Finance and admin – two words that make most business owners shudder. Want someone else to do it? ANNA could be a good shout, but here we study all the details in this comprehensive ANNA Business Account review.

Are you a sole trader, entrepreneur starting a new business venture, or business owner running a small business in the UK?

A finance and admin app could be transformative, but with so many to choose from, selecting the best for your business needs can be challenging.

Which is why I’ve taken the time to take an in-depth look at ANNA. It’s becoming increasingly popular, but is it as good as what the crowd believes? Is it any good for your needs?

Quick Verdict On ANNA

If you run a small business, or you’re a freelancer, or considering launching a venture in the UK, you must check out ANNA. It’s a cracking finance and admin app that features invoicing, managing expenses, and help with sorting out your taxes.

It’s safe and secure, though it doesn’t fall under FSCS protection (it’s not a bank, but rather an Electronic Money Institution, so your money is protected in safeguarded accounts).

It’s easy to set up an ANNA account, and you could be up and running in minutes, taking advantage of features like virtual and co-worker debit cards, and benefiting from real-time financial insight that will help you make better business decisions.

ANNA is definitely worth trying – it could be a business game-changer.

What is ANNA?

ANNA – standing for ‘Absolutely No Nonsense Admin’ – was launched in 2017 as a solution for small businesses, sole traders, limited companies, and entrepreneurs seeking to blend business banking with administrative services.

Unlike traditional banks, ANNA operates as an e-money institution.

It provides a range of services, from business current accounts to comprehensive admin tools, and integration with accounting software.

If you want a business banking app that is simple to use, highly efficient, and with good customer support, ANNA claims to be the solution you need.

ANNA – The Pros & Cons

As with any app or business bank account, there are reasons you’ll want to sign up and reasons you won’t. What’s crucial is that the strengths outweigh the weaknesses.

Ideally, those weaknesses will turn out to be little more than inconveniences. Here is how ANNA stacks up in the advantages and disadvantages columns:

Pros

There are plenty of positives to experience when you use ANNA. It’s amazingly easy to set up, and there are no fees for the first month – which is very helpful, giving you time to explore the app and all it offers.

You can create and send invoices in the app (a feature that I love), and its thoughtful design means navigating through its suite of services is as easy as making a cup of tea. With features such as free direct debits, 24/7 customer support, and seamless integration with accounting software, you may already be thinking this is a winning solution for your business.

However, there is more. The app incorporates a receipt scanner, provides a payroll service for directors, and simplifies VAT submissions to HMRC.

Cons

There are a few drawbacks you should know about.

For example, there is no overdraft facility, and although it facilitates international business, you will incur foreign currency transaction fees.

The monthly fee of £14.90 (+VAT) for the Business Account will add to your business costs. However, this is in line with other similar business banking apps and shouldn’t be a dealbreaker.

Finally, while ANNA operates in accordance with Financial Conduct Authority (FCA) regulations and adheres to the Electronic Money Regulations 2011, the Financial Services Compensation Scheme (FSCS) won’t protect you.

Here’s a summary of ANNA’s pros and cons:

| Pros | Cons |

|---|---|

| Quick Set-Up | No Overdraft Facilities |

| No Fees for 1 Month | Foreign Currency Transactions carry charges |

| In-App Invoice Creation | Not Protected by the UK’s FSCS scheme |

| Well-designed App functionality | Monthly Charge of £14.90 (+VAT) After the Trial Period |

| Free Direct Debits | No Joint Accounts |

| 24/7 Live Chat Customer Service | |

| Xero Integration | |

| Easy VAT Submission to HMRC via App | |

| Includes a Receipt Scanner | |

| Free Payroll Service for Directors |

ANNA’s Key Features

ANNA includes a comprehensive suite of banking and admin features that has been designed to improve your financial management, streamline payments, and provide flexibility to your business operations:

Virtual Cards

Immediately after signup, you have access to virtual cards to make payments online. This ensures that your business can start managing its finances and make necessary purchases immediately.

Personal Payment Link

ANNA provides you with a unique web link to send to clients or use on social media profiles for payments. This makes it easier for your business to receive payments.

Easy Deposits

Funding the ANNA account is easy, with the option to deposit funds at thousands of locations. Great to manage cashflow better.

Apple Pay/Google Pay Compatibility

You can make contactless payments using your smartphones – a seamless and secure way to manage transactions.

Co-Worker Debit Cards

Your business can provide employees with debit cards, complete with spending limits and automatic expense sorting. This simplifies expense management and enhances financial management.

Real-Time Updates

You’ll receive real-time updates on payments and deposits through your account – up-to-date information that is essential to monitor your business’s finances and make better decisions.

