Whether you are 50 years away from retirement or have only a couple of years left until you kick your job into touch, now is the time to start thinking about how to plan for the retirement lifestyle you desire.

I really started to get serious about my retirement options around five years ago – at a time when I wasn’t planning to call it quits on work for another 15 years.

The five-step process I detail in this article is the one that used to give me clarity on what I need to do to get to where I want to be when I do retire. It’s the process that I use when I review my retirement planning every six months.

30-Second Summary

When you take a systematic and proven approach to planning for your retirement, it helps to get a clear view on the lifestyle you desire in later life and how to achieve it.

While it’s challenging to think perhaps years into the future, the sooner you start to plan the easier it will be to achieve your financial goals. This said, there is no wrong time to begin the process – it’s only too late when you have finally retired (and even then, there are ways to boost your retirement income).

This simple five-step process will help you gain clarity on your options and needs:

- Work out the income you need in your retirement.

- Consider your options for income in retirement.

- Figure out what you have in place now – and what income you’ll really need.

- Plan and act to fill the gap.

- Review your retirement planning regularly.

In short, when you know what you want it’s easier to plan to get it – and with a good plan in place, you’ll know exactly what you must do to achieve what you desire.

The Five Steps to Achieving Sufficient Income in Retirement

You can read through the following action plan and then start the process, or complete each step as you work through this article. It may be that you decide to mix the two approaches.

Whichever way you decide to approach this, make yourself a cup of tea or coffee, and settle down with pen, paper, and a calculator by your side.

Step One

Work out the Income You Need in Your Retirement

If you’re going through this process two or three years ahead of retiring, it’s easier to figure out how much money you’ll need in retirement.

The longer you have until you retire, the more difficult this calculation might be because of the uncertainties that more time brings. No one knows how much a pint of beer will cost in 30 years, never mind the more important things like food and holidays!

I like to think in the present (as if I were retiring tomorrow) and then apply some simple maths to estimate the future. I also split my spending into two categories:

