If you’re a freelancer or small business looking for the best way to get your banking in order, then it’s worth considering Tide. Take a look at our Tide review to see what it offers, and whether it’s the business banking solution you need.

Wallet Savvy is a reader supported website. This means that some pages include links to products or services that we recommend and we may earn a commission when you make a purchase. You will never pay more by choosing to click through our links.

Post date

Post author name

Michael Barton

This article has been fact checked by a member of the Wallet Savvy editorial team and complies with our editorial standards.

If you run a small business like me, you’ll know how crucial it is to keep on top of your business finances. If you’re fed up with sub-par banking from your existing business banking, or you’re starting a new business, Tide could be the answer you seek.

TLDR: Our Verdict On Tide

Tide is a great alternative to traditional banking options for freelancers and small/medium-size businesses. It may fall short of some elements at the moment – like overdrafts – but it makes up for this with its easy-to-use app that puts you in control of your business finances.

You’ll find the account is easy to set up, and you can even set up a company through Tide for free! The fees are reasonable, and certainly transparent. Probably not the right choice if you transact in foreign currencies, but if your business is UK-based with UK customers, this could be ideal for you.

What Is Tide?

Tide is one of the new breed of challenger banks. Formed in 2015, Tide is a digital bank that is proving to be an effective alternative to the mainstream banks for businesses.

You manage your business account from the app. It’s like having your bank in your pocket, providing real-time info on all the credits and debits through your business account. It’s also very cheap compared to typical business bank accounts.

Who Is the Tide Account For?

A Tide account is highly suitable for most freelancers and small or medium-size businesses. It’s easy to open, and you can integrate it with your other bank accounts and most accounting software.

However, if you prefer face-to-face banking (personally, I haven’t been into a bank branch for three or four years), or you make a lot of cash withdrawals and payments, then Tide may not be for you. You’ll understand why in the next few minutes of reading time.

Tide Account Options

When you open your account at Tide, you’ll be presented with four options. If you’re starting out in business, then the free account will probably be best for your needs. If your business is growing, then you’ll probably need the Plus account. The Pro account offers the next step up, and if your business has a high turnover and you make multiple payments each month, the Cashback account is likely to be the one you want.

The (Free) Standard Account

This is the no-frills business account. Although it’s billed as free, you will incur some charges (yes, banks need to make money!). Mostly, these charges are on payments and transfers in and out of your account.

As you’d expect from a free account, you’ll only have access to basic banking features, but in my experience, these are enough for most one-man-bands and micro businesses.

The Plus Account

The next step up, the Plus Account delivers a little more than the Standard Account. For a start, you’ll get 20 free money transfers each month. You’ll also get a free expenses card, and have access to phone support and priority in-app support. (On the occasions I’ve needed support with my business banking, I’ve found that phone support is worth its weight in gold.)

The Pro Account

Is your business growing, but not quite at the ‘bigger business’ stage? Then Tide’s new Pro Account may be the most suitable. You’ll get two free expense cards and unlimited free transfers in and out of your account. You’ll also get phone support and priority in-app support, as well as exclusive member perks.

The Cashback Account

Tide’s highest premium account. You’ll get 150 fee-free transfers per month, access to a dedicated team of account managers, and 0.5% cashback on spending on your Tide card.

Comparison of Account Features

As you can see, Tide offers a sensible band of accounts that increment in features and cost. Here’s a visual guide on comparisons between them:

| Standard | Plus | Pro | Cashback | |

| ACCOUNT FEE | Free | £9.99 p/m (plus VAT) | £18.99 p/m (plus VAT) | £49.99 p/m (plus VAT) |

| FEATURES | ||||

| Tide Business Card | Free | Free | Free | Free |

| Expense Card | £5 p/m | 1 Expense Card Included | 2 Expense Cards Included | 3 Expense Cards Included |

| Transfers In/Out of Account | 20p Per Transfer | 20 Transfers p/m For Free | Unlimited | 150 Transfers p/m For Free |

| ATM Withdrawals | £1 | £1 | £1 | £1 |

| Read Access For Members | ✓ | ✓ | ✓ | ✓ |

| Scheduled Payments | ✓ | ✓ | ✓ | ✓ |

| Accounting Integration With QuickBooks, Sage, Xero, and more | ✓ | ✓ | ✓ | ✓ |

| Up To 5 Business Accounts | ✓ | ✓ | ✓ | ✓ |

| Create & Send Invoices For Free | ✓ | ✓ | ✓ | ✓ |

| Priority In-App Support | ✗ | ✓ | ✓ | ✓ |

| Phone Support | ✗ | ✓ | ✓ | ✓ |

| 24/7 Legal Helpline | ✗ | ✓ | ✓ | ✓ |

| Exclusive Member Perks | ✗ | ✓ | ✓ | ✓ |

| Support With Trademark Filing & Disputes | ✗ | ✓ | ✓ | ✓ |

| Dedicated Team Of Account Managers | ✗ | ✗ | ✗ | ✓ |

| 0.5% Cashback | ✗ | ✗ | ✗ | ✓ |

Tide – Free Company Set-Up

As anyone who has set up a company knows, it’s not hard to do. However, Tide helps to streamline the process and allows you to set up your company for free (other companies often charge hundreds to do this for you). All you need to do is follow these four steps on the Tide app:

- Search for an available company name

- Enter your business and personal details

- Receive your limited company registration certificate

- Get your free business bank account at the same time

Tide takes care of your company registration, and your business account should be ready to use within minutes.

