Michael Barton looks to pit Revolut Vs Monzo as he aims to determine which of the two digital banking platforms is best for you based on your needs. Find out all you need to know in this head to head comparison below…

I love banking online. I can remain in control of my finances from my laptop or mobile phone. It’s fast, efficient, and cheap, too.

No more queueing in an understaffed branch at lunchtime. No more cheques (“What’s a cheque?” I hear many ask!). No more listening to annoying music for hours while waiting for ‘help’ desk staff on the phone.

And for one in four people in the UK today, no more reliance on a high-street bank. Including me. For several years, I’ve included digital bank accounts in my financial armoury.

Are you fed up with poor service and high costs of traditional banking? I hear you. Which is why I’ve researched, tested and written this article comparing two of the most popular digital banks available today – Monzo vs Revolut.

The aim is to help you choose which is right for you.

Quick Verdict: Monzo Vs Revolut

If you’re seeking a flexible app to sit alongside your existing current account, then Revolut is better.

Revolut is also the marginal winner if you travel abroad or need to transfer money abroad regularly and has some excellent features for adding a kids card.

Monzo Vs Revolut – Based On Usage

Best For Saving – Monzo shades this. You’ll earn a little more interest, and there are some very cool features that will help you get into the savings habit. It also offers an ISA account, and higher interest rates on fixed-rate term accounts.

Best For Credit – Monzo, because Revolut doesn’t offer credit facilities. The caveat is that interest rates charged for overdrafts, loans, and on longer-term, buy-now-pay-later purchases are not cheap.

Best For Spending Abroad – Revolut, though the margins are small. The multi-currency feature is great.

Best For Rewards & Insurance – Revolut comes out on top here, as there are more rewards available for non-paid accounts than there are from Monzo.

Best For Premium Accounts – Revolut offers greater value for money on its premium accounts, with some very valuable rewards and benefits included.

Monzo & Revolut – Traditional Banking in Digital Bank Setups

Like other digital banks, Monzo and Revolut offer banking services like traditional banks, but everything is online. Because they don’t need to support a branch network, the fees you are charged tend to be lower than high street banks. And the apps you use to run your bank account are highly user friendly.

Though there are some key differences in how Revolut and Monzo are set up, you’ll find that both provide traditional banking services online. These include:

- Depositing, withdrawing, and transferring money

- Current accounts and savings accounts

- Access to financial products

- Credit and loans

- Paying bills and setting up standing orders and direct debits

There are some neat features on top of these traditional banking services that you can access with digital banks.

I particularly like the roundup feature. It’s like taking the change you accumulate in your pocket and putting it in a savings jar at the end of each day. Except it happens automatically every time you use your Monzo or Revolut debit card. You don’t miss those few pence, and they soon add up.

Both Revolut and Monzo offer ways to earn interest on your savings, too. If you bank with Revolut, you can open a savings vault (depending on the plan you have). Monzo links you to a partner bank for interest-bearing accounts.

Monzo & Revolut Accounts

The first question you’ll need to answer when choosing a digital bank is what type of account you need:

Both offer personal and business accounts, though Revolut does not provide a joint personal account facility.

Kids accounts are great for getting children used to managing their money. If you want a kids account, then it depends upon the age of your children which is best for you. Through Revolut, you have access to one free under-18 account (catering for children from 6 to 17 years old).

If you have more than one child, you can access more free kids accounts with a Revolut premium account (more about this later). Monzo provides a similar kids account, but only for children aged 16 and 17.

(Editor Note: I use the free under 18 account for my 11 year old. It’s simple to use, has excellent parental controls such as the ability to enable/disable online payments, easy to manage and gives real time notifications for spending.)

If you wish to deposit cash into your account, then Monzo is for you – though each deposit will cost you £1. Revolut doesn’t accept cash deposits.

Similarly, if you are likely to go into the red, a Monzo account is what you need (Revolut does not allow you to overspend). But be warned, with overdraft fees between 19% and 39% AER, you’ll be paying through the nose. (My advice is – don’t go overdrawn! If you feel you might, there are cheaper credit options available.)

Savings

Saving is an essential piece of good money management, and both Monzo and Revolut make it easy to get into a saving habit. First, there is the roundup facility that both provide. Then there are the automated transfers to make recurring payments into your savings accounts.

Monzo and Revolut separate your savings from your everyday money. Simply set up your savings accounts (in Revolut they are called ‘vaults’; in Monzo they are called ‘pots’).

Monzo has some cool savings features. These include setting ‘savings triggers’ to transfer money automatically. The example they use on their website is ‘Like putting a fiver into a Rainy Day Pot every time it gets hotter than 20 degrees’.

Both offer instant access savings facilities, though there are some crucial differences at the time of writing:

- Monzo’s InstantAccess pot pays 3.40% AER monthly, with no minimum deposit. Its EasyAccess accounts from its partner banks pay up to 3.40% AER, with a minimum deposit of £10. It also offers an EasyAccess ISA, currently paying up to 3.05%.

