum of £1,000 per year.

- Junior ISA – tax-efficient investment account designed specifically for under-18s.

You can invest a total of £20,000 into ISAs in any single tax year, though investment into a LISA is limited to £4,000 per year.

Personal Pension

A personal pension allows you to benefit from tax relief on your contributions. For example, a basic rate taxpayer will see £100 invested for every £80 contributed. You’ll have greater control over how your money is invested.

Nutmeg’s Investment Options

If you want to select your own assets to invest in, Nutmeg isn’t for you. You can’t invest in single shares, individual bonds, etc.

Instead, you have the choice between a range of up to 10 investment options. These are designed to align with your risk profile, investment goals, and financial situation.

The Nutmeg portfolios are constructed using mostly Exchange Traded Funds (ETFs). An ETF is a highly diversified fund, tracking a stock market index, sector of the economy, or industry. They provide exposure to a range of investment assets, including shares, bonds, and commodities.

The portfolios that Nutmeg’s investment specialist create include:

- Developed Equities – investing in companies listed on the stock exchanges of developed markets

- Emerging Market Equities – investing in shares listed on the stock exchanges of emerging markets

- Government Bonds Developed Markets – investing in bonds issued by governments of developed markets

- Government Bonds Emerging Markets – investing in bonds issued by governments of emerging markets

- Corporate Bonds – investing in investment-grade corporate bonds

- Global Equities – investing in companies listed on stock markets around the world

- Commodities – investing in commodities, such as metals and oils

The ETFs in which each portfolio is invested are managed by a range of investment companies, including VanEck, iShares, Invesco, J.P. Morgan, and UBS.

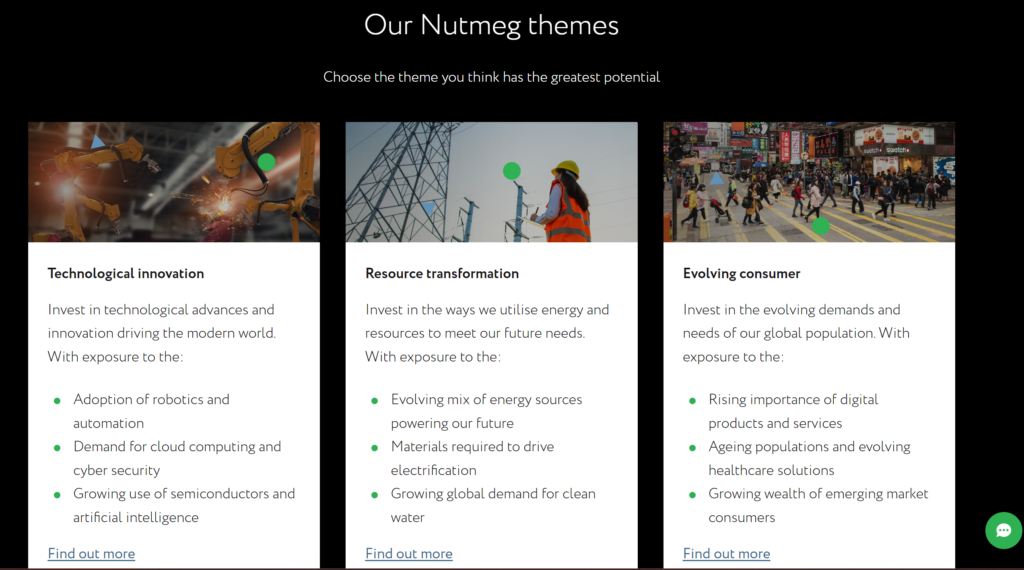

Nutmeg has also recently launched thematic portfolios. Through these you can invest in trends or sectors that Nutmeg believes will shape future economies. Examples include Artificial Intelligence, Healthcare Innovation, and Renewable Energies.

There are four investment styles to choose from:

1. Fixed Allocation

Financial experts select which ETFs to hold in which portfolios, and in what proportions. The robo piece of the puzzle decides what allocations you should have, based upon your personal investment profile.

2. Fully Managed

Nutmeg’s investment team takes a more interactive approach to your portfolio. They review daily news and data, and make investment decisions accordingly. This is a little more expensive than the Fixed Allocation option.

3. Smart Alpha

You might decide to invest in Smart Alpha portfolios, which are managed by J.P. Morgan Asset Management. These are designed to place money in investments that are considered as likely to beat the markets (whereas ETFs are designed to track markets).

4. Socially Responsible

Finally, if you are concerned about the planet and climate change, you might opt for socially responsible investments through Nutmeg (though you’ll find better socially responsible investing options with Moneyfarm or Hargreaves Lansdown, among others).

*Capital at risk

Platform Fees

ETFs are relatively cheap to buy and hold. This means Nutmeg charges similarly low fees. However, there are other fees that will affect you. These include the costs of buying and selling ETFs, and the difference between buy and sell prices (market spread).

Breaking down the fees charged by investment style, I’ve composed this table to make it easy for you to compare costs:

| Fee | Fixed Allocation | Fully Managed | Smart Alpha | Socially Responsible |

| Platform Fee < £100k | 0.45% | 0.75% | 0.75% | 0.75% |

| Platform Fee > £100k | 0.25% | 0.35% | 0.35% | 0.35% |

| Fund Charge | 0.19% | 0.20% | 0.23% | 0.28% |

| Market Spread | 0.07% | 0.07% | 0.07% | 0.07% |

Overall, total charges on the platform range from around 1% to 1.4%. This makes it more expensive than some (for example, Wealthify’s annual management fee of 0.6%, regardless of invested amount), but you do get a lot for your money.

