Knowing what everyone else is doing with their savings could be a good benchmark, right? Not necessarily. Here, we explain what the average savings are in the UK, where you stand, and how you can save handsomely even on a low income.

Something I learned at an early age, thanks to my parents, was the importance of saving. They used to insist that I saved 20% of my pocket money into a Post Office account. Because of this, at the end of the year I always had some money for Christmas presents.

As I grew older, this savings habit meant I was never caught with my pants down financially. If I needed a repair on my car, I had the money in an emergency fund.

In fact, the only times I’ve been in financial trouble (and yes, there have been some) is when I had neglected to save.

The cost-of-living crisis has been tough on savers. Forget saving anywhere near 20% – a recent study by City Index found that households are now only saving an average of 3.25% of their disposable income.

As if that’s not bad enough, The TUC has forecast that household debt will explode by 11% in 2024. But, enough of the doom and gloom.

I’ve looked at average savings in the UK, and I’ve got some good news. Even if you’re on a low income, with a little bit of planning and financial wizardry (actually, just a bit of simple budget planning using the best financial tools), you could turn less than £1.65 a day into more than £4,500 in four years.

30-Second Summary On Saving

The average savings in the UK sit at £11,185. But that figure doesn’t tell the whole story.

It’s a mix of highs and lows, where more than 20 million adults have under £1,000 tucked away, and around 11 million have no savings at all. This contrast really does demonstrate the stark divide between different financial realities.

However, despite the tough times, with a little budgeting nous and financial planning magic, you can still grow your savings. Even the lowest earners could turn less than £1.65 a day into over £4,500 in four years.

How Much are the Average Savings in the UK?

The quick answer to this question is £11,185 (so says the latest survey from Finder), which is a figure likely to leave a lot of people feeling demoralised.

However, this number doesn’t paint the real picture, but instead merely highlights the vast difference between the haves and have-nots in the UK.

If we look deeper, we find that more than 20 million adults have less than £1,000 in savings, and 11 million of these have no less than £100. In 2022, families on low incomes only managed to save an average of £95 over the full year – and things have hardly improved since then, have they?

The worst savings numbers are in the lower age groups, which, I guess, is to be expected.

Generally speaking, if you’re under 25, you won’t have been working long enough to build up your savings. Then, there are small matters like buying a house, getting married, and having children to pay for.

As you grow older, many of these costly expenses fall out of your budget, and you should be earning more than you did in those early years of work.

Here’s how age makes a difference to average savings pots:

| Age | Average Savings |

| Under 25 | £3,636 |

| 25 – 34 | £3,748 |

| 35 – 44 | £5,714 |

| 45 – 54 | £9,402 |

| 55 – 73 | £18,245 |

| Above 74 | £36,940 |

It’s not only in cash savings that so many of us are underprepared for what life has to throw at us. If you look at the average pension pot in the UK, you’ll find that it’s woefully short of enough to provide a comfortable lifestyle in retirement.

Do I Need to Save?

Oh yes, you should be saving. It’s incredibly important, not only to build finances for your future, but also to give you a financial buffer for when things go wrong.

With an emergency fund in the bank, a small emergency won’t become an insurmountable financial crisis. Having readily accessible cash in a high-interest savings account will prevent you needing to approach family or friends, or taking on debt that you can’t afford.

Those with no savings are much more likely to spend on credit cards, which leads to high interest charges and even less money in your pocket.

The Upward Savings Spiral

If you’re in debt, the interest you’re charged is like a downward spiral to more debt. When you’re saving, this effect reverses.

The more you save, the more interest you receive. If you allow your interest to remain in your savings account, you’ll earn interest on that, too.

This is called compounding, and it’s one of the keys to creating real wealth. (Just ask Warren Buffett, who calls compounding the ‘eighth wonder of the world.’)

The Joy of Saving – Financial Freedom

Saving money gives you financial freedom. Whether it is to put money away for a rainy day, save for the expense of Christmas, or invest toward your retirement, a pot of cash is like a comfort blanket – life can throw what it likes at you, but you’ll always be able to respond financially, and without worry.

Don’t underestimate the power of a savings pot to transform your life – you’ll be less stressed and make much better money decisions.

The Ability to Profit from Opportunity

When I was much younger, my then boss recommended that I buy shares in the company we worked for. For two years, I could have bought a total of £6,000 of shares via the company share scheme, which would have allowed me to buy the shares at 75 pence.

I couldn’t do this because I didn’t have the money. I was going through a period where saving was hard.

Big mistake.

The company was bought by a far larger organisation at a share price of £5.60. I’d missed almost £40,000 of pure profit. All because I didn’t have the savings to take advantage of the opportunity.

