How much must you earn to be in the top 1% of earners in the UK? Can you become a top earner in this elite minority of wealth? Here are the figures and facts you need to keep on rising like bubbles in champagne.

I saw a Tweet a few days ago that said the top CEOs would make the average UK annual salary in just three or four days of January. Today, I’ve seen a clip of the Jeremy Vine show, in which a caller said she needs to cut spending to make ends meet – and she’s earning an annual salary of £100k.

This got me thinking – how do you get to be among the cream at the top of UK earners? Just how much money do you need to earn to be among the top 1%?

30-Second Summary

The top 1% of UK earners is an elite group, with average salaries of £180,984. It’s also a fluid group, with many newcomers each year – and others dropping out.

Can you break into the top 1%?

The answer is yes. With motivation, dedication, good career choices, and by unlocking your entrepreneurial spirit, there is no reason you shouldn’t.

Staying in this elite may be a different matter, though. You’ll need to make savvy financial choices, use effective financial planning, and embed good financial habits in your daily life. Do these things, and you’ll be on the road to making the financial decisions that will propel you not only into the top 1% of earners, but into the top 1% of the country’s wealthy.

This article explains all you need to know to truly understand the elite earners club, how to get there, and how to stay there.

What Does it Mean to Be in the Top 1% of UK Earners?

If you were in the top 1% of the UK’s earners, you’d be in an elite group of around 320,000 people. A group that:

- Earns 14% of taxable income in the UK

- Pays 29% of all income tax in the UK

- Earns an average of £15,082 per month

Have you done the calculation yet? £180,984. More than the Prime Minister’s salary. That’s the average salary of the 320,000 top 1% of earners in the UK.

If you are earning this amount, you might not pass the UK’s median annual salary of £34,963 as fast as the average FTSE 100 CEO (who earns and average of a whopping £3.81 million a year), but, by mid-March, you’ll have already earned as much as the average UK worker.

Go From Top 5% to Top 1%

To be in the top 5% of income earners in the UK, you’ll be earning on average £7,251 per month – £87,012 per year. So to get into the top 1% you’ll need to make a big leap, to more than doubling your earnings.

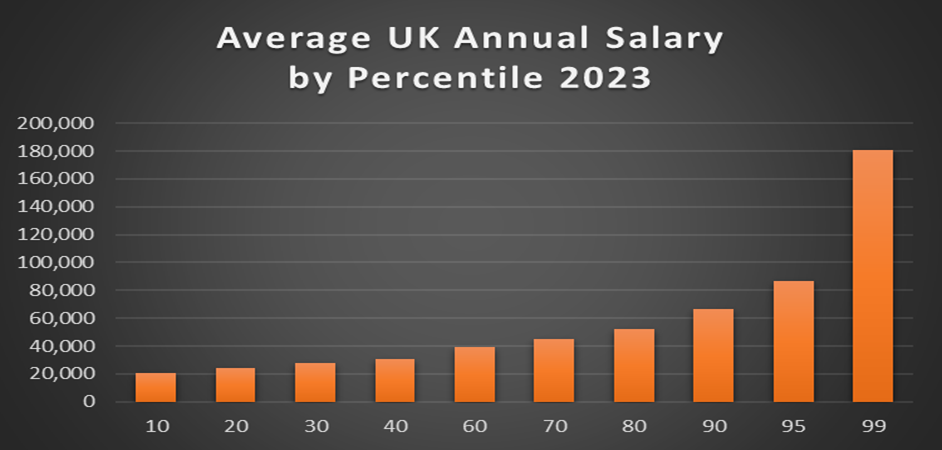

This is a far bigger jump than at any other income level, as the following chart shows:

But, despite more than doubling your gross salary, your take-home pay won’t be more than double. Far from it. The tax man makes sure of this.

How Much is a Top 1% Salary Worth After Tax?

Higher earners pay more in tax because they can afford to pay more. Here’s how gross pay, tax, and take-home pay compare for top 5% and top 1% earners:

| Percentile Earnings | Top 5% | Top 1% |

| Gross Income | £87,012 | £180,984 |

| Taxable Income | £74,442 | £168,414 |

| Income Tax at 20% | £7,540 | £7,540 |

| Income Tax at 40% | £14,696.80 | £34,976 |

| Income Tax at 45% | £0 | £19,473.30 |

| National Insurance | £4,504.84 | £6,384.28 |

| Take Home/Year | £60,270.36 | £112,610 |

| Take Home Pay/Month | £5,022.54 | £9,384.20 |

The bottom line, thanks to the taxman, is that even though you are earning £7,831 per month more, you ‘only’ take home £4,362.66 more. The biggest step-up in income tax is the massive jump from 20% to 40% (currently at earnings of £50,270).

