Think investing isn’t for you? Think again. Robo advisors such as Wealthify now exist to help guide you through it. Lucky for us, financial expert Michael Barton has trialled it to bring you this Wealthify review. Here’s all you need to know…

In the age of artificial intelligence and machine learning, shouldn’t you be able to invest through a robot? Well, you can. It’s called algorithmic trading, though it’s not a new concept. I was creating algorithms for trading systems more than 20 years ago! The difference today is that you can access this technology on your smartphone to invest efficiently and effectively.

It’s called robo advice, or robo trading.

Is Wealthify the robo advisor for you?

Quick Verdict On Wealthify

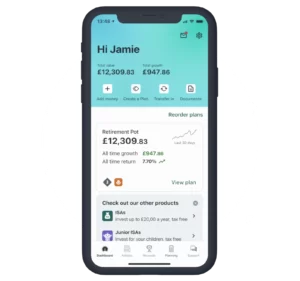

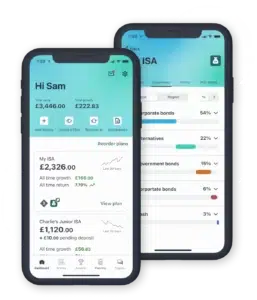

I love the simplicity of Wealthify. Especially if you are new to self-investing, this app makes it simple. It’s clean and easy to use. You can dip your toe in, investing as little as £1 as you get used to the system and its features.

Products include ISAs, pensions, and general investment accounts. Management fees are much lower than you would pay through a discretionary investment management firm. The backing of Aviva is confidence-boosting, too.

20 years ago, there was a buzz in investment circles about robo advice being the future for private client investment. That future has certainly arrived with Wealthify.

*Capital at risk

What, or Who, is Wealthify?

Wealthify is well-established in the UK. Owned by Aviva, one of the UK’s largest financial companies with a track record that can be traced back to the late 1700s, Wealthify launched its suite of online investment services in 2016.

As a robo advisor, Wealthify uses a range of technologies to help you invest. Its methodology is based on decades of data and incorporates all applicable financial rules and regulations. It allows you to take control of your investments without the added expense of investing through a financial advisor.

As a Wealthify customer, you can invest in a range of financial products. These include:

- ISAs

- Pensions

- General Investment Accounts

- Junior ISAs

*Capital at risk

How Wealthify Invests for You

Many other investor platforms leave all the onus of investment selection to you. Not so with Wealthify.

Wealthify puts your money to work in a portfolio that is tailored to your risk profile. This is based upon your financial objectives, attitude to risk, and tolerance toward risk:

- Financial objectives are what you want to achieve with the money you have to invest

- Attitude to risk is how you feel about the risk involved in investing

- Tolerance to risk is about how a short-term loss might affect your finances

The investment team at Wealthify has developed its algorithmic investment process to select, manage, and adjust investments based upon five risk profiles:

- Cautious

- Tentative

- Confident

- Ambitious

- Adventurous

Wealthify’s algorithms will invest your money into a range of funds selected to match your risk profile. Mostly, these are ETFs and passive mutual funds. ETFs (Exchange-Traded Funds) track an underlying index or sector of the market, investing passively in them. (I helped to create the first ETFs in the UK, when trading equities at a company called Spear, Leeds, & Kellogg.)

Don’t let the way they invest fool you about the potential returns. Passive tracking funds have regularly outperformed actively managed funds for decades. In fact, long-term research shows 80% of actively managed funds (which are more expensive to own than passive funds) underperform their benchmark index.

In a nutshell, ETFs and passive mutual funds generally perform better and are much cheaper than actively managed funds. This means more of your money is invested and the potential returns you might make are generally better.

*Capital at risk

Great for Beginners

One of the things I like most about the platform is how good it is for beginners. It takes the mystique out of investing. Even if you have no knowledge of investing, you can get started on making your financial goals a reality. Wealthify’s expert team is behind your investments all the way.

