Considering using a trading platform? Here are the key differences for Moneyfarm Vs Hargreaves Lansdown – two of the most popular investment platforms in the UK.

Are you looking for a way to invest? There are many platforms you could use to invest your money in stocks and shares, funds, commodities, and more.

Two of the most popular are Moneyfarm and Hargreaves Lansdown. In this article, I compare the two to help you decide which is the best for your unique circumstances.

You’ll find all you need to know here from how each works through to how their apps measure up.

Quick Verdict

Both Moneyfarm and Hargreaves Lansdown have some big plusses and some small downsides.

If you are an experienced investor, you might opt for Hargreaves Lansdown’s wider choice of investment instruments and DIY functionality (as well as personalised financial advice options).

On the other hand, as a beginner, Moneyfarm’s ease-of-use and done-for-you portfolio range will be attractive.

*Capital at risk

*Capital at risk

How Moneyfarm and HL Work

When we consider how these two investment platforms work, you’ll see the first key difference between them:

Moneyfarm

Moneyfarm is a robo-advisor. The advice you receive is based upon a questionnaire you’ll be asked to complete, using an algorithmic approach to investing. This simply means that its computer programs match your investment and attitude-to-risk risk profile to the funds it offers.

These funds aren’t run by robots, though. There’s a team of investment experts making dealing decisions for each portfolio.

Moneyfarm has around 90,000 investors with a total of around £2 billion invested.

Hargreaves Lansdown

Hargreaves Lansdown provides access to thousands of funds, and other investment securities. You’ll have access to personal financial advice from a human advisor (though there is a fee for this).

The Hargreaves Lansdown investment platform is the largest in the UK for private clients. The company’s goal is to become your trusted partner and your go-to resource for financial advice.

Hargreaves Lansdown boasts 1.6 million private investors on its platform with more than £135 billion invested.

*Capital at risk

Product & Service Offerings

Moneyfarm is much more limited in its products and services than Hargreaves Lansdown. This doesn’t mean it’s a bad choice – it simply has a different target market.

As we’ve just mentioned, Hargreaves Lansdown’s goal is to become your trusted partner for financial advice – and this is reflected in the depth of its products and services.

Moneyfarm’s Investment Options

There are several investment vehicles you can choose to utilise as a Moneyfarm client:

General Investment Account (GIA)

This lets you invest unlimited amounts at any time, and withdraw when you wish, too. You can hold multiple portfolios within a GIA, combining risk levels to match your risk profile. Each portfolio is actively managed to maintain its specific risk balance.

Stocks & Shares ISA

You can invest up to £20,000 in a stocks and shares ISA each tax year. Inside an ISA, your funds won’t incur capital gains tax, and income will be tax free, too.

You’ll need to invest at least £500, and this will be invested in a globally diversified portfolio designed to match your risk profile and investment goals. This portfolio is managed by Moneyfarm’s investment team.

Self-Invested Personal Pension (SIPP)

When investing for your retirement, a SIPP provides a tax-efficient investment vehicle. You’ll receive a 25% bonus on your contributions (thanks to the government’s tax treatment of SIPPs). If you pay income tax at a higher rate, you can claim the tax back through self-assessment.

In addition to the above, Moneyfarm also offers investment advice from investment consultants, or digital investment advice. The aim is to ensure your investments are updated to your evolving attitude and tolerance to risk, as well as designed to achieve your financial objective.

It’s worth noting that the advice you receive covers your existing investments, and considers quality, cost, and performance.

*Capital at risk

Hargreaves Lansdown’s Investment Options

Like Moneyfarm, Hargreaves Lansdown offers:

- A General Investment Account (which it calls the Fund and Share Account)

- A Stocks and Shares ISA (though you can invest from only £100 or £25 per month)

- A SIPP

However, you’ll have a wider range of funds to select from – more about these shortly.

In addition to the GIA, ISA, and SIPP options, you’ll also have access to:

Lifetime ISA

Designed for 18- to 39-year-olds (though you can continue to pay in until you are 50), a Lifetime ISA pays a bonus of 25% up to a maximum of £1,000 per tax year – pay in £4,000, and you have £5,000 working for you.

It’s a great ISA, though you’ll be penalised if you don’t use it towards buying your first home or you reach 60.

Junior ISA

Save for your children in a tax-efficient Junior ISA. You can deposit up to £9,000 per tax year in this type of ISA, with minimum contributions the same as for the Hargreaves Lansdown ISA. Your child can access the funds when they reach 18.

