Want a helping hand figuring out where you stand with your pension and what you need to do to ensure a stable retirement? These best UK pension calculators do the legwork for you – but which is our top pick?

A pension calculator is a tool designed to help you estimate how much money you might receive from a pension when you retire. This might include the tax-free cash available to you.

I really got interested in these when I was getting closer to being able to take my tax-free cash from my pension fund. I’ve used several (and continue to do so when I review my retirement planning). They all do the same basic job of providing an indication of how much income your pension pot will deliver when you start to take benefits.

However, some pension calculators go a little further than others. Some allow you to easily adjust contributions, fund returns, and more, as well as detailing how much you should be contributing to accumulate the funds needed to produce your desired retirement income.

In this article, I’ll introduce you to what I consider the best pension calculators for UK residents. You’ll also learn why it’s crucial to use these tools, and a few tips to use them effectively.

Best Pension Calculator: Our Verdict

Each pension calculator I’ve reviewed here offers distinct benefits, from Standard Life’s user-friendly interface to Vanguard’s detailed adjustment options. Some, such as Hargreaves Lansdown’s pension calculator, give you the ability to adjust for various scenarios, while others like Nutmeg and PensionBee stand out for their ease of use and immediate feedback.

Personally, and while Standard Life’s Pension Calculator is my favourite, I suggest not limiting yourself to one calculator. Use a few at each financial planning review. You’ll get a fully rounded perspective, and be better informed to make the financial decisions that will keep you on track to the retirement lifestyle you desire.

Standard Life Pension Calculator

9/10

Standard Life’s Pension Calculator is easy to use. The way it is laid out makes it a little more user-friendly than Aviva’s tool and, in my opinion, easier to understand for financial planning.

After entering some basic information (age, gender, salary), you’ll be asked about your retirement goals – and I love this piece of the tool. You’ll get a choice ranging from More Limited to More Prosperous. This is based upon your current income, with each option including a description.

You’ll be able to include your existing pension funds, any contributions you and your employer are making, and, if you wish, change your retirement income target.

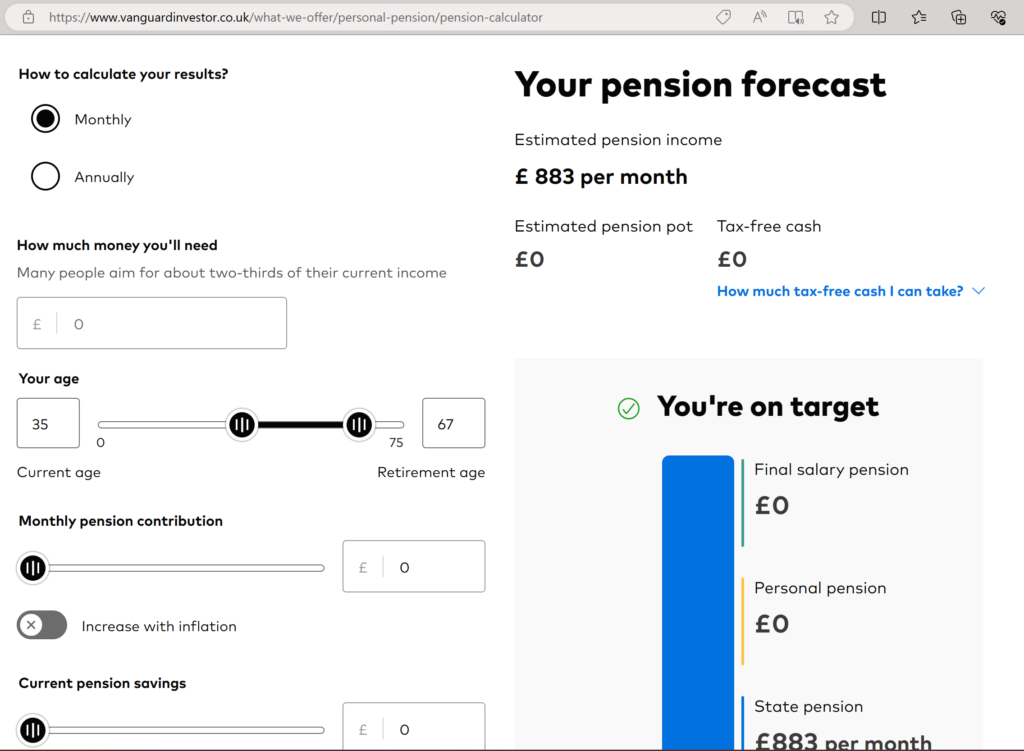

Vanguard Pension Calculator

8.5/10

With Vanguard’s Pension Calculator, you get to input your desired income in retirement.