Part of its simplicity is the platform’s design. It’s easy to follow, easy to use, and easy to stay updated. There’s no technical jargon to bamboozle you, and plenty of content written in layman’s terms to guide you. They also have a blog that delivers information in six categories:

- New to investing

- Saving for your children

- Planning for the future

- Planning for retirement

- Ethical investing

- Wealthify news and performance

Though not updated overly regularly, you’ll find plenty of information to whet your appetite and inform you.

Here are some other features that make Wealthify a great option for investment beginners:

From Little Acorns Tall Oaks do Grow

Many online stockbrokers require clients to invest high minimum amounts. Even platforms like Moneyfarm want you to invest at least £500 to get started. Not so with Wealthify. You can start with as little as £1 (£50 if investing in a pension).

I would always advise people to start small when investing for the first time, because it takes time to gain confidence in what you are doing ─ even when there is an expert team at the helm. Wealthify is perfect for this.

You Can Invest Little & Often, Easily

Whichever type of investment plan you choose, it’s easy to invest regularly. You can do this manually with a bank transfer, or by direct debit. (Tip: transfer your investment amount on the day you get paid before you spend it. I call this paying yourself first, and it’s a key to building long-term wealth.)

You Don’t Need to Be an Investing Genius to Get started

Apart from telling the system about your financial goals and risk profile, there is no stock or fund-picking for you to do. Wealthify’s experts do all this for you. They have built a robo advisor that uses huge amounts of data, experience, and history to create algorithms that select the best funds for your personal financial circumstances.

This team monitors performance and market risk, and adjusts these algorithms to ensure that fund selection stays in-step with evolving markets.

You Get a Diversified Portfolio

Whatever the amount you invest, Wealthify’s investment system diversifies your investment. This diversification includes:

- Around 15 funds (even for investments of less than £750)

- Around 6,500 investments in total

- Investment around the world

You’d never be able to invest in such a diversified way so cheaply when DIY investing. Wealthify can achieve this because of how much it invests for all its clients and its ability to split those investments.

No matter the value of your Wealthify Plan, you’ll benefit from the diversification that suits your risk profile and financial goals.

Funds from Some of the World’s Top Fund Companies

The fund managers that Wealthify uses funds from include some of the biggest and best known, such as Fidelity, Vanguard, BlackRock, Legal & General, and iShares. In effect, you will be investing in a ‘fund of funds’ – a wealth portfolio created by investing in several funds instead of individual securities.

This type of investment means you benefit from a wider range of investment expertise, with all the due diligence donkey work done by Wealthify’s investment team.

You Can Watch Your Investments 24/7

Forget about monthly statements and being in the dark about how your investments are performing. You can view the value of your plans online 24/7. With just a few clicks, you can make changes to them or withdraw funds.

The Plan Details page shows you what funds you hold, your transaction history, fees paid, and lifetime performance of your investment. It’s very easy to follow, too.

*Capital at risk

What About Customer Support?

The last thing you want to happen when using any service is to be left high and dry. For customer support, Wealthify does well here, too.

With live chat and a telephone helpline available between 8am and 6:30pm on weekdays and from 9am to 12:30pm on Saturdays, the customer service team has you covered. Or you could always email them for less urgent queries.

I also like their FAQ section on the Wealthify website. It covers everything from investing to types of plans, making withdrawals, investment calculators, and even includes a glossary of terms. With most of this type of service, I usually skip the FAQs and head straight to live chat.

Wealthify is different. Instead of its questions answering what they want you to know, they answer what you need to know, and more.

How Much Will You Be Charged to Invest?

Charges on investments can make a huge dent in your long-term wealth. Here’s an example for a 10-year investment plan with an annual return of 5% before charges:

| Initial Investment | £1,000 | £1,000 | £1,000 |

| Monthly Investment | £100 | £100 | £100 |

| Initial Charge | 1% | 1% | 0% |

| Annual Management Charge | 1.5% | 1% | 0.75% |

| Fund Value After 10 Years | £15,596 | £16,198 | £16,425 |

| Fund Value After 20 Years | £36,200 | £38,307 | £36,200 |

Wealthify charges a flat annual fee of 0.6% to manage your funds. It doesn’t charge to deposit or withdraw money, or to transfer or close your plan. Other costs amount to around 0.16% per year. For every £1,000 invested, this makes an investment charge of around £7.60, which is debited at around £0.92 monthly.