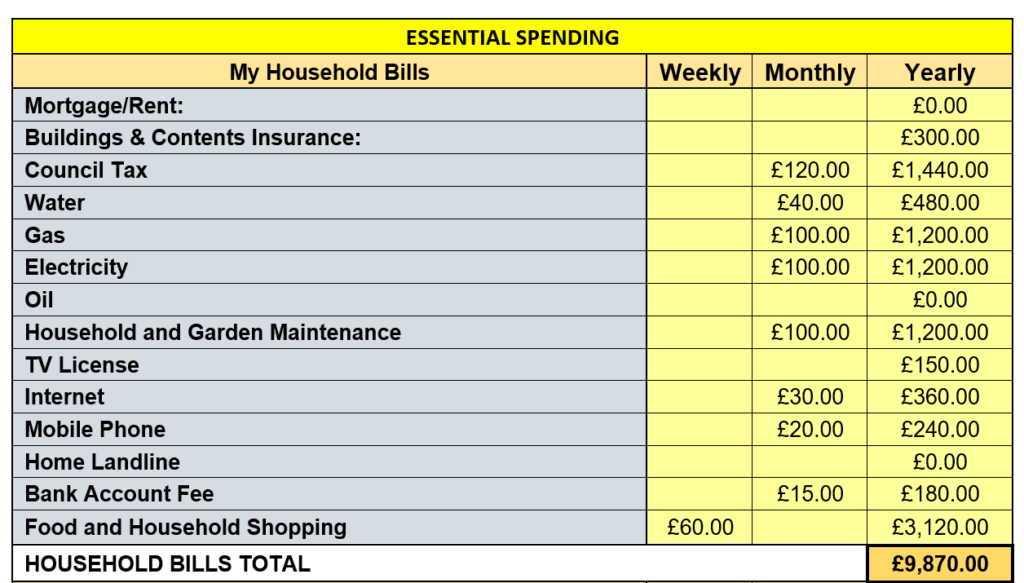

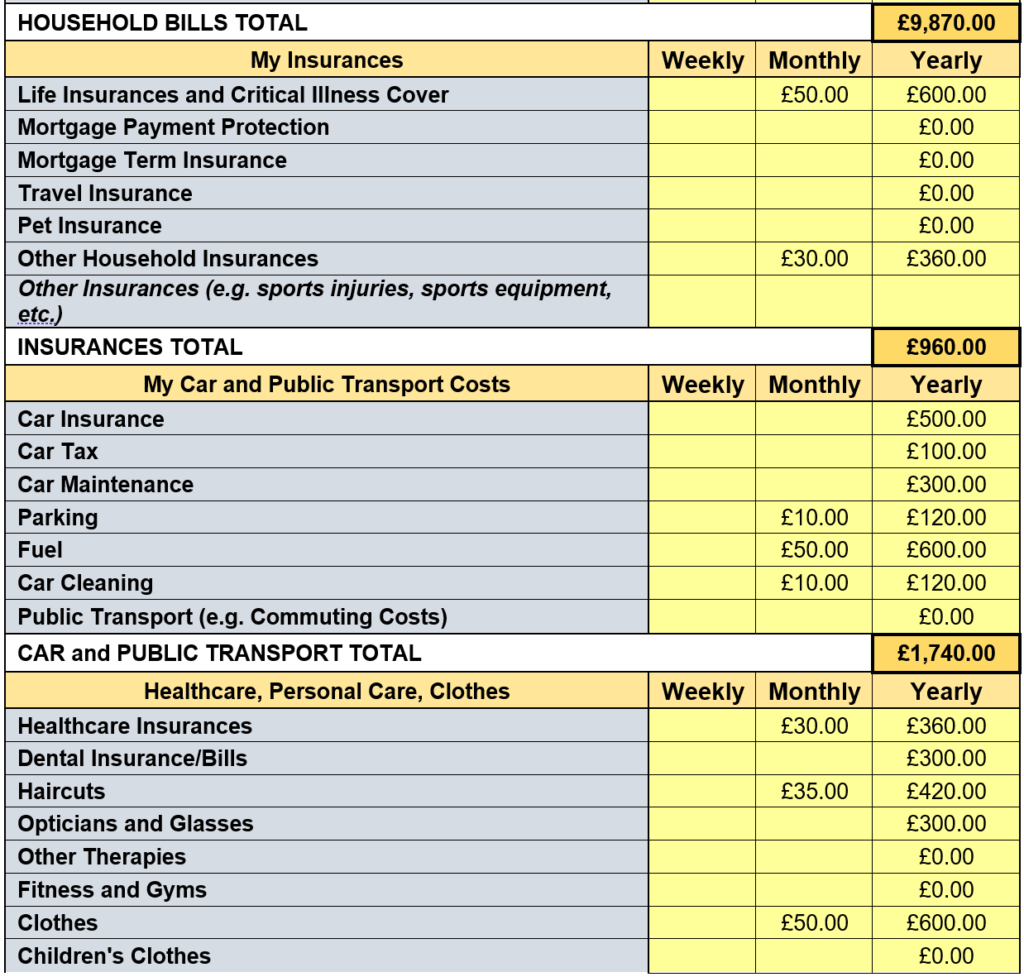

Essential Spending

This is the money you need to cover your cost of living – all the basics without which you couldn’t exist. Items in this category include housing costs (rent or mortgage), utility bills, food and drink, transport, and so on.