This tool also allows you to adjust factors like your retirement age – it’s cool to see how this might affect your final pension pot and income. You also get to play with the potential growth rates on your pension fund, as well as enabling the tool to include inflation-linked pension contributions.

This is a one-page tool that will give you an income estimate within a minute, then almost walk you through the options available to you: increasing your pension contributions; delaying your retirement; or lowering your income target.

However, it doesn’t allow you to include employer contributions separately, so you’ll need to include these yourself.

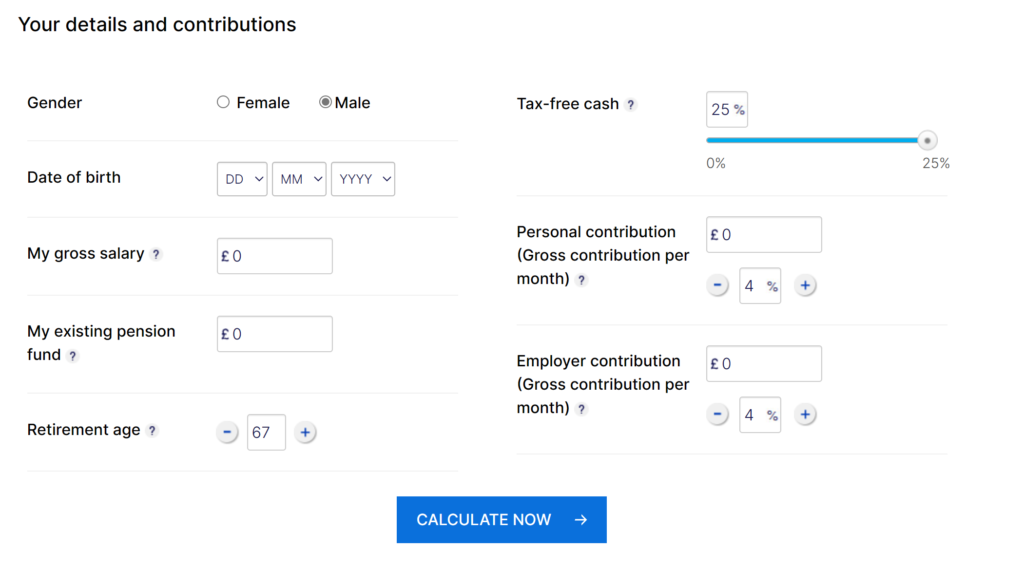

Hargreaves Lansdown Pension Calculator

7.5/10

Hargreaves Lansdown’s Pension Calculator is comprehensive without being complex.

On the first page of this calculator, you’re asked to input your salary, existing pension fund, and the contributions you and/or your employer makes – this is great for those with a workplace pension. It’s easy to either add the actual contribution amount or a percentage for the calculator to work out the amount.

All you need to then do is push the ‘Calculate Now’ button to receive an estimate of your retirement income.

What I don’t like about this calculator is that the output is limited to around two-thirds of your current income. On the other hand, you can easily see how your retirement income could be affected by increasing your contributions or delaying retirement.