If it’s only a pension you wish to invest in, then PensionBee’s total charge of 0.75% is also attractive (though your final decision should never be made based on charges alone).

Portfolio Performance

Though I understand that past performance isn’t an indication of future performance, I do like to know how funds that I might be investing in have performed. From Nutmeg’s website, I have been able to calculate these approximate returns for the following investment styles.

These returns represent a ‘composite of asset-weighted average returns for Nutmeg portfolio clients, net of all fees’:

| Portfolio | 3 Years | 12 months |

| Fixed Allocation | 23.70% | 7.00% |

| Fully Managed | -2.40% | 2.50% |

| Smart Alpha | 17.75% | 8.00% |

| Socially Responsible | 15.70% | 5.10% |

As is so often the case, it appears that fully managed portfolios underperform (many studies and much research has been conducted into this, and found that around 80% of managed funds underperform their benchmarks).

How Safe is Your Money in Nutmeg?

There’s always a fear of losing your money when investing. That’s why so many people leave investment choice to the professionals. Invested wisely, and given time, your investments should perform as expected – though, of course, investments can go down as well as up.

Investment performance aside, one of the biggest risks we run when we invest is that the company managing our money will go bust, or that our funds will be fraudulently stolen. You’ll have heard the horror stories of people who have placed their trust in a financial advisor or investment company only to find they have no money left in their pension pot.

You’ll be pleased to know that you don’t have these worries with Nutmeg. Your money is protected by the FSCS, which guarantees up to £85,000 against an unexpected event such as bankruptcy or fraud.

Further to this protection, it’s J.P. Morgan who holds your money, in your name – it can only be paid to you.

How Much Do You Need to Open a Nutmeg Account?

The minimum investment you can make through Nutmeg is £500 to open an account, though this is reduced to £100 for its LISA and Junior ISA products. There is no minimum monthly investment required.

This minimum initial amount compares unfavourably with other similar platforms, such as Moneybox, with which the minimum investment is only £1 – though Moneybox does charge a minimum of £1 per month for subscription to its SIPP.

*Capital at risk

Is Nutmeg Easy to Use?

If you access Nutmeg via a computer, you’ll find that it is user friendly. You’ll have access to detailed portfolio information, as well as interactive charts and tools. In fact, there is so much information available, beginners can feel a little overwhelmed.

When you first open an account, you shouldn’t have any problems with the questionnaire. It’s pretty straightforward. You’ll be able to view projections and pension investment illustrations, and I found these easy to dissect and understand. Overall, it’s easy to set up and fund a Nutmeg account.

If you’re using the app, you’ll have a similarly satisfying experience. A few flicks of your finger will lead to all the information you need, including the value of your investments and the makeup of your portfolios.

Investment Education on Nutmeg

When it comes to investment education, I find Nutmeg a little light. Though there are some useful articles published on the site, there isn’t much to really get your teeth into, especially if you want to learn about investing.

However, this reflects the type of investment service that Nutmeg provides – it’s not for DIY investors, so why would you need to know about stock analysis, charts, trading strategies, and so on?

This said, it does include some quite neat calculators – such as ISA projections, a compound interest calculator, and a pension calculator.

7 Tips to Get the Most Out of Nutmeg

How do you get the most out of Nutmeg? Here are my top tips:

Understand Your Financial Goals & Your Investment Style

Define your financial objectives and track your progress. Select the investment style that aligns with your financial objectives and risk profile.

Start with a Realistic Investment Amount

You don’t have to go all-in. Start with an amount that you are comfortable with. Get to know the app, and learn about Nutmeg’s portfolios.

Maximise ISA & Pension Contributions

Take advantage of tax-efficient wrappers like ISAs and pensions in the Nutmeg app. You don’t want to pay more tax than you must, and tax relief boosts your pension savings.

Think Long Term

Investments go up and down. Stay patient, and resist knee-jerk reactions by taking a long-term perspective.

Make Regular Contributions

Setting up regular contributions can help in building your investment over time, and you’ll benefit from pound-cost averaging (buying more when prices are low).

Take Professional Advice

If you need to, seek financial advice to get personalised guidance, especially if you are making larger investments.

Review & Adjust Your Risk Profile as Needed

As your personal circumstances change, so too might your financial objectives and risk profile. To ensure your investments in Nutmeg remain aligned with this, keep your Nutmeg profile up to date.

Alternatives to Nutmeg

Before opening an account with Nutmeg, it’s worth shopping around. Though Nutmeg is popular, it doesn’t necessarily follow that it is right for you. There are many other options available, including:

| Hargreaves Lansdown | Offers access to thousands of investments as well as dedicated investment advice |

| Moneyfarm | Though offering only seven portfolios, it’s a good alternative for those seeking a simple platform with transparent charges |

| Plum | A savings and investment app with many features to help you save and invest more wisely |

| Wealthify | Low minimum investment, but a limited choice of portfolios |

The Bottom Line

If you want a hassle-free, easy-to-use investment app, Nutmeg could be the solution you seek. It’s a good choice for beginners, but also for more seasoned investors who prefer a ‘do-it-for-me’ approach.

Catering for a range of investment styles, you’ll benefit from professionally managed portfolios that focus on ETFs to target diversified investments on achieving your financial goals. Though higher than some alternatives, fees are justified by the value and experience Nutmeg provides.

If you’re starting with a modest sum to invest, or looking for a way to streamline existing pensions into one easily managed fund, Nutmeg is a digital option worth considering.

*Capital at risk