Active Savings Accounts

These are ideal if you have cash savings that you don’t wish to invest for the longer term. They remove the hassle of finding the best savings interest rates and switching savings accounts. You can move your money with a click of your mouse, without the worry of filling in endless, and often confusing, switching and application forms.

Financial Advice

After speaking with a help-desk consultant, you’ll be matched with an advisor specialised in your specific financial needs. While there is an additional fee for this service, it does provide cradle-to-grave help with achieving your financial goals today and in retirement.

Pension Drawdown

You can access your pension from age 55 (rising to 57 in 2028), and receive 25% of your pension fund as tax-free cash. After this, the rest can remain invested, withdrawing only when you need.

You’ll have greater control over your pension funds, though the value of your investment can go down as well as up.

Annuity Comparison Service

This service enables you to compare annuity rates and payments easily. You might then decide to buy an annuity, which pays a known income to you through to death. This removes the stress of holding your pension in a fund that can fall in value as well as grow.

However, once you have bought an annuity, your money is locked away. You won’t be able to change to another annuity, and your partner or children won’t be able to access the funds after your death (unless you purchase an annuity with specific terms that allow your spouse to receive an income through to their death).

*Capital at risk

Portfolios And Funds

When you invest in a GIA, ISA, SIPP, or otherwise, you’ll invest into funds, managed portfolios, or other securities within them. There is a big difference between Moneyfarm and Hargreaves Lansdown here.

Moneyfarm’s Portfolios

Moneyfarm offers seven actively managed portfolios, with each investing in hand-picked Exchange Traded Funds (ETFs).

These portfolios are managed by an investment team who decide which ETFs to invest in and what rebalancing needs to be done to keep each portfolio aligned with its objectives. The lower-risk funds mostly invest in securities like government bonds and fixed-income assets. They will also hold a higher proportion of cash.

The robo part of the Moneyfarm platform will allot your investment to one or more of these portfolios according to your investment profile.

Hargreaves Lansdown’s Global Investment Assets

Hargreaves Lansdown offers many more assets for investment than Moneyfarm.

You’ll be able to invest in thousands of funds, as well as individual UK and global shares. You’ll also have access to ETFs, investment trusts, corporate and government bonds, and more.

If you prefer ready-made portfolios, Hargreaves Lansdown offers five ‘Master Portfolios’. These are invested in a range of investment assets and designed to meet the full range of investment profiles (according to aims and risk appetite). These portfolio options include:

- Conservative

- Medium Risk

- Adventurous

- Investing for Income

- Investing for Children

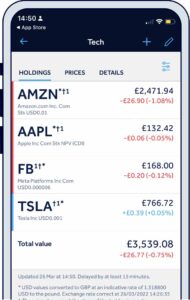

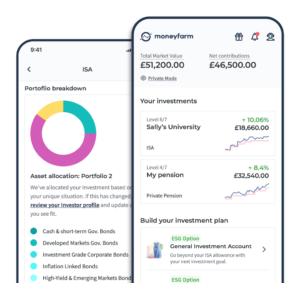

App Vs App

Both Moneyfarm and Hargreaves Lansdown have apps for you to use while on the go. Both are easy to use, intuitive, and provide a range of features you’d want to see in an investment app.

Overall, you’ll find that the Moneyfarm app is easier to use – but this may be because its functionality is more basic.

On the other hand, Hargreaves Lansdown’s app provides a more comprehensive platform for more seasoned investors.

Moneyfarm’s App

Ideal for beginners and occasional investors. You can even get it to suggest a portfolio based upon your existing investor experience and knowledge.

You’ll have access to a pension calculator, and the news and views of its own fund managers.

Hargreaves Lansdown App

Allows you to do everything you’d expect from beginner to veteran investor.

It allows you to trade, view, and manage your portfolio, as well as access the latest news and up-to-date research. You can set up alerts to tell you when a stock hits a certain price.

Comparing Fees

Both Moneyfarm and Hargreaves Lansdown operate a tiered fee structure – the more you have invested, the lower the charges are.