Free Direct Debits

Direct debits are free on all ANNA plans, reducing the cost of recurring payments and subscriptions.

Scheduled Payments

Set up payments to be automatically sent at a scheduled date – improving cashflow management and ensuring no payments are late.

Cashback

You now receive 1% cashback up to £100 per month on certain business expenses, providing an additional financial incentive for using the account for business transactions.

Fast-Track To Credit

For a monthly fee of £9, the FastTrack to Credit feature can help your business boost its credit scores after three months – meaning better access to credit.

ANNA Pay In 3

This feature allows your business to spread the repayment for purchases over three months – helping cashflow, especially for significant business expenses.

Pots

Open separate accounts within the account to put money away for expenses like VAT, tax, legal expenses, or larger future business investment.

When you consider all these features in total, you’ll see that ANNA offers a banking solution that is as functional as it is innovative, helping you manage finances better in a rapidly evolving business climate.

Costs, Fees, Rates, and Charges

ANNA’s pricing structure reflects its mission to serve small businesses and entrepreneurs with a transparent, straightforward banking solution, as well as provide bigger businesses with an alternative to traditional banking arrangements.

It’s an approach to pricing that I find refreshing, especially as I like no-nonsense banking:

| Pay As You Go | Business | Big Business | |

|---|---|---|---|

| Account Fee | No Monthly Fee – pay only for what you use | £14.90 per month (£149 if paying annually) with first month free of all charges | £49.90 per month (£499 if paying annually) |

| Local Transfers | 20p per bank transfer | 50 free bank transfers per month – 20p per transfer after that | Unlimited free bank transfers |

| ATM Withdrawals | £1 per ATM withdrawal | 3 free ATM withdrawals per month – £1 per withdrawal after that | Unlimited free ATM withdrawals |

| SWIFT Payments | £5 per SWIFT payment | 1 free SWIFT payment – £5 per payment after that | 4 free SWIFT payments per month – £5 per payment after that |

| Currency Conversion Fee for Transfers | 1% | 1% | 0.50% |

| Personal Payment Link for Accepting Payments | Payment link with 1% commission | Free payment link usage up to £200 per month – 1% commission after that | Unlimited, commission-free payment link usage |

| Additional Debit Cards | 1 debit card included – £3 per extra card, per month | Up to 5 debit cards included £3 per card – per month after that | Unlimited free debit cards |

| Pay Cash In | Pay cash in with 1% commission | Pay in up to £300 cash per month for free – 1% commission after that | Pay cash into your account commission free |

| Pots | £1 per pot monthly | 2 free pots – £1 per pot, per month after that | Unlimited pots |

| Cashback on Purchases | 1% on select categories | 1% on select categories | 1% on select categories |

ANNA’s Credit Options

Though ANNA is not a bank and does not offer an overdraft facility, but this doesn’t mean it is bereft of credit options for your business needs. Indeed, you can access several credit solutions as follows:

FastTrack to Credit

Do you want to improve your business’s credit score to gain better access to credit facilities? ANNA’s FastTrack to Credit is a paid-for service that could help you.

Pay £9 per month and channel all transactions through your ANNA account, and access to a credit of around 30% of your average monthly sales volume will be granted, with no interest, no overdue payment penalties, and no hidden fees.

Pay in 3

Great for spreading the cost of larger bills or expenditure over a more manageable three months (and thus smoothing cashflow ), this is a credit option offered in collaboration with SteadyPay. There is a 3% fixed direct debit fee on the amount you repay.

ANNA Credit

Do you need fast access to funds to help grow your business?

In conjunction with SteadyPay, you can access up to £10,000, with a 3% monthly interest rate. While I don’t consider this to be cheap credit, you will receive the funds into your account within one business day.

SME Lending

ANNA uses your business transaction history to reduce paperwork and red tape, giving you more efficient access to tailored loans via an ANNA/Business Score partnership.

Grant Finder

Many businesses are eligible to receive grants, but either don’t know or find navigating the grant market difficult. ANNA has paired up with Swoop to help businesses identify and apply for grant funding, supporting you throughout the process.

Security and Safety Measures

When I’m reviewing financial services, one of my major concerns is how safe it is to use the app or account. If security isn’t taken seriously, then I could never give a positive review – because no matter how good the app is, if using it puts you at a higher risk of monetary loss then you shouldn’t open an account.

Is your data safe?

ANNA maintains a good balance of measures to protect your data. This includes adhering to strict data protection regulations and maintaining policies to ensure that your business and personal data remain secure.

