If you’re looking to invest with the use of an online trading platform, then you may have come across Interactive Investor. It’s one of the UK’s largest, but is it any good? Is it too good for anyone new to investing? Michael Barton explains all in this Interactive Investor review.

Wallet Savvy is a reader supported website. This means that some pages include links to products or services that we recommend and we may earn a commission when you make a purchase. You will never pay more by choosing to click through our links.

Post date

Post author name

Michael Barton

This article has been fact checked by a member of the Wallet Savvy editorial team and complies with our editorial standards.

If you want to invest using an online trading platform, you’ve got a reasonable choice available. One of the UK’s largest is Interactive Investor. But being big doesn’t always mean being good, does it?

I’ve had a fair amount of experience with trading platforms (including on the development side of things – not from the behind-the-scenes tech side of things, but from a trader’s point of view), so I thought I’d run my slide rule over Interactive Investor to find out if it merits its position as one of our most popular online investment solutions.

Interactive Investor – Quick Verdict

I’ve used several online trading platforms, and I can tell you that Interactive Investor stands out. Not because it’s one of the UK’s largest, either. Rather, it’s the ease of use, vast range of investment options, and transparent and simple pricing structure, among other features.

If you’re a beginner, you’ll find its Quick Start funds are very helpful. As your experience improves, you’ll want to take a more active role in your investments. This is where its model portfolios and Super 60 and Ace 40 lists come into their own.

There are four investment plans to choose from, and these give you access to trade via a General Investment Account, Individual Savings Account (ISA), or a Self-Invested Personal Pension (SIPP).

The bottom line? if you’re looking for a reliable, comprehensive platform to build a diverse investment portfolio, Interactive Investor could be the perfect choice.

*Capital at risk

Who is Interactive Investor?

Founded in the 1990s, Interactive Investor is now wholly owned by Abrdn (previously Standard Life Aberdeen). Abrdn has something of a pedigree in the financial world, with a more-than 200-year history, 30 offices around the globe, and around £500 billion of assets under management.

Interactive Investor employs more than 700 people, boasts around 400,000 customers, and holds £50 billion of investments under administration. It’s an award-winning company, providing access to a substantial number of investment instruments through its trading platform – which is the main thrust of this review.

Type of Investment Accounts

When you’re investing, it’s essential to invest in an account that not only suits your investment goals, but also gives you the maximum protection against the taxman. If there is any (legal) way of not paying tax, you want to take it.

You’ll be pleased to know that Interactive Investor offers tax-efficient investment accounts as well as a General Investment Account (GIA). Here are the accounts (or investment wrappers) that you can open with it:

Trading Account

You can buy, hold, and sell the full range of investment instruments in this account, which is a GIA. However, any profits or income will be liable to capital gains tax or income tax, respectively.

Stocks and Shares ISA

You can invest up to £20,000 each tax year into ISAs. The investments in an ISA will benefit from tax-free growth and income, as will any income you take from it.

You can also open a Junior ISA (JISA) for children or grandchildren under 18, with contributions limited to £9,000 a year.

Self-Invested Personal Pension (SIPP)

If you are investing for retirement planning, a SIPP offers you some fantastic tax benefits. You can contribute up to £60,000 each year, and benefit from tax relief on those contributions (you’ll have 25% more invested than you pay in net of tax). You can also claim more tax back through self-assessment if you are a higher rate taxpayer.

A SIPP also gives you maximum control over your pension investments – you can invest in all the assets and instruments available through Interactive Investor and have flexible options to withdraw money from age 55 (57 from 2028).

*Capital at risk

What Assets Can You Invest in Your Interactive Investor Accounts?

Here is one area in which Interactive Investor is a clear winner against its competitors. You have access to trade in more than 40,000 investment instruments across assets that include:

Shares

A share is a slice of an individual company that is listed on a stock exchange. As a shareholder, you benefit from growth through share price increases and income via dividends paid. As an Interactive Investor customer, you can trade online in the shares of thousands of companies around the world.

Investment Funds

These are collective investment schemes, managed by professionals. They give you access to diversified portfolios across different asset classes, as well as geographies and industries.

Investment Trusts

Like investment funds, but listed on an exchange (making them easier to trade). The major difference between an investment fund and an investment trust is that an investment trust is structured as a company.

ETFs

Exchange-Traded Funds (ETFS) are also like investment funds. However, they aren’t ‘actively’ managed. Instead, they are set up to track an underlying benchmark. This might be a stock market index, an industrial sector, an industry subsector, and so on. Like investment trusts, ETFs are traded on a stock exchange.

Corporate & Government Bonds

Do you want to benefit from a fixed income over a set period? Then become a lender to companies and governments by investing in their bonds. Doing so is usually lower risk than investing in shares, though this is reflected in the potentially lower returns.

