We all want to know where the interest rates are going to help us invest, save and borrow better. Through knowledge, experience and expertise, Michael Barton shares his latest Bank of England interest rate predictions.

Whether you’re a borrower, saver, or investor, where interest rates are heading should concern you.

Rising rates can be good news for your savings and bad if you have debt, and vice versa. How fast or slow rates rise and fall also makes a difference to you, as do expectations of interest rate moves.

Yep, when it comes to your finances, the Bank of England wields more power than you might think. It’s not only what it does that moves markets, but also what it says.

In this article, I’ll look at what the market thinks the Bank of England will do with interest rates over the next 12 months, why it matters to you, and what you might consider doing to benefit from the direction of interest rate moves.

TLDR: 30-Second Summary

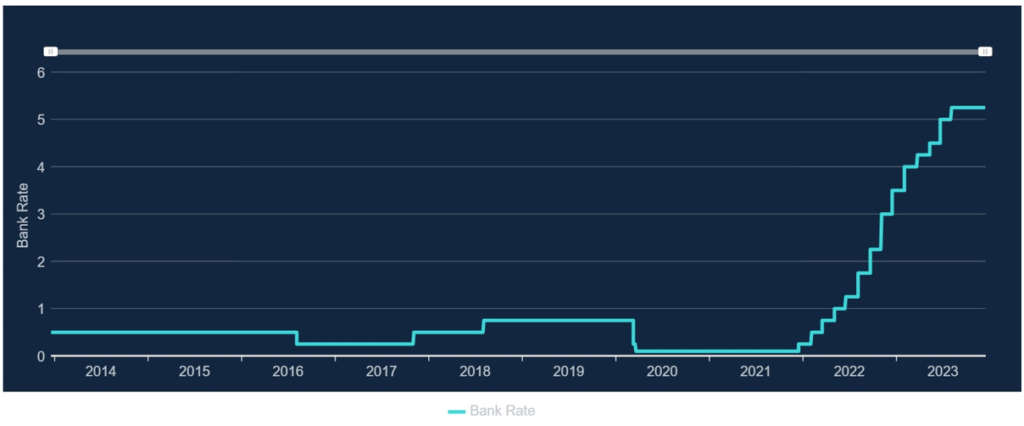

It looks like the almost relentless rise in the Bank of England Base Rate is at an end, and the market now anticipates falling interest rates over the next two years.

If you’re a borrower, prepare yourself for some relief from high repayments. If you’re a saver, get ready for the challenge of getting the best return on your cash savings.

On the other hand, if you are an investor, you’ll need to navigate the complex relationship between interest rates and market dynamics, and pick your investments carefully.

By understanding the factors that affect Base Rate decision making, you’ll be able to get ahead of the curve and make more effective financial planning decisions.

Where Next for Bank of England Interest Rates?

Largely because of the supply chain crisis caused by the pandemic lockdowns, inflation exploded in recent years. It reached a high of over 11% last year, with a symptom being the ensuing cost-of-living crisis. The Bank of England’s (BoE) major weapon against rising prices is to increase its Base Rate.

When the BoE raises the Base Rate, high street banks and other finance houses raise their interest rates to borrowers and savers (though it always seems by more to borrowers and savers, doesn’t it?).

Thankfully, after 14 consecutive interest rate increases between December 2021 and August 2023 – which saw the Base Rate rise from 0.1% to 5.25% – the BoE has kept interest rates steady.

It appears that its aggressive action has done the trick, and inflation (as measured by the Consumer Price Index – CPI) had more than halved to 4.6% in October 2023. December’s inflation report showed that inflation had fallen below 4%.

Because of its impact on the economy, the BoE Base Rate is one of the most widely watched and forecasted of all our economic indicators.