Whether it’s an investment opportunity, or your desire to get out of the rat race and build something special via the route of self-employment, it’s much harder (often impossible) to take advantage if you don’t have savings behind you.

You still have the rent or mortgage to pay, and food to put on the table. The more you have saved, the less anxiety you’ll have when presented with opportunity.

How Much Should You be Saving?

My parents were onto something when I was a kid. There is no way they could have been called financial experts, and they certainly didn’t have high-paying jobs.

My mum worked two or three part-time jobs, and my dad had various roles including hospital porter, handyperson, and chauffeur. But they always put money away for a rainy day and more.

Now, having experience in personal financial advice for several years, I can tell you that the experts advise you to save 20% of your take-home pay each month. “Impossible!” you say. Well, let’s have a look, shall we?

How Much Can You Save?

The most recent surveys show that the average monthly household saves around £450 per month. Now, if you’re thinking this is a load of tosh, you’d be right. Because those who save way more than the average distort this number.

The truth is that the top 20% of savers manage to stash away more than £1,800 each month, while the bottom 20% save nothing at all. Worse still, if these non-savers were able to, they would (in theory, at least) spend an extra £350 each month on top of their current outgoings.

The chances are that you lay somewhere between these two extremes. If you do, and you’re not saving at least £180 per week, you are firmly in the bottom 50% of savers.

Wherever you sit in the savings league, you need to either start saving or save more. Your lifestyle today and in the future depends on it.

Saving starts with good money management and financial habits. The first step is to take control of your finances with effective budget planning.

Budgeting to Save

I remember Friday evenings, we would usually have a tea of bread and cheese, waiting for my dad to return from work with his pay packet.

Back then, weekly pay came in a brown envelope. The envelope would be opened, and my parents would divide the cash into separate jars – one for rent, one for food, one for utilities, and so on.

The first jar to be filled would always be the savings jar. The last to be filled would be the free cash jar – the money they had left over for life’s little pleasures.

And therein lies the first step to successful saving: budget to save first and spend last.

So, let’s look at the standard advice of how to budget, which tells us you should allot 50% of your net pay to household bills like rent, utilities, and food. This leaves you with 30% to spend on yourself – including clothes, going out, and (if you have children) books and other items for school.

The final 20% should be saved. “Easy for you to say, Michael!” I hear you tell me. Yep, real life is a far cry from theory, isn’t it?

But can you do better? Most people can’t – the amount that UK households save has averaged 8.7% over the last 10 years, though this increased to more than 10% in the last quarter of 2023.

Can you increase how much you save?

To Save Well, Know How You Spend

Most people live to their means. In other words, they get paid at the end of the month and their focus (without knowing it) is on spending what money they have. If they are lucky and have a smidgeon left over, they may put this in a savings account.

Yeah, not a good financial strategy, is it?

To become a good saver, you first need to understand your bad spending habits. Are you a compulsive spender? Do you buy things on a whim? Is spending money an addiction for you?

Tracking your spending is key. When you see how you spend your money, and on what, you can take action to replace bad spending habits with good ones:

- Instead of wasting money on wants, you’ll focus on your needs

- You’ll mend and maintain instead of trash and replace

- You’ll save for major purchases instead of putting it on plastic

- You’ll look for ways to cut your spending, by shopping at the cheapest supermarkets

Yes, it can be difficult to take the action you need to transform your finances, but you can’t complain if, for example, you smoke a packet of cigarettes or down six pints each day. You have the financial muscle to save, but do you have the willpower?

Track Your Spending to Save More

Tracking your spending doesn’t have to be challenging. It’s not like you must keep every receipt and a manual log of your expenses. You don’t even need to open a spreadsheet and key in your spending.

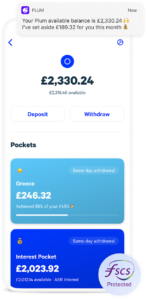

Apps like Plum let you link your financial accounts and analyse your spending easily. It will tell you how much spare cash you have, and automatically sweep it into a separate account from which you can choose to invest it in diverse ways.

Another budgeting app that I really like is Emma. This comes with a stack of inbuilt tools that will help you take control of your money. It helps you understand your finances, create rolling budgets, set savings goals, and gives cashback on eligible spending.

Perhaps a different route would be better for you. A Monzo account includes budgeting and savings tools.

I particularly like its jars facility – just like my mum and dad used to do, you can set up your digital jars to put money by for all your needs, from rent or mortgage to Christmas saving and long-term savings.

Simple Ideas to Spend Less Money & Save More

If you’re finding it tough to save money, it’s time to be more strategic and figure out how you can reduce your outgoings. I haven’t yet met anyone who could not cut their spending, and often by thousands of pounds each year.

Here are a few ways to save money:

- Plan your meals to reduce waste.

- Make a shopping list and stick to it – cut out the impulse buys!