Options

Options are specialised trading instruments, and part of an asset class called ‘derivatives’. High-risk, high-reward stuff – though there are option strategies that can help you boost your returns from shares that you own.

So, a very wide range of assets and instruments available to you, and way more than the 16,000 available through AJ Bell, 11,000 at Hargreaves Lansdown, and 3,500 with Bestinvest.

Two notable exceptions to its asset offering are Cryptocurrencies and Foreign Exchange. However, I consider the former too risky as an investment (you can make a big profit or lose the shirt off your back) and the latter for day trading, so this doesn’t bother me.

Interactive Investor’s Quick Start Funds

Here’s something I really like about the Interactive Investor offering – its Quick Start Funds. These are ideal for beginners. They are low-cost and specifically selected to meet a range of investment and risk profiles. The six funds provided by Vanguard and Columbia Threadneedle are:

Lifestrategy Funds from Vanguard

These have been selected because they provide a balanced approach at low cost. They are passively managed funds, meaning they track market performance without a dedicated fund manager. They invest in a wide range of sectors around the world, with asset mix determining the risk associated with each portfolio:

- Lower Risk – 20% equities (shares)

- Medium Risk – 60% equities

- Higher Risk – 80% equity

Each of the funds is highly diversified, consisting of between 6,000 and 20,000 shares and bonds. As prices fluctuate, the asset mix is rebalanced to return to its original ratio of shares and bonds.

Charges are 0.27% for the 60% and 80% equity funds, and 0.28% for the 20% equity fund.

Sustainable Funds from Columbia Threadneedle

You can select from actively managed cautious, balanced, or growth funds to suit your risk profile, with funds targeted to provide inflation-beating returns. Why sustainable? Because the fund managers invest in companies that make a positive difference to the world. These funds hold a fluctuating proportion of equities as follows:

- Cautious – 20% to 60% equities

- Balanced – 30% to 70% equities

- Growth – 40% to 80% equities

Charges are only 0.35%, which is exceptionally low for actively managed funds. You should invest to remain invested for five years, as their target is to beat inflation over five years.

*Capital at risk

Model Portfolios

Interactive Investor also offers a range of model portfolios to take the strain out of selecting which assets to invest in. You can opt for actively managed or passively managed income and growth portfolios, with the portfolios made up like this:

- Active Growth – Ten actively-managed trusts and funds

- Active Income – Ten high-yielding, actively-managed trusts and funds

- Low-Cost Growth – Nine low-cost ETFs and tracker funds

- Low-Cost Income – Nine low-cost, high-yielding ETFs and tracker funds

One of the things I like most about these portfolios (apart from their simplicity), is their transparency. Interactive Investor regularly updates investors about the decision-making process that guides asset mix and buying and selling decisions, via press releases and its own analysis pages on its website.