If you’re a borrower, I have good news for you: the market expects the UK’s central bank to cut interest rates in the first half of next year. For example:

- Morgan Stanley believe they will fall to 4.25% by the end of 2024

- Capital Economics expect rates to fall to around 3% by the fourth quarter 2025

If you’re a saver, this isn’t such good news. The interest rate you receive on your savings is likely to fall, and if the history of interest rates to borrowers and savers tells us anything, it’s likely to fall faster than the interest rates charged to borrowers.

How Do Interest Rates Affect the Economy?

To understand how interest rates really affect you, let’s first look at how interest rates affect the economy.

When interest rates rise, the cost of borrowing rises. This makes most people and businesses worse off.

As your mortgage rises, you have less money to spend. You start to cut down – first on those luxury goods you buy, then on the essentials. To help close the gap between your income and outgoings, you seek higher pay rises.

If you think of yourself like a business, you’ll see the parallels:

- Food and energy = Input costs (raw products and energy, among others)

- Mortgage/rent/property taxes = Debt

- Decorating and house repairs = Equipment maintenance

- Discretionary spending = Expenses, factory upgrades, staff parties, bonuses, etc.

- Salary/Income = Sales

When a business’s costs rise – either because of inflation or interest rate rises – profits get squeezed. A company’s ability to spend falls – and the clamour for higher salaries exacerbates this squeeze.

Eventually, a business will seek to reduce its costs – by seeking out cheaper suppliers, using cheaper raw materials, cutting back on equipment maintenance, reducing its discretionary spending… and making staff redundant.

Just like you’ll take time to react to the squeeze on your tighter finances, so do businesses. Hence there is often a lag between increases in interest rates and businesses taking action, and this action leading to a recession.

This is why some economic forecasters are predicting that we will enter a mild recession in 2024, despite expectations that interest rates will fall.

How Do Interest Rates Affect Borrowers?

Do you have a mortgage, personal loan, credit card debt, or other debt? If the answer is yes, then you’re probably feeling the pinch.

As a rough guide (because the actual amount will depend upon how your interest is calculated), each 1% increase in the interest rate charged will cost you an extra £10 per £1,000 of credit per year.

Doesn’t sound a lot, does it? But consider this:

- The average mortgage amount in the UK is around £185,000.

- In December 2023, the average standard variable rate mortgage rate stood at 8.19% – up from 4.40% two years earlier.

- It follows that over the last two years, the average mortgage holder in the UK has seen their mortgage increase by more than £7,000. That’s almost £600 per month. That has got to hurt.

Now, you may hold a fixed rate mortgage. If you do, you may still have been hit hard. The question for you now – irrespective of whether you hold a fixed rate mortgage or variable rate – is if you should fix or refix your mortgage rate now.

Should you fix your mortgage rate?

As the BoE cuts its Base Rate, mortgage rates should fall, too. What seems like a cheap rate today could be seen as expensive in 12 months. So, should you fix your mortgage rate today, even if you have a few months left on your current deal?

Remember when interest rates started rising, and the best fixed-rate mortgages disappeared like a domino topple? When interest rates fall, the fixed rate market will become more competitive, and new, lower-rate mortgages are likely to trickle onto the market.

As a general rule of thumb, it’s better to pay a variable rate as interest rates are falling, and a fixed rate when (preferably before) they are rising. This said, it’s rarely a clear-cut decision.

There are, however, a few questions that will help you make the best choice for you:

- Do you think interest rates will fall further? If you do, then it may be wise to wait it out while keeping a close eye on what the economy is doing, and listening to what the BoE is saying.

- Will fixing/refixing now cost you money? Many fixed-rate deals have early repayment penalties attached to them – you’ll need to consider these before making a move. If you’re on a variable rate mortgage, how much will it cost you to convert to a fixed rate mortgage? Yep, beware the small print and costs!)

- Is the fixed rate deal you’re considering sustainable for you? Is the interest rate on a fixed rate mortgage sustainable – will you be able to afford the monthly payments over the period of the fix?