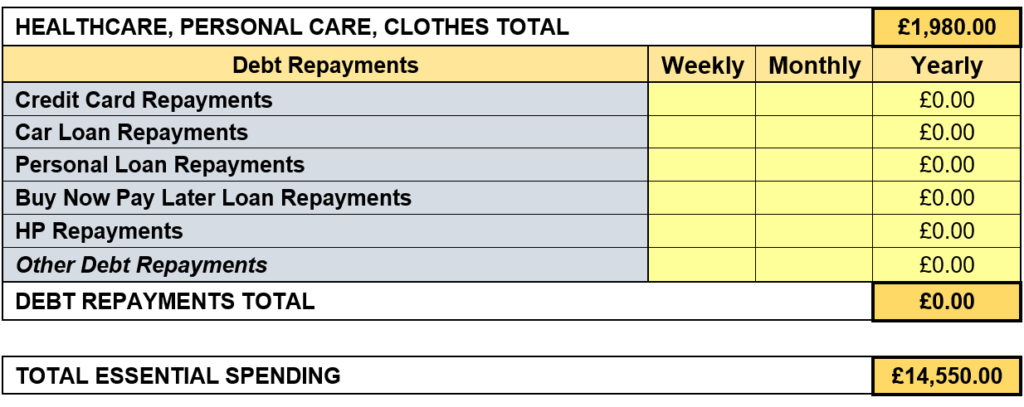

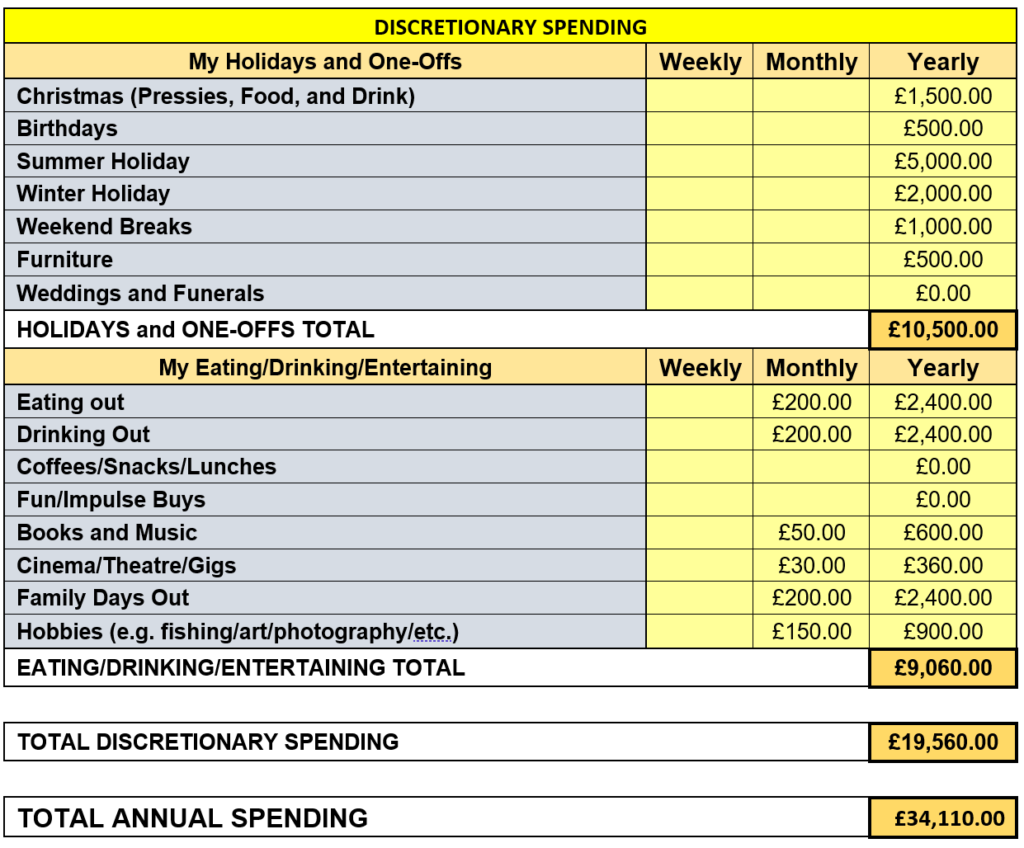

Discretionary Spending

These are the things that make living worthwhile. This list is unique to you. However, items I’ve got on my list include eating out, hobbies, holidays, and family (birthdays, Christmas, etc.).

Here’s an example of how a retirement budget might stack up. Remember, this is based on prices today.

You’ll also notice that there are some costs that you might be paying today that aren’t on this budget, such as mortgage payments.

On the other hand, other costs might have increased (more leisure time means higher spending to do the things you most like to do):

In this example, to live you’ll need an income of £14,550 per year. To live how you want to live, you’ll need an income of £34,110 per year.

Using the above as a template for your own retirement income needs budget, work out how much income you would need if you were to retire tomorrow. A tip here is to err on the high side of costs – it’s better to overestimate than under-cost.

How can you achieve this income? Time to move to step two.

Step Two

Consider Your Options for Income in Retirement

£34,110. That’s a lot of income when you aren’t working!