- Revolut’s savings vaults pay up to 3% AER, with interest paid daily. However, it can take two business days to arrive at your chosen bank and interest is only paid after it has arrived. (My advice here is to choose a bank in which your money will be protected by the FSCS scheme – more on this later)

- If you are prepared to lock your money away without instant access, Monzo’s fixed savings pots pay up to 4.55% AER over a 12-month term.

Are you an investor?

If so, as a Revolut account holder you could trade in the shares of global companies up to 10 times each month with no commission to pay.

Credit

If you want to access credit facilities, go with Monzo. It offers overdrafts, personal loans, and a buy now pay later facility. As a Monzo customer:

- You can apply for an overdraft of up to £2,000 (though beware of the high interest rates)

- You might also be able to arrange a personal loan of up to £25,000

- With a Monzo Flex facility, you can spread the cost of a purchase up to £3,000 over 3 months interest free, or up to 12 months with interest charged at 24% (variable)

Of course, your credit score will be affected when you take credit. If you miss any payments, it could negatively impact your credit score.

Spending Abroad

The choice of Monzo or Revolut for spending abroad is a little less clear, and depends on what your spending is likely to be.

Both offer fee-free cash withdrawal from ATMs, but Revolut charge 2% if you withdraw more than £200 in a single month, while Monzo will charge you 3% if you withdraw more than £250 per month.

If you plan to buy goods and services on your Revolut card, there is no charge if you spend less than £1,000 in a month. Go above this, and you’ll pay a fee of 1% (only 0.5% if you have a premium plan). Monzo account holders won’t be charged, whatever the amount spent on their card abroad.

A further complication to consider is the exchange rate used by Monzo (Mastercard rate) and Revolut (Interbank rate). Research has shown that the Interbank rate is around 0.40% better than the Mastercard rate. This isn’t surprising: the Interbank rate is the ‘spot rate’ (sometimes called the ‘real rate’) and the rate at which banks trade between each other.

Overall, you are likely to be a little better off as a Revolut card user than a Monzo card user if you spend less than around £1,650 in a month. If using your card to withdraw cash, Revolut becomes cheaper from about £300.

Another Revolut feature I really like (perhaps because I spend a reasonable amount of time abroad) is its multi-currency accounts. You can exchange your pounds for euros, at the Interbank rate, and hold them in a Euro account.

This makes it much easier to see at a glance how much money you have while holidaying in Europe or elsewhere (Revolut supports accounts in 29 different currencies).

The conclusion? Revolut is better for spending money abroad, though the margins are small.

Rewards & Insurance

Many banks and cards offer rewards to users for spending. From in-store discounts to cashback and insurance products, the saving you can make by using a Revolut or Monzo card can be substantial. However, Revolut is the winner, and this summary shows you why:

| Reward | Revolut | Monzo |

|---|---|---|

| Cashback (automatic) | Yes | On premium accounts |

| Dining out | Up to 30% cashback at London pubs and restaurants | No |

| Discounts on taxis, grocery shopping, holidays, takeaways, and more | Yes | On premium accounts |

| Discounted airport lounge access | Yes | Yes – on certain premium account |

| Purchase protection | Yes (up to £10k) | Yes – on certain premium account |

| Salary a day early | Yes | No |

| Insurance options | Yes – including travel insurance and pet insurance on certain premium accounts | Yes – including phone insurance and travel insurance on certain premium accounts |

As you can see, Revolut offers more rewards for all accounts, though there are some great rewards available to premium accounts at Monzo, too.

Best Premium Accounts

While free banking is fantastic if you want a no-frills current/savings account facility, premium accounts offer many more features and greater flexibility. Monzo offers two premium accounts, while Revolut offers three.

Monzo Plus

For £5 per month, the Monzo Plus accounts offer benefits that include:

- Budgeting tools

- Credit tracker

- Use of virtual cards

- Payment directly from a pot

If your other bank or credit card companies allow it, you can also add these into your Monzo app to get an overall view of your finances. This also makes it easier to transfer money and keep track of what you are spending your money on. You can have up to five cards in different colours.

You’ll be paid interest on your account balances, and can make fee-free withdrawals of up to £400 abroad.

There is a range of other benefits available with the Monzo Plus account, including discounts at retailers, Babylon Health, RAC, and more.

Monzo Premium

Is this account worth the £15 per month subscription? Here’s what you get, on top of the benefits of Monzo Plus:

- Mobile phone insurance

- Worldwide family travel insurance (worth an average of £141 per year)

- Higher interest rates on current accounts

- Discounted airport lounge access

- £600 fee-free withdrawals abroad

Oh, you also get a metal card and can make five fee-free cash deposits per month.

Revolut Plus

Revolut’s entry-level premium account costs only £2.99 per month. With this account, you can withdraw up to £2,000 each month without charge. You also receive:

- Purchase protection up to £1,000

- Up to two free under-18s accounts

- Higher interest rates on savings vaults

- 3 commission-free stock trades each month

- 3% cashback on applicable holiday accommodation

- Everyday protection including theft and accident cover

You can also personalise your card (for a fee).