If you are earning £181,000 a year, your tax and national insurance bill will be more than £68,000 – that’s approximately twice the gross average salary in the UK! No wonder the highest earners and wealthiest in the country use innovative tax-avoidance schemes and possess good financial planning habits.

You Don’t Need a Top 1% Salary to Be a Top 1% Earner!

So far, we’ve focused on only salary. However, this isn’t the whole story. Official figures show that income from employment is the most important source of income for the top 1%. However, it only accounts for around 60% of income in this group of high earners.

The truth is that many of the UK’s top 1% of earners do not have such a high salary. Instead, a good portion of their income is made up of partnership and dividend income. These are taxed at lower rates than salaries, and so their net income (their take-home) is higher.

In fact, according to the IFS, more than a quarter of the total income of the top 1% is through dividends and partnerships – and a third of the income of the top 0.1% is derived the same way. Its evidence suggests that one-in-three of the top 1% of earners in the UK is a business owner.

Good financial planning (and owning a business) literally pays dividends!

What Professions Could Propel You into the Top 1%?

Even though so many of the top 1% of earners have diversified income streams, the IFS is clear that those with higher incomes are likely to break into and remain in the top 1%. Now the question becomes, what types of jobs will provide the highest potential of becoming part of the elite?

It’s not too challenging to make a list of highly paid professions. Think of the usual suspects and write them down:

- Finance

- Law

- IT

- Marketing

- Entertainment

- Sales

- Medicine

- Pharmaceuticals

- Sports

- Aviation

What Are the Highest-Paid Jobs in the UK?

Now, working in any one of these industries won’t guarantee that you’ll become a top 1% earner. What you need is to navigate toward the highest-paying roles within those professions.

Our friends at the ONS regularly do the legwork for us all, when they produce the Annual Survey of Hours and Earnings (AHSE). Here is what they found to be the highest-paying jobs in April 2023:

| Job | Average Annual Salary |

| Chief executives and senior officials | £84,131 |

| Marketing, sales, and advertising directors | £83,015 |

| Information technology directors | £80,000 |

| Public relations and communications directors | £79,886 |

| Logistics, warehousing, and transport directors | £72,177 |

| Pilots and air traffic controllers | £71,676 |

| Financial managers and directors | £70,000 |

| Functional managers and directors | £69,933 |

| Specialist medical practitioners | £66,031 |

| Head teachers and principals | £66,014 |

In August 2203, jobsite Indeed published its list of the highest average annual salaries:

| Job | Average Annual Salary |

| Chief Financial Officer | £124,677 |

| VP of Sales | £98,687 |

| Orthodontist | £94,658 |

| Nephrologist | £94,188 |

| Ophthalmologist | £93,072 |

| Paediatrician | £92,864 |

| Plastic Surgeon | £90,531 |

| Dermatologist | £86,734 |

| Tax Director | £86,619 |

| Director of Engineering | £78,368 |

| IT Director | £66,031 |

| Head Teachers and Principals | £77,446 |

| Managing Director | £74,450 |

| Marketing Director | £69,049 |

| Actuary | £64,362 |

| CEO | £61,805 |

| Lawyer | £51,237 |

Which Are the Highest-Paying Companies in the UK?

Let’s turn to data compiled by jobsite Glassdoor. According to its job postings, finance and tech firms make up most of the top 10 highest-paying companies, with average basic salaries that put their employees well within the top 5% of UK salaries. Here is its list:

| Company (Sector) | Average Basic Salary |

| Citadel (Financial Services) | £121,759 |

| Contino (Business Management) | £108,128 |

| White & Case (Law) | £102,115 |

| G-Research (Finance, Research) | £101,066 |

| Google Cloud (Tech) | £99,677 |

| Palantir (Tech) | £98,095 |

| Squarepoint Capital (Financial Services) | £96,933 |

| Bank of America Merril Lynch (Financial Services) | £94,393 |

| MongoDB (Tech) | £93,993 |

| Pegasystems (Tech) | £93,844 |

Have you noticed anything odd, yet?

Yep, that’s right. The highest-paid professions, jobs, and companies don’t pay averages that would put you in the top 1% of earners in the UK. They just give you the best chance of getting there – but you still need to excel in your chosen company, profession, and job to earn the big bucks.

