Looking for a way to give your employees an easier expenses system, while you have real-time control and a clear view? This Pleo review could be the start of finding the solution to your spending management…

Wallet Savvy is a reader supported website. This means that some pages include links to products or services that we recommend and we may earn a commission when you make a purchase. You will never pay more by choosing to click through our links.

Post date

Post author name

Michael Barton

This article has been fact checked by a member of the Wallet Savvy editorial team and complies with our editorial standards.

When I worked in the corporate world, we didn’t have services like Pleo, which is a platform that helps businesses manage their spending.

Back in the day, spending money on the company account and claiming expenses was something of a nightmare. I had to get permission to buy bigger ticket items and make sure I kept all my receipts to reclaim my expenditure. This was even true when I had a company Amex card. It felt like my boss was sitting on my shoulder everywhere I went.

Thankfully, times have moved on. Using services like those offered by Pleo gives a company’s employees autonomy of spending, while the company retains real-time control over it. This helps to improve efficiency, free up time, and manage company finances more effectively.

In this review, I take my magnifying glass to Pleo and the services it provides. Could it be the ideal expense solution for your business?

TLDR: Pleo Verdict

Pleo is a cloud-based platform designed to enhance business spending management. It offers features like automated expense management, digital receipt capture, third-party system integration, individual spending limits, invoice management, and more.

With real-time tracking of spending, a user-friendly interface, and seamless integration with existing business software, it’s a potent solution for businesses seeking to streamline their spending and expense processes, offering a balance of control, efficiency, and ease of use that management, admin, and employees will appreciate. It’s particularly cost-effective for smaller businesses and startups.

What Is Pleo?

Set up in 2015 by Jeppe Rindom and Niccolo Perra, Pleo is now used by more than 25,000 companies to help them improve their management of business spending. Using the cloud-based Pleo, you can:

- Automate expense management

- Digitise all receipts

- Integrate with third-party systems, like accounting and travel platforms

- Set individual spending limits

- Manage and pay invoices

- And more

Pros & Cons

Let’s get into the good and not-so-good of the Pleo platform right away. What are you going to love about it, and what might irk you?

| Pleo Pros | Pleo Cons |

| Real-time tracking of spending – no more waiting for expenses to be claimed or bank accounts to be updated. See your company’s expenditure as it happens, giving you ultimate control over budgeting and forecasting. | High fees on foreign transactions – if your business spends money in foreign currencies, the fees charged by Pleo are on the high side. |

| One-click merchant payments facilitated through Pleo’s support of digital wallets like Apple/Google Pay. | Prepaid cards must be topped up – and this means less flexibility when compared to a credit card. |

| Expense reporting made easy – employees can capture their receipts digitally to be matched with transactions made. | No cash withdrawals – a bugbear if your company or its employees need cash for some spending. |

| User-friendly interface, making Pleo simple to use for both admin and employees. | Limited workflow customisation – there’s little room to customise workflows on the Pleo platform, which may necessitate a change in your processes. |

| Automated spending categories help you to understand how your company is spending its money, and solve the conundrum of mis-categorised expenses. | The learning curve – you’ll need to introduce Pleo carefully and ensure that your employees understand how to use the system effectively. |

| Seamless integration with business software – this includes accounting systems, business management systems, and TravelPerk. | Cost linked to number of users – how much you will be charged depends upon how many Pleo users you have. This could crush cost-effectiveness for larger and rapidly-growing businesses. |

| Individualised spending limits – helping your business to manage spending based on seniority or need, and reducing the risk of overspending. | |

| Individual cards give autonomy to employees, meaning they don’t need to seek approval or follow lengthy and painful expense reimbursement processes. |

Key Features

We can divide Pleo’s major features into two categories – Card and Financial Management:

Expense Cards

Physical And/Or Virtual Cards

Your business and its employees can have physical or virtual cards, meaning you can also pay by Apple Pay and Google Pay.

Cards Managed From The Platform

You can order, freeze, and cancel cards from the Pleo platform. It’s quick and easy to do, putting your business in full control of card management in real time.

Individual Spending Limits

Set up spending limits according to seniority or business need. You can manage these in real time, too.

Cashback On Card Spending

Receive up to 1% cashback on spending made on your Pleo cards – a welcome bonus for your company’s bottom line.