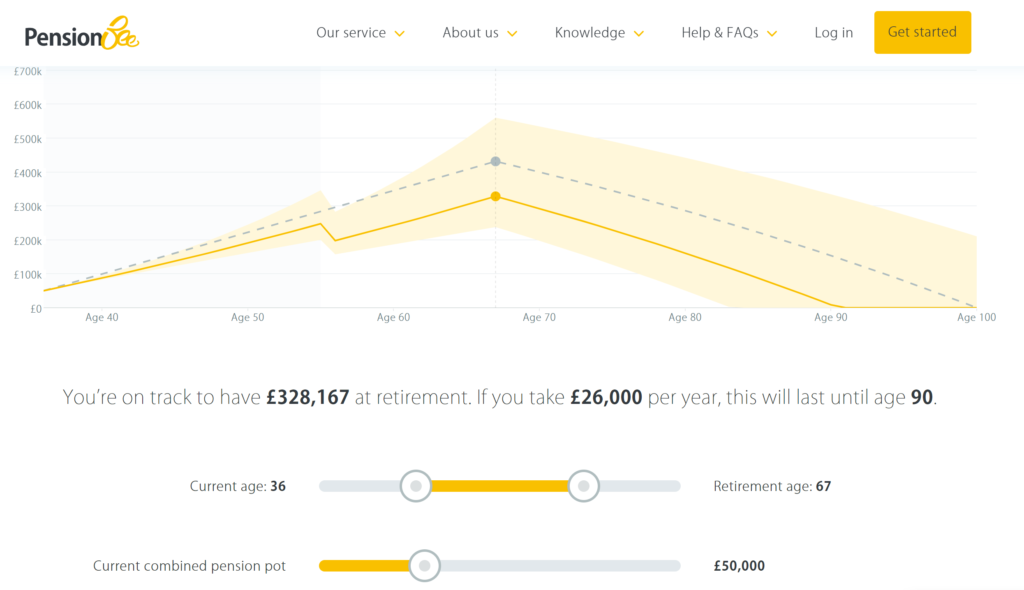

PensionBee Pension Calculator

7.5/10

PensionBee’s Pension Calculator is a more stylish calculator than most. It’s colourful and includes a neat-looking chart.

Like Vanguard’s Pension Calculator, this is a one-page solution that delivers a result in seconds. Despite this, it’s not quite so user friendly as other calculators. It uses sliders to adjust contributions, current pension pots, and desired income in retirement.

It also uses a set growth assumption, and shows a range of potential outcomes on the graph, which I find a little clunky and not informative enough.

This said, this pension planner makes it easy to see how long your desired income might last, but you must then ‘play’ with the inputs to see the difference adjustments to your planning can make.

Aviva Pension Calculator

7/10

Aviva’s Retirement Planner Pension Calculator is a clean, easy-to-use calculator, with a certain amount of flexibility.

It is more complete than most. It asks questions about your height, weight, and health (though you can elect not to take medical conditions into consideration).

You can add your current salary, and the value of any pension pots that you currently have, as well as other pension schemes (such as final salary schemes). You can also include the State Pension, though you cannot adjust this from the Full State Pension amount.

It uses certain assumptions to calculate potential income in retirement, though you can adjust these assumptions if you wish.

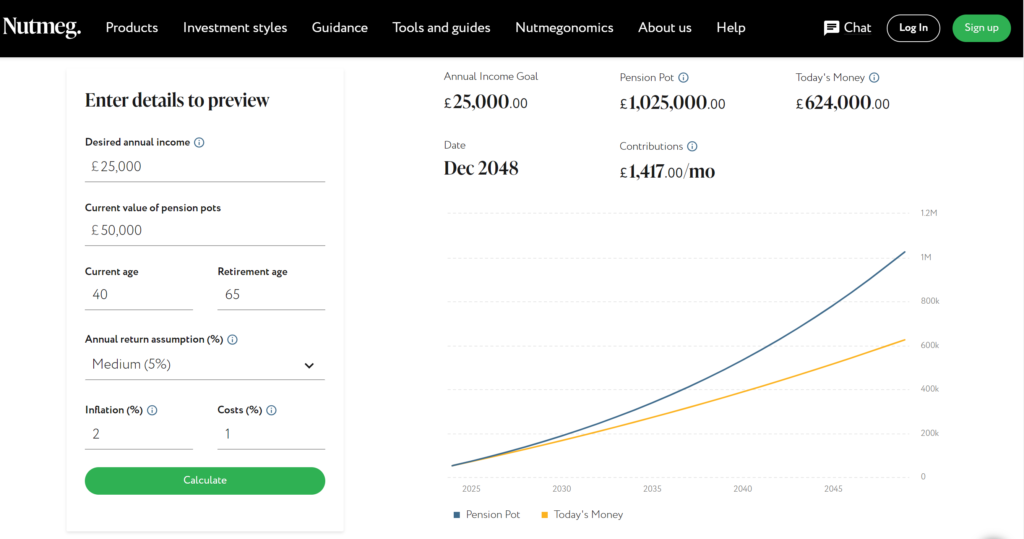

Nutmeg Pension Calculator

7/10

Nutmeg’s Pension Calculator turns the calculation upside down, beginning with the question “What’s your desired income in retirement?”.