Other Ways to Break into the Top 1%

Apart from making good employment choices, working your way up to the C-Suite, and eventually becoming a CEO of a major company, how else could you boost your income to climb into the top 1%?

There are many ways to earn extra income – including taking a second job, gaining higher education qualifications, earning money from your home, or setting up a side hustle. It’s the last of these three that might unlock an unlimited earnings potential.

If you have an entrepreneurial spirit, starting a business could lead to significant earnings. Sure, there is risk involved; but if you get it right and scale your business effectively, you could soon be the CEO of a thriving company that you built.

Many entrepreneurs start by following their passion, or building on their experience and connections: for example, by offering themselves in a consulting capacity, building up their client list, and then developing into a business consultancy by employing others.

Think creatively. Use your skills and experience. Build something that pays dividends!

Being a Top 1% Earner is Difficult to Maintain

What if you’re a top 1% earner? What does this really mean?

It simply means that you’ve had a stonking year – usually in your job. This might be because of a one-off; a huge bonus, perhaps.

As we all know, jobs come and go. Company finances change. Businesses go bankrupt. Recessions play havoc with earnings.

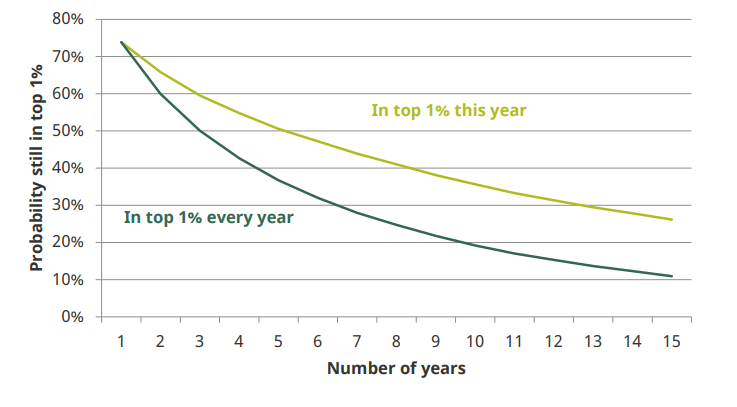

Staying in the top 1% of UK earners is not easy. According to the IFS, the top 1% is a highly fluid group. Of this year’s top 1%, a quarter won’t be in the group next year.

Only half in the top 1% this year will be in the 1% in five years. Between 2000/01 and 2015/16, only 11% remained in the top 1% every year.

This rate of turnover is important. It means that you have a good chance of being in that elite group at some point in your life.

Wealth is Different to Earnings

I’ve talked a lot about earnings, but it’s crucial to understand that earnings are different from wealth. But with effective financial planning, you can build the kind of wealth that will help you to remain in the top 1% of income earners.

You’ll need to budget effectively, save and invest wisely, and get your money to work for you.

Can you push yourself into the top 1% of wealthy individuals in the UK? Do you have what it takes to build this kind of wealth – the £3.6 million that the ONS says would get you there?

“Impossible!” you say?

“Not so,” I say.

When you craft a career or a business that pushes you into the top 1% of earners, make sure you set the financial goals needed to boost your wealth. Careful and clever financial planning, and living a comfortable, non-extravagant life, is key to building real wealth. The sort of wealth that will help you to improve your lifestyle every year and leave a financial legacy of note to your heirs.

If you were earning, say, £100,000, £150,000, or £200,000, could you set aside £50,000 toward your long-term wealth? Do this for 25 years, earning 7% per year, and you’ll have built up a fund of more than £3.6 million.

How To Break into the Top 1% of Earners in the UK: Verdict

Breaking into the elite 1% of UK earners may be a challenge, but it is an achievable goal. To be successful, understand that it is about more than earning a hefty salary. You’ll need to think and act strategically, employing effective financial planning, embedding good financial habits in your daily life, and diversifying income sources.

Many of the UK’s highest earners supplement salaries with partnership and dividend income, which are both taxed more favourably.

In this article, I’ve considered the importance of aiming for high-paying roles, in high-paying companies, in high-paying sectors. However, all that is really stopping you from reaching your earnings potential is you. Set your entrepreneurial spirit free!

As your earnings grow, plan to create life-changing finances. Because breaking into the top 1% isn’t just about earning a high income; it’s also about building sustainable wealth through judicious planning and investment.