Financial Management

Easy Receipt Management

Employees can take and send an image of a receipt, reducing the challenge of collecting them. You also receive immediate notification of spending.

Integration With Business Software

It’s easy to integrate Pleo with a host of business software. This includes accounting systems, travel management platforms, transport services, ERP systems, and bookkeeping software.

Invoice Management Dashboard

You can monitor and manage invoices received from a central dashboard. This simplifies approving and paying invoices, saving time, and giving more control to your financial management team – it’s easier to schedule payments and facilitate accounts payable.

Easy Reimbursement Of Employees

You can link your employees’ bank accounts to the Pleo platform, making it easy to reimburse them quickly, rather than wait for a month-end and executing a time-consuming process.

‘Pockets’ For Automated Expense Management

Out-of-pocket expenses, mileage, invoices… all are placed into separate ‘pockets’ for automated expense management.

Cashback

Up to 1% on Essential and Advanced Plans.

Pleo Plans

There are three plans available for Pleo users:

The Starter Plan

This is ideal for freelancers and micro companies that want to automate their expenses. There is no monthly charge for this, and you can add up to three users. As a Pleo Starter, your benefits are:

- Physical or virtual cards

- Real-time expense tracking

- Automated expense reports

- Manage and pay invoices

- Integrate with business systems and software

- Apple Pay and Google Pay

The Essential Plan

For larger businesses, the Essential Plan is an all-in-one spending solution providing full control and visibility.

There is a monthly fee of £39, with three users included. Additional users cost £11.50 each per month. If you are new to Pleo, there is an option to try Essential free of charge for a limited period. On this plan you receive all you would in the Starter Plan, plus:

- 0.5 % cashback (for eligible customers)

- Spending limits per user or purchase

- Spend analytics dashboard

- Review spending per team

- Reimburse employees with or without Pleo cards

- Reimburse cash expenses and mileage

- Track subscriptions and other recurring payments

- Live chat support

The Advanced Plan

For larger enterprises that need a full service and customised configuration, the Advanced Plan offers a larger range of features and benefits.

This plan costs £79 per month, with three users included. Additional users are charged at £13.50 per month per user. On the Advanced Plan, you receive all the benefits of the Essential Plan, plus:

- 1% cashback (for eligible customers)

- Control recurring payments with Vendor cards

- Open API access

- Single sign-on with SAML

- Chat, email, and phone support

- Assisted onboarding session

- Dedicated Customer Success Manager

Pleo Integrations

The ability to integrate with your other business systems and software is a major advantage for any business using Pleo. By integrating these systems with Pleo, you’ll gain maximum efficiency and productivity benefits. Here’s a taste of how this integration could help your business:

Accounting Software

There is a host of different accounting software and systems available today. Pleo integrates with many of them (including Xero, Sage, QuickBooks, and FreeAgent) to remove the chore and bore and potential for error of manual entry of expenses.

ERP Systems

Manage and enhance your business workflows and process management with Pleo integration to ERP systems such as Microsoft Dynamics Business Central 365 and SAP Business One.

Business Productivity Software

Streamlining what you do and how you do it can explode productivity. In the longer run, this will help you to serve customers more effectively and reduce your overheads. You may already use software such as Slack and Odoo – Pleo can integrate with these to smooth the expense journey and streamline your expense processes.

Travel Management Platforms

Do your employees travel for business? Pleo integrates with TravelPerk, the system designed to manage business travel – your employees can use their Pleo card and automatically match up receipts, to eliminate the need for hours of invoice and receipt reconciliation.

Should You Use Pleo?

Pleo has been designed for businesses that want to manage their spending processes more effectively and efficiently. It’s not for self-employed sole traders, but can be a useful addition in the process of automation armoury of any size of business (you’ll need to be a registered business with a business bank account).

If you handle paper receipts, Pleo is likely to reduce the time it takes to process these receipts as well as cut the administration and reporting work.

How to Open a Pleo Account

Opening an account with Pleo is uncomplicated. There are four steps to take:

- Go to the Pleo website and click on the ‘Get started’ button.

- Enter your email address.

- You’ll receive an email requesting that you verify your identity. Follow the onscreen instructions.

- Fund your account.

You’re now ready to start using Pleo.

A Brief Guide to Using Your Pleo Account

Everything is controlled via the Pleo Menu. Your first port of call is to head to the ‘Get started’ option, invite team members, and order the Pleo cards you need. You can order physical or virtual cards, and set up individual spending limits here.