*Capital at risk

How Good is Wealthify’s Investment Team?

How your money is invested depends upon several factors. This includes your attitude toward risk and how the financial markets are moving.

While the system and its algorithms will use the information you supply to keep your investment aligned with your risk profile and financial goals, the assets held in your Wealthify portfolio are determined by Wealthify’s investment team and the expertise of the fund managers they use.

The funds used to build your portfolio contain a selection of financial assets. These may include:

- Cash

- Cash equivalents

- Government bonds

- Infrastructure

- Property

- Shares

What you really want to know is how Wealthify’s portfolios have performed, right? Here’s a breakdown of performance between 29th February 2016 and 31st March 2023:

| Risk Profile | Gain |

| Cautious | 6.4% |

| Tentative | 17.7% |

| Confident | 29.4% |

| Ambitious | 39.8% |

| Adventurous | 52.9% |

On a per-year basis, the performance for these portfolios for the five years to and March 31st 2023 is:

| Risk Profile | 2018/19 | 2019/20 | 2020/21 | 2021/22 | 2022/23 |

| Cautious | 2.49% | 1.96% | 2.90% | -2.24% | -6.32% |

| Tentative | 2.82% | 0.24% | 8.72% | 0.33% | -6.03% |

| Confident | 3.08% | -1.74% | 14.48% | 2.83% | -5.62% |

| Ambitious | 3.26% | -4.55% | 20.68% | 5.44% | -4.89% |

| Adventurous | 3.67% | -7.52% | 27.42% | 7.97% | -4.76% |

How Safe is Wealthify?

It’s not only fund performance and ease of use that matters when you’re investing your hard-earned cash. While fund values can go down as well as up, you’ll want to know that your money is protected against fraudulent activity or bankruptcy.

Wealthify is as safe as they come.

The company is registered with the Financial Conduct Authority, which means it has passed all the tests to be authorised to manage your money.

The money you hold with Wealthify is also protected under the Financial Services Compensation Scheme (FSCS). If Wealthify should experience a financial setback, your money is protected up to £85,000 – exactly like it would be in any other FCA authorised institution.

On top of this protection, because your investment is in funds managed by other companies, Wealthify cannot access these funds. The money you have invested in them can only be accessed to return to you.

There’s more, too.

You can also give your account extra protection from cybercriminals, by using two-factor authentication (2FA) to access your account. To log in, you’ll need to enter your password and a random code sent to your phone to verify that it is you.

*Capital at risk

It’s Easy to Set Up a Wealthify Account

You can get started investing through Wealthify in only a few minutes. It’s one of the easiest account opening processes I’ve come across. You won’t be charged to open your account and will only need to invest a minimum of £1 (except for pensions, in which the minimum investment is £50). Oh, and you’ll need to be at least 18 years old!

Let’s walk you through the account opening process, with screenshots from the desktop version of Wealthify.