- Have you taken advice? The difference between mortgages can be huge. Sometimes the lowest-rate mortgage is not the best for you – it could be loaded with hidden costs and penalties that you should avoid. That’s why I would always recommend you seek professional mortgage advice – typically, good advice could save you between £50 and £100 per month per £100k of mortgage.

If you’re on a tracker mortgage, expect to see your mortgage payments come down in 2024 when the BoE does ease the Base Rate – and use the extra cash in your pocket wisely.

Pro Tip: Overpay your mortgage and avoid ‘buyer’s remorse’

Here’s a big tip for you – possibly the most important tip I could give to a mortgage holder. If you can afford to, overpay your mortgage. It’s going to save you a fortune over the term of your mortgage. Here’s an example:

Let’s say you have a £185,000 repayment mortgage, payable over the next 25 years, at an interest rate of 5%. If you overpay by £200 per month, you’ll have repaid your mortgage in full in 18 years and 6 months. This will save you almost £41,000 in interest!

Finally, if you do fix your mortgage rate because it makes sense to do so, walk away! What I mean is, don’t keep a continual eye on the mortgage rate and suffer from ‘buyer’s remorse’ should the interest rate fall further.

You’ve made the decision to fix the rate for all the right reasons. Start reviewing your situation again six months to a year before the fixed rate expires.

Why you should use an independent mortgage broker

You know those annoying TV adverts promoting price comparison sites, with jingles you can’t get out of your head? My advice is to use comparison sites only for a point of reference, because many of the best mortgage deals are only available through mortgage brokers.

This isn’t the only reason not to use price comparison sites when you want a mortgage. It’s only when you make your application that the lender will run a credit check on you. When this happens, it will be marked on your credit report, and could harm future credit applications you make.

If you are seeking your first mortgage or looking to remortgage, do as around 7 in 10 borrowers do – use an independent mortgage broker.

How do Interest Rates Affect Savers?

Savings rates seem to avoid the laws of gravity when interest rates move. They fall faster than the Base Rate when the BoE cuts the Base Rate, and rise more slowly on the way up.

As a saver, the general advice is to act opposite to how you act as a mortgage payer. When rates are expected to fall, you’ll want to lock in the best savings rates if you can. This means moving money between the best regular savings accounts.

You’ll need to consider several factors before doing so, including:

- Your tax position

- Whether you need access to your cash (the best rates are usually paid on fixed-term savings accounts/bonds)

- The safety of your savings

- Your savings goals

Pro Tip: Never miss the best savings interest rates and save effortlessly

I’m adept with knowing how to save money (for example, I use a few simple tactics to save for Christmas).

However, I don’t have time to conduct a thorough search of market interest rates for my savings, and then, having found the best, fill out all those tiresome forms to open or transfer an existing account.

You feel my pain, right?! Which is why I love accounts like that offered by Hargreaves Lansdown – its Active Savings Accounts:

- Eliminate the hassle of interest rate searches

- Enable you to switch accounts at the click of your mouse

- Remove the pain of form filling

If you find saving money a challenge, take the pain out of saving by automating the process using an app like Chip, Plum (which is also great for budgeting), or Moneybox.

How Do Interest Rates Affect Investors?

When it comes to investing, the effect of interest rate moves is a little less clear; though, in general:

- When interest rates fall, stock markets tend to rise

- When interest rates rise, bond prices tend to rise

Let’s look at how the nuances within these two asset classes shape price movements.

Stock prices and interest rates

We’ve already seen that higher inflation and interest rates can damage company profits (and cash flow). This is especially true of sectors such as luxury goods and discretionary products.

If all else is equal, this will lead to a lower stock price. When enough companies’ stock prices fall, so will the general market.

Additionally, as interest rates rise, the risk you take when investing in stocks begins to outweigh the possible reward of holding higher-yielding assets, such as cash savings. Why invest in the stock market if you can get 5%, 6%, or 7% or more in cash?