As a limited company, you’ll be liable to corporation tax instead of income tax as self-employed, though there are also some cracking benefits that you can claim, too (Trivial benefits is one that few accountants seem to know about!).

Integrate with Accounting Software

A very cool feature of Tide is its ability to integrate with your accounting software. Every transaction that appears on your bank account will appear in your accounting software. It only takes a few minutes to set up, and saves hours or more each year.

I’ve got my business bank accounts integrated with my accounting software. My end-year accounts take less than an hour for me to prepare. It saves me the cost of a bookkeeper, and makes monitoring my company’s financial position easy. It’s not quite real time, but it isn’t far off. (I also get plaudits from my accountant who loves the ‘clean’ books I present to him at the end of my financial year.)

Customer Support

Customer support is a bit of a bug bear of mine. If something should go wrong, I want to know that I’ll have help putting it right.

Tide’s customer support does exactly this. You access help directly from the app, and chat online with a member of their Member Support Team on the messaging feature.

As you’d expect, the higher up the account scale you are, the higher prioritisation will be given to your query. If you are on the Cashback account, you’ll have access to a dedicated account manager. This is just like the long-gone days when you could arrange your needs over the phone with your bank manager. (I do miss those.)

How to Set Up a Tide Business Account

It’s easy to sign up for and open a Tide account. A completely online process, you could be banking through Tide in only a few minutes. You’ll need to provide some basic details about your business.

You’ll also need to provide a couple of forms of ID, and be verified as the account holder. There may be one or two other security checks, but nothing that should be too onerous.

Once you have opened your account, you’ll receive your free Tide Mastercard in around three days. However, you can start to use your Tide account straight away. With the app downloaded, you’ll have a handle on your business finances immediately.

Tide App Features

The Tide app is intuitive and easy to use. You can do everything you’d expect to be able to do on a business banking app, including:

- Viewing your account balance, previous transactions, and forthcoming payments

- Connecting multiple accounts to track all your business activity

- Managing your card PIN, and freezing and unfreezing your card

- Reordering a lost card

- Creating financial categories to track your revenues and spending and improve business decisions

- Creating invoices

- Paying invoices

- Integrating with your accounting software

- Downloading and exporting statements and transaction details

- Setting up direct debits and standing orders

- Accessing the support team through live chat

Is Tide Safe?

Whatever stage your business is at, you’ll want to know that its finances are in safe hands. You can rest assured this is the case with Tide. It is authorised by the Financial Conduct Authority (FCA) and held accountable by the Bank of England through the Prudential Regulation Authority.

The Pros & Cons of Tide

Let’s summarise the good and the bad of Tide:

The Pros

- First, the app is super simple to use. It’s easy to keep track of your business finances and manage your money held in your Tide account, as well as other accounts that you have integrated with it.

- You’ll find some fantastic business tools on the app – such as the invoicing tool that makes it easy to create and send invoices. If you’ve been in business before, you’ll understand how important this is.

- Integrating with accounting software is a real benefit, too. This improves your bookkeeping accuracy, and makes it easy to provide a full and complete set of accounts.

- Its customer service is good, even at the non-premium end of the account scale.

- You can easily register a company through Tide.

- There are account plans for all businesses, though Tide is especially good for freelancers and small/medium-size companies.

The Cons

- Tide does not offer some account features that you might get elsewhere, such as overdrafts.

- It only allows UK transfers, so if your business is international then you’ll need to set up a separate solution (such as Wise or Revolut).

- You cannot pay in cheques or cash.

- While the support is good, you only get the best personal support when you pay for a Cashback Account.