These measures include data encryption technologies to safeguard data while in transit between your device and ANNA’s servers.

What about the security of your account?

Access to your account is protected by several measures, including password protection and biometric authentication (fingerprint or facial recognition).

In addition to this, you receive real-time alerts for activity on your account. This helps you to monitor your account, with instant notification letting you see any suspicious transactions immediately. That could be a business saver.

ANNA’s systems also monitor account transactions for possible fraudulent activity, just like your high street bank does when it sends a notification to you asking for confirmation of what it believes to be a suspicious transaction.

Does ANNA comply with financial regulations?

ANNA operates in accordance with FCA regulations. It also adheres to the compliance requirements of the Prudential Regulation Authority (PRA), who set out the regulations for banking services to ensure stability and integrity of those services.

You’ll find that ANNA also implements strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to prevent financial crime. These can be a bit of a pain in the backside, but they are unavoidable – I wouldn’t deal with a financial firm that does not meet these requirements.

Overall, ANNA’s comprehensive security policies and procedures should give you a high degree of comfort as a user. It’s an app you can trust.

What about FSCS Protection?

Because it is not classed as a bank (it is an app that provides admin support), ANNA is categorised as an Electronic Money Institution (EMI). These types of financial services are protected by the FCA but not by the FSCS.

Money held with ANNA is held in what are called ‘safeguarded accounts’. This means that your money is held separately to ANNA’s own money.

ANNA can’t lend this money or use it. The only way it can be accessed or used is with your explicit instructions – for example, to pay a bill or withdraw cash from an ATM with your debit card.

Customer Service

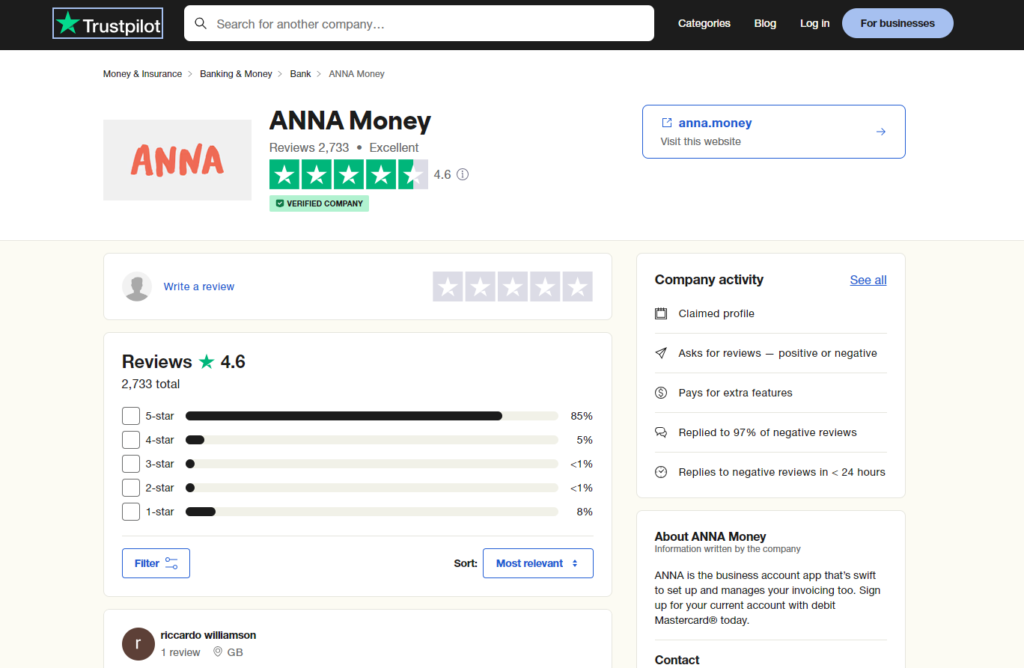

ANNA has a 4.6/5 star-rating on Trustpilot, and many of the more than 2,700 reviews comment on its customer service.

ANNA is commended for its responsive support team, with a variety of channels available, including live chat, email, and phone. Customer service staff are knowledgeable, going beyond merely answering queries.

You’ll also find there is a library of user-friendly resources (such as articles, tutorials, and FAQs) as well as a vibrant online community where you can leave feedback that helps ANNA evolve its services.

Who Can Benefit from Anna?

ANNA’s services are tuned to cater to UK businesses, sole traders, and entrepreneurs. You’ll be operating within the UK’s legal and financial framework, with the system helping you to navigate what is sometimes a complex business environment.

Sole traders will find the app simple to use and an effective way to manage finances, freeing up time to service clients and make money.