Revolut Premium

For £6.99 per month, you receive all that the Revolut Plus plan delivers, and the following:

- 5% cashback on applicable holiday accommodation

- Access to worldwide emergency medical and dental treatment and holiday insurance

- Unlimited domestic transfers, and 20% off fees on every international transfer you make

- Up to £400 fee-free ATM withdrawal each month

- Full purchase protection up to £2,500

- Another step-up in interest rates for your savings

- 5 commission-free stock trades each month

That’s quite a range of rewards and benefits. Then we move up to Metal.

Revolut Metal

For £12.99 per month, you’ll receive all you do on the Plus and Premium plans, with the following additions:

- Annual interest of up to 3% paid daily with Savings Vaults

- 10 commission-free stock trades each month

- 1% cashback in any currency

- 40% off fees on international transfers

- Withdraw up to £800 from ATMs each month free-free

- Full purchase protection up to £10,000 of a year

- Up to five under-18 accounts

- 10% cashback on applicable holiday accommodation

Best App

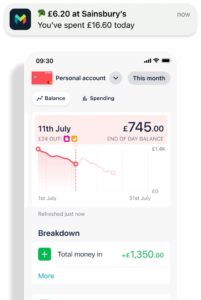

The experience you have with online banking is only as good as the app you use. Both Monzo and Revolut are exceptional. Each platform is designed to make managing your finances easier:

- You receive instant spending and deposit notifications

- Easy-to-use budgeting tools

- Multiple top-up methods (though only in pounds for Monzo)

You can make contactless payments through both apps, including with Apple Pay, Google Pay, and social payments. Both also allow you to ‘split the bill’ – great if you’re going out with friends and wish to share the cost of a meal.

One disappointment common to Revolut and Monzo is the quality of their customer support.

FAQs and live chat are available, but for those occasions when you need a human voice on the end of a phone, you’ll find it’s not always available. (Mind you, isn’t this the same for so many online companies today?)

You can access your Revolut and Monzo accounts on a desktop, laptop, or mobile device.

Overall, I can’t separate the quality and accessibility of the two apps. Both are equally user friendly and offer the features you’d want to see in a financial banking app.

Best Financial Protection

While Monzo is a UK registered bank, here’s how opening an account with Revolut may make you jittery.

Though it’s regulated by the FCA, Revolut does not have a UK banking license. This means that money held in Revolut is not – at least technically – covered by the FSCS (Financial Services Compensation Scheme). This scheme guarantees your account balances to a maximum of £85,000 should the financial firm fail.

However, Revolut does keep your money in regulated banks that are covered by the FSCS until you access it.

What Customers Say About Revolut & Monzo

I always think it’s good to read reviews of what others think before committing to any good or service. When it comes to my money, this certainly includes digital banking apps.

A quick look at Trustpilot shows that both Monzo and Revolut have the same 4.3/5-star rating.

Here are a few headlines of comments left by users:

Monzo

- ‘Great app, could be even greater’

- ‘Best digital bank in the UK’

- ‘I love how easy and straightforward it is to access services’

- ‘Keeps me up to date on finances’

- ‘Best banking app and experience’

- ‘Really easy to use and great benefits’

Revolut

- ‘Revolut make looking after my money so easy’

- ‘I love Revolut’

- ‘It’s a great product’

- ‘Revolut is the future of personal finance’

- ‘Revolut is great’

- ‘Good value for exchange rates’

Why You Should Go Digital with Your Banking

Aren’t you banking online yet? Aren’t you using a banking app like Monzo or Revolut?

When my high street bank allowed me to do my banking online, it transformed how I banked. Overnight, I could make payments and transfer money from anywhere with an internet connection and at any time of the day or night. That saves me time and removes a huge chunk of stress caused by queuing.

Digital banking apps like Monzo and Revolut have taken this to the next level. You can see your financial position in a few clicks of a mouse or taps of a finger, and access benefits beyond banking, too:

- It’s easy to monitor your spending, and adjust your budget

- Saving has never been easier, either – whether it’s for a rainy day or a holiday, the saving options available through digital banking apps will drive up your saving ability and results by several notches

- Take advantage of a range of rewards, saving both money and time

If you’re worried about security, you don’t need to be. You can add multifactor authentication or allow access to your banking app only with your fingerprint (known as biometric login).

Overall, convenient and safe control of your cash.

My Final Thoughts

If you want to take greater control of your finances, and do so from anywhere and anytime, Monzo and Revolut are both great options. Both offer some terrific rewards and benefits, and are easy to use.

If your main goal is to have a banking app with lots of financial management features, that’s great for saving and general everyday banking, then Monzo is probably the best app for you.

If you want a digital banking app that’s a little more flexible, especially when travelling abroad, you should, perhaps, opt for Revolut.

Whatever you decide, I’ve got a feeling that you’ll be pleased with your choice. Including when creating your account – it only takes a few minutes to do so, and you’re away!