How much you are charged also depends upon the type of investment you have with each platform. The best way to compare charges is in a table, as below:

| Moneyfarm | Hargreaves Lansdown | |

|---|---|---|

| Platform Fees | No platform fees | <£250k: 0.45% £250k – £1m: 0.25% £1m – £2m: 0.10% >£2m: 0% ISA: 0.45% (capped at £45) SIPP: 0.45% (capped at £200) |

| Fund Fees | 0.20% + 0.09% spread on price | 0.04% to 1.44% |

| Portfolio Management Fees | <£10k: 0.75% £10k – £20k: 0.70% £20k – £50k: 0.65% £50k – £100k: 0.60% £100k – £250k: 0.45% £250k – £500k: 0.40% >£500k: 0.35% | 0.92% to 0.99% Including fund fees |

| Fixed Allocation Management Fees | £500 – £100k: 0.45% £100k – £250k: 0.35% £250k – £500k: 0.30% £500k+: 0.25% | N/A |

| ESG Fund fees | 0.21% + 0.09% spread on price | 0.04% to 1.44% |

| Share Dealing | N/A | Fees are based upon the number of trades you execute each month, and range from £11.95 per trade down to £5.95 per trade. |

| Financial Advice | N/A | A mix of fee and commission-based charges apply: Investment advice starts at 1% of investment and reduces to 0% over £1m. Financial Planning advice starts at 2% and reduces to 0% over £1m. You can also receive advice over the phone or in-person, with minimum charges of £495 and £1,495 respectively. |

As you can see, the fees charged by Hargreaves Lansdown are, on the whole, higher than those charged by Moneyfarm.

However, a clean comparison is challenging because the services are different. However, the closest comparison we can make is between the average charges for each platform’s actively managed portfolios/funds: Moneyfarm is 0.28% and Hargreaves Lansdown is between 0.92% and 0.99%.

This said, you can select your own funds when investing through Hargreaves Lansdown, which means you could invest entirely in lower-cost funds, such as ETFs. Do this, and you could pay less in charges through Hargreaves Lansdown than you do through Moneyfarm.

Overall, it’s a complex calculation, and one that depends upon your unique, individual circumstances.

*Capital at risk

Minimum Investment

By now, you’ll probably have the impression that the Moneyfarm investment platform is better for beginners, while the Hargreaves Lansdown platform is best for more experienced and sophisticated investors.

This might lead you to think that the minimum investment amount is lower with Moneyfarm. You’d be wrong, though.

You must invest a minimum of £500 with Moneyfarm, while you can get started with only £1 at Hargreaves Lansdown – though there is a £100 minimum for lump sum investments into ISAs and SIPPs.

Which Is Best For Beginners?

Invest through Moneyfarm, and all the heavy lifting is done for you. The portfolio in which you invest is based upon your investment goals and risk profile, which is assessed by a questionnaire.

You don’t need to select individual funds to hold in your portfolio. If you’re just starting out, this all makes it very easy to start investing toward your financial goals.

What about Hargreaves Lansdown? That low minimum investment amount is appealing if you’re a beginner, and the actively managed funds they allow you to invest in, coupled with personalised investment advice, will help, too.

Complemented with a good offering of educational resources and guides, Hargreaves Lansdown can also be an attractive proposition if you are a beginner.

Is Your Money Safe?

Both Moneyfarm and Hargreaves Lansdown are regulated by the Financial Conduct Authority (FCA).

This means they must abide by a strict set of rules and guidelines in all aspects of their business.

You also benefit from protection under the Financial Services Compensation Scheme (FSCS), meaning that up to £85,000 of your money with either company is fully protected against events such as bankruptcy of the company.

Of course, this doesn’t mean that losses due to adverse market movements are protected.

How To Get Started

Signing up with Moneyfarm is easy. You’ll need to visit their website and:

- Enter your email address, create a password, and provide your mobile phone number.

- Next create a portfolio (for example, in a GIA).

- You’ll be asked a few questions – such as your investment amount, timeframe, and risk.

- The system will then provide an example of potential investment returns for the portfolio, and historic performance.

- When you’re happy with the portfolio, save it.

- Now create your investor profile by answering a few questions/statements about your attitude to risk, your investment experience, value of your assets, income, and some personal details like age and employment status.

- Finally, you’ll need to agree to some terms and conditions.

- Now your previous sample portfolio will be deleted, and you’ll have the opportunity to create a new one.

- Now, start investing after you have deposited money to invest.

Opening an account with Hargreaves Lansdown also only takes a few minutes. You’ll need to visit the Hargreaves Lansdown website, select the type of account you wish to open, provide a few personal details, and fund your account.

Once you’ve done this, you can make your first investment.

Weighing Up The Pros And Cons

It’s a lot to take in, isn’t it? To help you in your decision-making journey, here’s a summary of the pros and cons of each platform:

Moneyfarm

Easy to open, and with a friendly user-interface, Moneyfarm takes all the decision-making worries away from you. Simply answer a few questions and invest in a pre-selected portfolio that is actively managed by Moneyfarm’s investment team.