Here is what the other options on the Pleo menu allow you to do:

My Cards

Manage personal cards here, including freezing or unfreezing them.

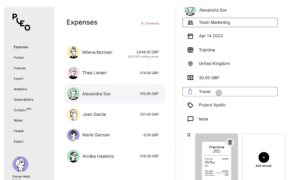

Expenses

Admins can view how much is available in the company’s Pleo wallet as well as recent expenses. If you wish to add a receipt to be expensed, this is where to do it.

You can also categorise expenses here, assigning them to categories that will help your company manage its spending more effectively.

Analytics

For paid Pleo accounts, this is where you’ll find all your company’s expenses. You can organise them how you wish to help you discover how your company is spending its available money. It’s also possible to view this data in several ways – bar charts or pie charts are examples – as well as view monthly spending to help you spot expense trends. You can organise this at team level or per individual Pleo card user.

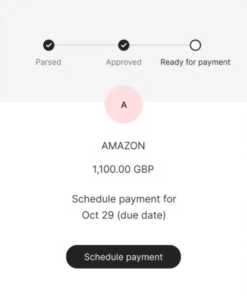

Invoices

View all your invoices in a single location. You can approve or reject invoices to be paid, and manage those that have been scheduled for payment. You can sort by status, department, date due, and more.

Subscriptions

In this section of the menu, you can view and manage all your recurring payments – such as accounting or bookkeeping software, industry body memberships, business process software, and more. This is invaluable information that will help you keep track of your regular costs (and reduce them if needed).

Wallet

This is where an admin can view the current balance in Pleo Wallets, review the history of spending, and top up balances. You can download transactions and balance history from here, too.

You can top up your Pleo Wallet by direct debit or manual bank transfer.

This section lets you keep track of all out-of-pocket expense claims, as well as mileage and cash withdrawals. Your employees can add these claims no matter where they are, with the Pleo app or on desktop.

People

Admins can add or remove users, request Pleo cards, and manage individual spending limits. If you are setting up a whole team on the system, you can do this by uploading a file instead of entering details individually.

Export

Here is where you can set up the export of receipts into your accounting system.

Settings

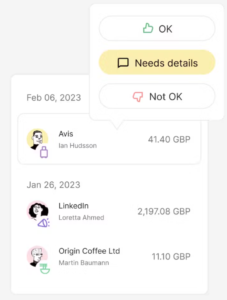

Here is where you manage typical aspects, such as company information, account billing, software integration, etc. Here is where you can also set two-tiered expense approvals – one at team level and one at company level.

What About International Payments?

You can use Pleo for international payments, but, if you wish to do so, you’ll need to mind some high charges. If you’re on the free plan, you’ll be charged a 2.49% transaction fee. On a paid plan, this fee is reduced to 1.99%.

If you pay an invoice in a foreign currency using Pleo, you’ll be charged a 2.5% fee.

If you sign up to Pleo and your employees travel abroad a lot for business, it may be worth considering using a travel credit card like Barclaycard Rewards or Halifax Clarity, with your employees then claiming their expenses outside of Pleo.

Alternatively, you might consider an alternative to Pleo, such as Airwallex, which offers fee-free spending abroad and fee-free ATM withdrawals while abroad (with some limitations).

The Pleo App

Business software like Pleo must be easy to use, otherwise it won’t be used. Your people will stick with their old ways of doing things.

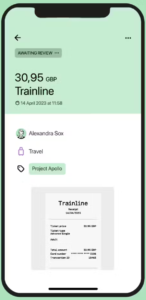

So, you’ll be pleased to know that the Pleo app is very user friendly – though there will be a learning curve, as there always is. Once your employees get used to inputting their receipts and expenses onto Pleo, they’ll wonder how they ever managed without it.

Managing expenses that used to take hours to work out and input is pretty much automated with Pleo. You simply take a photo of your receipt, and the app does the rest for you – including categorisation. Bang goes all the time and effort it used to take.

The expense dashboard also provides a clear view of spending habits, upcoming expenses, and budget, in real time. Budgets can be assigned by team and individual team members.

Is Pleo Safe?

Especially when considering your company finances, connecting to your bank, integrating with your other business software, and being used by multiple employees, you’ll want to be sure that a new system is safe to use. There are a lot of potential holes to be exploited. Is Pleo safe?