There are plenty of features for entrepreneurs who need fast access to credit, tools to manage cashflow, and real-time financial insight to help make better business decisions.

Small business owners with limited resources will benefit not only from a comprehensive suite of services, but also the convenience of co-worker debit cards and innovations like the 1% cashback on eligible spending.

How to Open an ANNA account

Opening an ANNA account is straightforward, and you could be up and running in just a few minutes.

You’ll need the ANNA app, as well as proof of identity and address (the usual suspects, such as driving license and a recent utility bill.

You’ll also need to provide business documentation, such as registration details and proof of business address, plus proof of trading activity if you’re a sole trader.

Once you’ve set up your account preferences and funded the account, you’re up and running with ANNA!

Note that to open an account with ANNA you must be at least 18 years old and have a registered business/be trading as a sole trader in the UK.

Making the Most of Your ANNA Account

Integrating ANNA into your business operations could help you transform your finances and make your business more efficient (I love any system that makes things easier and less time-consuming).

How effective it is for you depends upon how effectively you use ANNA. Here are my tips to get the most out of your ANNA account:

Utilise Virtual Cards for Immediate Payments

Get your business expenses organised from day one by activating and using your virtual card immediately. This will also help ensure all online transactions are made securely.

Issue Co-Worker Debit Cards & Earn Cashback

Issue direct debit cards to co-workers and set their individual spending limits. You’ll give your employees a sense of autonomy and responsibility, and simplify management of expenses.

Remember, all eligible expenses will reward your business with 1% cashback, helping to reduce business costs.

Set Up Personal Payment Links & Activate Apple Pay/Google Pay

This will make it easier for your customers to pay you – embed these in your website, invoices, and social media.

While you are setting this up, don’t forget to activate Apple Pay and Google Pay to allow payment direct from smartphones.

Schedule Payments & Exploit Free Direct Debits

Improve your cashflow by scheduling your future, and setting up direct debits to make regular payments. This will help you to remain a trusted partner to suppliers, and can help to reduce operational costs and prevent incurring costs because of overdue payments.

Monitor Real-Time Updates

Keep on top of your business finances and keep your account secure by monitoring your real-time notifications.

This will also help you to identify unusual account activity, manage cashflow, and make more informed financial decisions.

Enrol in FastTrack & Other Credit Options

Build greater financial flexibility in your business by enrolling in credit options like FastTrack and Pay in 3. You’ll have access to funds when you need them, helping you to manage cashflow and capitalise on business opportunities.

Alternatives to ANNA

While ANNA is a cracking finance and admin app, it won’t be the best choice for all. Fortunately, there are several great alternatives available. Each brings its own features, pricing structures, and unique selling points.

Here are four that I believe you should consider:

Tide

Tide’s focus is on small and medium-size businesses. Features include invoicing directly from the Tide app and integration with accounting software – and it integrates with more third-party apps, which could benefit you if your business is looking for specific workflow integrations.

With a few pricing plans, including a free basic plan, you have a broad spectrum of options to satisfy your business needs.

Monzo Business

Monzo may be best known for its personal banking solutions (my son is a huge fan), but entrepreneurs will find its business account offers a user-friendly interface and some snappy budgeting tools.

It’s a good option if you are looking for an extension to traditional banking services, and you’ll benefit from a seamless digital banking service.

There are two account options (the free Lite account and the paid-for Pro account). Which you choose may depend on whether you need features like tax pots, integrated accounting, and in-app invoicing.

Revolut Business

If your business conducts a lot of transactions in foreign currencies, then Revolut could be the stand-out contender, with currency exchange, international transfers, and corporate cards with spending control features.

You’re likely to get more competitive rates for currency exchange and international payments with Revolut than you do with ANNA.

There’s a free entry account, plus tiered accounts catering for businesses with higher volumes and differing needs.

Starling Bank

Starling’s business accounts offer in-depth financial insights, as well as integration with a wide range of accounting software. It’s an award-winning app – easy to use, but with the ability to manage more complex needs.

Its pricing structure is easy to understand – free business banking, only charging for extra services like international payments.

The Bottom Line

ANNA is a great finance and admin app designed specifically for UK businesses, sole traders, and entrepreneurs. It offers features such as invoicing, expense management, and tax calculations.

ANNA is not classified as a bank. It’s an EMI, and therefore not covered by FSCS protection. However, it does operate in compliance with FCA and PRA regulations and implements strict KYC and AML procedures.

Easy to set up an account, ANNA packs a punch with features like virtual cards, co-worker debit cards, and real-time financial insights.

Overall, a good package for many businesses in the UK.