You’ll find a range of educational materials on the website. These will help to guide you through the investment process.

In terms of charges, Moneyfarm’s are generally cheaper than those levied by Hargreaves Lansdown, though not always ─ and it depends on which funds you choose should you invest through Hargreaves Lansdown.

On the downside, while all the decision-making is taken away from you, you have far fewer options as to how to invest your money. You cannot invest directly in managed funds, and neither can you invest in stocks and shares or other investment instruments.

There’s also that minimum investment of £500 needed – you may wish to start smaller than this to dip your toe in the water first.

*Capital at risk

Hargreaves Lansdown

With Hargreaves Lansdown, you have a wide choice of how to invest your money (ISAs, SIPPs, and so on) as well as a huge range of funds and other investment instruments. These include stocks and shares, bonds, and ETFs.

You also have the flexibility of receiving investment advice, investing in managed funds and ready-made portfolios, or a complete DIY approach.

The education resource available on the Hargreaves platform is second to none, which helps to make this more sophisticated investment platform a good choice for beginners as well as more experienced investors.

We also like the Active Savings service, which is a great way to park your money and keep your emergency fund earning the best interest rates without the hassle. By making an investment possible from as little as £1, should you make an error out of the blocks, it’s not going to be a costly lesson.

Now for the negatives.

Trading charges to buy and sell stocks and shares are not the cheapest on the market, and you’ll be charged to use the platform, too.

You’ll need to calculate total charges, because these can also be on the expensive side for some actively managed funds.

*Capital at risk

Tips to Get the Most Out of Moneyfarm and Hargreaves Lansdown

While the choice of which platform is best for you is yours to make, and will depend upon your unique circumstances, there are a few general tips we’d like to share with you to help you use both platforms most effectively.

Understand The Fees

Know what management fees will be levied on your investment, as well as the transaction charges and, if applicable, any exit fees on individual funds. Every penny of costs will affect your net return.

Diversify

If you’re investing via Moneyfarm, diversification is done automatically, as it is in Hargreaves Lansdown’s Master Portfolios.

However, if you are DIY investing, then you should always diversify your investments – this may be by including a range of investment instruments (ETFs, stocks and shares, and bonds as examples), as well as by using different industrial sector funds and funds that invest in different global regions.

Do Your research

Before you invest, take care to know what it is that the fund invests in. Use the tools provided by the platform as well as independent research to make more informed decisions.

Whether you are an experienced investor or beginner, make sure to work your way through the educational resources on the trading platform, too.

These will help you when investing, as well as help you to use the platform efficiently.

Always Invest for Tax Efficiency

Tax can hurt your returns more than fund costs! Use your full ISA allowances before investing via a GIA.

If you are investing for the long term, toward your retirement, always consider if you should be investing in a SIPP. Your money will be tied up, but you’ll gain from the tax benefit.

Know Your Investment Goals & Attitude to Risk

Don’t try to cheat the system. Answer risk assessment questions truthfully, and be sure you know your financial goals before investing.

This will ensure that the investments you make, and those that are made for you, align with your investing personality and objectives.

Monitor Your Investments & Yourself

Check how your investments are faring regularly, but not too regularly. You’ve got better things to do than take time out of each day looking at the performance of your portfolio. A monthly health check on you and your investments will help to avert any nasty surprises.

Life never stands still, and as your life evolves, so will your financial priorities and investment goals. Going through that financial risk questionnaire regularly will help you to make the right financial decisions.

Use the Power of Pound Cost Averaging

Pound cost averaging is a fancy way of saying, “Invest regularly and consistently.” Asset prices go up and down all the time. If you try to time your investments, you’ll never hit the bottom of price cycles to buy, or the top of cycles to sell.

Instead, invest through the ebbs and flows of the financial markets. Over time, you’ll have invested at an average price that reduces the impact of market volatility.

The Bottom Line

Deciding which is the better investment platform is a close call. Not least because the two platforms seem aimed at different target markets.

Overall, I would lean toward Hargreaves Lansdown. However, this is a personal choice. I have a good number of years behind me at the sharp end of financial markets. I would want the advanced features and wider trading functionality of the Hargreaves Lansdown platform.

On the other hand, if I were a beginner, I would probably opt for Moneyfarm. Its easy-to-use interface is a real bonus, and all the work is done for you with the help of the investment questionnaire you complete.

In the final analysis, whatever your investment profile, you are unlikely to go far wrong with either of these investment platforms. There are pros and cons with each, but the pros outweigh the cons in both cases.

*Capital at risk

*Capital at risk