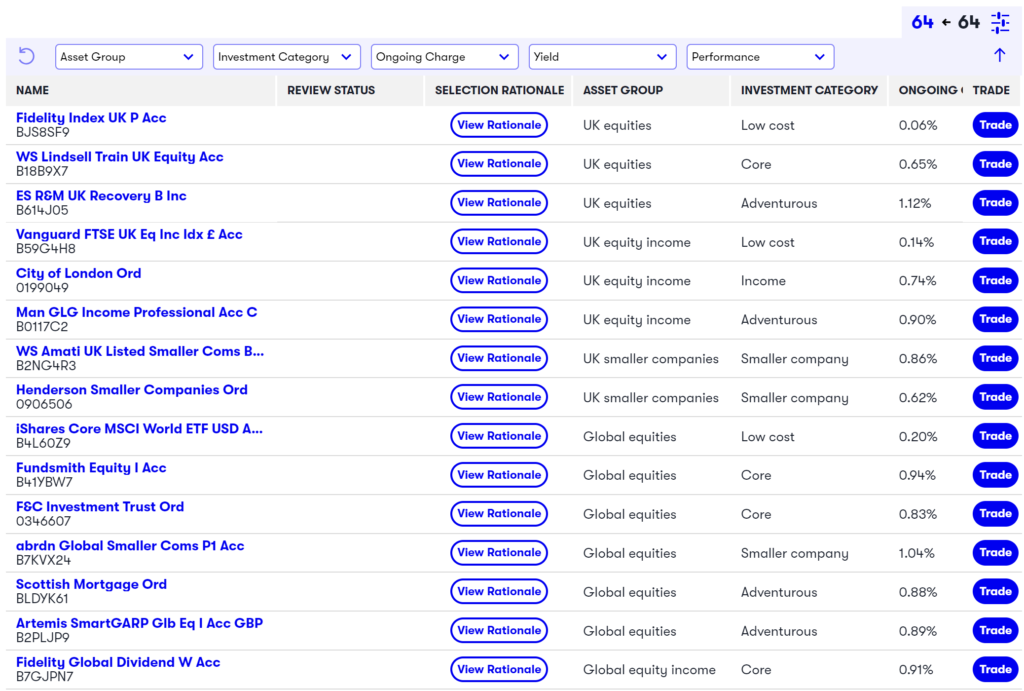

The Super 60 and Ace 40

Researching investment ideas is not an easy task. You must understand market fundamentals, and take time to discover which funds invest in what assets, before selecting which is most suited to your financial goals. This is where Interactive Investor’s Super 60 and Ace 40 come into play:

- The Super 60 is a list of funds, investment trusts, and ETFs that have been handpicked based on quality and performance. They cover a range of regions and sectors.

- The Super 60 Alternatives is like the Super 60, but comprising of investment instruments that include property, specialist, and mixed assets.

- The Ace 40 is a selection of 40 funds, investment trusts, and ETFs selected from a list of 200 sustainable investment instruments.

You can use these lists to select the investment instruments that best suit your criteria, such as cost, risk, sector, region, and asset classes.

Cash Held with Interactive Investor

One of the things that often bugs me about online (and offline, for that matter) investment platforms is the paltry returns they offer on cash held with them. Sure, it’s usual to want to have your money working as hard as it can, but what about the cash you don’t want to invest?

Interactive Investor’s Cash Savings facility allows you to keep your cash in one place and benefit from seamless transfers between 25 UK banks and building societies. The minimum cash you can hold is £10,000, and the maximum is £250,000. At the time of writing, the best rate for a 6-month plan is 5.35% and 4.76% for a 3-year plan.

The Investment Platform

The Interactive Investor platform is functional and friendly, though it doesn’t have a wow factor. To trade, you can navigate to an investment using a simple search function. This takes you to the instrument you are considering, and you’ll see information such as current price, historical price charts, and instrument fundamentals.

Something that I particularly like here is that you get a comparison to similar instruments. You will also see the latest analyst ratings and news. If you decide to buy or sell, simply do so from this page.

You can also view your portfolio, seeing details that include investment values, your gain or loss, and prices paid. There is some basic analysis here, but no more.

You can set up stock watchlists, define your lists by categories such as sector, market cap, and so on – but it only includes basic technical analytical tools. For me, this is a small inconvenience. If you are investing for longer-term returns, the lack of charting functionality shouldn’t matter – you’ll be more concerned with long-term fundamentals than short-term trading patterns.

I also love Interactive Investor’s Knowledge Centre. This is packed with information in easy-to-consume chunks, covering a range of subjects from investing for beginners to behavioural investing. Information is delivered in a combination of videos, podcasts, and articles – so whichever way you prefer to absorb learning, you’re catered for.

*Capital at risk

How Much Does Interactive Investor Cost?

Interactive Investor offers four investor plans. You’ll need to open one of these before opening the investment account(s) you want to use for investment:

- Investor Essentials

- Investor

- Super Investor

- Pension Builder

Here’s something else I really like about Interactive Investor – its easy-to-understand fee structure. You won’t think your costs are ‘x’ only to find you’re stuffed with other charges that you weren’t expecting. Here’s what each plan costs, and what you get for your money:

| Plan | Investor Essentials | Investor | Super Investor | Pension Builder |

| Monthly Subscription | £4.99 | £9.99 | £19.99 | £12.99 |

| Stocks and Shares ISA | ✓ | ✓ | ✓ | |

| Trading Account | ✓ | ✓ | ✓ | |

| Junior ISA | ✓ | ✓ | ||

| SIPP | ✓ (for £10 charge per month) | ✓ (for £10 charge per month) | ✓ | |

| Friends and Family | +£5 p/m | +£5 p/m | ✓ | +£5 p/m |

| Free Monthly Trades | û | ✓ (1 per month) | ✓ (2 per month) | û |

| Free Regular Investing | ✓ | ✓ | ✓ | ✓ |

| UK Shares and Funds, US shares | £5.99 | £5.99 | £3.99 | £5.99 |

| Other International Shares | £19.99 | £19.99 | £5.99 | £19.99 |

| Dividend Reinvestment | £0.99 | £0.99 | £0.99 | £0.99 |

You can set up regular investing from as little as £25 per month. As a Super Investor, you’ll also be able to participate in monthly seminars and webinars.

It’s worth noting that there are inactivity fees levied if you have not traded for 12 months and there is less than £2,00 in the account.

How do these costs compare with others in the market?