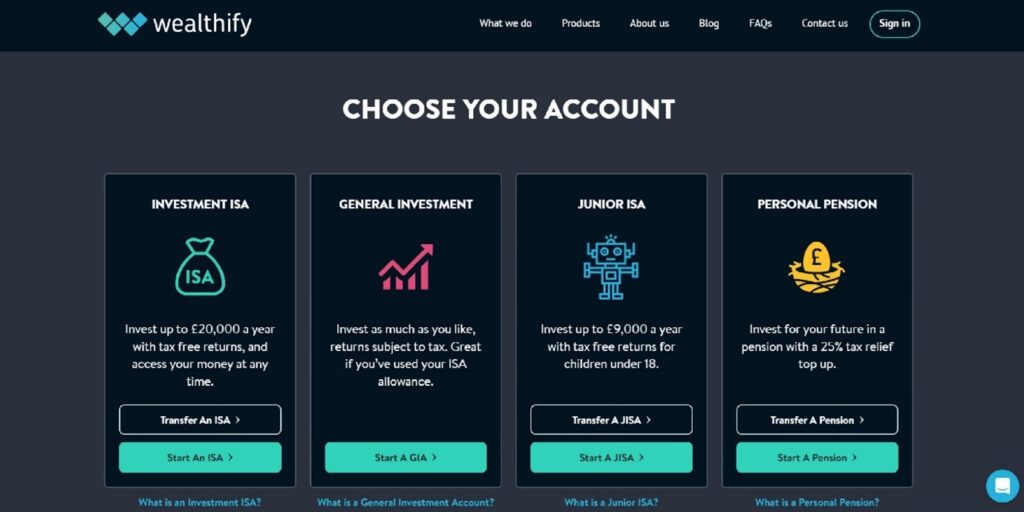

Step 1: Choose Your Account

The first step is to navigate to the ‘Create a Plan’ page and choose your account type. You’ll have four options:

- Investment ISA – holding your investment in an ISA wrapper means that any capital gains and income produced will be tax free. You have an ISA allowance of £20,000 in 2023. Before you decide how you wish to invest, you should check to see if you can use your ISA allowance – who likes paying tax?!

- General Investment – you can invest as much as you like, though any money you make will be subject to tax. If you’ve already used you ISA allowance, this is the route for you, unless you want to plough money into a pension.

- Junior ISA – If you’re investing for a child (certain rules apply) you might decide to invest via a Junior ISA wrapper. This allows you to invest up to £9,000 per year, with all returns tax-free.

- Personal Pension – if your goal is to create a fund to deliver income in retirement, then a personal pension plan (called a self-invested pension plan, or SIPP) is the route for you. Your money will be inaccessible until retirement, but you will benefit from tax relief on the money you invest.

I selected to make a General Investment, by clicking the ‘Start a GIA’ button:

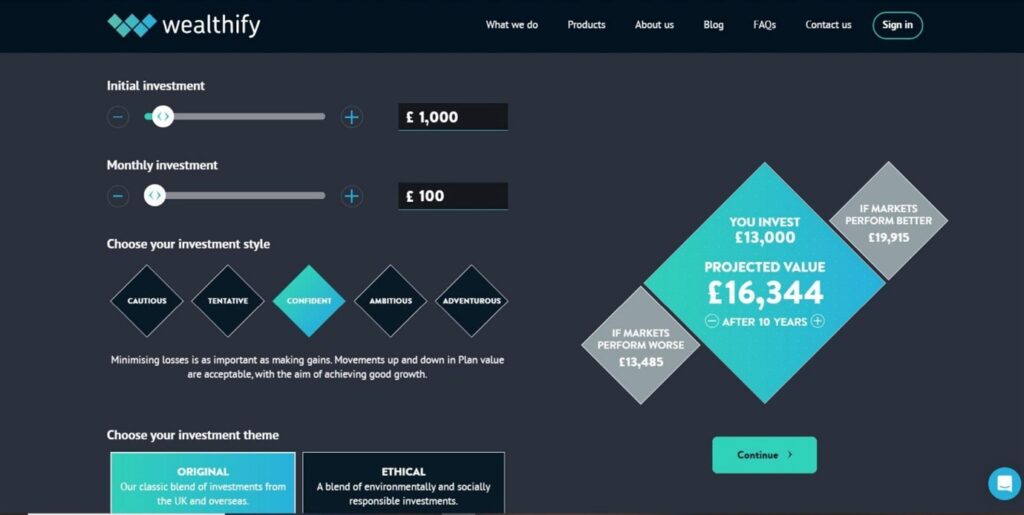

Step 2: Create Your Investment Parameters

Next, you’ll need to create your investment parameters, by selecting:

- Your initial investment amount

- How much you plan to invest monthly (if you do)

- Your investment style (your risk profile)

This will then indicate a projected value of your investment over 10 years. You can change this timeline to see how your investment might grow in a shorter or longer time, which is cool to see so easily.