What I like about this calculator is that it gives you an immediate indication of how much you’ll need to contribute to your pension to achieve your desired income (in today’s terms).

But it doesn’t include your State Pension, and you cannot split out your personal and employer contributions.

However, for its simplicity and the way in which it shows how much you need to invest to make up any shortfall, it gets a thumbs up from me. I just wish it would go further.

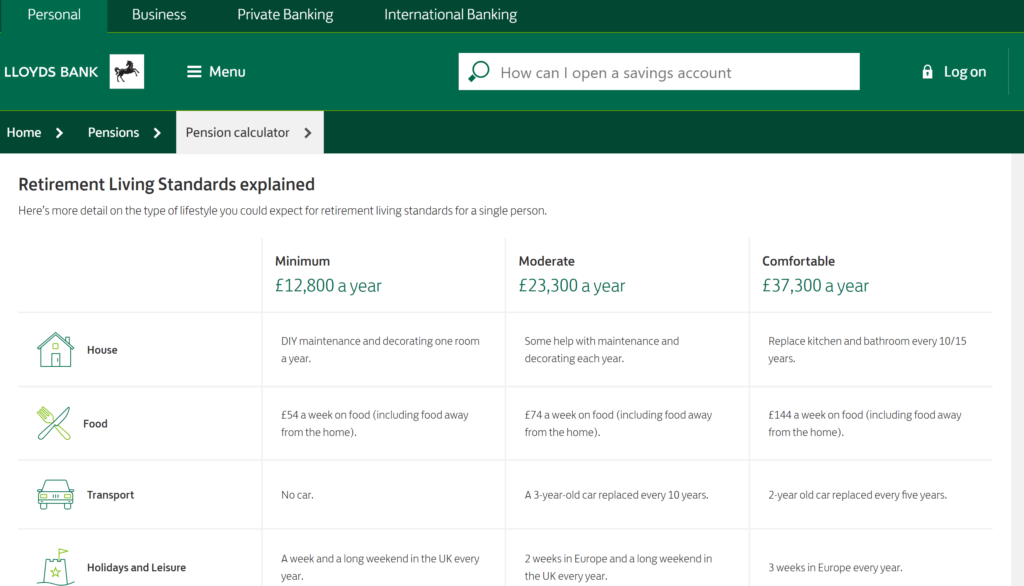

Lloyds Bank Pension Calculator

6/10

Lloyds Bank’s Pension Calculator is a very basic calculator.

One thing that I do like about this calculator is its explanations on Retirement Living Standards – they’re easy to understand and give you an idea of the type of lifestyle a range of different income might provide.

The calculation is made in seconds (there is not a lot of information you need to input), and includes the Full State Pension. You can then adjust your inputs to view what difference paying more into your pension or delaying your retirement age could make.

A useful and easy-to-use tool, but not as intuitive as it could be. It just feels a little like it has been developed by a bank that wants to sell you a pension!