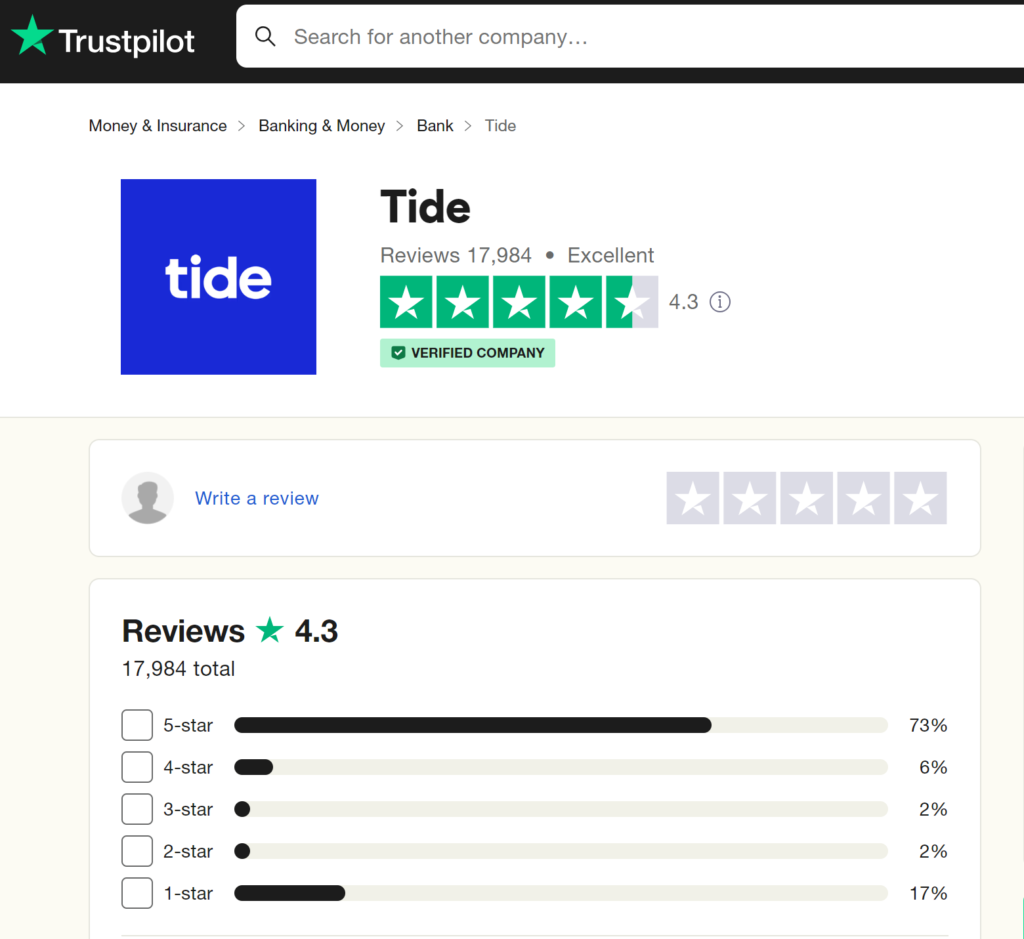

What Other Users Say About Tide

At the time of writing, there have been more than 17,000 reviews of Tide on Trustpilot. Overall, it has received an average rating of 4.3/5 stars. When you compare this to more traditional business account providers like Barclays and HSBC (with star ratings of around 1 to 1.5), you’ll see just how highly other users of Tide rate its account and app.

Tips to Maximise the Benefits of Tide

Tide offers a range of features that can significantly benefit freelancers and small businesses. To get the most out of your Tide account, consider these practical tips:

Integrate Tide With Your Account Software

Benefit from automatic and real-time updates to your financial records by integrating Tide with your current accounting software. This will save you valuable time and reduce errors, as well as give you an accurate and up-to-date overview of your business finances.

Utilise Tide’s Invoicing Tool

Tide’s invoicing tool allows you to create customised invoices with your business logo, contact, and bank details. It’s quick and easy to use, and will help you to track invoices and payments.

Manage Expenses Wisely

Tide’s free expense cards will help you to keep track of business spending. Use the categorisation feature to help you understand where you can cut spending, and keep your spending limits under constant review.

Regularly Review Account Features

Don’t miss out on Tide’s latest innovations and account enhancements. Make sure that you stay updated with any changes or additions to account features, and also ensure that the account you use is the best for your growing business.

Use the Company Set-Up Service

Starting a new business can include niggling costs that can be avoided. Tide’s free company set-up service will save you time and money – freeing you to focus on other aspects of your startup.

Alternatives to Tide

Still not convinced that Tide is for you? Here are a few alternatives you might wish to explore:

Revolut

Revolut offers a range of accounts, and enables you to operate across currencies. It is regulated by the FCA, provides a payment gateway, and offers accounts with various features, ranging from free-to-use to £100 per month.

Pleo

Not so much a bank as a financial management tool for businesses, Pleo helps you to control your business finances. You can set limits on each Pleo expense card, thus controlling company spending while giving employees appropriate financial autonomy.

Monzo

Back to challenger banks, and Monzo makes our list for freelancers/small businesses. You can integrate a Monzo account with accounting apps, and set aside some money for tax each month, too.

Mettle

An app-based account that allows you to create and send invoices from your smartphone. You can also manage recurring payments, and export your data, as well as integrate with accounting software.

The Bottom Line

Set up in 2015, Tide has proved itself to be a viable alternative to traditional banking for freelancers and small/medium-size businesses. You can access a range of account solutions, from the free Standard Account to the premium Cashback Account with a monthly cost of £49.99 (plus VAT).

The easy-to-use Tide app puts you in control of your business finances, with updates in virtual real time. It integrates with accounting software, helping to make end-of-year accounts and year-round bookkeeping a breeze.

You’ll find that Tide is easy to set up, offering a multitude of functionality, along with good customer service options. However, despite so many benefits, you won’t have access to some banking features, such as overdrafts. However, Tide are moving fast – when I first researched this challenger bank, they weren’t offering business loans – and now they are. They also added the Pro account. So watch this space for even more features.

Overall, we think that Tide certainly deserves its 4.3-star rating awarded by its users.