I selected an initial investment of £1,000 and a monthly investment of £100 with a confident investment style. I also chose an ‘original’ investment theme:

Once you have selected your investment parameters, click on the ‘Continue’ button.

Step 3: Review Your Investment Summary

You are now presented with a summary of your investment selection. This explains projected values, the fees you will pay, and how diversified your investment plan is. You can see a list of funds that you’ll be invested in, as well as the asset mix, and geographical reach of your investments. I recommend that you print or save all these pages for your records.

When you are satisfied with your selection, click on the ‘Continue’ button.

So far, you’ve spent only a couple of minutes to create your portfolio. That’s way faster than most other robo advice apps I’ve tried out.

My advice here is to ‘play’ with your investment styles. You’ll be presented with different results and be able to see how each theme impacts outcomes.

Step 4: Create Your Account

Next, enter your name and email address. Click on ‘Create My Account’.

Now you’ll need to fill in a suitability questionnaire. You’ll be asked a few simple questions. This enables the system to confirm your attitude to risk and that the investment style you have chosen is suitable for your current financial position and financial goals.

If you pass this suitability test, then you’ll be able to fund your investment. It’s much slicker than investing through a face-to-face financial advisor, and gives you a real sense of being in control.

Whichever account type you choose, the application process follows the same steps. You could be set up and invested within just a few minutes.

*Capital at risk

What Do Customers Think of Wealthify?

While I like to make up my own mind about services and products I review, I also like to take note of what others have to say about them. The Trustpilot reviews of Wealthify are convincing, with three quarters of all customers giving five out of five stars. Here are just a few of the most recent:

Great First Impressions (15/06/23) – Early days yet, as my cash hasn’t been moved to investments (only set up the account yesterday, and cash appeared sooner than expected). Everything has been great so far ─ from initial application process through app installation and questions answered quickly via chat and secure message. Cashback sounds great too!

Excellent service (16/06/23) – User friendly ─ so simple and well presented, also live chat assistance was prompt and efficient.

Seems good )09/06/23) – I’ve been with Wealthify for almost 12 months and I’m currently up 2.42% which seems pretty reasonable. I’ve had to reach out to customer services about a couple of things over the last week (changed my bank for one) and they have been faultless. I only had a small investment but look to start adding more now and see how I get on.

Excellent service (17/06/23) – User friendly – so simple and well presented, also live chat assistance was prompt and efficient.

Good set-up and user friendly app (12/05/23) – The set-up process with questions aimed at sussing out your understanding of risks level were very useful. The app is very well designed and user friendly. Considering the current volatile market, my funds aren’t doing too badly. Communication is excellent and professional.

Great company (05/05/23) – Love this company! Have been investing for 5 years now and returns are a lot more than you could ever get from a bank. You also get a lot of help, information, and reassurance about how investments work and how markets are performing. And if you have any questions, they will always get back to you. I don’t agree with some of the negative reviews I have seen, this isn’t a get rich quick scheme. You need time and patience when investing.

The Bottom Line

Whether it is for work, housework, hobbies, or investing, I always look for ways to do things that will make life easier. When it comes to investing, this is exactly what Wealthify does.

It’s easy to get started and open an account, and great for beginner investors with little knowledge of investing. You’ll benefit from a highly diverse portfolio of investment assets that align with your risk profile. The funds invested in are provided by some of the world’s top fund managers.

On top of this, I also like Wealthify’s simple single-priced fee structure – and around 0.76% in total is by no means expensive. (Fees are higher if you wish to invest in ethical funds.)

Overall, an extremely user-friendly investment platform. Ideal for those in the early stages of investment experience, with plenty of information on its site to help you make better self-informed investment choices.

You’ll be able to view your portfolios 24/7, and there is no cost to withdraw funds. You’ll also benefit from great customer service. Owned by Aviva and regulated by the FCA, your money is protected under FSCS.

*Capital at risk