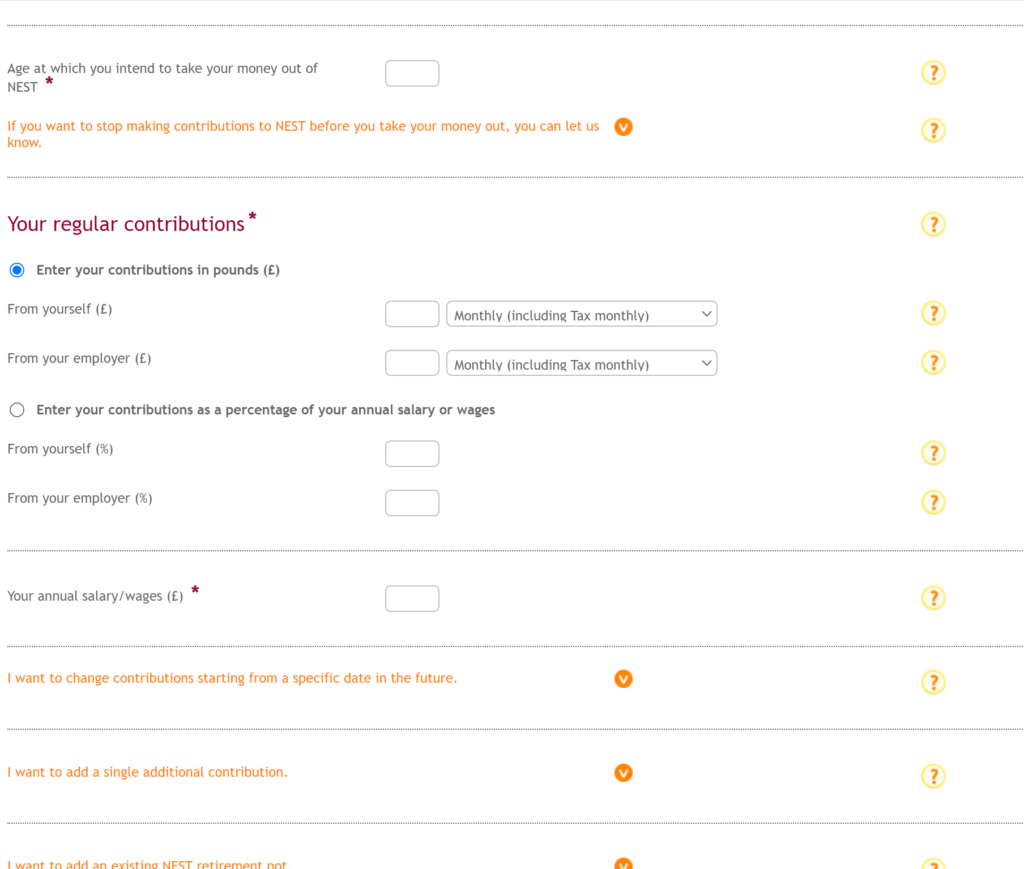

Nest Pension Calculator

6/10

The questionnaire for this calculator is the most comprehensive of all the pension calculators I’ve used.

However, this does not mean it is limited as a product. You cannot add in other pension pots (except by including them as a Nest pension), and the result is shown as an annuity quote.

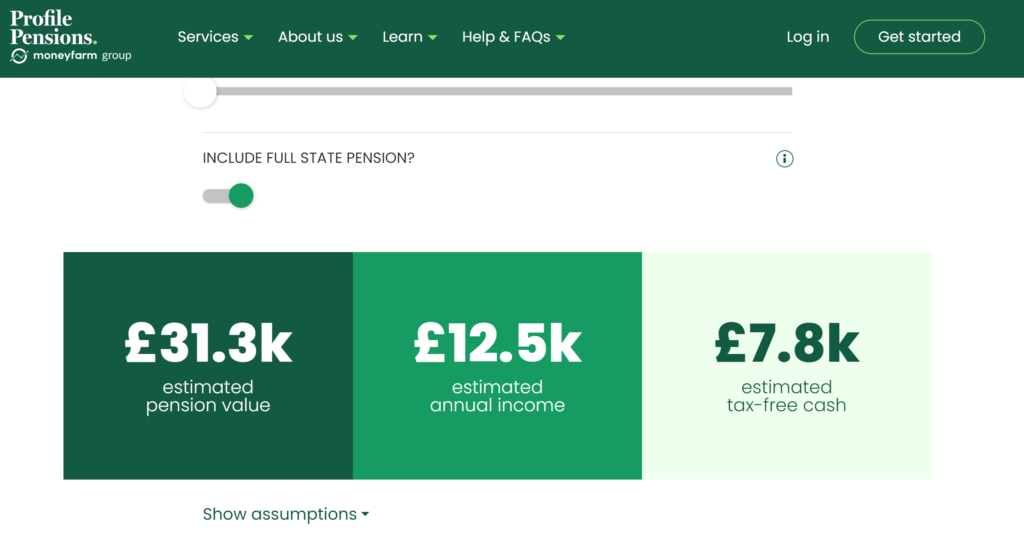

Profile Pensions Pension Calculator

6/10

This basic pension calculator from Profile Pensions is a good starting point if you’re on the first step of your retirement planning journey.