Before you start to sweat and have visions of living in poverty, let’s get clear about the income-generating options you have available to you:

The State Pension

For most people, this is likely to be their main source of income in retirement. The average pension pot in the UK is less than £110,000 for those nearing retirement.

Even if you achieve 5% income on this, it will be only a shade more than £5,000 per year – significantly less than the full State Pension, which is currently £203.85 per week (£10,600.20 per year).

If you are a couple and are both entitled to the full State Pension, you’ll have income of more than £21,000 per year between you.

Workplace Pensions

Next up, pensions from your current and previous employers. There are two types of pension scheme you might have access to from employers:

- Defined Benefits

A defined benefits pension is a type of final salary pension scheme. How much you receive will depend upon:

- Your salary when you retire (or your average career salary)

- How long you have been employed with the company

The pension will usually begin to pay out a guaranteed income from an age defined in the scheme’s terms and conditions (most commonly age 60 or 65). You may also be entitled to a lump sum when you retire.

These are considered to be the gold standard of pensions, and it used to be that you would never be advised to transfer out of them (and the highest of them all are those classed as ‘non-contributory’ – you won’t have paid a penny into these!).

Guaranteed income, after all, is not something to turn your back on.

Now, after years of ultra-low interest rates, it can, in certain circumstances, be beneficial to transfer a defined contribution fund into a private pension – though you should always seek professional advice tailored to your unique circumstances if you are considering doing so.

2. Defined Contribution

A defined contribution pension is one into which you (and your employer) have been contributing.

Over the years, you’ll have built up a pot of money in the scheme. This can then be taken as a pension according to the scheme’s rules – and often from the age of 55.

This type of pension is mandatory for most companies to provide. You will be allowed to contribute up to a certain percentage of your salary, and, in most cases, your employer will also contribute. You also get tax relief on your contributions.

When you do decide to take benefits from a defined contribution pension, you’ll usually be allowed to take tax-free cash of up to 25% of the fund value, and then begin to take pension income from the fund.

Personal Pensions

You may also contribute to private pensions schemes, which are effectively defined contribution schemes: how much you get out depends upon how much you’ve put in and the performance of the funds in the pension scheme.

Self-Invested Personal Pensions (SIPPS) allow you to be in control of how your money is invested. You benefit from tax relief on your contributions, and your fund grows free from income tax and capital gains tax.

Other Income Options

As well as state, workplace, and personal pension income, there are other ways in which you could boost your income. These include:

- Developing a side hustle – something you enjoy doing that will pay you an income.

- Working part-time.

- Using other savings and investments as a source of income (income from ISAs is tax free, too!).

- Earn money from home, developing a small home-based business or creating an income from your assets (did you know that you can earn up to £7,500 a year, tax free, by renting a room to a lodger?).

Does the income you need in retirement look a little more achievable now?

Before you breathe a sigh of relief and stop thinking about your retirement income planning, it’s time to consider what shape you are really in.

Step Three

Figure Out What You Have And What You Need

It’s now time to discover what your current plans amount to, and then figure out what you will really need in your retirement. Let’s start with your current situation.

How Much Income Are You Likely to Have in Retirement from Pensions?

We’ll forget about the extra ways that you could create retirement income for the moment. We want to focus on your pensions first. Let’s start with your State Pension.

Obtain a State Pension Forecast

How much state pension you will be paid depends upon your National Insurance (NI) contributions record. If you are short of ‘years’, then your state pension will be reduced.

You’ll need to have paid NI contributions for 35 full years to receive the Full State Pension, and 30 full years to receive the Basic State Pension. In 2023, this is what you would receive at these levels:

- Full State Pension – £203.85 per week (£10,600.20 per year)

- Basic State Pension – £156.20 per week (£8,122.40 per year)

It’s easy to obtain a forecast for how much State Pension you will be paid – though it will be in today’s terms. Open the Government’s ‘Check-State-Pension’ page, and then click on the ‘Start now’ button.

Follow the instructions, and you’ll be fully informed in just a few minutes. When I say fully informed, I mean it. You’ll see a history of your NI contributions, which years you are missing (and how much you would need to pay to make these year fully paid up), and a forecast for your State Pension when you reach retirement.