There isn’t a straightforward answer to this question. However, as a rule, the more you are investing/have invested, the more favourable Interactive Investor’s costs become, especially when compared to other brokers that charge a platform fee based on a percentage of the value of your investment.

Is Interactive Investor Safe?

It’s as safe as any other broker in the UK. Not only is it backed by a large company, but it is also fully regulated by the Financial Conduct Authority, and any money you hold with it is protected by the Financial Services Compensations Scheme (FSCS).

On top of this:

- Cash deposited with Interactive Investor is treated as client money, and segregated from their own

- Interactive Investor requires two-factor authentication, preventing unauthorised access to accounts

- Interactive Investor uses advanced encryption to help safeguard your personal data

*Capital at risk

Customer Support

Interactive Investor has won awards for its customer service, and if you have any issues, you can make contact in several ways. For an urgent query, Interactive Investor provides phone support between 7:45am and 5:30pm on weekdays – and, while I’ve never used it, customers who have report fast response times.

For less urgent problems, you can either message the support team or email them. You’ll also find a plethora of answers on its website to common queries.

Pros and Cons

| Pros | Cons |

| User friendly, easy-to-use platform | Only basic charting tools |

| Transparent pricing | More cost-effective for larger investment portfolios |

| Great customer support | No live chat, and no 24-hour support |

| Free regular investments | |

| Access to market leading research | |

| Plenty of education resources | |

| High level of investor protection |

How Do You Open an Interactive Investor Account?

It takes only a few minutes to subscribe to a plan and open an account with Interactive Investor. Here are the basic steps you’ll need to follow:

- Click the Sign-Up button on the Interactive Investor website, and follow the instructions to create your subscription.

- Select an account type for investment.

- Provide a few personal details.

- Verify your identity and provide proof of address.

- Fund your account (you can do this by bank transfer, debit card, or credit card).

- Make your first investment!

The process is simple, and you could be trading today.

Alternatives to Interactive Investor

If you aren’t convinced that Interactive Investor is the best choice of investment platform to help you achieve your financial goals, here are three alternatives you might consider:

eToro

A good option for most traders, with an easy-to-use interface. You can trade cryptos on the platform, and are able copy other trader’s moves in the market. However, you have a much smaller choice of investments. With great charting tools and technical analysis, eToro is more suited to active traders.

Hargreaves Lansdown

The largest UK platform, Hargreaves Lansdown’s percentage-based pricing could work out as a lower-cost option if you have a smaller portfolio. You have a choice of around 13,000 investment instruments to invest in, and its education and research offering is exceptional.

AJ Bell

If you’re a more experienced investor, AJ Bell offers a wide variety of investment instruments for investment, as well as several funds. You’ll be charged based on a percentage of your funds – starting at 0.25% and reducing for larger funds. Dealing charges are £1.50 for funds and £9.50 for shares.

7 Tips for New Interactive Investor Users

How can you use Interactive Investor to help build your financial future? Here are my top tips:

1. Select the best account types to help you achieve your financial goals, maximising your ISA allowances and taking advantage of tax relief when investing toward your retirement.

2. If you’re new to investing, consider starting with Interactive Investor’s Quick Start funds – they’re low-cost and cater to different risk profiles and investment goals.

3. For a more guided approach, leverage Interactive Investor’s model portfolios, choosing between actively and passively managed income and growth portfolios depending on your investment style and risk tolerance.

4. If you’re on your way to becoming a more experienced investor, use Interactive Investor’s Super 60 and Ace 40 lists to help you make informed decisions that align with your financial goals.

5. Take advantage of customer support when you need to. Don’t leave anything to chance.

6. Plan for your long-term financial goals, and avoid knee-jerk reactions based on short-term market fluctuations.

7. If you have surplus cash, consider depositing into Interactive Investor’s Cash Savings account to earn high interest rates.

The Bottom Line

There are many factors that make Interactive Investor a stand-out choice among online brokers. You gain access to an enormous range of investments via an easy-to-use platform, with accounts tailored to your financial goals.

Quick Start funds and model portfolios are fantastic options for beginners, while its Super 60 and Ace 40 lists will help you if you want to take a more active role, but don’t have the time to conduct extensive research yourself.

You’ll find the straightforward fee structure, with the option of four investor plans, takes away the stress, strain, and struggle of understanding investment costs. However, for smaller portfolios, there may be cheaper platforms available.

The trading platform itself is highly functional, though it lacks the charting tools that more active traders might expect.

Backed by a large owner, and with robust safety and security measures, Interactive Investor could be the perfect choice if you are seeking a platform that is reliable, and that will help you build a diverse investment portfolio on the way to building your financial future.

*Capital at risk