Okay, so higher interest rates are likely to send the stock market lower. But some companies benefit from higher interest rates. For example, as people tighten their purse strings, shopping habits change – and companies that focus on essentials at value prices often do well.

Finance companies (those who lend money) are often winners, too, because those compassionate bankers raise lending rates faster and higher than they do savings rates. So, they make bigger profits – while the rest of us get squeezed.

I’ve used this market dynamic myself in the past, going short of (selling) the general market while going long of (buying) the banking sector. Get this right, and you’ll outperform the market, and probably the fund managers, though it can be risky to do so.

When interest rates rise, the hardest-hit stocks are often the growth companies. These often rely on borrowing money to invest in their business, and cash flow and margins are usually damaged as interest rates rise.

When the BoE cuts rates, all of the above reverses… mostly! With cheaper finance available, growth companies can borrow more easily and cheaply to invest in their businesses.

You’ll need to watch out for those companies who have fixed debt interest at a higher rate, though.

Other winners when interest rates fall include REITs (Real Estate Investment Trusts), utility companies, and large companies with strong balance sheets and good cash flow.

Also, dividend-paying companies often outperform when interest rates are falling; the dividends they pay start to look more attractive versus declining interest rates paid on cash and bonds.

(Personally, I believe that dividend stocks are not valued high enough by many investors. The dividends they pay provide a cushion against falling stock prices and make them more attractive as interest rates fall.

They tend to be less volatile than other stocks, and over the long term they have outperformed the general market. However, you must still be careful in stock selection – a dividend-paying company isn’t always a safe investment.)

Bond prices and interest rates

As a general rule of thumb, bond prices move in the opposite direction to interest rates: when interest rates rise, bond prices fall, and vice versa:

- A bond that pays a coupon (interest) of 2% is less attractive than a savings account that pays 5%, so the bond price falls.

- A bond that pays a coupon of 5% is more attractive than a savings account that pays 2%, so the bond price rises.

Simple, isn’t it? Except, there are exceptions to prove this rule. For example, the price of bonds that pay a coupon that tracks the Base Rate may move in line with the direction of the Base Rate.

(But, even here you should take care, especially if investing in corporate bonds – the more money the company pays out in interest on its debt, the more their profits will be squeezed. If these are squeezed too much and the company goes bust, the bond is likely to fall in value.)

You should also note that longer-dated bonds (those that mature a long way in the future) often move most when interest rates move.

Pro Tip: ‘My word is my bond’ doesn’t always hold true

It’s not only companies that can go bust and shareholders lose big – so can governments.

The Latin American debt crisis of the 1980s is a good case study. Countries like Mexico ratcheted their debt so high that when countries around the globe started hiking interest rates to curb inflation, serving their debt became untenable. Many Latin American countries defaulted on debt repayment.

In more recent history, Donald Tusk’s Polish government’s swoop on its own bonds held in private pension funds was, in my opinion, nothing short of criminal.

Wishing to reduce its deficit in 2014, it seized around £40 billion of government bonds held in 13 private pension funds – more than half the value of the pension funds.

This gave pension investors two options: to move back into the state-controlled pension, or remain with their private pension provider and take a huge hit on their pension savings.

My tip? Government bonds are often cited as being among the safest securities, but you should still take care when investing in them.

Interest Rates – The Nuts And Bolts

Every six weeks, the Monetary Policy Committee (MPC) meets to decide what the BoE should do with the Base Rate. (The next meeting is due to be held on the 2nd February 2024.)

When the BoE announces its interest rate decision, it also publishes the minutes of the MPC meeting. Market analysts examine these in fine details, to get hints of which direction interest rates may move next, and when.

While control of inflation remains the BoE’s number one priority (with a target of 2%), there are 18 economic indicators that the MPC use when making its rate decision.