When I did this for my wife and myself recently, it confirmed that I am fully paid up and will receive the Full State Pension when I retire, and that Mrs B needs to pay in another 8 years out of 11 years before her due retirement date.

Check Your Workplace Pension

You should receive an annual statement from your workplace pension provider. This will detail how much is in your pension pot, how much you and your employer are contributing (if it is a defined contribution scheme), and should also include a projection of what you might receive when you retire.

You should treat the pension projection as a rough estimate, and the further away from retirement you are, the rougher the estimate is. Nevertheless, this number can be used in every one of your retirement planning reviews to help adjust and keep on track.

Check Other Personal Pensions

You should also receive a pension statement from any provider with whom you have a personal pension. This should include similar details to a workplace defined contribution pension plan statement.

Trace Your Lost Pensions!

Do you have pensions that you don’t know about?

Recent figures estimate that there is an astounding £26.6 billion in lost and unclaimed pension pots in the UK. With around a quarter of people losing track of their pensions, this means there around three million pension pots waiting to be claimed.

While the average lost pension pot is around £9,500 (£16,000 for those between 55 and 75 years of age), you may have a far higher pot waiting for you.

When I had a financial advisor track down my pensions, he found two pots I didn’t realise I had. While one of these was small, the other was worth over £55,000.

You can now trace your own lost pensions. It’s easy to do, and doesn’t cost a penny. There are two ways to do so:

- First, contact old employers and ask them. If this isn’t possible, ask ex-colleagues about their pension from your ex-employer to find out who the provider is.

- Second and much easier, use the government’s Pension Tracing Service. This uses your details to search for your old pensions. You’ll need to provide some information, of course, including employers’ names, your old addresses, periods of employment, etc.

A tip here is to beware scammers. There are many companies that offer to find lost pensions. Many of these will charge you to do the job you can do for free. Others may attempt to steal your pensions from you.

Have You Got Any Savings or Investments That Could Produce Income?

In addition to your pensions, do you have other long-term savings or income that you could use to improve your income in retirement?

ISAs in particular could provide the income boost you need. As things stand now, all income from your pensions will be counted as taxable income. This isn’t the case with ISAs – any income you receive from these will be free of income tax liability.

Figure Out What Income You’ll Really Need in Retirement

As you’ve probably twigged, all the numbers you’ve gathered are a mishmash of what you might receive if you were to retire tomorrow (for example, your State Pension forecast) and what you might receive when you actually retire (for example, your personal pension projection).

This ambiguity makes understanding your true position challenging, to say the least.

I’m going to attempt to remove some of this ambiguity, starting with figuring out what income you’ll really need when you retire – because, unless you are retiring tomorrow, it’s going to be more than you calculated in Step One above.

The longer you have until retirement, the more inflation will affect the amount of income you need to live the lifestyle you want when you retire.

What you need to do is:

- Take the TOTAL ANNUAL SPENDING number you calculated in Step One;

- Apply compound inflation to it over the number of years remaining until you retire.

Yeah, that’s not the easiest of sums to do, even if you’re a mathematical whizz. Fortunately, there are many online (and free) calculators you can use to help you.

One of the ones I like most is the Compound Interest Calculator from calculatorsite.com. Here’s how to use it to calculate how inflation will affect your spending requirement between now and your retirement:

- Select ‘Compound Interest’.

- Key in your Total Annual Spending in the ‘Initial Investment’ box (I’ve used £34,110).

- Key in what you think will be the average annual inflation rate over the period until you retire (I’ve estimated 4%) in the ‘Interest Rate’ box.

- Key in the number of years and months until you retire (I’ve used 10 years).

- Click on ‘None’ in the Additional Contributions option.

- Press ‘Calculate‘.

You’ll see that the need for £34,110 per year, with an inflation rate averaging 4%, has ballooned to £50,852.30 in only 10 years!

Yet this isn’t the whole story. Your pension income is liable to income tax. Currently, this is charged at 20% on income between £12, 571 and £50,270. So, you’ll be paying out more than £7,500 in income tax.

Adding this to your income requirement, and then rounding up to the nearest £1,000, the probable need is to produce income in retirement of £59,000 in 10 years, and not the £34,110 we previously calculated.

It’s this amount that you need to plan for.