In a nutshell, yes, it is. Pleo complies with many of the standards that other financial companies must comply with, and uses several strategies and tools to ensure data is protected. The measures it takes include:

- Platform certified to the Payment Card Industry Data Standard (this is the same security compliance as banks and card providers).

- Data and fraud protection, with controls that comply with GDPR.

- Funds are segregated from Pleo’s own funds. Your money is deposited with J.P. Morgan, and you benefit from its standing as a fully regulated bank.

- Pleo is powered by Mastercard, meaning you benefit from its high standards of card protection.

Pleo has also employed extra security measures on its app. These include:

- Biometric identification – users will need to use their fingerprint of facial recognition to log in.

- 3D secure – online transactions must be approved in the app.

- Payee confirmation – confirming the person or business you are paying is correct.

- Virtual cards – ensuring primary card details remain hidden and private.

As you can see, there’s nothing left to chance.

What Do Others Say About Pleo?

At the time of writing this review, Pleo has received 83% 5-star reviews on Trustpilot. Users particularly comment positively on ease of use, convenience, and simple integration with other business systems and software.

On the downside, negative reviews mostly centred on poor customer service.

Tips to Maximize the Benefits of Pleo

With so many features, it can be hard to know how to use Pleo to gain maximum advantage from it. Here are my top tips to help reap the rewards of your Pleo subscription:

Fully Integrate Pleo With Business Software

Integrating your existing systems and software with Pleo is crucial. This will help to streamline your business processes, reduce errors, and boost productivity.

Leverage Real-Time Tracking For Budget Management

Never have unexpected expenses throw your finances out of sync again! Pleo’s real-time tracking allows you to stay on top of your finances and quickly make small adjustments that could make a big difference. It’s critical to ensure that your employees report their expenses immediately.

Utilise Individual Spending Limits

Take time to tailor individual spending limits based on departmental budgets or project needs. This will help to give your employees the autonomy they require while staying in control of spending.

Train Employees On Pleo’s Features

Make sure you thoroughly train employees on how to use Pleo. Let them know why it is in their best interests to use features such as receipt uploading, expense categorisation, and card management. When they use Pleo, manual expense reporting will reduce (or even be eliminated) and reimbursements will be faster – that’s a huge benefit to them and your business.

Regularly Review Spending Analytics

Gain a more informed and up-to-date picture of your company’s expenditure and spending patterns by regularly reviewing the spending analytics dashboard. You’ll notice trends as they form and pinpoint areas of unnecessary expenditure. This will help you make better cost-saving decisions.

Regularly Review & Adjust Policies and Limits

Pleo gives you the ability to keep your company’s spending under regular review. You should also maintain a regular review of your spending policies and limits. This will help you to stay aligned with your changing business dynamics and objectives.

Don’t forget to maintain your Pleo Wallet balances, to ensure that employees always have access to the funds they need (within their limits, of course).

Alternatives to Pleo

There are a few alternatives that you might consider. Here’s how three of these – Airwallex, Soldo, and Payhawk, compare to Pleo:

- Pleo and Airwallex offer free standard accounts, while Soldo charges £6 per user. Payhawk is the most expensive at £199 per month.

- Monthly card costs are highest with Payhawk (£9) and lowest with Soldo (£5). Pleo and Airwallex both charge £6.

- Expense and invoice management, web app, and accounting integration are available across all four.

- Cashback is offered by all except Soldo.

- Fee-free spending abroad is offered by both Airwallex and Payhawk, while Airwallex also offers fee-free ATM withdrawals (though with conditions).

In summary, Pleo and Airwallex are more budget-friendly, while Payhawk is the most expensive expense management solution. Soldo offers the advantage of lower card fees, but does not provide cashback or fee-free international transactions.

The Bottom Line

If you’re looking for a tool to improve financial management in your business, then Pleo could be the answer. It’s easy to integrate with your existing business systems and accounting software, and provides an effective solution to minimise workload in two specific areas: expenses and accounting.

You’ll need to consider the cost of Pleo before implementing it into your business (it may be cost-prohibitive for large enterprises); but for smaller businesses and startups the efficiency and time-saving benefits it offers could justify your investment.

Its no-cost entry plan provides an affordable way to test its value. Or you could opt for the free trial period on the paid plan. The Essential Plan offers a comprehensive suite of features at a reasonable cost for most smaller businesses.