Asking one question – “How much income could your pension give you?” – you only need to input your gender, age, and the age at which you’d like to retire, estimated pension pot currently, and how much you are contributing to your pension.

You’ll receive an estimate of the income your fund could generate (including Full State Pension if you wish), and the tax-free cash you could take.

This calculator is quick and easy – showing a result in seconds – but it doesn’t allow too much personalisation. For example, you can’t enter your employer’s contributions separately (so you’ll need to calculate these yourself before starting).

The real juice here is then signing up for their pension personalisation review.

Legal & General Pension Calculator

5/10

Using only two pieces of information, Legal & General’s Retirement Income Calculator is the most basic of all the calculators in this review.

Enter your age and how much you have saved in your pension pot, and after a bit of whirring that looks like something sexy is happening behind the scenes, you’ll be presented with three estimates – one for a pension annuity; a second for a fixed-term retirement plan; and a third for income drawdown.

There are a few bits of useful information, but it’s clear that the objective is to encourage you to either ‘find out more’ or click on ‘Quote and apply’.

Why Should You Use a Pension Calculator?

Using a pension calculator is crucial. It’s going to save you a lot of work when you are figuring out how much income you might expect from your existing pension pots, and the gap between this and the income you’ll need to pay for the lifestyle you desire.

A pension calculator can also help you to ‘play’ with different scenarios, adjusting contributions, retirement age, earnings, and desired income.

Overall, by using a pension calculator you’ll be more informed when it comes to making decisions about saving and investing for your retirement. It also helps to reduce any anxiety about your retirement – and that’s peace of mind that will help you sleep more soundly.

Tips to Get the Most from Pension Calculators

Having used pension calculators for several years, I’ve learned a fair bit about how to get the most from them. Here are my top tips to help you do the same:

- Input accurate information to get more reliable estimates.

- Experiment with different scenarios to help you understand the impact of different decisions.

- Allow for different growth and inflation rates to get a realistic picture of the future.

- Understand the assumptions used by the calculator.

- Use any graphs and charts provided to get a visual look at the future.

- Use comprehensive calculators that allow you to add various pension pots, adjust for a variety of factors, and view different scenarios.

When Should You Use a Pension Calculator?

Whenever I review my pension (because I’m only a few years away from state retirement age, I do this every quarter), I’ll input all my information into three or four pension calculators. It only takes a few minutes and provides me with the information I need to help my retirement planning stay on track.

However, there are other occasions when you should include retirement planning in a financial review. These include:

- If you are considering changing jobs – what pension contributions will your new employer make compared to your current employer, and how will this affect your financial future?

- You experience a major life event – marriage, children, buying a home… all such events can have a significant impact on your finances and financial planning.

- When you receive a pay rise or bonus – should you contribute more toward your pension?

- Before making investment decisions – should you invest for your retirement instead of shorter-term goals?

You should also use pension calculators if you are considering early retirement and, in any case, 5 to 10 years before anticipated retirement to get a clearer picture of what to expect and if any last-minute adjustments are needed.

The Bottom Line

If you want to plan for your retirement, then pension calculators are crucial. They provide a window into your financial future, without having to spend hours in the rule books and on a spreadsheet. The best let you view different scenarios, adjust contributions, and include other pension pots and state pensions.

Each of the calculators I’ve reviewed in this article has its own pros and cons. Some excel in simplicity, while others are more comprehensive and complex.

While it’s essential to choose one that aligns with your specific requirements – and my favourite is Standard Life’s Pension Calculator – I suggest never limiting yourself to only one. Personally, I’ll use at least three of four when I review my pension planning.

When you use a pension calculator effectively, you’ll be more informed about how to shape your financial future. Employing pension calculators when you review your finances or when experiencing life-changing events will help you keep on track for the retirement you desire as your life evolves.