Step Four

Plan and Act to Fill the Gap

So, how much income are you likely to receive in retirement, given your current position? It’s now time to add up the following:

How much you are likely to get in State Pension

This is from your State Pension Forecast; however, the projection is shown in today’s terms. You’ll want to estimate this for your retirement date by applying how much you think it will rise by each year.

Now, the UK State Pension increases by something called the Triple Lock (though this may change). What this means is that the government increases the State Pension by the highest of the following factors:

- Growth in average earnings

- CPI inflation

- 2.5%

So, while the Triple Lock is in place, the State Pension will grow by a minimum of 2.5%. Erring in the conservative side, you’ll need to apply this to your State Pension forecast using the Compound Interest Calculator you used earlier.

For a couple who are both due to receive the full State Pension when they retire in 10 years, the State Pension income they receive should be a total of £27,214.78. That’s a great start to getting toward the £59,000 our fictitious couple need, but still a way off.

How much you are likely to get from your workplace pension

This is the amount indicated on your annual pension statement from work. Our fictitious couple both work and their most recent workplace pension statements indicate that they will receive a total of £16,000 from their current workplace pensions.

Fantastic news! They’re up to £43,214.78. Only another £16,000 of income to find…

How much you are likely to get from previous pensions that you have traced

The first time you undertake this review, this piece of the puzzle may take a few weeks to put together. However, with your traced pension statements in hand you can now add this income to your state pension and workplace pension.

Our fictitious couple traced a few pensions down. However, they decided to transfer all these into their personal pension schemes – the transfer values were too good not to, and they liked the idea of having a single scheme to administer rather than several.

How much you are likely to get from your personal pension

Do you pay into a personal pension other than your workplace pension? Then you’ll need to include this. Your pension statement will give you a good estimate.

Our fictitious couple have used PensionBee to get a grip on their personal pension, using its Pension Calculator to figure out their shortfall. Remember they needed to make up £16,000?

Combined, they have an existing personal pension fund of £125,000, with 10 years remaining until they retire. If they make no further contributions to their pension fund, and withdraw £16,000 per year while in retirement, they discover that their projected fund will last only 10 years during retirement.

The PensionBee Pension Calculator allows you to adjust the amount you take as income, the contributions you make into your pension, and the contributions made by your employer.

The results may shock or surprise you – whichever it is, they will inform you and help you to decide what you need to do now to have your desired lifestyle in retirement.

Fill the Gap

Using the Pension Calculator, our couple found that if they did nothing about their situation, then they could afford to take an income of around £6,000 per year from their personal pensions. Their pension funds would then last until they are both 98 years old.

They could make some drastic retirement lifestyle adjustments – such as cutting back on travel and holidays – or plan now to improve their financial future. They need to improve their retirement funding to make an extra £10,000 per year in income.

What Could You Do to Fill the Gap?

Like our fictitious couple, you may have a gap to fill. If you haven’t – congratulations, your retirement planning is on track; though this doesn’t mean you should rest on your laurels.

Here are five ways in which you could close the gap between your planned spending in retirement and your capacity (income) to spend.

1. Cut Back on Your Retirement Plans

Okay, I know this option is not going to be popular. However, you could plan to spend less by doing less.

You know, cut back on your bucket list; not visit your children so often; buy smaller birthday presents for your grandkids. You could take a major holiday every other year instead of each year. Upgrade the car every 10 years instead of every five years.

In short, reduce your expectations for your retirement lifestyle.

Not for you? I hear you. You’ve worked all your life, and been looking forward to a long and fulfilled retirement. You’re determined to live the life you want.

2. Work Longer

If you’re fit enough and enjoy your work, why not work longer? Whether you do so to delay taking your pension, or do so to supplement your income in retirement, it could make a huge difference to your finances.

Our fictitious couple, wanting to make up £10,000 per year, could each work, say, 10 to 12 hours per week in a local supermarket to make up the shortfall – and still enjoy two or three months when they are not working through the year.

3. Save More Toward Your Retirement

Saving more toward your retirement should help to close the gap. There are many ways to do so, but it all starts with budgeting to save. You may need to give up on a few of life’s little luxuries today to benefit tomorrow.