- Reduce your utility bills – turn off lights, unplug electrical items you aren’t using, and turn your heating down a notch.

- Cancel unused or underused subscriptions like the gym, Sky, Amazon, and unused insurance policies.

- Buy stuff when it’s on sale, but only if you need it.

There are dozens of ways to save money – get creative and be more diligent about your spending.

Automate Your Saving

A simple strategy to help you save more easily is to automate your savings. This could be by simply paying money into a savings account as soon as you get paid, to using autosave features of various budgeting apps.

One of the features I love about apps like Plum and bank accounts like Monzo is the roundups feature. You won’t even realise you’re saving money.

The idea is simple, and replicates taking the loose change you would build up in your pocket throughout a day of normal spending and putting it into a savings jar

All that happens is that a debit card spend of, say, £2,57 is rounded to £3 and the extra 43 pence is deposited onto a savings account. Simple saving with no effort!

Should You Pay Off Debt First?

Oh, this is easy to answer, isn’t it? Just go with conventional wisdom that says always pay off debt.

The problem is, it’s not always the case. Some debt is what I’d call good debt, while other debt is extremely bad for your wealth.

Examples of good debt include mortgages and student loans. When you borrow on a mortgage, you are taking on debt that will, hopefully, increase your wealth in the future, and certainly put a roof over your head in the present. A student loan is an investment in yourself, improving your job prospects and earnings potential.

Examples of bad debt include credit cards, car loans, and payday loans (please, avoid these at all costs). This type of debt is expensive, and often taken for depreciating assets or everyday spending.

So, should you pay off debt first?

The answer is not clear cut, and you’ll need to consider your personal situation, type of debt, and interest charges.

Save On A Low Income

Just like there are plenty of ways you can reduce your spending to save more, there are plenty of strategies you can use to boost the returns on your savings. You simply must get clued up to what’s available to you in your circumstances.

Don’t let a low income stop you from saving. You have an incredible opportunity to be a savings superhero, with a strategy that will earn you the equivalent of around 32% APR (annual percentage rate).

Best of all, this saving strategy has no risk, and it’s perfect if you want to save a deposit for a first home, or to save toward your retirement.

To put this strategy into action, you’ll need to use two specific financial instruments.

The first is the Government Help to Save Scheme.

You’ll need to be over 18, a UK resident, and receive Working Tax Credit, Child Tax Credit, or Universal Credit of £722.45 per month (either yourself or with your partner). You can deposit up to £50 per month into this scheme – just under £1.65 per day – for four years.

The second is a Lifetime ISA (LISA).

This is a special kind of ISA available to you if you want to save toward buying your first home or toward your retirement. You’ll need to be over 18 but under 40 to open a LISA, and can deposit up to £4,000 a year.

Here is what is so special about these two schemes:

- You get a 50% government bonus on your savings into a LISA (though certain rules apply)

- You get a 25% government bonus on your deposits into a LISA

Here’s a step-by-step guide on how to work this strategy:

| 1. | Open a Help to Save Scheme account, and deposit £50 per month into the account for two years. |

| 2. | At the end of the two years, you receive a 50% bonus on your balance of £1,200. |

| 3. | Use this £600 bonus to open a LISA, and receive a 25% bonus (an extra £150). |

| 4. | Continue to invest £50 per month into your Help to Save Scheme for another two years. |

| 5. | Four years has passed by. Here, you’ll receive a 50% bonus on the difference between the highest balance held above the end of the two-year balance and the highest balance held during the last two years. |

| 6. | In this case, this will be £1,200 – another £600 bonus. Deposit this £600 bonus into your LISA and receive another £150 bonus. |

| 7. | You have £2,400 remaining in your Help to Save Scheme account. Withdraw this and deposit it into your LISA. |

| 8. | Receive a bonus of £600 on this deposit. |

The total in your LISA is now:

(£600 + £150) + (£600 + £150) + (£2,400 + £600) = £4,500

Yep, you have been saving just £1.65 per day. A total of £2,400 over four years. You come out with £2,100 profit, thanks to the government!

Oh, and this example doesn’t include any other growth of interest you achieve on your LISA.

Take Control of Your Savings, and Be Better Than the Average Saver

This is just one example of what strategic thinking could do for your savings and investments.

You can develop your own strategy to suit your unique personal circumstances and financial goals using one or more specific financial instruments, apps, savings accounts, investment accounts, and tax strategies – and you can get all the information you need on this Wallet Savvy website.

The real key to saving more is to understand your spending habits, reduce your outgoings, and then budget to save.

If you really want to power up your savings while you power down your energy use, and develop good depending habits, you could also find a part-time job or use your experience, skills, and passion to create a money-making side hustle.

There is nothing, except you, in the way of achieving all your financial goals.