Here are three of the most critical (and one that gives you an insight to the mood of the MPC) that will help you to not only understand Base Rate moves, but also to predict them yourself:

1. The rate of inflation and direction of movement

The BoE has a remit to use monetary policy (the primary tools are interest rates and quantitative easing (QE) to achieve a target inflation rate of 2%. It also uses monetary policy to help support growth and employment. Balancing these three goals is rarely easy.

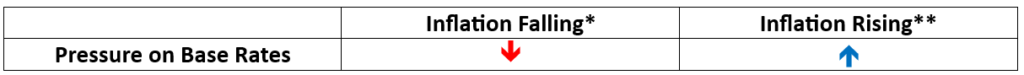

If inflation is higher than 2%, the BoE is more likely to raise the Base Rate. If it is higher than 2% but falling, the BoE is more likely to hold back.

*The lower the inflation rate and/or the faster it is falling, the greater the pressure to cut the Base Rate.

**The Higher the inflation rate and/or the faster it is rising, the greater the pressure to increase the Base Rate.

2. The state of the UK economy

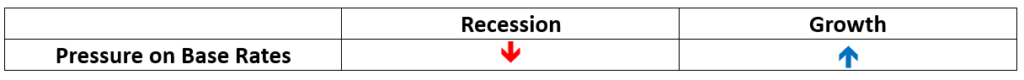

The MPC also considers the general economy. If we are in recession, or it appears that we are heading for recession, the BoE is more inclined to reduce interest rates. This relaxes the squeeze on company balance sheets and cash flow, and makes investing for the future more attractive.

Right now, we’re not in a recession (despite doomsday reports in much of the mainstream media), but we are only just hovering in growth territory. It’s a fine line, with many economic forecasters now predicting that the UK will avoid a recession.

This is a challenging balance for the MPC to make. It does not wish to be seen to be killing economic growth, but must consider that rapid growth can lead to an overheated economy and rising prices.

3. Unemployment and wage growth

The level of employment and new job creation has confounded economic forecasters, both post-Brexit and post-Covid. When unemployment is low and there are plenty of job vacancies to be filled, this is seen as an indication of a stronger economy and more money sloshing around the system.

Similarly, if wage growth is high, this could put more money in people’s pockets – and greater spending power could lead to higher prices (as well as the upward pressure on business costs).

If unemployment is rising and wage growth is falling, the BoE will be more inclined to cut the Base Rate. This is the case at the moment.

4. Watch the MOC votes and the accompanying statement

Finally, it pays to watch how the individual members of the MPC think. The voting numbers have gone into reverse, from being unanimously in favour of increasing interest rates to a split decision, with only three in favour of a rate rise and six voting for rates to remain unchanged in the December meeting.

This said, the MPC reported that it would not hesitate to raise rates if it felt this was necessary.

Base Rates and Personal Financial Planning – The Bottom Line

Summing up, whether you are a borrower, saver, or investor, the trajectory of the BoE Base Rate is a critical component of effective financial planning.

If you’re a borrower, falling interest rates will bring you some relief from high repayments. This said, understanding how decisions are made on Base Rate moves will help you decide whether it’s wise to remortgage to a fixed rate deal.

Whatever style of mortgage you have, overpaying, if you can, will help to reduce long-term interest costs.

On the other side of the coin, savers lose out as interest rates fall. Your strategy here should shift to finding the best savings rates and consider the access to your cash you need.

By using active savings accounts, you can remove the pressure of chasing the best interest rates for your cash savings.

For those of you who are investors, it’s crucial to understand the relationships between interest rates, stock prices, and bond prices. While falling interest rates are considered good for the stock market (with sectors like REITs, utility companies, and dividend-paying companies doing particularly well), you should always take care when investing and use proven stock selection strategies.

When all is said and done, the BoE’s Base Rate decisions will ripple through all aspects of your financial planning. Whether interest rates rise or fall, there will be winners and losers.

With careful financial planning, and keeping a constant eye on interest rates, you will be able to evolve your financial planning so that the positives outweigh the negatives whatever the interest rate scenario.