There are plenty of ways to save money on your spending, and every penny saved could be a penny invested toward your retirement. The trick is to:

- Be disciplined and get into good spending habits to save money

- Be conscious about your spending – this is crucial to saving money

- Use every trick (and tool) available to save money when you spend, and then budget to save

How might you save money toward a more fulfilled lifestyle in retirement? Here are my tips:

i) Benefit From A Workplace Pension Scheme – It’s ‘Free’ Money

Ask your employer about contributing more into your workplace pension scheme. Between you and your employer, you will need to contribute a minimum of 8% of your eligible salary into the scheme. Many employers match the contributions you make, but some will pay far more.

A friend of mine works for a large UK retailer, and has recently increased their contributions from 3% of their salary to 6%. Their employer doesn’t simply match these contributions – it contributes double the amount: a full 12%.

The difference this could make to your pension is incredible, with ‘free’ money added to your pension fund:

- Let’s say you are 38 years old, expecting to retire at 68. Your salary is £25,000 a year. You contribute 6% of your salary, and your employer contributes 12%.

- Your monthly contribution is £125 (though this includes £25 tax relief – a ’gift’ from the government – so the actual effect on your take home wage is only £100).

- Your employer contributes £250 each month.

- Your total monthly contributions into your workplace pension scheme are £375 per month, at a cost of only £100 to you!

How might this tally up for you when you retire? Look at this:

- Your estimated pension pot would be more than £173,000.

- You could take 25% tax-free cash lump sum of more than £43,000.

- The estimated income the remaining pension pot could provide is more than £7,000.

Without your employer’s contribution, your pension pot would have been only around £58,000; the tax-free lump sum available at just around £14,500; and the income in retirement you might receive from the remaining pot? You’d be lucky to get more than £2,000 a year.

In short, if you have access to a workplace pension and your employer will contribute to it, you’d be crazy not to take advantage of this.

ii) Buy Shares In Your Employer’s Company

Another great way to save for your retirement is to take advantage of share schemes:

Save as You Earn (SAYE) Schemes

These are savings contracts that last for three to five years. At the end of the term, you’ll receive a tax-free bonus on the amount you have saved. You can use your savings to buy shares at a price that was set at the beginning of the term, or simply take the cash.

If you buy the shares, you might have a capital gains tax liability when you sell them – unless you put them into an ISA or a pension scheme when you buy them.

Invest Via A Company Share Option Plan (CSOP)

You can buy up to £30,000 of shares at a fixed price in a CSOP, without paying income tax or NI contributions when you receive the option, nor when exercising the option – providing you meet certain conditions (the option is exercised within 10 years of being granted and at least three years after being granted).

You will have a capital gains tax liability, with how much you must pay is determined by the profit made, your capital gains tax allowance, and your personal income tax position.

Share Incentive Plans (SIPs)

Share Incentive Plans (SIPs) allow you to own shares in your employer’s company. If you keep these shares for more than five years, you won’t pay income tax or NI contributions on them.

Provided you have kept them within the SIP, you won’t pay capital gains tax when you sell them, either.

How good can such schemes work out for you? When I was a financial advisor in the UK, I had a client who had worked with a single employer for around 30 years. Each year, she had made sure to take full advantage of the share schemes made available to her. She wasn’t a Director or senior manager.

In her early 50s, the value of her shareholding had reached almost £700,000, having invested only a fraction of this.

I wasn’t so clever. In my early 20s, I could have bought £3,000 of shares via an option scheme in my employer’s company in each of two years. The ‘strike’ price was 80p.

My employer was taken over, at a share price of £5.60. For an investment of £6,000 over two years, I would have received £42,000 – enough to repay the mortgage I had at the time. Not making the space in my budget to buy those options remains the biggest financial mistake of my life.

iii) Use Your ISA Allowance

You should also consider investing in ISAs. These are highly tax-efficient investment wrappers. You’ll pay no capital gains or income tax on investments held within an ISA, and can invest up to £20,000 in an ISA in any tax year.

Unlike investing in a pension plan, you won’t receive tax relief on the contributions you make into an ISA. Another key difference is that (depending on the ISA you hold) you are not locked into the investment until you retire (depending upon the ISA).

There are various types of ISA. If your goal is to invest for retirement, and you are between 18 and 40, you could invest up to £4,000 a year into a Lifetime ISA (you can invest into an existing Lifetime ISA until you are 50).

As well as tax free growth and income within the ISA, you will also receive a 25% bonus on your contributions in each tax year (to a maximum of £1,000).

However, you cannot withdraw money from a Lifetime ISA until you are 60, or buying your first home, or diagnosed with a terminal illness and less than 12 months to live. If you do withdraw for reasons other than these, you’ll be subject to a 25% penalty.

Other ISA options include:

- Cash ISAs

- Stocks and Shares ISAs

- Innovative Finance ISAs

4. Position Your Current Investments Toward Retirement

Do you have existing investments? What are your goals for them? Would they be better invested differently?

Your existing investments could be used to boost your income in retirement, especially ISAs. There’s a bit of guesswork involved here, and a little number crunching, too.

However, here’s an example of when it might be worthwhile to consider selling your ISA and investing the proceeds into a pension fund:

- You have no need to access your ISA funds before retirement

- You are a higher rate taxpayer

- You can invest in a pension without breaking through your tax-free contribution level

How does this work? Let’s say you earn £60,000, paying tax at 40% on a portion of this:

- You sell your ISA, realising £20,000.

- You invest this into a pension scheme, and immediately receive 20% tax relief on this – your total contribution to your pension is £24,000.

- You can claim tax relief at the higher rate (40%) on up to the amount of income on which you pay 40% income tax (for the sake of argument, let’s say this is £10,000) through your self-assessment tax return.

You’ll now earn interest/benefit from investment performance on £24,000 (in your pension) instead of £20,000 (in your ISA). You’ll also be able to take 25% of your fund as a tax-free lump sum according to your scheme rules (usually from age 55 or 60).

However, remember that the income your pension fund delivers will be subject to income tax when you start withdrawing from it.

5. Build a Side Hustle

Finally, you might also decide to build a side hustle to either earn extra income in retirement or develop passive income for your retirement. There are heaps of side hustle ideas, including earning opportunities such as:

- Blogging

- Writing books

- Driving

- Teaching/tutoring/coaching

- Product testing

- Completing surveys

- And more

If you are considering doing this, you’ll need to think about the time you have to devote to it, how much work is involved, and the resources you need to make it happen.

(A big tip here is to make sure you build a side hustle around something you are passionate about – it won’t feel like work, and you’ll get enjoyment from it as well as earning an income.)

How Much Can You Save in Pensions?

The pleasing answer is that you can now invest as much as you like into pensions in any one tax year.

Not so pleasing is the £60,000 limit on how much you can contribute to pensions to benefit from tax relief. Invest any more than this into pensions in any tax year, and the amount over this allowance won’t attract tax relief.

This allowance is calculated using the following contributions into defined contributions plans:

- Your contribution (including tax relief received)

- Your employer’s contributions

- Any contributions made into your pension by someone else

The tax relief you can claim is also dictated by how much you earn in a year:

- The lower of £60,000 or your gross earnings

- If you earn less than £3,600, you can pay in up to £2,880 and still receive tax relief

You should also note that the annual allowance applies across all of your pension schemes, and not per pension scheme. Higher earners receive tapered tax relief, too – so the more you earn, the less tax relief you can claim.

Finally, you might also benefit from something called ‘carry forward’. This allows you to utilise unused allowances from up to three previous tax years.

Now, I know that many of these rules are confusing. It’s something of a minefield – which is why, if you have a complex financial situation, you should always seek advice from a pensions specialist.

However, if your finances are less complicated, then take a look at an online pension service like PensionBee, Nutmeg, or Penfold.

Step Five

Review Your Retirement Planning Regularly

Here’s the easy step!

Put it into your diary to review your retirement planning at least once a year. I complete the above four steps every six months. The first time was the hardest. Now it’s a breeze.

Having all my records handy as I do now, it takes no more than a morning to complete my retirement planning review. Time well spent for the peace of mind and the knowledge that I am on course to enjoy the retirement lifestyle I built. Money won’t stop me ticking off my bucket list!

Here’s my final tip to help keep you on track for a bountiful retirement:

Underestimate your potential income, and overestimate your expected spending. It’s always best to err on the side of caution, and much better to be on the right side of your finances.